Russian authorities have arrested six men accused of operating some of the most active online bazaars for selling stolen payment card data. The crackdown — the second closure of major card fraud shops by Russian authorities in as many weeks — comes closely behind Russia’s arrest of 14 alleged affiliates of the REvil ransomware gang, and has many in the cybercrime underground asking who might be next.

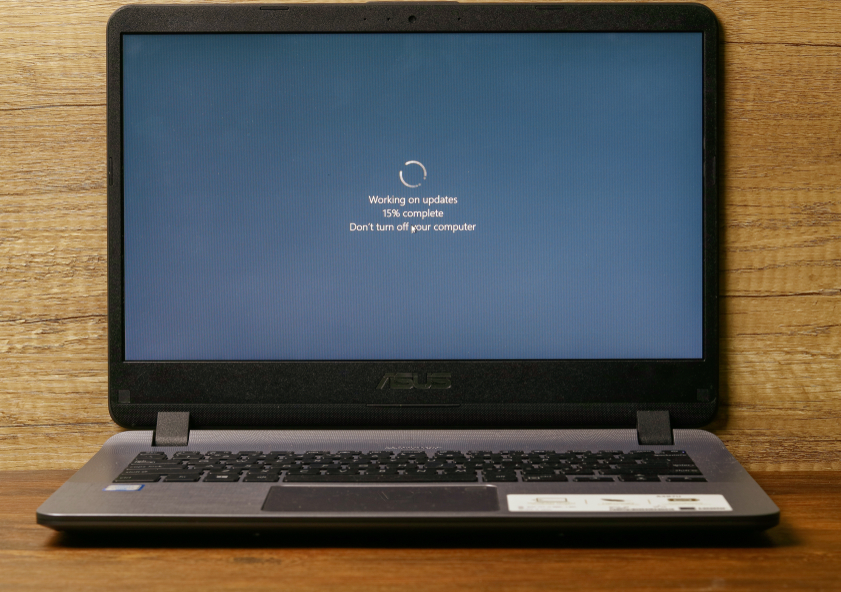

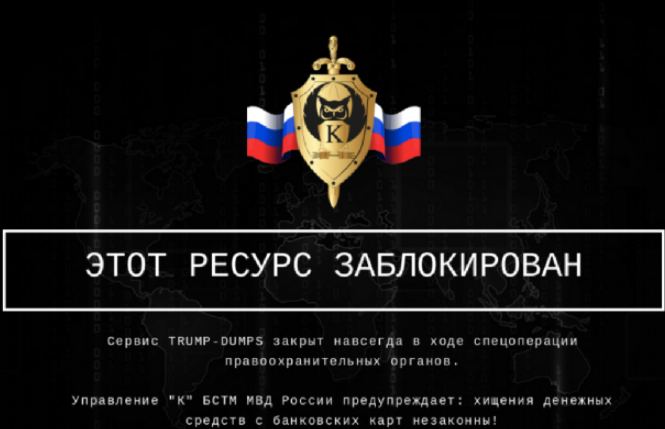

Dept. K’s message for Trump’s Dumps users.

On Feb. 7 and 8, the domains for the carding shops Trump’s Dumps, Ferum Shop, Sky-Fraud and UAS were seized by Department K, a division of the Ministry of Internal Affairs of the Russian Federation that focuses on computer crimes. The websites for the carding stores were retrofitted with a message from Dept. K asking, “Which one of you is next?”

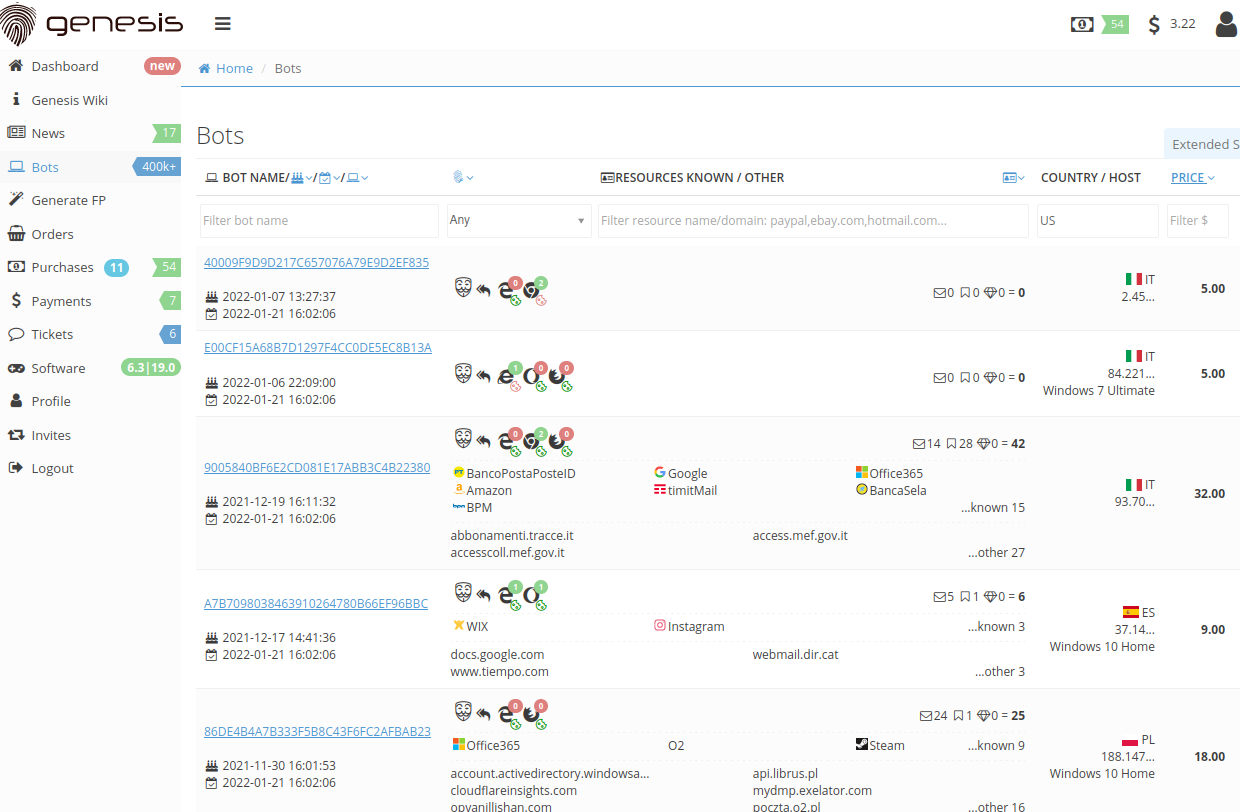

According to cyber intelligence analysts at Flashpoint, that same message was included in the website for UniCC, another major and venerated carding shop that was seized by Dept. K in January.

Around the same time Trump’s Dumps and the other three shops began displaying the Dept. K message, the Russian state-owned news outlet TASS moved a story naming six Russian men who were being charged with “the illegal circulation of means of payment.”

TASS reports the six detained include Denis Pachevsky, general director of Saratovfilm Film Company LLC; Alexander Kovalev, an individual entrepreneur; Artem Bystrykh, an employee of Transtekhkom LLC; Artem Zaitsev; an employee of Get-net LLC; and two unemployed workers, Vladislav Gilev and Yaroslav Solovyov.

None of the stories about the arrests tie the men to the four carding sites. But Flashpoint found that all of the domains seized by Dept. K. were registered and hosted through Zaitsev’s company — Get-net LLC.

“All four sites frequently advertised one another, which is generally atypical for two card marketplaces competing in the same space,” Flashpoint analysts wrote.

Stas Alforov is director of research for Gemini Advisory, a New York firm that monitors underground cybercrime markets. Alforov said it is most unusual for the Russians to go after carding sites that aren’t selling data stolen from Russian citizens.

“It’s not in their business to be taking down Russian card shops,” Alforov said. “Unless those shops were somehow selling data on Russian cardholders, which they weren’t.”

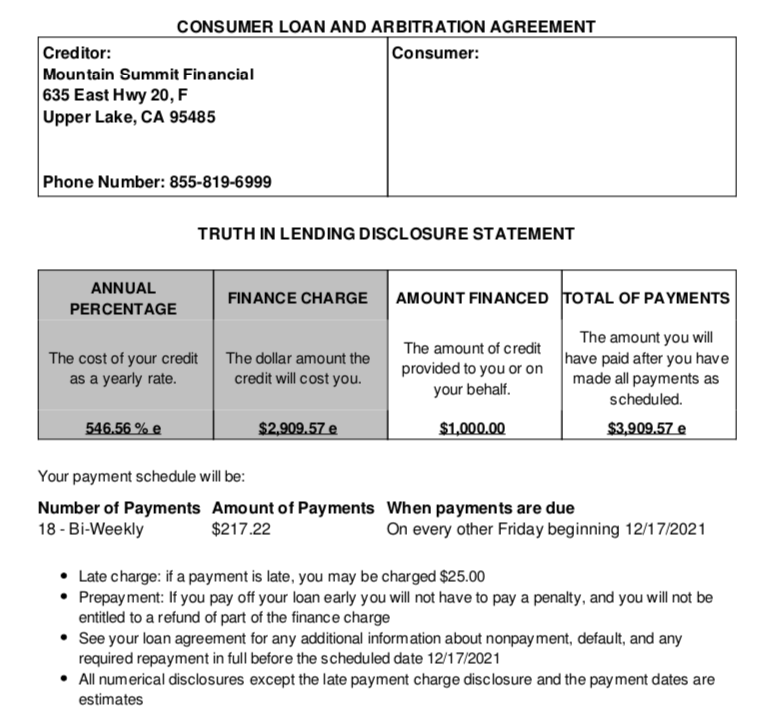

A carding shop that sold stolen credit cards and invoked 45’s likeness and name was among those taken down this week by Russian authorities.

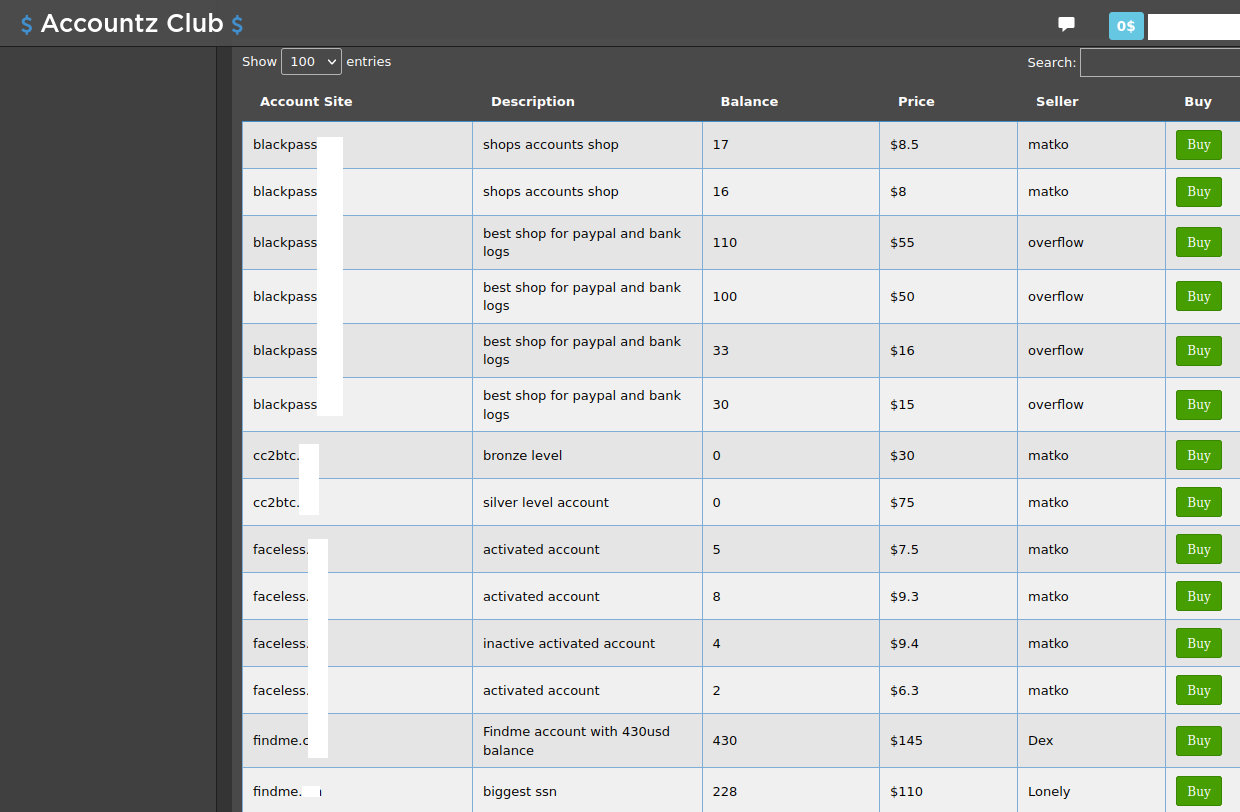

Debuting in 2011, Ferum Shop is one of the oldest observed dark web marketplaces selling “card not present” data (customer payment records stolen from hacked online merchants), according to Gemini.

“Every year for the last 5 years, the marketplace has been a top 5 source of card not present records in terms of records posted for sale,” Gemini found. “In this time period, roughly 66% of Ferum Shop’s records have been from United States financial institutions. The remaining 34% have come from over 200 countries.”

In contrast, Trump’s Dumps focuses on selling card data stolen from hacked point-of-sale devices, and it benefited greatly from the January 2021 retirement of Joker’s Stash, which for years dwarfed most other carding shops by volume. Gemini found Trump’s Dumps gained roughly 40 percent market share after Joker’s closure, and that more than 87 percent of the payment card records it sells are from U.S. financial institutions.

“In the past 5 years, Ferum Shop and Trump’s Dumps have cumulatively added over 64 million compromised payment cards,” Alforov wrote. “Based on average demand for CP and CNP records and the median price of $10, the total revenue from these sales is estimated to be over $430 million. Due to the 20 to 30% commission that shops generally receive, the administrators of Ferum Shop and Trump’s Dumps likely generated between $86 and $129 million in profits from these card sales.” Continue reading