A story in a national news source earlier this month about freezing your child’s credit file to preempt ID thieves prompted many readers to erroneously conclude that all states allow this as of 2016. The truth is that some states let parents create a file for their child and then freeze it, while many states have no laws on the matter. Here’s a short primer on the current situation, with the availability of credit freezes (a.k.a “security freeze”) for minors by state and by credit bureau.

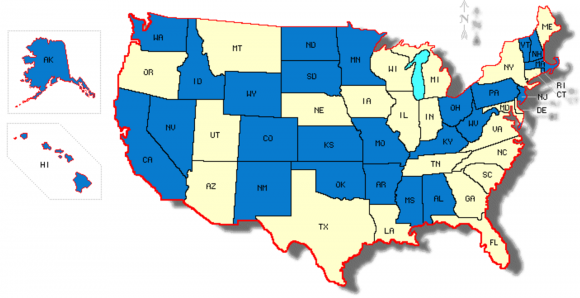

The lighter-colored states have laws permitting parents and/or guardians to place a freeze or flag on a dependent’s credit file.

A child’s Social Security number can be used by identity thieves to apply for government benefits, open bank and credit card accounts, apply for a loan or utility service, or rent a place to live. Why would ID thieves wish to assume a child’s identity? Because that child is (likely) a clean slate, which translates to plenty of available credit down the road. In addition, minors generally aren’t in the habit of checking their credit reports or even the existence of one, and most parents don’t find out about the crime until the child approaches the age of 18 (or well after).

A 2012 report on child identity theft from the Carnegie Mellon University CyLab delves into the problem of identity thieves targeting children for unused Social Security numbers. The study looked at identity theft protection scans done on some 40,000 children, and found that roughly 10 percent of them were victims of ID theft.

The Protect Children from Identity Theft Act, introduced in the House of Representatives in March 2015, would give parents and guardians the ability to create a protected, frozen credit file for their children. However, GovTrack currently gives the bill a two percent chance of passage in this Congress.

So for now, there is no federal law for minors regarding credit freezes. This has left it up to the states to establish their own policies.

Credit bureau Equifax offers a free service that will allow parents to create a credit report for a minor and freeze it regardless of the state requirement. The minor also does not have to be a victim of identity theft. Equifax has more information on this offering here.

Experian told me that company policy is not to create a file for a minor upon request unless mandated by state law. “However, if a file exists for the minor we will provide a copy free to the parent or legal guardian and will freeze it,” said Experian spokesperson Susan Henson.

Henson added that depending on state law, there may be a fee ranging from $3 to $10 associated with the minor’s freeze. However, if the minor is a victim of identity theft and the applicant submits a copy of a valid police or incident report or complaint with a law enforcement agency or the Department of Motor Vehicles (DMV), the fee will be waived.

Trans Union has a form on its site that lets parents and guardians check for the presence of a credit file on their dependents. But it also only allows freezes in states that reserve that right for minors and their parents or guardians, and applicable fees may apply.

Innovis, often referred to as the fourth major consumer credit bureau, allows parents or guardians to place a freeze on their dependent’s file regardless of state laws.

According to Eva Casey Velasquez, president and CEO of the Identity Theft Resource Center, there are currently 23 states that have regulations that provide some kind of protective mechanism for parents and guardians when it comes to children’s credit reports.

“Some allow you to create and freeze a report, others allow for some kind of ‘flag’ on the Social Security number,” Velasquez said. “Kentucky has proposed legislation and it will go for a hearing, probably this month.”

Here’s a list of the states that have minor freeze laws on the books, and the status of pending state legislation from the National Conference of State Legislators (NCSL). That list currently includes Arizona, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Louisiana, Maine, Maryland, Michigan, Montana, Nebraska, New York, North Carolina, Oregon, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin. These states are reflected in the map above as the lighter-colored states.

Many of these states will only allow parents or guardians to request a freeze if the child is 16 or younger. Others allow 18 years of age or younger, and some — like New York — are debating legislation to increase the age from 16 to 18.

According to the U.S. Federal Trade Commission (FTC), several signs can tip you off that someone is misusing your child’s personal information to commit fraud. For example, you or your child might:

-be turned down for government benefits because the benefits are being paid to another account using your child’s Social Security number

-get a notice from the IRS saying the child didn’t pay income taxes, or that the child’s Social Security number was used on another tax return

-get collection calls or bills for products or services you didn’t receive

The FTC has published a comprehensive set of resources that parents and guardians can use to check for the presence of a credit file on their child or dependent, including a checklist of what to do next if a file is found.

Readers have asked whether signing kids up for identity monitoring services might be a better solution than a freeze. As I explain in How I Learned to Stop Worrying and Embrace the Security Freeze, identity monitoring services are great for helping to recover from identity theft, but they are not so effective at blocking thieves from creating new accounts. The most you can hope for in that regard is that the service will alert you when a new account is created.

Some fans of my series explaining why I recommend that all adults place a freeze on their credit files have commented that one reason they like the freeze is that they believe it stops the credit bureaus from making tons of money tracking their financial histories and selling that data to other companies. Let me make this abundantly clear: Freezing your credit will not stop the bureaus from splicing, dicing and selling your financial history to third parties; it just stops new credit accounts from being opened in your name.

Incidentally, it appears many more consumers are starting to get the message about the efficacy of and/or need for security freezes. Bob Sullivan, an independent investigative reporter and editor of BobSullivan.net, recently polled the major credit bureaus and found a considerable uptick in new applications for security freezes in 2015. According to data Sullivan obtained from Credit.com, between 2011 to 2014 freeze users ranged from 130,000 to 160,000 annually. During that same period, about 600,000 consumers requested initial fraud alerts be placed on their credit files, Experian said.

“But that might have changed in 2015,” Sullivan wrote. “In February 2015 alone — the same month as the high-profile data leak at health insurer Anthem — nearly 160,000 consumers asked Experian for a credit freeze. Through October, the yearly total was 434,000, meaning about triple the consumers used freezes in 2015 than 2014.”

credit system is a fraud. cash>credit

***i know blah blah blah credit used correctly is the most powerful thing, blah blah blah. Correct except look what is happening in China, look what already happened here in the states. Credit is evil. Credit is slavery. Credit is insanity. Credit make it so you can buy that shiny new iPhone every year or two. Credit makes kids greedy. Stop this credit buying non-sense, its almost as bad as student loans for college.

Do you have a mortgage? If so you had to have established credit and paid it on time to qualify for a mortgage.

Blanket statements like yours do not benefit the conversation.

Not only that, but you cannot even get a cell phone unless you do a prepaid. Even if you bring your own phone, the non-prepaid companies will not give you service without a credit check.

Re: Credit is evil

Yup. We didn’t collectively own as much crap in the past but we also didn’t work such a high % of each year to service debt to others. Working by demand and without pay (since it goes to someone else) is a form of slavery.

Pay-as-you-go may not be as glamorous but it truly lightens the burden.

After paying off our cars and our house, my 401k and other savings skyrocketed. We chose not to move to bigger houses on at least 3 different occasions as we paid down out 30 year mortgage in 15 years.

If you can’t pay cash, you probably don’t need it.

“Owe no man any thing” – Romans 13:8, remains good advice all these years later.

Do you have a point that has any connection at all to the story or are you just being a troll? Even if you don’t have a single credit card, you will still have a credit report.

A file freeze for a child is a double edged sword. To freeze that file you have to first create it. Once created, it now exists and that can lead to problem, even if frozen.

The greater problem with “child ID theft” is not the use of their name and SSN, which a child file freeze protects against. Rather it is the use of the child’s SSN alone. Most fraud against a child’s SSN is not matched with their name, much less DOB. Synthetic ID fraudsters will use a child’s SSN because it doesn’t match up to anyone in the credit systems. However they will pair it up with a made up name and DOB. Creating and freezing your child’s credit file will NOT stop that.

The only way to stop the rampant synthetic ID theft is to register the SSN as belonging to a minor, something I tried to get TransUnion to do for the last 10 years. You can do it in the State of Utah. That model should be used in all 50 states.

Great comment Steve. Thanks for sharing.

+1, thanks, Steve. I like your idea of flagging it as a minor’s SSN. However, I also believe that too many people dismiss solutions that don’t fix all of of the associated problems.

I fully agree that we don’t dismiss solutions that help at least solve part of the problem. The concern I always had running the fraud group at TransUnion was that creating credit files to freeze for children could have unintended consequences. For example, if I were to run my 9 year old son’s SSN through TU right now it will come back with nothing and in turn a crook couldn’t determine it belonged to him much less learn his name or DOB. On the other hand, once I create a file linking the SSN to his name and DOB for purposes of a freeze, subsequent searches of his SSN could now say that number belongs to him. Maybe that info is now useful for some other type of crime. The solution isn’t necessarily a bad one but rather a one size fits all approach that leverages the legacy file freezing technology for adults.

Flagging at the SSN level doesn’t attribute the number to a name in the credit bureau systems and it doesn’t necessarily even need to tie to a formal date of birth. Just use month and year or even just year. The point being, until the child turns 16, 17 or 18, however you want to define an adult for credit purposes, any use of that SSN is returned with a flag that the SSN belongs to a minor. Fraud stopped. Now if Joe Criminal uses the SSN with his fake name, or even my son’s for that matter, an alert comes back.

Great info. Maybe a dumb question, but how do you establish the flag? Do you need to contact all 3 bureaus?

Brian/Readers

What is the latest advice for minors? A few years back, I was advised by a detective who investigated crimes against minors to never request a minor’s credit report unless absolutely necessary. By requesting a credit report, a record is created where one may not exist, and now, the child’s existence is confirmed and basically public information.

Good article! Anyone with kids or has any kids in the family needs to know this. Thanks Brian! 😀

SubscriberWise has proposed an effective solution: SubscriberWise Proposes Child Identity Theft Protection Legislation to U.S. Congressman Bob Gibbs of Ohio as Representative Maxine Waters Introduces The Fair Credit Reporting Improvement Act of 2014. Info can be obtain via Google search.

Someone is trying to protect kids

http://www.businesswire.com/news/home/20160108005930/en/SubscriberWise-CEO-Contacts-President-Obama-Executive-Action

Why can’t they get simple things like this done ?

They are happy to have the government spend $4 billion on driverless cars, yet nothing that would help just about everyone.

Because such a law:

1) can’t be monetized.

2) can’t be brokered for political power or influence.

3) isn’t useful in legislative horse-trading.

4) won’t help to get you re-elected.

And the most-likely explanation of all:

5) Because someone somewhere is almost certainly making money off the current state of affairs, and would therefore strongly oppose *any* legislation that might put that income stream at risk.

Fully agreed.

If this were something we were talking about happening in another country, we would just use the word corruption.

I mostly agree with what you except that it CAN be monetized:

At least one of the credit agencies recognizes this as a way to distinguish itself as more friendly to the families out there with credit. They are given better tools to protect their children’s credit and create loyalty towards their services: credit reports, credit monitoring, etc.

Ranking: Equifax #1, Trans Union #2, others = losers.

Equifax

Great article. Awful to know that kids aren’t just susceptible to booters anymore.

Looks like USA are land of the milk and honey ?? Are USA economy. So strong that they can give money to cyber rooks ??? Why only USA is vulnerable ? UK ca au are they are not lucrative ? Anybody knows ?

I’ve never met anyone who lives here that would describe the US as the land of milk and honey, not even, and especially, new, legal immigrants happy to be here.

Yes, this is being talked about in the UK and other places. Along with invasive corporate data tracking.

I know that it’s considered not practical but it seems that in 2016 and given the amounts involved that an industry driven replacement for the SSN could be created. I’d pay good money for a biometric linked alternative to the SSN. Get it out of the equation or make it needed in addition to the SSN to get credit.

Never mind ID thieves. What about loser parents who use their kids information to open up utility accounts because they don’t pay their bills?

Yes, what ABOUT this thing I just made up, or perhaps heard from my cousin Marcia whose neighbor read it in the newpaper!

In my opinion, creating MORE digital record on children in an effort to “protect” them is misguided. It’s like software: more code == more bugs. For children, the more digital records there are, the more attack surface/risk there is. And theirs is much harder to manage because managing identities by proxy isn’t something we’re good at yet in the digital world.

Kids are vast uncharted territory when it comes to security. Part of the problem is that people say “how do we protect kids unless we know who they are?” So then, as in these solutions, they ask you to give them all the data on the children so that the children can theoretically be protected. But digitising the kids and creating digital records has its own set of risks.

Sony’s PSN works similarly. If you want to impose child content protections and restrictions on your PS4 games, you have to send all the child’s details to Sony by signing the child up for a PSN account. But then you run into all sorts of difficulties: games marketed at children that simply won’t play unless you disable all the protections that child accounts allow. Or the lack of a process of graduating a child account into an adult account when the child becomes old enough to pay for/manage their own account. They literally can’t do these things. And you can’t effectively manage the child controls on the device if you don’t have PSN accounts for the children.

The Equifax link is helpful to understand your options, but this second link is for actually submitting your request which must be done in writing.

https://help.equifax.com/app/answers/detail/a_id/779

Good News: Free for Children. Bad News: Takes some paperwork.

His victim himself he’s deluded by easy money but not like that this hacker is just victim that’s all just tool for evil people who using young Eastern European people im sure this guy don’t serve spend his time in prison! It’s not fair people who really behind conspiracy never go to jail

Sorry I posted my comment wrong section I was going to post it to hacker article about flyk

I think that it is time we turn the tables. Someone pretends to be me and a merchant falls for it. Why is that my problem? We need to turn the tables and make it the criminals problem and the merchants problem and 0% my problem.

The root cause is a merchant performing a transaction with someone who is not me. Prevent that problem. Then I don’t have to worry about protecting my credit.

I admit that it’s been a long time since I’ve gotten a credit card, but the last time I did I read the terms that came with it and one stood out: “You, or anybody else you give the card to…”

That part got my attention. Since the card has my name on it I thought only I could use it. But that phrase creates the definition of a bearer instrument. I found out later that (at that time, don’t know about today) there was no legal or contractual obligation for the merchant to verify identity or otherwise restrict card usage to the person named on the card.

Fraud has always and continues to be an issue for merchants: they absorb the losses through chargebacks, even if they did everything right according to the credit card industry. What changes are needed are in the credit card industry, and that’s a challenge.

Hi Brian – Do you plan to attend his sentencing?

Whoops – I replied to the wrong article!

It’s even more pathetic when you research the history of SSN and how it wasn’t supposed be used for identification or anything else(like credit), it was just the account number for the insurance you pay into(I know there is no account and it’s basically a ponzi scheme)

BTW.. when you use the form on the Trans Union site to check for the presence of a credit file. They are good enough to email you back with your child’s information, INCLUDING THE FULL SSN, in the clear to let you know they don’t have a credit file. Thanks for sending that info in the clear cause we know how secure email is!