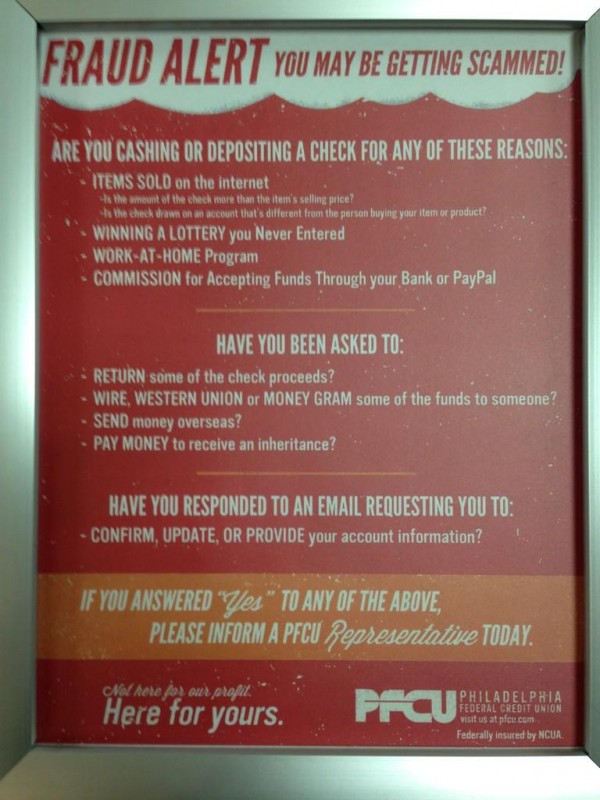

One of my Twitter account followers whose tweets I also follow — @spacerog — shared with me the following image, which he recently snapped with his phone while waiting in line at the Philadelphia Federal Credit Union. It’s an excellent public awareness campaign, and one that I’d like to see replicated at bank branches throughout the country.

© Krebs on Security - Mastodon

Thanks!

I wonder what the next step is AFTER informing a PFCU representative of “any of the above”? Are they actually going to investigate the how or what…or just pre-emptively close the accounts at worst, or record that person for being a moron at best? “Yes, Jane Doe had a trojan that wiped our her accounts, but as you see, she has a history of bad decision-making…..”

Whew! I was worried the poster might have listed the Nigerian Prince who is sending me money! Good thing some folks are still honest! 🙂

You mean he’s written to you too?

He wrote to me first, in fact I’m just about to send him my bank details via email so he can deposit the money I won in the State Lottery

You mean he contacted you too?

He’s promised to marry me as soon as I send him my bank details, date of birth, social security number and passpot.

I;m just off to the post office now===!!!

Mark A. One clever guy. Yup. Good thing some folks are still honest!!

A Maine construction company that sued its bank after losing $345,000 in an online banking heist has settled its dispute after a protracted legal battle that raised questions about the bank’s responsibility in protecting customer accounts against cyber fraud.

The settlement between Patco Construction and People’s United Bank (formerly Ocean Bank) comes about four months after the U.S. Court of Appeals for the First Circuit faulted the bank’s security measures at the time of the theft and advised the two sides to work out a compromise.

I dig the somewhat retro design.

Rick, unless I’m mistaken (very possible), banks are not held liable for customers’ losses based on transactions they knowingly commit. I see no conflict of interest in suggesting the customer consult someone with experience before conducting a questionable transaction. I think there are plenty more possible responses than the two you were able to come up with.

Oh, agreed. Where I was going was if someone was that clueless, they also wouldn’t be following computing best practices and then could be trojaned and then wiped out…and having it on the record that they historically didn’t follow best practices.

Banks have to follow a new requirement to educate their customers about fraud. My current employer and previous employer, both banks, have training in place for employees and consumers.

In the event that someone does “answer yes” to any of those questions and brings it to someone’s attention, the bank will counsel our customer and if necessary, refuse to perform the transaction.

If a check is being deposited, (always forged or fraudulent), we will accept the check for deposit but put an extended hold on the check. The customer usually believes when we get notified that the check is being returned as forged or fraudulent.

The checks are usually for more than $5,000 and we usually get a large dollar return notification if the check is being returned. If a check greater than $2,500 is being returned, the returning bank is supposed to send the bank of first deposit a large dollar notification through the Fed’s FedAdvantage system.

But will a customer actually read it?

I am a banker and I just sent this to our marketing department to see if we can replicate. I think this is a great idea as well.

Does the bank call LE if there is fraud?

Rolo: I was the one who took the photo, this sign is almost impossible not to read if you are waiting in line, its basically in your face, you have to actively try to NOT to read it. In addition there are white laser printed pieces of paper posted at each teller window warning about standard phishing attacks.

My Citizens Bank branch in Philadelphia has similar notices.

.oO( send pic to vote for KrebsOnSecurity BestPractice Award 2012. 8-))

@Brian: the 2011 Award Page is offline? ;-P

Excellent. Really enumerates the major risks and red flags in an engaging non-corporate style.

However, when I visited their website, pfcu.com, I could not find anything about fraud, risks or how to report them at all 🙁

From PFCU’s homepage, go to Financial Education. From there, you’ll find at least three category links (see below) that all lead to the Security Resource Center.

https://www.pfcu.com/financial-education/security-resource-center.aspx

Protect Yourself from Scams

Fight Identity Theft

Security Resource Center

For financial institutions, instead of trying to recreate the wheel, simply use the one published by the FBI. Found here…

http://www.fbi.gov/scams-safety/fraud/fraud-alert-poster-pdf

I think the PFCU one actually addresses the issues that involves money mules pretty well. In fact, it does it a lot better than the one done by the FBI. Maybe it does not hurt me or you, but I think the money mules issue hurts a lot more people than the lottery scam or selling something on the Internet.

Yuck, that FBI poster is not well designed and difficult to read. I would gloss over it and not pay attention to it if I encountered it, unlike the PCFU one, which kind of sucks you in to read it.

I think there is a Citizens bank near me, here in Philly, I will ty to head over to see if they have a similar sign.

– SR

And yet… I have seen far too many people who have seen lists like this and still said, “But this is different!”

Most people understand how it applies to other people, but they don’t realize that it applies to them. Even people who have been burned before don’t often see it happening a second (or third or fourth) time — even if you tell them and explain to them how the scam works. “But this is different!”

It should say check or money order. Most people fall for this because they think money orders are secure. I’ve never seen the “opps we sent you to much” scam pulled with a check.

Chesapeake is one of the largest in terms of land area and population. Homeowners have come to view the city as an ideal place to live for its geography and proximity to the Atlantic coast. Here one can enjoy the access to the beaches and attractions available in Norfolk, and Virginia Beach, yet remain distant enough from tourist traffic. homes and condos are available in the city, convenient to good schools and shopping. Affordable Depending on where you live, you need not worry about a rough commute to work. If you plan to move to the Hampton Roads area, Chesapeake is worth a tour for potential homes – you just need to find the right neighborhood.

In Japan, where bank-to-bank transfers are the norm instead of personal checks, major bank ATMs now include this sort of message printed on the ATM and as a prompt when using them. There has been a lot of the “It’s me grandma, send money” scam in the past 10 years (http://www.japantoday.com/category/kuchikomi/view/its-me-send-money-scam-creator-tells-his-story-in-new-book) and banks have finally taken action. I’m interested in seeing more of this sort of warning in more prominent locations.