KrebsOnSecurity spent a good part of the past week working with Cisco to alert more than four dozen companies — many of them household names — about regular corporate WebEx conference meetings that lack passwords and are thus open to anyone who wants to listen in.

At issue are recurring video- and audio conference-based meetings that companies make available to their employees via WebEx, a set of online conferencing tools run by Cisco. These services allow customers to password-protect meetings, but it was trivial to find dozens of major companies that do not follow this basic best practice and allow virtually anyone to join daily meetings about apparently internal discussions and planning sessions.

Many of the meetings that can be found by a cursory search within an organization’s “Events Center” listing on Webex.com seem to be intended for public viewing, such as product demonstrations and presentations for prospective customers and clients. However, from there it is often easy to discover a host of other, more proprietary WebEx meetings simply by clicking through the daily and weekly meetings listed in each organization’s “Meeting Center” section on the Webex.com site.

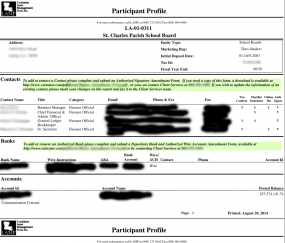

Some of the more interesting, non-password-protected recurring meetings I found include those from Charles Schwab, CSC, CBS, CVS, The U.S. Department of Energy, Fannie Mae, Jones Day, Orbitz, Paychex Services, and Union Pacific. Some entities even also allowed access to archived event recordings.

Cisco began reaching out to each of these companies about a week ago, and today released an all-customer alert (PDF) pointing customers to a consolidated best-practices document written for Cisco WebEx site administrators and users.

“In the first week of October, we were contacted by a leading security researcher,” Cisco wrote. “He showed us that some WebEx customer sites were publicly displaying meeting information online, including meeting Time, Topic, Host, and Duration. Some sites also included a ‘join meeting’ link.” Continue reading