Senator Chides FBI for Weak Advice on Mobile Security

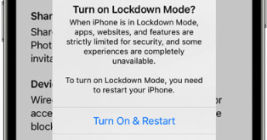

Agents with the Federal Bureau of Investigation (FBI) briefed Capitol Hill staff recently on hardening the security of their mobile devices, after a contacts list stolen from the personal phone of the White House Chief of Staff Susie Wiles was reportedly used to fuel a series of text messages and phone calls impersonating her to U.S. lawmakers. But in a letter this week to the FBI, one of the Senate’s most tech-savvy lawmakers says the feds aren’t doing enough to recommend more appropriate security protections that are already built into most consumer mobile devices.