The Common Vulnerability & Exposures (CVE) index, the industry standard for cataloging software security flaws, is growing so rapidly that it will soon be adding a few more notches to its belt: The CVE said it plans to allow for up to 100 times more individual vulnerabilities to be indexed each year to accommodate an increasing number of software flaw reports.

Currently, when a vulnerability is reported or discovered, it is assigned a CVE number that corresponds to the year it was reported, followed by a unique 4-digit number. For example, a recent zero-day Java flaw discovered earlier this year was assigned the identifier CVE-2013-0422. But in a recent publication, The MITRE Corp., the organization that maintains the index, said it wanted to hear feedback on several proposed changes, such as modifying the CVE to allow for up to 999,999 vulnerabilities to be cataloged annually.

Currently, when a vulnerability is reported or discovered, it is assigned a CVE number that corresponds to the year it was reported, followed by a unique 4-digit number. For example, a recent zero-day Java flaw discovered earlier this year was assigned the identifier CVE-2013-0422. But in a recent publication, The MITRE Corp., the organization that maintains the index, said it wanted to hear feedback on several proposed changes, such as modifying the CVE to allow for up to 999,999 vulnerabilities to be cataloged annually.

“Due to the increasing volume of public vulnerability reports, the Common Vulnerabilities and Exposures (CVE) project will change the syntax of its standard vulnerability identifiers so that CVE can track more than 10,000 vulnerabilities in a single year,” CVE Project announced last month. “The current syntax, CVE-YYYY-NNNN, only supports a maximum of 9,999 unique identifiers per year.”

It’s not clear if this shift means software is getting buggier or if simply more people are looking for flaws in more places (probably both), but new research released today suggests that bug finders have more incentive than ever to discover — and potentially get paid handsomely for — new security holes.

For example, one of the hottest areas of vulnerability research right now centers on the industrial control system space — the computers and networks that manage critical infrastructure systems which support everything from the power grid to water purification, manufacturing and transportation systems. In a report released today, Austin, Texas based security firm NSS Labs said the number of reported vulnerabilities in these critical systems has grown by 600 percent in 2010 and nearly doubled from 2011 to 2012 alone.

NSS’s Stefan Frei found that 2012 reversed a long running trend of decreasing vulnerability disclosures each year. At the same time, NSS tracked a decline in vulnerabilities being reported by perhaps the top two organizations that pay researchers to find bugs. For example, Frei noted, iDefense‘s Vulnerability Contributor Program (VCP) and HP Tipping Point‘s Zero Day Initiative (ZDI) each reversed their five-year-long rise in vulnerability reports with a reduction of more than 50 percent in 2012.

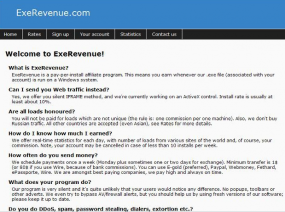

Frei suggests one major reason for the decline in bugs reported by ZDI and the VCP: researchers looking to sell vulnerability discoveries today have many more options that at any time in the past.