Following the U.S. government’s seizure this week of virtual currency Liberty Reserve, denizens of the cybercrime underground collectively have been progressing through the classic stages of grief, from denial to anger and bargaining, and now grudging acceptance that any funds they had stashed in the e-currency system are likely gone forever. Over the past few days, the top discussion on many cybercrime forums has been which virtual currency will be the safest bet going forward?

As I mentioned in an appearance today on NPR’s show On Point, the predictable refrain from many in the underground community has been that the demise of Costa Rica-based Liberty Reserve — and of eGold, eBullion, StormPay and a host of other virtual currencies before it — is the death knell of centrally-managed e-currencies. Just as the entertainment industry’s crackdown on music file-sharing network Napster in the late 1990s spawned a plethora of decentralized peer-to-peer (P2P) file-sharing networks, the argument goes, so too does the U.S. government’s action against centrally-managed digital currencies herald the ascendancy of P2P currencies — particularly Bitcoin.

This knee-jerk reaction is understandable, given that private crime forums are now replete with postings from members who reported losing tens of thousands of LR dollars this week. But as some of the more seasoned and reasoned members of these communities point out, there are several aspects of Bitcoin that make it especially unsuited for everyday criminal commerce.

For one thing, Bitcoin’s conversion rate fluctuates far too wildly for communities accustomed to virtual currencies that are tied to the US Dollar: In both Liberty Reserve and WebMoney — a digital currency founded in Russia — one LR or WMZ (the “Z” designation is added to all purses kept in US currency) has always equaled $1 USD.

The following hypothetical scenario, outlined by one member of an exclusive crime forum, illustrates how Bitcoin’s price volatility could turn an otherwise simple transaction into an ugly mess for both parties.

“Say I pay you $1k today for a project, and its late, and you decide to withdraw tomorrow. You wake up and the $1k I just sent you in Bitcoins is now worth just $600. It’s not yet stable to be used in such a way.”

Another forum member agreed: “BTC on large scale or saving big amounts is a mess because the price changes. Maybe it’s only good cashing out,” noting WebMoney now allows users to convert Bitcoins into a new unit called WMX.

Others compared Bitcoin to a fashionable high-yield investment program (HYIP), a Ponzi-scheme investment scam that promises unsustainably high return on investment by paying previous investors with the money invested by new investors. As the U.S. government’s complaint alleges, dozens of HYIP schemes had a significant amount of funds wrapped up in Liberty Reserve.

“Bitcoin is a trendy HYIP. There are far more stable and attractive currencies to invest in, if you are willing to take the risk,” wrote “Off-Sho.re,” a bulletproof hosting provider I profiled in an interview earlier this month. “In the legit ‘real products’ area, which I represent, a very small niche of businesses are willing to accept this form of payment. I understand the drug dealers on Tor sites, since this is pretty much the only thing they can receive without concerns about their identities, but if you sell anything illegal, WMZ should be the choice.”

What’s more, MtGox — Bitcoin’s biggest exchanger and the primary method that users get money into and out of the P2P currency — today posted a note saying that it will now be requiring ID verification from anyone who wants to deposit money with it in order to buy Bitcoins.

Perhaps the closest competitor to Liberty Reserve and WebMoney — a Panamanian e-currency known as Perfect Money (or just “PM” to many) — appears to have been busy over the past few days seizing and closing accounts of some of its more active users, according to the dozens of complaints I saw on several different crime forums. Perfect Money also announced on Saturday, May 25 that it would no longer accept new account registrations from U.S. citizens or companies.

For now, it seems the primary beneficiary of the Liberty Reserve takedown will be WebMoney. This virtual currency also has barred U.S. citizens from creating new accounts (it did so in March 2013, in apparent response to the U.S. Treasury Department’s new regulations on virtual currencies.) Still, WebMoney has been around for so long — and its logo is about as ubiquitous on Underweb stores as the Visa and MasterCard logos are at legitimate Web storefronts — that most miscreants and n’er-do-wells in the underground already have accounts there.

But not everyone in the underground who got burned by Liberty Reserve is ready to place his trust in yet another virtual currency. The curmudgeon-in-chief on this point is a hacker nicknamed “Ninja,” the administrator of Carder.pro — a crime forum with thousands of active members from around the world. Ninja was among the most vocal and prominent doubters that Liberty Reserve had been seized, even after the company’s homepage featured seizure warnings from a trio of U.S. federal law enforcement agencies. Ninja so adamantly believed this that, prior to the official press announcements from the U.S. Justice Department on Tuesday, he offered a standing bet of $1,000 to any takers on the forum that Liberty Reserve would return. Only two forum members took him up on the wager.

Now, Ninja says, he’s ready to pay up, but he’s not interested in buying into yet another virtual currency. Instead, he says he’s planning to create a new “carding payment system,” one that will serve forum members and be housed at Internet servers in North Korea, or perhaps Iran (really, any country that has declared the United States a sworn enemy would do).

Another core member of a different, Russian-language crime forum used the Liberty Reserve news to announce his own, private e-currency and exchange exclusively for forum members. To generate interest in the new system, which this member says has been under development for six months, he is offering a $5,000 reward to any hackers who can break the system’s security.

Dear friends! I submit to your consideration a new project as a payment system,” writes “Taleon,” a longtime provider of cashout services for fraudulent wire transfers sent via Western Union and Moneygram (think cyberheists against small businesses). “After eight years of excellent reputation in the financial services industry, I now want to offer a mini-payment system, designed specifically for your needs. It is not necessarily made for you to keep your savings in, but instead to use this system for small settlements.”

Taleon highlighted the benefits of his new currency thusly:

“The pros:

- -It is not registered anywhere, and is not governed by any law other than arbitration private forums.

- -We do not ask for your personal data, except for the private message on the forum or confirmation from other members.

- -The system focuses strictly on the activities of the forum.

- -Security system is set up with the reality of today and even more.

- -Information stored 2 months, and then permanently deleted, and deletion of information at the request of the user-specified encryption key.”

If these private systems focus heavily on security, it will be unsurprising given Liberty Reserve’s reputation. Liberty Reserve used an insanely secure and redundant system — including far more protections against account takeovers than I’ve seen at any legitimate financial institution. Users were required to enter an account number and password, and then a Login PIN. If the system didn’t recognize your computer and/or IP address, it would send a one-time “verification PIN” to your email and require that before logging you in. In the event that you wished to send someone LR currency, the process involved solving a CAPTCHA, entering a static, user-specific “Master Key” and your Login PIN — the latter two often requiring the use of a randomized on-screen keypad. Enter any of these incorrectly and the system required you to start over.

In the short run, I’d expect WebMoney to be the chief beneficiary from the closure of Liberty Reserve. Longer term, I’d expect to see more of these independently-run, forum-specific currencies+exchanges that are not tied to any specific country, or that are based in countries that are actively hostile or at least not particularly friendly to the United States.

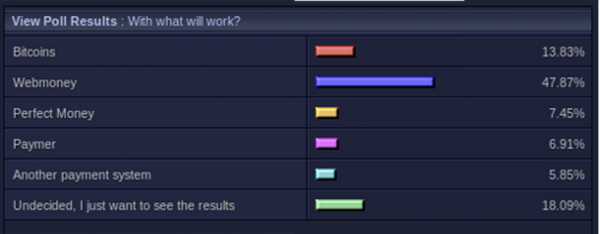

Update, 9:58 p.m., ET: Looks like I am not alone in saying WebMoney will be the big winner here. Sophos just filed a blog post on the Liberty Reserve takedown that includes a graphic of a poll one underground site took on which e-currency would work best:

i guess Ninja doesn’t realise that north korea has no internet and those few who have access go through china.

From what I have read in sources like Radio Free Asia, the North Korean elite has unrestricted access to the Internet, but those people probably number in the low hundreds.

On a related note, NK has a hacking team similar to what China has. Their military’s special Unit No. 3 specializes in such things and was recently in China “posing as researchers and businessmen in major cities like Beijing, Dalian, Tianjin, and Shanghai.”

North Korean Hackers Target Foreign Currency

http://www.rfa.org/english/news/korea/hackers-04112013162328.html

Or that the net they do have is heavily monitored and any significant monetary involvement will wind up having them banned from any banking institution outside of NK as well as likely have their money confiscated by NK instead.

Or that the net they do have is heavily monitored and any significant monetary involvement will wind up having them banned from any banking institution outside of NK as well as likely have their money confiscated by NK instead. Net: It’s monitored everywhere these days. 🙁

I might add to your comment , that through my research on the internet fiber backbone going into Iran, most of the bandwidth comes from Russia . I know this because I seen many phishing sites that where hosted in Iran, that where on bullet proof hosting. Complaints going to the I.S.P./Hosting companies in Iran where ignored over and over again. The only solution was to send complaints to the downstream provider of the A.S.N. number.

By the way, I wonder how many phishing miscreants lost money due to the shutting down

of Liberty Reserve?

I final question here, Has anyone else posting here been receiving tons of spam lately ? Sort of like retaliation spamming ? Just wondering? :–)

You wouldn’t be using your real name and/or real email address, would you? If so, why? Anyone can google your name an harvest your email addy if it appears somewhere on the net connected to your real name.

I think it’s silly going online using a alias or pseudonym just to protect yourself from posting your opinions. It’s pure F.U.D.

I saw a prior user’s comment.

http://krebsonsecurity.com/2013/03/the-world-has-no-room-for-cowards/comment-page-3/#comment-162683

about the krebsonsecurity comments section displaying a last user email

address.

The name and email address showed up for me of a prior user once.

Brian’s comment when I asked: “I’ve tried everything, but it still shows up from time to time. ”

FYI: This time I used a fake address.

And that Taleon system really work?

So why do all these fans of “alternative” currencies insist that their currency of choice be valued on par with the evil, hegemonic USD? Don’t they see the irony?

+1

Not all are. Usually there are a few options for any of the big services: USD, EUR, maybe Gold or RUB, sometimes UAH or others. Even LR had LR USD, LR EUR, LR Gold (not exchangeable for one another without an exchanger usually).

The USD & EUR are highly regulated. As for the RUB, customers are at the mercy of Putin. The UAH dropped by 50% against the USD overnight in 2009.

BitCoins suffers from huge swings and now the exchangers are starting to regulate themselves.

For the most part, people want a stable, regulated currency.

It’s not just the “alternative” crowd. America’s enemies still denominate oil contract in the USD even though (I think Saddam) some have taken steps to use the EUR as their reserve currency of choice. It’s not just oil, the world wants another reserve currency, it just has not hit the mainstream so far.

Agreed. Though a big part of it is that other currencies tend to be pegged to the USD, even though the USD has some volatility (well it does it you compare it to other currencies; it probably wouldn’t matter much to you if you were an American living in the US that the Australian dollar is now about the same as the USD, but it’d affect you a lot if you were visiting Australia. Also a lot of funding cards and outbound/inbound wiring sources come from USD currency accounts (or the others as mentioned). Of course the Asian exchangers will typically convert to their local currency which is great if you have a bank account local to them too (and directly to your bank through a transfer instead of a wire is pretty common in CIS and Asia in general — in those cases the currency you choose may matter because you may get better or worse rates on the e-currency you have depending on the exchanger’s stock).

Re: Pegged to the USD, for instance the Panamanian Balboa which is basically the US Dollar, or the Costa Rican Colon which is pegged to the value of the US Dollar. And a lot of offshore banking is just plain conducted in USD anyway regardless of where it originates. I’d say it’s more a matter of the world choosing the currency because there’s no ‘better alternatives’.

Churchill once said that “democracy is the worst form of government….except for all the others”. It seems the world agrees to certain extent regarding the USD.

The USD certainly has its challenges. I am not going to say the U.S. or USD are infallible. But it’s the best available option out there, in many instances, or people would have voted with their feet. So far they have not.

I’m willing to bet that if any of this winds up having to do with valuation, almost nobody will base their currencies on USD. It’ll probably go back to gold which, while volatile, has fewer possible legal implications (given how wildly a stretch foreign governments have been willing to take to prosecute).

“It’ll probably go back to gold which, while volatile”

That’s an understatement. Gold was $273 per ounce in 2000, has been as high as $1600+, but now is $1400+. The price of gold soars during economic tribulations.

If money exchangers are intelligent, they will implement what China and a few other countries want to do with respect to the price of oil: price it using a basket of currencies, e.g. USD, euro, British pound, Canadian dollar, Japanese yen, and Swiss franc. China would like to add its renminbi to that list, but that would be problematic for all sorts of reasons.

Which makes sense only up until the point that a good portion of my reasoning is that the US could ostensibly claim that by incorporating the value of the dollar at all, any virtual currency traded in it could be seen as exposed to US law (or the law of whatever country’s currency they wind up choosing). By using a basket of currency (which unquestionably would stabilise value), it is conceivable that this would open up the currency to the laws of any number of lands (because this is one of the precedents I can see coming along down the road).

(which isn’t to say that that is the “reasoning” behind this massive raid, but I predict that the more people around the world try to get out of the reach of the US, the more the US will push the bounds of what is considered acceptable to gain access to data and money they might deem ‘criminal’ or ‘laundered’.

In an interview with American Banker, the head of FinCen states that the Liberty Reserve takedown was a criminal enforcement action. Digital currencies are not the problem. Setting up a MSB without proper anti-money laundering controls is the problem.

http://www.americanbanker.com/issues/178_104/fincen-chief-q-and-a-what-we-expect-from-digital-currency-firms-1059485-1.html

Two things — (1) You’re taking them at face value. (2) They had that to lean on. People will move away from things that can be prosecuted for this, so they’ll move on to something else. Note that this prosecution was already heavily questionable — certainly in that it was prosecuted by the US.

At the end of the day they’re still trying to dictate how people outside of the countries in question do business. At the end of the day they’re going after exchangers who aren’t even connected to LR, but merely do exchanges for it (and they ask for ID — which should tell you something in and of itself).

My point is they are using their power to influence policy around the world, as they always do. And that’s f*ed up. Pun intended.

Err, you’re leaving out that Costa Rican regulators shut down LR.

And the Americans allege that LR had “virtually no legitimate customers”. As at least one trial will be held in the U.S., the defense attorneys can easily present all the legitimate customers to the judge or jury, discrediting the allegations.

Another quote from the feds is that “LR was set up by criminals, for criminals”. That allegation has to be proved at trial as well.

Rule Number 1: When you’re in a room with an elephant, be very conscious of where the elephant is stepping.

Sure the U.S. uses it’s influence, so does everyone else when they can. It still amuses me that all these “alternative” systems tie their value to the USD.

I guess the old saying is true. We’re everyone’s problem and everyone’s solution.

As for “alternative” payment systems, there are dozens of them out there that seem to operate year after year with no problems. NetTeller, PayNova, MOL, etc. Why is that?

“by incorporating the value of the dollar at all, any virtual currency traded in it could be seen as exposed to US law … By using a basket of currency (which unquestionably would stabilise value), it is conceivable that this would open up the currency to the laws of any number of lands”

I realize your mind is completely made-up, but I will just say one last time that the Liberty Reserve action was not taken because the USA wanted to show the world who has the biggest dick. Liberty Reserve’s customers were almost exclusively cyber-criminals and their work affected the U.S. economy, making it legally justifiable. Have you noticed how the only people complaining are people in the cyber-business? No countries are complaining, not even Russia to the best of my knowledge.

A basket of the six most traded currencies would the most stable index available anywhere. It is an indicator of the less-than-logical thinking of the oil exporters — including your favorite country, Russia, which is the world’s #1 oil producer and #2 oil exporter — that they do not adopt the currency basket mechanism.

And speaking of cyber-criminals: you have been real coy about your work, yet you know more about the mechanics of cyber-crime than most people. C’mon, fess up. You are not the one who actually sends phishing emails, but you do create exploits and sell them to the phishers, right? You really need to apply for a job with one of the anti-virus vendors.

My point is they’ve been throwing their power around to get what they want — and everything they do serves an agenda; Theirs. For instance you REALLY don’t see anything wrong with this (quoted from a link you yourself pasted)… Hint: Do they give a shit what anybody else thinks? The entirety of the article basically is them saying they can’t possibly be wrong (and this happens repeatedly in the US):

Q: But there’s a debate over this. I just talked with someone who said experts disagree on this issue. Should Fincen be more specific?

A: It’s a common theme we hear from industry on being more specific, being more prescriptive and then other times don’t be specific, go with a risk-based approach. I think there’s always going to be people who think the balance isn’t quite right on any particular action. We’re comfortable with the guidance as it stands.

Q: Did you consider putting the guidance out for comment?

FinCen: We didn’t consider it.

Q: Is there a reason why not? Some have said Fincen could have used more input on the guidance and that they didn’t hear from enough outside sources before crafting it.

FinCen: The guidance is an interpretation of our MSB rule on which — it’s been around for quite a while — in which we went through the whole comment period. So this is more of a technical guidance on something that already exists.

Basically, all that language means is that at a certain point, institutions need to use their own judgement. The intent of the MSB regulations are clearly spelled out. They are designed to control money laundering and funding of terrorism. Not every possible scenario will be spelled out in gory detail. Most people get that.

Also from the article:

“Do digital currencies pose a threat to the U.S., given their money laundering potential?

Calvery: Digital currencies are just a financial service and those who deal in them are a financial institution. Any financial institution and any financial service could potentially pose an AML threat. It depends on whether folks have the controls in place to deal with those money laundering threats and that they are meeting their AML reporting obligations.

That’s a very broad question and there’s no easy answer to that.

What I do think, though, is that digital currencies are exciting because of the innovation around it. I think it shows the great innovation that’s going on in the financial services industry these days, whether it’s a digital currency or whether it’s using other types of technology to improve and extend financial services to those that are unbanked or to make things more efficient or to be able to do things in a different way that has a customer base. That innovation is a great thing. But the fact is that being a financial institution comes with certain responsibilities.”

I’m curious … do you not believe that there could be an agenda? Or do you just not believe that there is an agenda? If the US is not against digital currency but wants to dictate how it is used and who is using it and who is *issuing* it, would they not reply this way and to avoid “lying” but quite obviously be gearing things for their own ends? Almost every thing I have seen that has ended up THAT way has been phrased almost exactly THIS way.

You still have not answered my question as far as what your opinion is as far as why the US is the ones ‘leading’ this and not CR or any other country. This is not the US aiding CR — this is the US doing the charging.

And saying all people are criminals is again telling everybody else what to think — and the government likes to prejudice cases like this. Seriously, child porn? If I am going to be lumped in with child pornographers, you do not think this could be at ALL tilted to sway the mostly ignorant about e-currency in America public interest to excoriate anything but the US way of doing things?

PS: “You really need to apply for a job with one of the anti-virus vendors.”

You mean the ones that spread FUD and claim a 10,000x per day increase in ‘unique malware’ in order to increase their sales, when really the actual number of ‘unique underlying code’ is grossly and vastly smaller (by an order of several, several thousand) — because people have realised they can actually, like, CRYPT BINARIES SO THE HASHES differ while in no way changing the actual underlying malware’s method of operation, structure, or base signatures?

The way AVs approach problems is short-sighted, and spreading bullshit like that is a guaranteed way to keep a healthy profit margin, so they have no reason to change it.

After all of this do you think I’d tolerate FUD from either side? 🙁

Its real delusional to think only the US is against hackers. When the owner was arrested in spain and the site was shut down in costa rica.

The world is growing its hate for hackers….not just the USA buddy.

Noone thinks your Robin Hood, or someone fighting the powers that be.

Just little pathological lying delusional greedy thiefs who would rob grandma and snitch on their mom.

@cooloutac: Is this like you playing one of those Abu Ghraib soldiers calling me a dog because you think it will offend me, because you insist everybody who is Muslim is a terrorist? Get your head out of your ass, man, and quit lumping people together. I’ll just make one post a day to you until you quit it, each time telling you you are an ignorant fool who cannot read, use logic, reason, or intellect, or find a single shred of proof to lump me in with people. I think I may even copy/paste this. Have a nice day.

“And speaking of cyber-criminals: you have been real coy about your work, yet you know more about the mechanics of cyber-crime than most people. C’mon, fess up. You are not the one who actually sends phishing emails, but you do create exploits and sell them to the phishers, right? You really need to apply for a job with one of the anti-virus vendors.”

I’ve found it consistently interesting that you believe you know what side I am on, simply because I know a lot about what is going on. While I am certainly not Brian, I am curious — are you asserting that knowledge of crimes makes one a criminal? Could it not just be that I am somewhat of an expert on the subject without being a *perpetrator*? And come on, if you must insist I am a perpetrator, at least let me sound like a “bad-ass” (isn’t that what passes for reputation in “the scene”?). It is funny to me that nobody has asserted that I may in fact be on the opposite side but believe in balanced arguments. Perhaps I am not on any side because I believe ‘sides’ expose people to danger no matter what ‘side’ they choose to be on. Perhaps I do not believe in blanket statements and ‘black or white’ and believe that all things should be analysed individually and on their own merit.

Provocateur 😉

I bet somebody made a Bitcoin that doesn’t fluctuate wildly 🙂

“the classic stages of grief, from denial to anger and bargaining, and now grudging acceptance”

In this case, it was denial that they were involved in cyber-crime, anger at the USA, depression over having lost a great deal of cash, and sulking acceptance.

“Ninja [is] planning to create a new ‘carding payment system,’ one that will serve forum members and be housed at Internet servers in North Korea, or perhaps Iran”

These carders are completely ignorant of the world. North Korea is notorious for changing the rules of economic games.

In the past few weeks, NK closed the industrial park in Kaesong just over the border. Quite a few South Korean businessmen had invested money in sewing machines and other equipment and still face the loss of that, even though NK appears to be backtracking now.

NK revalued its currency a few years back, and when it predictably went south and severely damaged the economy, they executed the guy at the top of the project.

https://lampeduza.net/topic/4138-%D0%BF%D0%B5%D1%80%D0%B2%D1%8B%D0%B9-%D0%BA%D0%BE%D0%BC%D0%BC%D0%B5%D1%80%D1%87%D0%B5%D1%81%D0%BA%D0%B8%D0%B9-%D0%B1%D0%B0%D0%BD%D0%BA-%D0%B2-%D1%80%D0%B5%D1%81%D0%BF%D1%83%D0%B1%D0%BB%D0%B8%D0%BA%D0%B5-%D0%BB%D0%B0%D0%BC%D0%BF%D0%B5%D0%B4%D1%83/

i found Uaps advertise here, but i dont understand russian who can translate?

Нет.

Mr Krebs, it seems to me that the weakness of these private money systems is the gateways that people use to get money in and out. No matter how secure and how well hidden, if you take the gateways down, you’ve made the system irrelevant at best. (It seems obvious to me that after a few takedowns, it will be hard to find people willing to risk prison to the currency owner can get away scott free.)

The private system Taleon is apparently starting seems to suffer from it’s exclusivity. The method of putting money into the system is so limited and exclusive that it seems like it would be more noticable and less camouflaged within the stream of transactions, meaning that investigators can get on the trail and accumulate evidence faster.

I’d be interested in hearing your analysis of this.

The more insulated the system is, the more you have all the pirates on a single deserted island. Their potential victims are not going to jump through 725 hoops to evade all controls and safe guards in order to be robbed.

Well, except maybe the HYIP crowd….

Dirty Bird, That’s only part of it. The Taleon system appears to be openly set up to convert stolen money from Western Union, Moneygram, and so on into a bankable currency in Russia. The problem with that system is it’s transparency. Western Union may find itself held responsible, may be banned from doing business with Russian banks, or may itself see the writing on the wall and choose to stop allowing this kind of crap to continue. (Not that I’m betting on corporate responsibility, but rather fear of retribution.)

But if the camouflage the system behind the gateways that people use to put money in, you give WU plausible deniability at the cost of exposing the gateway. Now I don’t expect thieves to give a damn about sentences the gateways receive, but I do expect gateway applications to become rare as the consequences become clear.

I’d just like to know if Mr Krebs feels like this is correct, or if I’ve missed something.

WU & MG have different issues as they are commonly used in money mule operations. Their “solution” is to have signs posted in their offices to the effect that “you are wiring money to a third party who will receive cash or the equivalent, once you send the money, the transaction is not reversible”. Of course, when the bank comes back and reverses the credit to the mules’ account, the mule is liable for the full amount of the fraudulent deposit. Variants exist. From the scammers point of view, WU & MG are perfect vehicles precisely because the transaction is not reversible and the fraudster makes a clean getaway.

With LR and “alternative” currencies, you can wire or send money from your bank to an “exchanger”. The exchanger then interacts with the “alternative” currency insulating the bank from the “alternative” currency.

In either case, the person sending the money opens themselves up to to being a victim either out of ignorance or greed. Personally, I have had no reason to use either WU or an “alternative” currency although many people (often immigrants sending money to family members) legitimately use WU to remit money.

I can definitely see a legitimate need for a low cost micro payment vehicle capable converting currencies but I do want first world regulations if those systems are to be made available to the general public. The world has changed and banking is still costly to many people. Even in the U.S., many people do not have bank accounts. The irony is that those people generally pay much heftier fees in the long term.

“In either case, the person sending the money opens themselves up to to being a victim either out of ignorance or greed.”

Greed. It is no coincidence that money mules are much more common in the USA versus the rest of the world. The national sport here is not the NFL, it is getting rich quick.

Long before Brian educated me, I remember reading ads on Craigslist asking for people to transfer money from one account to another. Not being dishonest, I could not understand why there was a need for such people. And not being naive or greedy, I was never tempted to answer one of those ads.

“many people (often immigrants sending money to family members) legitimately use WU to remit money.”

And this is the reason why Western Union is acceptable, but Liberty Reserve is not.

I agree that greed is a primary motive of most money mules.

However, I have a personal friend that wound up as a mule out of ignorance. As a student, she was subletting a room in an apartment and received a Craigslist reply that a foreign student was interested in the room. The catch, of course, was that the deposit was coming from a third party and she needed to wire the difference via WU. In her mind, the money was coming from the parents of the student or some other party paying the bill. So she sent the difference despite the warnings on Craigslist and at WU. In her case, she learned a hard lesson out of ignorance. The fact that it was a scam never entered her mind.

Additionally, I am old enough to remember people telling me X, Y or Z was true because they saw it on TV. Television was an authority to them. These were not dumb people, they were simply out of touch.

On the other hand, I have stopped people from sending money to a scam only to see it collapse fairly soon after our interaction. After thanking me profusely, the party asked me about programs A, B & C which were clearly exactly the same type of operation. In their cases, they managed to avoid one disaster only to actively seek out the next. Oh, well.

So I agree that greed is a primary motive in many, maybe most, cases. But otherwise intelligent people will fall victim simply because they don’t make the connection between A and B.

Then again, there are some really dumb folks out there as well. They don’t get it even after they have been had.

I agree on greed and ignorance, but I think a lot more people do it out of desperation and/or denial. You don’t see people with a lot of money generally doing this. It is possible some people do not know the odds of getting caught and believe in plausible deniability if they do get caught — ie they are so desperate to get out of a situation they are in now that they just want to believe they can, despite how ‘good it sounds’. Also a lot of people are stupid, and one only needs to find that % of people to find and fuel a successful muling operation. Stupidity is not the same as ignorance if there is no capacity to learn (and that 100 IQ thing is only an average, but a great many people below that 100 IQ level have jobs and need money too, they just lack capacity to be logical).

Taleon just isolates the carder crowd, etc in one spot. The Feds can easily decree that Taleon is a “no go” zone. Only the most determined HYIP fanatic would even attempt to move money via something as dodgy as Taleon. And all they would have succeeded in doing is paint a big fat target on themselves. They might as well be moving money via kiddy porn sites, it’s that stupid.

Dear Mr.Krebs,

There is a MISTAKE in the following statement about Webmoney:

“This virtual currency also has barred U.S. citizens from creating new accounts (it did so in March 2013, in apparent response to the U.S. Treasury Department’s new regulations on virtual currencies.)”

referring to FIN-2013-G001 issued on March 18, 2013

http://fincen.gov/statutes_regs/guidance/html/FIN-2013-G001.htm

(the same mistake was also present in your previous article, where you cited your friend’s experience)

Actually that decision of the Webmoney System took effect in January 2012 (Twenty TWELVE)!!!

An this was as per the regulation of FinCEN released on July 18, 2011

http://www.fincen.gov/news_room/nr/html/20110715.html

This regulation expanded the requirement to get registered as MSB to any business which services are available from the territory of the US, and/or for the US citizens, even if that business itself is registered out of the US, and/or located out of the territory of the US.

And the time-frame was observed too:

“The compliance with the registration requirement will not be required until 6 months from publication in the Federal Register to allow time for the form to be updated.”

Since that time any use of Webmoney Transfer in the territory of the US, for citizens and residents of the US, even if they are abroad of the US, – is STRICKTLY FORBIDDEN! This relates to any user – newly registered, or previously registered. And this rule is observed by the Webmoney System without any exclusion.

Please correct the mentioned paragraph in your article.

Hi Bailment, thanks for your comment. What is your source of information that Webmoney made this change back in 2012?

I found this on WJunction from March 12, 2012:

WebMoney says F*** You to USA?

http://www.wjunction.com/16-webmaster-discussion/133991-webmoney-says-f***-you-usa.html

Quotes the following from WebMoney registration process:

Please be advised, the services and products described on wmtransfer.com, webmoney.ru and offered by WM Transfer ltd. are not being offered within the United States and not being offered to U.S residents or citizens, as defined under applicable law. WM Transfer ltd. and its products and services offered on the site wmtransfer.com,webmoney.ru are NOT registered or regulated by any U.S. including FINRA, SEC, FSC, NFA, FinCEN, CFTC or ASIC.

Once again, a lot of these guys don’t get it.

Go fully underground or go home. Or go big or go home.

No “above ground” service is going to work for long – unless it’s “too big to fail” and “too big to prosecute” – like the normal banking system.

Most drug dealers deal in cash. The big ones deal with the normal banking system by one means or another. There are ways to do this obviously, as they’ve been doing it for decades despite increased bank monitoring.

Cybercriminals need to learn the methods that have worked for the criminal drug industry. The problem is such methods reduce the profit as you end up paying premiums to intermediaries in order to not be rousted. But that’s just a “cost of doing business” – just like prison terms and guys with guns seizing your stuff.

As for these services requiring “identity verification”, how hard is that given the plethora of fake IDs available in the underground? That’s the first thing any competent cybercriminal should be doing.

I do suspect, in the same manner that various “criminal banks” arose during the previous decades of “flight capital” and drug smuggling, that criminal banks will arise to support cybercrime.

If you REALLY control a bank, it’s going to be very hard to prove malfeasance unless you can infiltrate it.

I agree with this. The truth is the LR shutdown mostly affected HYIP, forex, skiddies, and some legitimate people. The people the US really wants to get hold of probably doesn’t even go near e-currencies. I continue to believe this is like drug shakedowns — they’ll get a lot of little guys and use them to get to bigger people via informing as a way to plead out.

Just found the site WJunction, a “hangout for Webmasters” – and apparently this whole business is a pain for some Web sites that use WebMoney or Liberty Reserve as well. I never thought of normal Web sites using alternative currencies.

http://www.wjunction.com/135-other

Yes, we (normal websites) do.

The focus on monetary currency is as old as law enforcement’s investigation of financial crimes. However, with new technologies and the increasing movement of money through virtual worlds and online exchange systems, law enforcement has only scratched the surface with its crackdown on Liberty Reserve.

I’ve just found some interesting articles on WebMoney on Yahoo. Apparently there is a disparity between the way the US deals with cash customers and the way Russia does. Russia has many more non-banking/non-credit card cash customers, so this sort of service apparently is considered normal there.

WebMoney: Well Liked & Established Digital Currency from Russia

http://voices.yahoo.com/webmoney-well-liked-established-digital-currency-from-167426.html?cat=3

Non Bank Payments with Webmoney Transfer (part 1)

http://voices.yahoo.com/non-bank-payments-webmoney-transfer-part-1-4658887.html?cat=3

Non Bank Payments: America Vs. Russia

http://voices.yahoo.com/non-bank-payments-america-vs-russia-4664577.html?cat=3

Non Bank Payments: Pay Pal or WebMoney (part 3)

http://voices.yahoo.com/non-bank-payments-pay-pal-webmoney-part-3-4682869.html?cat=3

Non Bank Payments: Webmoney & Plastic Cards (part 4)

http://voices.yahoo.com/non-bank-payments-webmoney-plastic-cards-part-4-4682923.html?cat=3

And here’s an article that bashes Brian’s Washington Post article from years ago on WebMoney. 🙂

Washington Post Vs Webmoney Transfer

http://voices.yahoo.com/washington-post-vs-webmoney-transfer-1559655.html?cat=3

This article is summing up a lot of the points we both have made, as well as some others. I am starting to believe logic and reason won’t work. Well, I never really believed it but I used to have hope.

No surprise here .Brian Crebsky works for FBI .he is A sucking ghost of jealousy .and Full of S**t .

quote — Webmoney Transfer by directly linking the multi billion dollar a year company to illegal online child pornography.http://voices.yahoo.com/washington-post-vs-webmoney-transfer-1559655.html?cat=3

sound familiar is in it ?? same words they use to clamp on LR .

And the fallout continues…

Not So Anonymous: Bitcoin Exchange Mt. Gox Tightens Identity Requirement

http://www.forbes.com/sites/andygreenberg/2013/05/30/not-so-anonymous-bitcoin-exchange-mt-gox-tightens-identity-requirement/

I’m imagining what sort of currency system based on US dollars would be located in North Korea. Since NK’s major export is counterfeit US dollars, once real money goes in there, it’s going to be difficult to prove it’s real when you try to transfer it back out.

@ AlphaCentauri,

Providing the quality of the NK fake dollars is sufficient to pass muster then it does not realy matter.

A number of years ago a middle east country was forging USD in vast ammounts. The quality was so high that the US Treasury had a problem in detecting them. The USTres also realised that the cost in finding and removing them and the attendent international financial crisis it would cause was so vast in comparison the least costly option was just to ignore the fakes…

Ironically the fakes were probably worth more, in costs and labour, than the value of the actual notes, if you consider the ease of printing the latter for the government.

I seem to remember a bunch of scams not too long ago concerning people trying to con people into believing they had supernotes for sale.

“Ironically the fakes were probably worth more, in costs and labour, than the value of the actual notes, if you consider the ease of printing the latter for the government.”

North Koreans make far less than Americans. And North Korea has one big economic advantage over any Western country: it can just send people to one of the six prison camps if they do not cooperate.

There are a plethora of alternative money transacting systems in place, some from before the Federal Reserve aquired it’s dubious status.

You need only look at Asian and Arab merchant and Jewish moneylending systems some of which predate banks by several hundred years. Some of which were set up to avoide cut-throats, foot-pads, highwaymen, pirates and other villains such as corrupt kings, princes and other officials who presumed it was their right to a percentage if not all easily negotiated valuables such as precious metals, stones, spices etc.

Even after BCCI there are still many “banks” moving around funds with few if any questions asked. One well known offender for “Nigerian officials” and other corrupt officials and despots is HSBC working out of London.

One wheez for such things is to setup in the UK a Limited Liability Partnership (fill out a form and make a 40GBP. Payment to Companies House). Provided the “partners” are in effect forign entities (preferably legal not natural) and do not (officialy) carry out business in the UK then there is in effect no oversight by either Companies House or the UK tax authorities. Provided the LLP sets up some kind of office in Lux or Switz then vast sums of money can quite legitimatly be piped through at minimal taxation. If the organisation decides to trade in other parts of the world say buying and selling gold coins (or other VAT zero rated commodity) it can quite happily launder money to it’s hearts content.

An organisation can also avoid all tax liability by using a series of “back to back loans” from various tax havens such that all parts of the organisation make small losses in the various juresdictions it operates in and the “loan interest” accumulates in a zero tax haven.

All of this is fairly standard practice for large organisations out of Seattle and other places in the US operating in Europe (it’s estimated that a number of such companies have in total avoided paying the UK treasury somewhere well north of 50billionUSD equivalent).

But other oportunities arise on the smaller scale one such that has been used for money laundering is the “Pay Day Loan”, “Cash shops”, and Forign exchange booths. In particular the likes of “Travelers Cheques” have been used as have Lotto Tickets.

And new more modern systems that have sprung up revolve around such things as mobile phone credits.

The simple fact is that many of the Internet criminals whilst smart in some ways are woefully ignorant in others. They almost have a blindness in that they only want to use High Tech solutions that they think they understand rather than the low tech systems that are tried and tested and have worked well for a long time. The flip side is again their self beliefe in their technical invulnerability yet they reveal much of themselves on various sites and forums so much so that more traditional criminals want nothing to do with them, thus they have in effect slamed the door on themselves and cann’t avail themselves of the more traditional systems that are quietly operating and have done for many years.

One ironic thing about the first Finacial Crissis (FC1) is that the only liquidity in the US economy was the vast sums of drugs money being laundered through the system…

Good post. I wanted to point out that when I said in an earlier post that HYIPs would sometimes pay people back — I’ve heard of ersatz HYIPs being created to back businesses like payday loans, etc, as their initial funding, which would in fact pay back the investors until the invested was liquid (which seems crazy until you realise the percentages these places get — and their (almost) guaranteed returns).

clive, there is a distinction between whether a flow of money is taxable and whether it constitutes money laundering

regardless of whether the money in your hypothetical is subject to taxes, it is certainly subject to investigation by any of the numerous authorities who have the legal power to observe financial transactions in the UK and elsewhere

and that, as they say, is the ballgame

@ JohnEtcEtc

For there to ba a “ballgame” both sides need to activly participate…

In the UK “government cutbacks” have decimated the ranks of investigators in HMRC and for political reasons these are focused at individuals and SoHos and Small and Medium Sized business and a limited number of home PLCs. Thus large businesses and multinationals especial those who “off-shore” in various ways get an effective “freepass” on tax avoidence.

Thus those in the know especialy in the lower levels of HMRC know that for quite deliberate reasons David Cameron PM and George Osbourn have significantly dropped the ball and left the field long before half time. Thus multiple billions are being leached not just out of the UK Treasury but also the UK economy.

Now it does not matter if you call it tax avoidance or otherwise what matters is the actual process and if it’s known a blind eye is turned on any given method of tax avoidence then that method will be used for money laundering as well. This is for the obvious reason that even small amounts of tax on each stage of a complex fraud used to hide money laundering will quickly remove any profit in operating such as system thus making the money laundering more obvious.

The classic example of blind eye exploitation if you want to look it up is VAT fraud in Europe using loop holes in re-export legislation. However due to a slight twist in the game you can actually make a profit by claiming back the VAT that you’ve never paid and it has turned into a fraud system in it’s own right which is now known as “Carrosel Fraud” it costs many EU Treasuries billions each month, not in lost revenue but actuall direct payments out to the fraudsters. This profit can then be used to offset expenses and taxes in complex money laundering schemes and has been seen to be done so in relation to drugs crime.

However rather than sort out the system investigatory agencies are chasing asset rich Small and Medium sized organisations due to the likes of the UK’s “Proceads of Crime Act” known as POCA. Rather than use it to do what it was designed for which was to strip the assets of serious crime organisations it’s being used against these asset rich organisations because firstly it stopes them being able to mount a defence (known as “striping of rights”) and secondly the agency gets to keep around one fifth of the assets and the Treasure gets to keep the rest. And it is not unknown for these agencies to tell outright lies to judges to ensure convictions. They get away with it because tax legislation or law is considerably more complex than criminal law, however due to the peculiarity of this a judge has to take as said the word of chartered accountants on the way the tax legislation is to be interpreted…

Often the targets of such action have not set out to commit crime but just to run a business and provide employment, and have got caught up in the labyrithan and very contradictory tax legislation, and have followed the advise of accountants or other financial advisors.

I don’t know with the purpose for this article maybe to propose closing the left except paypal LOL (sorry just joke), actually statement Media that say users in LR is anonymous i think is not all is true, because in every memo in our country (Indonesia) when you transact in exchange “must” write down the account bank number an Name in that Bank Account in the LR memo.

http://i39.tinypic.com/161xbbc.jpg

About fake identity in bank account is almost impossible because it need IDCard that has digital signature with newest technology.

So if your govt interested to trace and doing investigated a “suspect” it will so easy to find it.

But i don’t know the exchangers now have been closed too by US gov.

But anyway i’m sorry to Mr Brian my comment in your article before have offend.

Actually I don’t about your policy in money laundering, is it one requirement main need is real ID, of course like in our account banking name is real name, just look news newest case in money laundering (in association with corruption), so members in our country especially most of user LR is very realized about how to avoid money laundering.

Why i make statement clear in here just because when i updating this case seemly our exchanger have been closed too and this will make impact with transaction , The main goal exchangers actually is cut off period if it compare with sending swift transfer and it’s more cheaper, but the main important is “they help us for buying time”.

I hope with this comment can be give another perspective, because it’s so boring see almost media always report the same thing.

The next important thing is we want clearly to specific from your gov authority is “what may” and “may not to be done” maybe it should be communicated

in the international formal forum just because impact from shutdown LR web in order we suffered and getting paranoid with “political claiming” as usual done before LOL .

How are we going to get our money back? LR we are dissapointed in you

You’re not going to get your money back.

When you deal with criminals, you often end up losing money due to their activities.

The trick is to not deal with criminals in the first place.

Oh poo, almost every single person that banks in a Bank is also dealing with criminals. One might want to suffix with ‘sanctioned by the state’.

These guys need to learn to use DECENTRALIZED currencies. USD swings up and down too. Criminals not smart as usual 🙂

Buttcoins are just a pyramid scam where you don’t realize you’re a participant.

I said decentralized currencies not Bitcoins 🙁

Does anyone one where the sophos poll was done? the forum??

A legal perspective from the WSJ …

http://blogs.wsj.com/law/2013/05/31/what-the-liberty-reserve-bust-means-for-digital-cash/?mod=WSJ_hps_MIDDLENexttoWhatsNewsForth

Bitcoin is not a pyramid scam.

Bitcoin provides a service and has unique value. Yes, it is true that when there are new investors, the price goes up, if there are less investors price goes down.

1) People make the mistake by saying that Bitcoin “needs” new investors for it to succeed. Yes, Bitcoin “needs” new investors for the price to go up, but Bitcoin itself does not require the price to up or for it to succeed. Bitcoin’s price going up is not its objective. If that was its sole objective, they yes it would be a Ponzi. Bitcoin is a new technology, so it is to be expected that it would attract new investors/users, thus causing the price to go up over time.

2) Another mistake people make is to presume that a “need” for new investors for the price to go up automatically makes it a Ponzi. There is nothing Ponzi about Bitcoin itself, it is just that recent speculation, has caused price fluctuations, and people are wrongly concluding that all Bitcoin is then good for is speculation. Bitcoin’s purpose is not for speculation, it provides value and services.

Example: One could say the same of early investors who bought Apple stock in 1980 (initial price, split-adjusted: $2.75 – current price: $450) but you wouldn’t call Apple a Ponzi. Most technologies experience an explosive growth spurt. This is the concept that actual Ponzis take advantage of…they try to convince people that something that is worthless has value, and if you get in early you will be rich.

Bitcoin derives value from many things. It serves as a unit of account. It is divisible out 8 decimal places, allowing for even very small micro transactions. It cannot be counterfeit. It does not wear out. Bitcoin is a global currency that is designed so well it is easier to use as money than many other options.

Bitcoin is neither fish nor fowl, neither a currency nor an investment.

You forgot to mention the bit about how more Bitcoins are “mined” via fast computers. China and other countries rightfully scream very loudly when the U.S. “mines” more money, i.e. it prints more, because the people who hold USD have just lost some value via dilution.

And the wild swings in the market make Bitcoins unsuitable for use as currency and make it highly risky to use as investment.

The creators of Bitcoin tried to make it everything to everyone and therefore ended up making it suitable for almost no one.

“Bitcoin is not a pyramid scam … Bitcoin is a new technology”

That’s what many snake oil salesmen promised in the late 1990s regarding dot-com stocks.

We are in agreement. Another issue is, of course, the limited supply which means far easier ‘value manipulation’ in general.

Yet another issue is the “cool” factor. Bitcoins are new, hip, and used by people other than Establishment fuddy-duddies.

Could not agree with you more on the ‘cool factor’. Bitcoins are like the iPod/iPad/MacBook of ‘e-currency’. While I am not saying only hipsters use it, I think that right now it is hipsters that are mostly so gung-ho for it — and I wonder how they will react when their own ‘e-currency’ of choice gets choked off. In a way I kind of hope it does so that they will, as you might say, “kick up a fuss”.

Nice sales pitch. What are your positions in bitcoins?

But in a way it IS a pyramid scam: The people that got in early will (and/or have) become very very rich (at least potentially) while those that come in later will see decreasing returns, or at least not increasing ones (most likely). Doesn’t mean it will or would stay a pyramid, but I’d say it already has been one… What is happening next, of course, may not be.

I am curious about non crimimal users of Liberty Reserve.

Why aren’t you using paypal?

Are you using it to avoid taxes?

What is the main advantage as a user (aren’t commissions more than paypal?)

Plenty of people have already answered this in comments. You might be best to start with ‘not everybody is an American, and not everybody is banked (not even a lot of Americans)’.

Once again, the U.S. government has won the battle, but lost the war.

LR is down, atta boy Mr. Prosecutor.

Now what?

The underweb will move to:

1) Webmoney – an even harder for the western researchers to explose, virtually no info in English, painful registration and verification process.

2) BitCoin – money launderer’s heaven.

Dump the BTCs on some exchanger, get WU/Wire/Whatever you want. Simple and anonymous.

3) WU/MoneyGram – No comments.

Next time when you want to buy some underground

*You name it*, you will have to use your own name or will have to explain why the payment came from the U.S.

By shutting down LR, the U.S. community that research the underground world shot itself in the leg.

Regards,

Or other places. Though of course certain places are more open to bribery than others.

Hm. 13 May, Amazon introduced its own virtual currency (only good for Amazon products right now, but who else is not willing to believe that will be limited to that soon?). Let us just see if this has anything to do with these other things.

C’mon, man, really?

“briankrebs @briankrebs

Looks Liberty Reserve wasn’t the only thing seized by the USG this week. Carding/dumps store t12shop.cc goes down http://ow.ly/lBktf ”

You know full well that mentioning the two together is a trick of words that makes them look similar, whether you meant it or not. It’s shameful.

“Hm. 13 May, Amazon introduced its own virtual currency (only good for Amazon products right now, but who else is not willing to believe that will be limited to that soon?). Let us just see if this has anything to do with these other things.”

“You know full well that mentioning the two together is a trick of words that makes them look similar, whether you meant it or not. It’s shameful.”

LOL…..

Uh, LR was a site used for (often legitimate) payments. The other link was a freaking carding shop — nobody said anybody was doing anything ‘legal’ there that went there.

Disingenuous.

The US likes things to be in its territory by people it wants doing things — and you’d better be willing to go along with it. They tend to squeeze out other places, even ones that have nothing to do with the US, to push people into the boxes they want them to be in and use the products they want people to use — and you’d better believe that’ll be products they have full surveillance powers over.

As I said, you’re being disingenuous.

And like I said, there are 6.7 billion people who don’t live in the U.S. There should be plenty of market opportunities. And dozens of “alternative” payment processors like PayNova exist who manage to operate year after year with no allegations of having been set up as as payment processor for criminals.

Hell, one big complaint about the non-secular Jews in the U.S. is that they are insular and don’t want to participate in society as a whole. The same complaint can be heard about the Mormons. Both sub-cultures are considered to be insular but also considered to be well off compared to Joe Sixpack middle America.

Part of the 6.7 billion people not in the U.S. could certainly set up a payment processor not catering to criminals. In fact, it’s been done, dozens of times. Who says you have to accept money from the U.S. Surely, we are a declining empire given that we can’t pay our bills and just bully everyone when given the chance. Why do you want us in your club? And tie everything to the USD and expect American style justice?

“Why do you want us in your club?”

Cyber-criminals want to be able to fleece Americans because, as bank robber Willie Sutton apocryphally said, that’s where the money is.

Cyber-criminals also want to be able to use the ATMs in the USA for money mules to withdraw the loot from the transgressions of cyber-delinquents.

Yet they refuse to accept that they are as annoying as bratty children when they whine about U.S. law enforcement taking action against them.

All true, of course.

They want the safety and legitimacy of a law abiding, but “loosely regulated” jurisdiction to funnel funds from their marks to their own accounts.

Having followed the HYIP scene for years, I’ve seen StormPay, e-Gold, e-Bullion and now LR bite the dust. AlertPay aka Payza, STP and, the new kid on the block, PM, are still up and running. What do all these entities have in common? They are the favorite payment processors of the HYIP crowd. Every “program” was accepting LR.

StormPay, e-Gold and e-Bullion were all U.S. based and the first to be taken down. The “solution” was to go offshore as everyone knows U.S. law does not apply outside the U.S. and in cyberspace, at least that’s the “logic” to Americans in the HYIP crowd. Now that LR is down and PM is blocking Americans, that leave Payza and STP as the default processors. Well, at least until the Canadians wake up.

I won’t repeat my argument vis a vis processors and the American way of insisting there are only x numbers of ways to do things that are ‘correct’. As I’ve said before, there is a huge place for anonymous transactions online that has shit-all to do with crime and a whole lot to do with privacy. I’ve actually known people who were robbed in foreign places who were WU’ed money without ID and it was a lifesaver — so you also cannot say everybody that does not show ID must be a criminal, but I’d argue you don’t need to prove a reason for not wanting to show ID either. As has been pointed out numerous times, cash itself is ID-less. And there is clearly a great willingness in the US to do away with cash, which means increased trackability. You do realise everything you buy is stored and tracked when you purchase things with any non-cash method of payment right? Is it so wrong to wish for an alternative to cash that is also anonymous? Why does that have to be worse than cash?

And if you try to give me the argument that those who have nothing to hide don’t need Anonymity… Well I’ll just give up. I realise I did not pick the most balanced place to try to make my point, but it seemed like somebody had to, here.

Actually, we actually agree much more than you realize. My issue is specifically with LR, not cash and not with anonymous payment systems. In the case of LR, the prosecution alleges that LR was set up by criminals for criminals. They will have to prove that in court. To that extent, I am very happy that enforcement action was taken. The HYIP crowd is shitting bricks. And it’s about time.

As for my personal spending habits, I use cash when appropriate and convenient. I use my credit cards when I want the convenience and protection they offer. i.e. charge backs if I am making a large purchase.

Of course all my cc purchases are traceable. The card companies and merchants want to track my spending habits. As a merchant, don’t you track what your customers buy? Or is everything a surprise? If you peddle software, you don’t have to make inventory decisions and/or worry about whether you have your capital tied up in merchandise that gets stale.

As for privacy, my spending habits would bore most people to sleep in heartbeat. My assets and spending habits fit well within my reported income. i.e. I don’t report a meager income and drive a Maserati and live in a mansion.

What worries me? Facebook, Twitter and peoples need to film everything possible and post it online. How long until employers and insurance companies develop algorithms that crawl Facebook and Twitter, documenting every “like”, photo and associate I have? Oops, too late, it’s already happening. My “solution” is to shun those sites. But it makes no difference, they can profile me just by looking at what my relatives post. No need for me to be online at all. And, alarmingly, their profile is likely very accurate.

Warrantless wiretaps, National Security Letters and locking people up in Guantanimo Bay. I think the U.S. justice system is strong enough that the legal system can handle most situations. And I want a judge to review LE requests. There’s a reason we have 3 branches of government.

So to summarize, I use both cash and credit cards realizing one is anonymous and one can be tracked depending on what my needs are. Whatever.

I am much more worried about Facebook and the ginormous predictive databases which are populated every time I login to anything.

I actually have noticed we are not completely at odds, and that you are able and willing to at least explain yourself (as I have tried to) and your reasonings which is one reason I have chosen to continue our discussions. I’m not against people who disagree with me because I know I am not always right; I’m generally just against people who think they are always right. I’ve seen that we generally agree about social networking and massive corporate databases, although in a way that has also urged me forward to see if we can find other common ground. I probably need to take a break for a day or so from commenting. If you wanted to take this off of Brian’s blog, I’d be open to that as well, although obviously the logistics might be complicated.

Hi,

I have a tendency to go on posting binges and take long breaks, frankly, because I have had most of the discussions previously and the online HYIP script never changes. That’s where my main experience is.

That said, I am interested. We could create dummy gmail accounts and one of us post it here. Or PM via some forum. If we get a few followers, who cares, they will get bored after a bit.

I don’t see Russians, Ukranians, Americans or cops as monolithic entities. Everyone’s an individual with a different perspective. I will say that you’re more interesting and literate than most Americans I know.

About the absolute I can say about myself is that I am 100% anti-scam. I’ve seen them ruin too many families and there’s at least one suicide in every big HYIP that collapses. There are legitimate ways to make money online cuz I have done it.

Peace.

I have as well. Honestly I find HYIP scams to be one of the most boring scam templates out there — it hasn’t been new for a hundred years in its modern incarnation (and longer before Ponzi), and translating it to digital doesn’t make it any more impressive. The fact that it ISN’T new is probably why I have little sympathy when people lose money to them. I often think the biggest shame they do not teach kids in school is ‘you cannot get something for nothing’, ‘do not trust things that seem TOO TOO good to be true’, and the basic rudiments, in general, of how to spot things like this to begin with — i.e. ‘logic’ and ‘reasoning’. That said (and this no doubt will not make me any more popular), I probably have some radical views as far as why it shouldn’t necessarily be considered illegal either. Don’t worry, I have no interest in debating that, though. As I said, I find HYIPs boring. 😉

Aside from going through Brian, I don’t really see there being a way with temporary email addresses to avoid the other person from being taken in by someone pretending to be the other person (and it looks like we both did a reasonably decent job at separating our identities here from elsewhere). If Brian is willing to forward your email to me that could work; he has my address… although it is probably an imposition.

(Which is to say I am not going to just ignore your post, here — it has a lot to it and needs more time than I can give at the moment).

That’s stupid. All it takes is two people with an MSR-206, one with a prepaid debit card in someone else’s name, and one with a blank plastic card to transfer things in a TCP/IP packet or two and you’d have the same basic ability to “fleece the American public by using your ATMs”. In other words “oh, please”.

Since you seem to think only America’s “enemies” cannot use American payment systems or credit card systems, can you explain to me why countries like Israel (hardly an American ‘enemy’), Macedonia and Montenegro (which is up for EU status soon) typically cannot but places like Romania (which has as has often been pointed out one of the highest electronic theft rates in the world) often can?

http://cardshop.su/ and http://cvvplaza.net/ seems to be still operating, but I can see now they started accepting Perfect Money and Bitcoins.

Dear voksalna.

You have written many times of how the USA is a bully throughout the world, with the Liberty Reserve incident being just the most recent example. You are probably too young to remember how the Soviet Union was a bully throughout the world, but then the USSR imploded and bullying became too expensive. See the below Reuters link for a story on Putin restarting the Cold War.

Russia to send nuclear submarines to southern seas

http://www.reuters.com/article/2013/06/01/us-russia-submarines-patrol-idUSBRE95007V20130601

And if you want to read of how China has begun to bully the world, especially all other countries bordering the South China Sea, see the below BBC News link.

Q&A: South China Sea dispute

http://www.bbc.co.uk/news/world-asia-pacific-13748349

Finally, see the below link for a story on how China and Laos forcibly repatriated nine North Korean orphans, aged between 15 and 23, almost certainly to be imprisoned or even executed. These people simply wanted to be free, and not in that naive cyber-anarchist sense.

UN ‘dismayed’ over North Korea refugees

http://www.bbc.co.uk/news/world-asia-22739419

There are bullies, and then there are bullies.

My apologies to those who believe this post is completely off-topic. Brian, go ahead and put me back on double-secret probation.

What are you smoking? Haven’t you seen all the pics of happy people parading through Pyongyang saluting their leaders and how they mourn when one of them dies.

What do the South Koreans have? Food, cell phones, the fastest Internet connections in the world (good for porn) and political freedom. All frivolous and decadent. And they are free to emigrate to the Great Satan, the U.S. if we manage to brainwash them.

You left out reasonable wages, including some of the highest wages for English educators in the world, which has opened them up to a vast breadth of knowledge. I’ve also never seen English teachers happier anywhere else in the world — yes, people whose native languages are English and who came from Canada and the US. And in case you couldn’t tell, I have known quite a few English educators. 😉

Actually, no, I was alive, well, and old enough to remember that very well. Just for fun, by the way, have you read ‘http://cryptome.org/2013/05/RussiaWWII.pdf’? How much do you know about the McCarthy era and the ‘Red Scare’? How much do you know about the Eastern Bloc countries in general?

What I find ironic here is if anything I see your country becoming what many or most from where I came from might consider the worst of what you accused my part of the world of being. I think you mistake pity and warnings as insults, which goes hand-in-hand with precisely what I am saying. In the meanwhile your country has consistently instigating the use of propagation of various types of weapons, leading to other countries pedaling furiously to try to keep up, and then attacking them because your country believes only it and its allies should have the power to do this.

You do realise that to some good extent it was actually the cold war that probably DID prevent further use of nuclear weapons right? There is actually a lot to be said for the concept of Mutally Assured Destruction. For one thing it makes people far more careful about what they are willing to do and how far they are willing to go. I will not go into a whole lot of political blah blah because, perhaps contrary to what you think, I am not saying CIS is in the least bit without fault. We have had our own surveillance problems, and our own unjust laws, a lot of which were struck down briefly but some of which have slowly crept up again — although I would argue that yours have been far outpacing ours, especially in the area of surveillance and ‘snitching’.

To wit, the very things your country was so against (neighbours snitching against neighbours, the State monitoring everything, coercion, inhumane treatment, ends at any costs (here I somewhat disagree; I do not believe CIS was anywhere near as bad as your country has *chosen* to become). And you are being ruled by the very same concepts that too many other what you’d dub ‘non-democratic’ societies have repeatedly been subjected to: Your government has propagandised you into believing it is doing it all in your best interest, while in the meanwhile your economy has rather quickly come to more and more represent what you believed that ours was during the cold war, but with more gadgets to make you less capable of seeing it, and more fear to make you willing to continue abiding by it (again, see McCarthyism). Granted you have better grocery stores and more ‘consumer products’ but your buying power continues to decline and the haves have grossly surpassed the have-nots in almost every arena in your country — certainly politics, where everything is just a system of favours couched in the rhetoric of ‘lobbyists’.

What makes me sad is those from my part of the world probably have learned far less biased things about your country than people from your part of the world have learned about mine. While I know my English is far better than most (and there’s a good reason for that — I have an advanced scientific education and spend a lot of time reading and studying and analysing all sides of every conversation because *I want to understand and try to be as unbiased as possible*), that does not mean that others from my part of the world are incapable of great deep thought. In point of fact I’d say our voluminous literature proves we are a very thoughtful and analytical people, and the average man on the street in most of the large cities in the CIS, ex-USSR era, knows vastly more about world politics and geography than the majority of people in your own. It takes will and experience to become capable of having dialogues of this sort, and when I say this I mean to especially emphasise ‘experience’. I suspect your country will eventually learn what dangerous roads it is going down, I just fear that by then it will have started a culture that reverberates throughout the rest of the world and kills the advances BOTH of our sides have made to get away from state-sponsored manipulation.

People need to wake up, and not just to have lovey peace fests with warm soups and Guy Fawkes masks and ten minute attention spans and no willingness to make sacrifices to preserve your own country’s founding tenets.

And yet I know posts like this are ultimately futile — every people needs to learn for himself through loss and experience, and no amount of commenting is likely to change that. It is only when things touch you on a far more intimate level that it will hit you that you have probably lost the ability to protest at all.

Definitely futile. Noone has any sympathy for anyone with money in some shady website bank for hackers.

The gov’t can spy on me all they want. If they get the hackers virusing my pc, trying to ruin my hardware, or trying to rob my family members of their credit or identities.

(they’re not only after muslims nowadays)

Maybe you just deny how much of a problem this really is. Which is suspicious. Most ceo’s of major corporations in the US still do not take this seriously. And the US is not the only one against groups like this…. the whole world is.

and you keep telling us what side your on.

PC gaming has been dying for years for the same reasons man. now its the whole industry, meaning more power and freedom and learning potential in kids hands, dying to androids and ipads.

Now you make think this silly. But an e-sport industry could also save as many lives proving as many jobs as pro athletic sports shown on tv. It should be a billion dollar industry….but its not, even after 20 years.

One thing the internet has proved, imo anyways, is that human nature is evil and we learn how to be good as grown ups. When a person remains anonymous and can have so much influence they abuse that power.

Even still as these industries crumble, The presidents and ceos of these companies would just tell you paranoid.

Well one thing is for sure, I’m proud to be an American, where at least the US gov’t, if not its comapnies, is finally understanding how hackers are trying to ruin the world like jealous children.

And if you think its bad now. You just wait till its the norm in most companies. The world is gonna change alot i feel it, this is just the medieval times of the internet. only 20 years old.

One thing i will agree with you on though. I don’t fully trust my gov’t. noone should…they are our employees and we are micro managers lol. You should def be voting in local elections.

They do do alot of things in the name of safety, that actually make us unsafe. They are still naive and ignorant and stubborn in some ways. But these things will change too and they will have to make sacrifices as well.

Payment service Paymer (paymer.com) mentioned in the poll is currently offline.

Nah, it’s back.