The U.S. federal government is now in the process of sending Economic Impact Payments by direct deposit to millions of Americans. Most who are eligible for payments can expect to have funds direct-deposited into the same bank accounts listed on previous years’ tax filings sometime next week. Today, the Internal Revenue Service (IRS) stood up a site to collect bank account information from the many Americans who don’t usually file a tax return. The question is, will those non-filers have a chance to claim their payments before fraudsters do?

The IRS says the Economic Impact Payment will be $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

- $75,000 for individuals

- $112,500 for head of household filers and

- $150,000 for married couples filing joint returns

Taxpayers with higher incomes will receive more modest payments (reduced by $5 for each $100 above the $75,000/$112,500/$150,000 thresholds). Most people who who filed a tax return in 2018 and/or 2019 and provided their bank account information for a debit or credit should soon see an Economic Impact Payment direct-deposited into their bank accounts. Likewise, people drawing Social Security payments from the government will receive stimulus payments the same way.

But there are millions of U.S. residents — including low-income workers and certain veterans and individuals with disabilities — who aren’t required to file a tax return but who are still eligible to receive at least a $1,200 stimulus payment. And earlier today, the IRS unveiled a Web site where it is asking those non-filers to provide their bank account information for direct deposits.

However, the possibility that fraudsters may intercept payments to these individuals seems very real, given the relatively lax identification requirements of this non-filer portal and the high incidence of tax refund fraud in years past. Each year, scam artists file phony tax refund requests on millions of Americans, regardless of whether or not the impersonated taxpayer is actually due a refund. In most cases, the victim only finds out when he or she goes to file their taxes and has the return rejected because it has already been filed by scammers.

In this case, fraudsters would simply need to identify the personal information for a pool of Americans who don’t normally file tax returns, which may well include a large number of people who are disabled, poor or simply do not have easy access to a computer or the Internet. Armed with this information, the scammers need only provide the target’s name, address, date of birth and Social Security number, and then supply their own bank account information to claim at least $1,200 in electronic payments.

Unfortunately, SSN and DOB data is not secret, nor is it hard to come by. As noted in countless stories here, there are multiple shops in the cybercrime underground that sell SSN and DOB data on tens of millions of Americans for a few dollars per record.

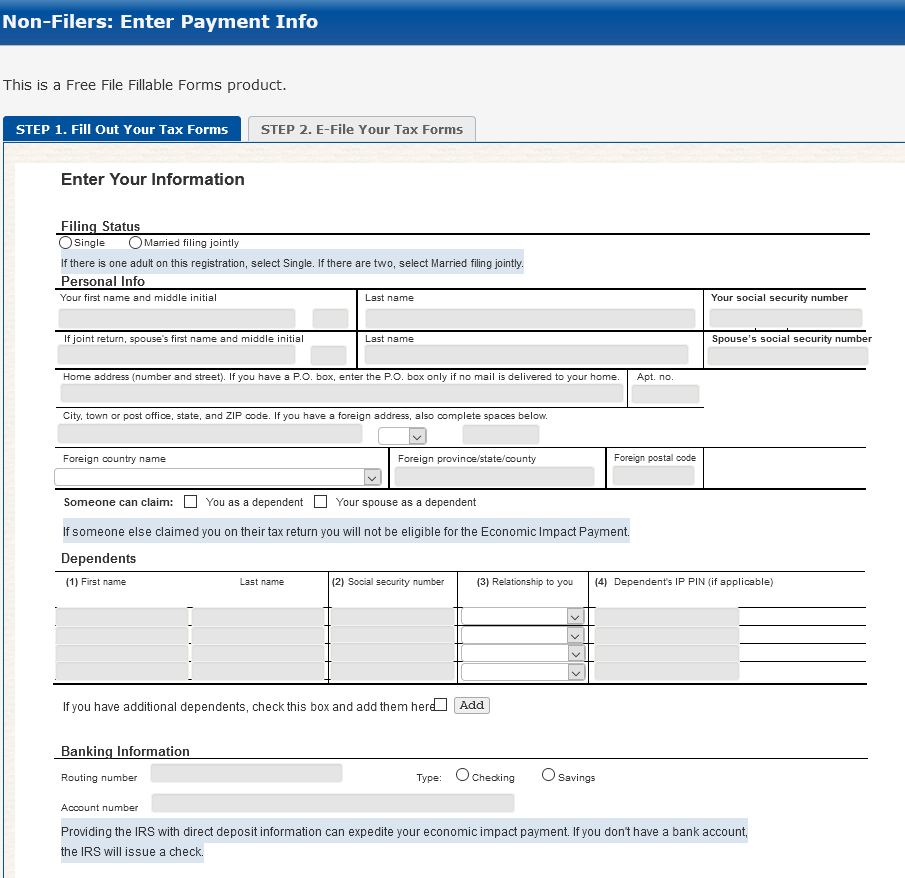

A review of the Web site set up to accept bank account information for the stimulus payments reveals few other mandatory identity checks to complete the filing process. It appears that all applicants need to provide a mobile phone number and verify they can receive text messages at that number, but beyond that the rest of the identity checks seem to be optional.

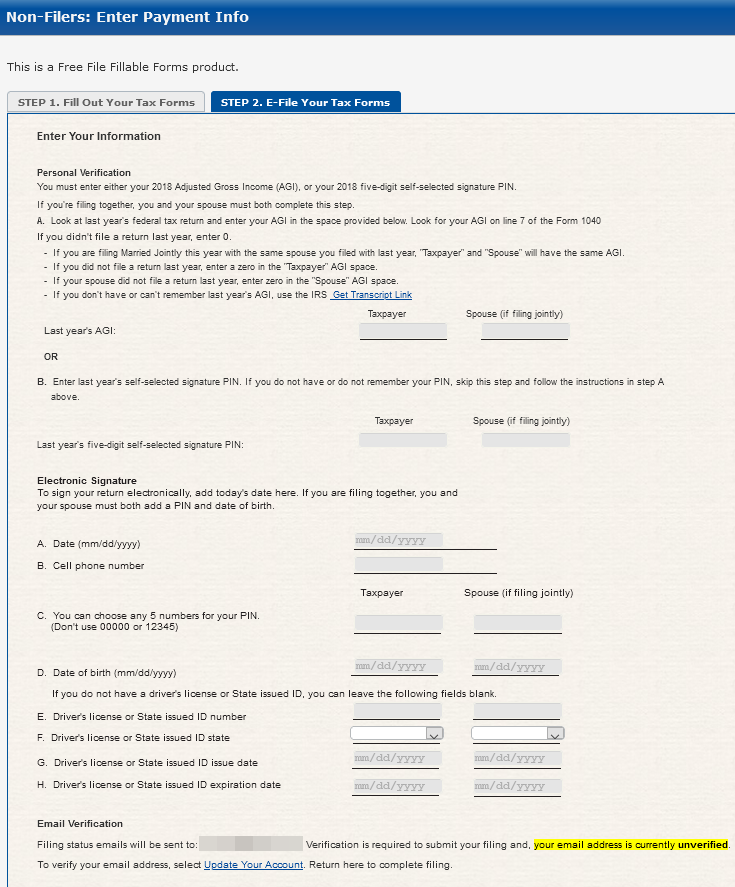

For example, Step 2 in the application process requests a number of data points under the “personal verification” heading,” and for verification purposes demands either the amount of the applicant’s Adjusted Gross Income (AGI) or last year’s “self-selected signature PIN.” The instructions say if you do not have or do not remember your PIN, skip this step and follow the instructions in step A above.

More importantly, it appears one doesn’t really need to supply one’s AGI in 2018. “If you didn’t file a return last year, enter 0,” the site explains.

In the “electronic signature,” section at the end of the filing, applicants are asked to provide a cell phone number, to choose a PIN, and provide their date of birth. To check the filer’s identity, the site asks for a state-issued driver’s license ID number, and the ID’s issuance and expiration dates. However, the instructions say “if you don’t have a driver’s license or state issued ID, you can leave the following fields blank.”

Alas, much may depend on how good the IRS is at spotting phony applications, and whether the IRS has access to and bothers to check state driver’s license records. But given the enormous pressure the agency is under to disburse these payments as rapidly as possible, it seems likely that at least some Americans will get scammed out of their stimulus payments.

The site built to collect payment data from non-filers is a slight variation on the “Free File Fillable Forms” product, which is a free tax filing service maintained by Intuit — a private company that also processes a huge percentage of tax returns each year through its paid TurboTax platform. According to a recent report from the Treasury Inspector General for Tax Administration, more than 14 million Americans paid for tax preparation services in 2019 when they could have filed them for free using the free-file site.

In any case, perhaps Intuit can help the IRS identify fraudulent applications sent through the non-filers site (such as by flagging users who attempt to file multiple applications from the same Internet address, browser or computer).

There is another potential fraud storm brewing with these stimulus payments. An app is set to be released sometime next week called “Get My Payment,” which is designed to be a tool for people who filed tax returns in 2018 and 2019 but who need to update their bank account information, or for those who did not provide direct deposit information in previous years’ returns.

It’s yet not clear how that app will handle verifying the identity of applicants, but KrebsOnSecurity will be taking a look at the Get My Payment app when it launches later this month (the IRS says it should be available in “mid-April”).

I put in my Tax information and bank account information,now its saying I either put in Tax info that didn’t match theirs or I have tried to get into the site to many times….How can I check to see if the Tax info is put in right…..

I tried to check on my refund. It did say I need to enter direct deposit, I guess because I dealt with Jackson Hewitt. I was inputting the wrong refund amount. I kept trying it and locked myself out. It said to try again in 24hrs, I have been trying for 3 days now and it still haven’t opened by up.

This is so frustrating. I tried filing the non filers form and it keeps coming back rejected because apparently i have an ip pin and if i dont write it down they wont accept it. I tried getting an ip pin thru the irs website and it keeps telling my personal info dont match their records. I haven’t filed taxes in years and i never received an ip pin. Irs offices are closed and theres no live help over the phone. What am i supposed to do?? Someone please help! Im just trying to get this much needed stimulus check

Me an my fiancee are in same boat. Cannot get ahold for a pin number we must call but offices closed

Im having the same exact issue, never knew i needed an IP pin until it got rejected and info isnt working on the website to retrieve my pin, this is very frustrating. How can they close the IRS? Its totally irresponsible of this country

has anyone got an answer for this??? I read today the deadline for no m filers is 4/22, would love some help!! I’ve been searching and searching with the closest I’ve come is here finding that I m not the only one with these frustrating isdues

I have applied for the stimulus and having the same issue. Is there no way possible to help us who need the stimulus just as much as the next. I can’t get anyone to respond. Tax preparer says to mail it in but the offices are closed until further notice and I can’t wait I’m a single mother with 3 kids about to be evicted because I’m now unable to work

To Danielle, and all who have had issues with entering their IP PIN(self identity pin). You are given 2 choices for this option: 1) ENTER YOUR 2018 AGI amount. IF YOU DID NOT FILE 2018 TAXES, ENTER “0” (zero)….OR….2) ENTER YOUR 2018 5 digit IDENTITY PIN. I haven’t filed taxes for a few years, so i entered “0” under the AGI for myself and my husband, and left the PIN empty. It was accepted without an issue. I hope this helps in your situation.

“Those who miss the deadline (4-22-20) to register their children with the non-filer tool at irs.gov will still get their payments of $1,200 per individual, but they will now have to wait until next year to get the additional $500 per dependent child under 17, the IRS said Monday.” Per the Washington Post newspaper.

What day did you file the non filers ? And did you receive your payment yet ??

Danielle, Plus I didn’t get it finished until 3am on 4/23….past the deadline…and they still accepted it….good luck! Cyn

Same here! All of my information is updated but the IPpin tool says info doesn’t match nor do they have a live assistant to send out a letter with IP pin

I’m having the same issue..I’ve lost 2000 in refunds due to me and now this stimulus it looks like..if you find a way to get your pin please let me know..I’ll do the same!! Being punished for something I wasn’t aware of

same boat. tried everything .. makes no sense since we re in the system obviously and supposedly we then would fall under those people who neednt do anything category for getting our stimulus checks. unbelievably frustrating and no help in site. and unemployment offices everywhere are denying people under the pre cares requirements and not the updated requirements. so

WHAT ASSISTANCE ? thats all i have to say. what damn assistance ?

Same problem here I’m so frustrated

Two days after entering my info into the IRS! (when will i get my check) website i was issued two new high limit credit cards. These fraudulent cards caused me to freeze all my accounts and credit data. Did the IRS site get hacked? Will these thieves be able to re-route stimulus checks? Do not use sites offering to trace your check.

I am extremely frustrated I filed and received mt tax return and still when I go to get payment it indicates my information is incorrect.

I was filling out the form to create an account, but there is a field called ‘Users ID’ that gives no direction in what it needs to be filled with. Can you tell me how this field needs to be filled in?

Where it says “user ID” that is where you just make up a user name for the website. It can be anything but write it down in case you have to sign back in..you will need it and your password to sign in. Hope that helps!

I keep getting rejected by the IRS saying that my birthdate is wrong ,, Does anyone know of a birth date they prefer,, because I will damn sure use it. So aggravating,,, can someone tell me what I’m supposed to do about this please thanks JJ

Same !! Tells me my birthday doesn’t match their damn database…

do u know an addresss to mail the forms??

Thx

I need help please!! So I did the non filers portal on the irs website because i did not get a stimulus check last week. I filled out all forms last thursday. it took about a hour as the site kept crashing or the portal not sure. anyways i put all info in and bank account info. however i have gotten no money. and the irs approved my submission like 1 to 2 minutes later. What i need to know is why is there no money in my account why does the check my payment portal always return my sh*t as status unavailible? I am down to my last 2 bucks i can not pay my bills not a single one i need that 1200 some people got it and didnt even need nor deserve it. its not fair how some got it and others didnt my unemployment has not started yet either i have no sorce of money comming in.

Well anyone who got it deserved it…unless of course they entered fraudulent information and got it illegally but otherwise anyone who is a US citizen with a social security number “deserved” to get it.

Did you get it ?? And did you use non filers ??

Yes well technically no not yet… but the payment is set to deposite on thursday

I never filed taxes and file non filers and was rejected 7 times because it need a IP PIN. I never received a IP PIN. I reached out to a tax advocate no help. Tried every IRS number no help. Reached out via email and Fax no help. Send letter to IRS waiting on Response since March and printed my return to and mailed it in to get money for stimulus for independents. The website keeps saying it can’t verify matching records for my identity. I did just about everything I can do and time is running short for me to claim stimulus. I have till May I assume. No one is helping those people who need help with IP PIN. If we had the assistance we need a lot would work for the better. They need to open up phone lines or assist those people who are asking and reaching out for help with Identity pins so they can get their fair share.

I applied for the stimulus grant,my claim was rejected.Stating IND-180-01 is missing.I don’t have an IP PIN#. I have received letters from IRS showing there is a claim of identity theft. The burden of proof or denial falls the on the victim.For well over 2yrs. I’ve tired to resolve this issue. Ive tried calling the official IRS IP PIN phone# it’s down until further notice.IRS referred me to retreive IP PIN# online.I can’t provide information to complete requirement list

1.credit card last 8 digits

2.home owner (HELOC)

3.auto loans

4.Individual Tax Identification number (ITIN)

Where does this leave us?Those that are in need of a helping hand…..There’s no outreach……KrebonSecurity thank you for the comment box to input some of my frustrations.Take care.

Hi Linda, thanks for post about IP PIN issues many of us are facing with stimulus payment. Also received same error message at the NEW portal for uploading your direct deposit info— this new portal rejects the forms for lack of IP PIN just like the old one does! When will this all be fixed??? When will the phone agents return to their phone center to provide that IP PIN? Why is the new portal giving the same old error messages and rejecting returns? Please post updates folks. Keep the faith, we’ll get our stimulus soon!

How do I send my refund if I don’t have my ip pin

my return keeps being rejected because i dont have an ip pin i cannot get the ippin through the online tool nor can i create an irs account because i do not have a credit card student loan auto none of the requirements to get poassed the one step to prove my identity i cannot call the irs with everyone being shut down. im more then frustrated with this process. there is absolutely no instructions for thge peoples whos returns are being rejected for whatever reason an not enough tools to fix the issues.

Was directed to ‘Get my payment’ from a website to check on stimulus check and put in my SS# and birthdate and noticed a cursor moving on right side of my computer screen as if someone was on with me. I immediately shut down my laptop computer by pulling out the battery from back. I feel I was hacked and am hoping they can’t redirect the payment to their bank account. What should I do about this? Very concerned

I am sorry this happened to you!!! 🙁 you should never ever ever use a link in a article to get to the my payment portal alway always go to the website directly. like google irs and go to the officle site never through a 3rd party website. as far as help i am not sure what you can do other then call your bank or the irs and report id theft if you start to see charges or unauthorized banks transactions

I am on SSDI and have direct deposit. Like a dumby my friend told me I had to fill out the non filers form. After reading about it, I was not supposed to fill out one at all. I make more than 12,200. But less than 20,000. I do not have any dependent children and I am not required to file taxes.

Did I ness myself up? Will I still get my check direct deposit into my direct express account which is on file with my 1099 form that was sent ti the IRS.

Please tell me I didn’t screw everthing up by filling out that non filers form by mistake. I live check to check really need the money. Help!!

Me and my wife are on SSI n have 5 kids n it’s rejected every attempt I’ve made.and continues to Denis me for reasons that aren’t true.somthing about a first time home buyers loan n I’ve never put based a house or tried too

Why won’t the electronic filing button come up. I cannot get the screen large enough to hit the submit button. Help

Most likely you are using a mobile device like I was trying to do. If you have EBT, you can go to the app and submit your taxes for free through their link on a mobile device – that is if you have an IP pin. If you don’t have one, you can request one through the IRS website – unless you are also like me, and do not have their qualifications of a loan or credit card. A debit card will not satisfy the requirement. The only thing I and many others can do is to wait until their phone service is up and running, and call their number for customer service: 1 800 829 1040, or 1 800 908 4490 to have an IP pin mailed which they state can take 21 days. All we can do is try to be patient right now, and hope things get up and running soon. What we really need right now is for our infrastructure personnel to be able to work at home, with the help of computers and/or trusted IRS phone numbers that can filter through to these IRS agents we so dearly need right now or ASAP. We are all in the same boat, and there are also the ever present dangers of intercepting hackers, scam sites that we must be patient to wait out the safest way we can.

To Danielle, and all who have had issues with entering their IP PIN(self identity pin). You are given 2 choices for this option: 1) ENTER YOUR 2018 AGI amount. IF YOU DID NOT FILE 2018 TAXES, ENTER “0” (zero)….OR….2) ENTER YOUR 2018 5 digit IDENTITY PIN. I haven’t filed taxes for a few years, so i entered “0” under the AGI for myself and my husband, and left the PIN empty. It was accepted without an issue. I hope this helps in your situation. Also, I didn’t complete and send it until around 3:00 am on 4/23, well past the deadline, and they still accepted it…I’m sure, because they have been so inundated with Non Filer Forms. I wish you good luck with this. Cyn

IP Pin is different from the 5 digit signature pin! It’s a pin for those who are victims of identity theft

I just wonder I did filled out the no filter irs site and I’m retired what is the chances I get scammed I need the money I did not put a pin and did not put my licence down put I did get a e mail and the irs said it was accepted will I get my 2 checks next month may

I am very frustrated w this non filers form as well. I have tried numerous times to complete my form but on the last step at transmit my form, it won’t let me access the click part of that page. I finish the Java script and the efile transmit won’t give me the full page , I’ve tried turning my phone etc etc, still won’t work !!! PLEASE HELP.

On your mobile you have to go into settings and switch to view desktop site

Keeps asking for a captcha code after sending and verify.it goes to admit under purrgery that everything correctly but once push enter.it loads and just stays on the same page.someone help already verified email setup account and still not able to go through with submit in application.

To those having issues at transmitting your file to irs thru non filers…. Top right hand corner those 3 little dots, push that please folks…. Ok after that go down to where it says desktop site and there is an unchecked box next to it…. Click that. Problem solved screen will reload, yes all your info you just typed in will still be there and then you can pinch your screen zoom in and out 😉 took me 3 days to figure that one out folks do not feel bad ok!!!!

When i checked my payment info, it states that my payment is going into acct i dont have. However I get SS through Direct Express card and have an acct number that Direct Express desnt release. Its not same as card number. Should i be concerned?

Did you use non filers ??

This no filers site is terrible! Countless errors although they did update the codes with better instructions to help you.

But my error is beyond me they are asking for an AGI number but since I have not filled in years I do not have 1 an it will not except my “0”.

I am so mad an with my horrible luck i will be one of the last to receive it which i understand is in September! So much for this to be considered immediate relief!!

NO IP PIN…CANT FILE MY TAXES

So has anyone had any luck ? I havent filed since 17 and i moved so i didnt get my new ip pins in mail and being i wasnt filing wasnt concerned. Big mistake i see now. I have never been able to get my pin through the website being i dont have the proofs of id they require. The only other way ro do it is currently shut down. Im not unique so imagine many are in the same position. I know this website isnt gonna answer questions or help but maybe if someone has had some success they can fill us in. I guess most people are not gonna come back on looking for answers if they got their money, lol

No ip pin cant file non filers PLEASE HELP!

I’ve been getting the same error since last week. I’ve tried using turbotax and the IRS site and get the IP PIN message. I dont have a pin and never been sent one. I haven’t filed in a few years and have lived at the same address for a long time. So I dont believe one was mailed to me. I’ve called turbotax and they explained a lot of people where having this issue but had no answer. They gave me a number to the IRS, I will call today and update all.

Update as promised, I called the IRS number and received the “we are closed message”. I then called turbotax back and explained my issue and explained the IRS isnt taking calls(only because they supplied the number). They couldn’t offer any solution or suggestions as this doesn’t appear to be their issue. They again said many people are having this issue, since I waited in queue for an hour I believe them.

I’ll post updates if I make any progress. Everyone else please do the same. It sounds like many are struggling with this issue. Good luck and stay safe out there.

ARE ANY OF YOU REALLY SURPRISED?!

Once again, our government screws up at our expense! They use and squander billions of OUR hard earned tax dollars on pet projects, wasteful spending and websites and services that never work! You and I would be fired & or in jail if we acted with the same INCOMPETENCE!

This current issue with their website is just another example!

None of the suggestions made by so called experts, the media, or industry experts that are posting tips such as the latest, to use all caps when entering your address, or abbreviating your street etc., have worked for me or millions of other. Even though the IRS says they updated the site to resolve some of these issues!

Like many others, I personally keep getting several different messages on several occasions that just didn’t apply to me or my circumstances. I have also gotten locked out! While the IRS is FKNG OFF with their usual incompetence, we all have to suffer and do without our stimulus cash! This is causing millions of us undue and unneeded stress!

So typical of our government, especially the IRS! They can screw things up at our/ the tax payers expense, such as these current website issues, and screw up our taxes and owe us money and not have to pay us or suffer any penalty, but should any of us make and honest mistake or not, or have and financial challenges, we have to pay dearly either financially, & or lose our property! This is the ultimate in hypocrisy and out of control big government and needs to be stopped!

Remember these words…

“When governments fear the people, there is liberty. When the people fear the government, there is tyranny. The strongest reason for the people to retain the right to keep and bear arms is, as a last resort, to protect themselves against tyranny in government.”

I entered my direct deposit information in the IRS’s ‘Get My Payment’ website and within 24 hours I had fraudulent charges appearing in that same bank account. I sincerely believe my direct deposit information was intercepted from the IRS website! Be vigilant and watch your accounts everyday! Be safe and be financially aware!!! Thanks

Anything new on this IP PIN problem? I am still getting rejected through the non-filers portal