A nonprofit organization is suing the state of Massachusetts on behalf of thousands of low-income families who were collectively robbed of more than a $1 million in food assistance benefits by card skimming devices secretly installed at cash machines and grocery store checkout lanes across the state. Federal law bars states from replacing these benefits using federal funds, and a recent rash of skimming incidents nationwide has disproportionately affected those receiving food assistance via state-issued prepaid debit cards.

The Massachusetts SNAP benefits card looks more like a library card than a payment card.

On Nov. 4, The Massachusetts Law Reform Institute (MLRI) filed a class action lawsuit on behalf of low-income families whose Supplemental Nutrition and Assistance Program (SNAP) benefits were stolen from their accounts. The SNAP program serves over a million people in Massachusetts, and 41 million people nationally.

“Over the past few months, thieves have stolen over a million SNAP dollars from thousands of Massachusetts families – putting their nutrition and economic stability at risk,” the MLRI said in a statement on the lawsuit. “The criminals attach a skimming device on a POS (point of sale) terminal to capture the household’s account information and PIN. The criminals then use that information to make a fake card and steal the SNAP benefits.”

In announcing the lawsuit, the MRLI linked to a story KrebsOnSecurity published last month that examined how skimming thieves increasingly are targeting SNAP payment card holders nationwide. The story looked at how the vast majority of SNAP benefit cards issued by the states do not include the latest chip technology that makes it more difficult and expensive for thieves to clone them.

The story also highlighted how SNAP cardholders usually have little recourse to recover any stolen funds — even in unlikely cases where the victim has gathered mountains of proof to show state and federal officials that the fraudulent withdrawals were not theirs.

Deborah Harris is a staff attorney at the MLRI. Harris said the goal of the lawsuit is to force Massachusetts to reimburse SNAP skimming victims using state funds, and to convince The U.S. Department of Agriculture (USDA) — which funds the program that states draw from — to change its policies and allow states to replace stolen benefits with federal funds.

“Ultimately we think it’s the USDA that needs to step up and tell states they have a duty to restore the stolen benefits, and that USDA will cover the cost at least until there is better security in place, such as chip cards,” Harris told KrebsOnSecurity.

“The losses we’re talking about are relatively small in the scheme of total SNAP expenditures which are billions,” she said. “But if you are a family that can’t pay for food because you suddenly don’t have money in your account, it’s devastating for the family.”

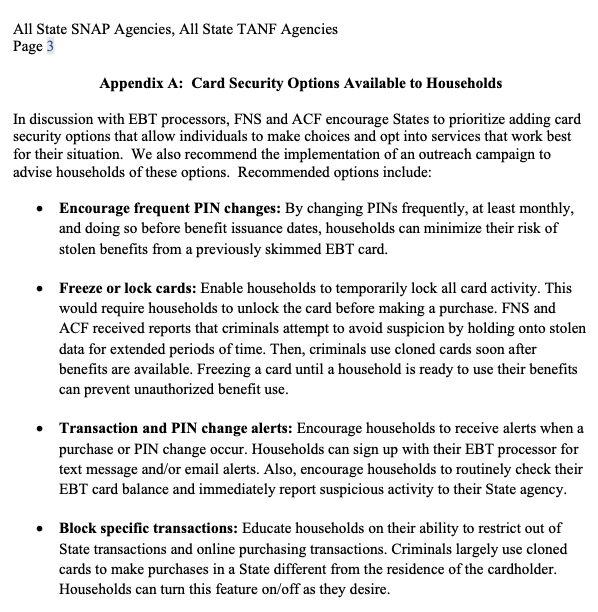

The USDA has not said it will help states restore the stolen funds. But on Oct. 31, 2022, the agency released guidance (PDF) whose primary instructions were included in an appendix titled, Card Security Options Available to Households. Notably, the USDA did not mention the idea of shifting to chip-based SNAP benefits cards.

The recently issued USDA guidance.

“The guidance generally continues to make households responsible for preventing the theft of their benefits as well as for suffering the loss when benefits are stolen through no fault of the household,” Harris said. “Many of the recommendations are not practical for households who don’t have a smartphone to receive text messages and aren’t able to change their PIN after each transaction and keep track of the new PIN.”

Harris said three of the four recommendations are not currently available in Massachusetts, and they are very likely not currently available in other states. For example, she said, Massachusetts households do not have the option of freezing or locking their cards between transactions. Nor do they receive alerts about transactions. And they most certainly don’t have any way to block out-of-state transactions.

“Perhaps these are options that [card] processors and states could provide, but they are not available now as far as we know,” Harris said. “Most likely they would take time to implement.”

The Center for Law and Social Policy (CLASP) recently published Five Ways State Agencies Can Support EBT Users at Risk of Skimming. CLASP says while it is true states can’t use federal funds to replace benefits unless the loss was due to a “system error,” states could use their own funds.

“Doing so will ensure families don’t have to go without food, gas money, or their rent for the month,” CLASP wrote.

That would help address the symptoms of card skimming, but not a root cause. Hardly anyone is suggesting the obvious, which is to equip SNAP benefit cards with the same security technology afforded to practically everyone else participating in the U.S. banking system.

There are several reasons most state-issued SNAP benefit cards do not include chips. For starters, nobody says they have to. Also, it’s a fair bit more expensive to produce chip cards versus plain old magnetic stripe cards, and many state assistance programs are chronically under-funded. Finally, there is no vocal (or at least well-heeled) constituency advocating for change.

A copy of the class action complaint filed by the MLRI is available here.

Seems pretty clear to me what must happen, but thanks for not charging me 8 bucks Brian.

hi Brian, as always great coverage/research …thank you ! Scott

Maybe they should look at our SkimScan skimmer detectors 🙂

https://www.bvsystems.com/product/skim-scan-atm-pos-credit-card-skimmer-detector/

Scott Schober

http://www.BVsystems.com

SPAM!

Here’s some additional information from CommonWealth magazine that gives this issue a more personal aspect (https://commonwealthmagazine.org/courts/lawsuit-seeks-to-recoup-stolen-food-benefits/):

“The lawsuit was brought by Christina Santiago of Saugus and Natahlie Rahmsay of Boston, two SNAP recipients who had their benefits stolen, but the Massachusetts Law Reform Institute wants it to become a class action lawsuit representing all beneficiaries who had benefits stolen…

The lawsuit focuses on the impact the theft has on its victims. Santiago is a pharmacy technician at a long-term care facility who is getting her associate’s degree and raising two children. She relies on the $740 a month in SNAP benefits to buy food for her family. When she went food shopping in October the day after her monthly benefits were issued, she was told there was no money in her account. She called the DTA office and was told her benefits had been spent in Texas, and the state would issue her a new card but not refund the money. Someone a week earlier had spent smaller amounts in Arkansas, and Santiago said DTA never flagged those purchases or warned her that someone may be improperly accessing her account.

Rahmsay is 71 and cares for her adult son with Down’s syndrome. The sole income for both of them is disability benefits. In July, she found that around $400 of her SNAP benefits were stolen from her account and used in Illinois. DTA did not repay the money, putting a strain on her finances.”

This happened to me as well. I used my card in MA and my ‘card’ was used in MD as well as AZ the same day! Cleaned me out, my case was denied.

Who is responsible for the use of that stone age technology? Shouldn´t that party carry the cost of reimbursement AND mandate more secure methods like EMV chipcards?

Roughly, nobody.

Congress should probably pass a law instructing the USDA to mandate that SNAP payment cards have security that matches the current level used for credit cards, and not less secure than Chip-and-PIN/Chip-and-Signature, along with allocating funding for each state to update.

Because the cards aren’t credit cards on the VISA/Mastercard networks, they aren’t required to do Chip-and-… by VISA/Mastercard.

Mr. Kebs,

Your coverage here is very, very, very nice.

Food assistance programs in america….instead would it be better to spend money providing opportunity for those in need to become self reliant? Money much better spent then whats been going on the last 40 yrs.

We try both. Provide opportunity, but that still isn’t 100%. Raising the minimum wage falls in that category too.

Corporations get greedy, and the government can’t cap prices for basic staples and medicine. Housing prices are crazy too, so the opportunities that are used, are still not enough to live self-reliant.

Unfortunately, population growth will exceed the demand for labor. We need to think about how to have a basic society when robots can do all cheap labor and there aren’t enough high end jobs for people to all live a self-reliant life.

It’s impossible to have taxpayers fund labor assistance it doesn’t work and hasn’t. What isn’t popular is providing small business with less regulation allowing people to start their own dreams. Corporations are lobbyists in bed at the state and federal level. They ain’t greedy quite the opposite they have market share “power”. No quick fix since it’s so FU..

The vast majority of SNAP recipients fall into three categories, the working poor(i.e. employed full time with one or more dependents), the disabled and the elderly/retired.

Note, you may be able to find single adults receiving benefits in states that more or less follow the Federal minimum wage, but at a reduced rate.

The only ones your programs might help would be that last class. A minority anyway you go about it.

Such a metaphor for our system’s failures, the poor have to hire a damn lawyer to get basic food assistance.

I’m sure it boils down to the cost of issuance. A mag stripe card can be issued for pennies, but chip cards can cost a dollar or more to issue. And that’s a million dollars most state agencies would rather squander on their internal bureaucracies than spend on client security.

Really, the retailers should refuse to take these SNAP cards with mag stripes. They already have to have chip readers for PCI compliance. A mag stripe reader is just extra risk and cost to maintain.

I hope this lawsuit sparks some changes, but I’m not holding my breath.

Merchants don’t appear to lose anything in these transactions. As such, there’s no incentive for them to change.

The only victims are SNAP recipients who are poor, and, as noted, generally not a powerful voting block.

Oh man…you mean a govt program meant to help people got ripped off and people were affected? Tell me that’s not true…everything the Govt does is 100% safe..right?

Those were Tax Funds

They should go back to Paper Welfare Checks….

are you sure the users weren’t selling the credit for Cash…that’s usually how these things are

Paper checks were rife with fraud. Even worse than with swipe cards.

Government programs can work if they stay ahead of criminals. The programs that do work, you never hear about.

The problem is that anti-government people want to get rid of these programs entirely, but can’t. So they just sabotage them so they can later point to them as inherently flawed and can’t be saved.

Government programs can work if they stay ahead of criminals.

– Name a Govt Program that you can measure that has EVER been successful? What determines the level of success?

Successful Govt program would be one that, imo, accomplishes the goals it sets…but I bet you can’t name ONE single program that has ever been disabanded due to being…..successful. Usually they just run out of money.

The programs that do work, you never hear about.

– Really…..such as? You never hear about them because

They are NEVER successful

Govt will NEVER be as efficient as the private sector because GOVT does NOT CREATE anything…it has to have CREATORS to scavenge from….thus taking the labor of others to further It’s OWN self-Created position.

We didn’t get 31 Trillion in debt by being successful….there are still too many kid starving to say we are doing everything we can do.

My .02.

Which federal programs and policies succeed in being cost-effective and targeting those who need them most? These two tests are obvious: After all, why would we spend taxpayers’ money on a program that isn’t worth what it costs or helps those who do not need help? A smattering of the numerous examples: farm subsidies, flood insurance, ethanol requirements, Amtrak, student loans, and many housing programs. All the more reason, then, to study the successes to learn from them.

To this end, I selected for closer analysis a dozen programs that academic studies generally consider successful. Three were implemented long before cost-effectiveness analysis: the Homestead Act of 1862, which distributed the government’s vast western lands, cheaply, for settlement and cultivation; the Morrill Act of 1862, which granted land for agricultural and technical colleges; and the GI Bill, which subsidized higher education for veterans. The other nine programs generally receive high marks from economists for both cost-effectiveness and targeting of the groups they’re intended to benefit. (Not on this list, notably, are Medicare and much environmental regulation. While they’re popular and confer large benefits, they’re also far costlier than they should be—Medicare because it is built on top of a notoriously inefficient health care system, and environmental regulation because so much of it is heavy-handed and creates poor incentives.)

In looking closely at my top 12 programs, I could find no single formula for success, but I did identify some important attributes that made each program successful. Here’s my list of the best strategies government has shown it can deploy:

Eliminating barriers to opportunity. Government succeeds when it creates opportunities by altering the social and legal contexts in which people pursue their goals. For example, the civil rights laws of the 1960s, including the Voting Rights Act, dismantled unjust barriers to minority advancement, opening doors so that more people could walk through them to greater equality. The 1965 immigration reform enabled people to come here from countries which for years had been subject to arbitrary national origins quotas. By expanding opportunity, these programs promote fairness, individual well-being, and national progress.

Strengthening work incentives. Two programs—the Earned Income Tax Credit law of 1974, which targeted the working poor, and the 1996 welfare reform, which targeted unemployed mothers dependent on welfare payments to raise their children—clearly increased the incentive to work. These programs, respectively, raised incomes for the working poor and reduced child poverty and adult dependency with a combination of carrots (higher benefits and subsidized work support programs) and sticks (time limits and work requirements for welfare benefits). Recessions, alas, have eroded some of these gains.

Giving resources to those positioned to exploit them. As it did with the Homestead and Morrill Acts, the federal government can sometimes distribute its valuable assets to large numbers of citizens who then use them to advance national goals. Today, government auctions of unused portions of the broadcast spectrum, for wireless and other uses, serve a similar purpose.

Simplifying rules and administration. The country’s antitrust laws protect competition with simple rules that encourage private initiative. Motivated by the prospect of winning treble damages, competitors aid in enforcement. Whistleblower laws use similar techniques, recruiting private citizens to improve government programs. Deregulation of the aviation, freight railroads, trucking, and natural gas industries during the late 1970s and early 1980s strengthened those industries and hugely benefited the public by replacing notoriously complex, inefficient, government-controlled systems with the discipline of private markets. Administrative simplicity also helps explain the success of Social Security, a program that processes basic demographic information, applies straightforward rules, and instructs its computers to send out monthly retirement checks accordingly. (In revealing contrast, Social Security’s disability program is a dense forest of complex procedures, ambiguous standards, federal-state overlaps, and incentives not to work—factors that have combined to produce an out-of-control fiscal nightmare.)

Fulfilling basic moral imperatives. Some programs succeed because almost all Americans believe that fundamental fairness requires them, even if we differ on their details. With the GI Bill, the government gave a kind of delayed compensation. Sending veterans to college proved socially transformative—an achievement celebrated despite the program’s shortcomings. Providing food stamps to assure basic, life-sustaining nutrition for dependent children, the disabled, and other needy groups is another moral obligation that almost all Americans favor. Despite recent cuts, Congress continues to support the food stamp program at a high budgetary level. (The program’s political link to farm subsidies also buttresses it.)

Going where markets fear to tread. Sometimes the government invests in public goods and services that are essential to economic vitality, basic research, and national heritage—and that the market won’t adequately supply. Examples include the interstate highway system, regional dams, and other infrastructure; national parks, monuments, and museums; research through the NIH and the National Science Foundation, and the patent system.

To be sure, each of these successful programs has had its problems. Were we writing on a blank slate, we might well design them differently. Much of the land allocated under the Homestead Act, for example, was available only because it had been seized from Native Americans. The Morrill Act’s land grants wound up disadvantaging historically black institutions that served their students well under difficult conditions. Many of the more recent successes must be brought up to date. Remorseless demographic changes threaten Social Security’s solvency; some straightforward solutions are available that politicians will eventually have to adopt. The 1965 Immigration and Nationality Act helped make us the most diverse, dynamic nation on earth, but it desperately needs renovation. Parts of the Voting Rights Act also should be updated—by Congress, not by the Supreme Court, contrary to its decision last year. Like food stamps, the EITC is subject to fraud and error-inducing complexity, and Congress will likely reform the latter. Some industries that Congress deregulated to promote competition, as well as some such as telecommunications that it continues to regulate, need more vigorous antitrust oversight. Many experts believe that our patent laws now slow innovation rather than promoting it, and need fundamental reform.

Success and failure, of course, are relative concepts, and reasonable people differ in their assessments. But what is most important are the principles that seem to generate successful programs: removing unjust barriers to opportunity and membership, maximizing the social returns from government assets, strengthening work incentives for the underemployed, simplifying regulation where possible, and providing public goods for all and the necessities of life for those who can’t provide for themselves. God is in the details, of course, and noble aims don’t necessarily produce good policies; they merely point us in the right directions. Understanding exactly how and why they’ve succeeded can help us to design more like them— and to abandon or improve the many more that fail.

You should write a book. I just want less Govt myself

I grew up in Sec 8 housing……you should visit it sometime. Will rock your world on how people who dont appreciate what they are given…so let’s give them more

What is with people thinking going back to paper solves problems. First election deniers suggest using only paper and hand counting, as if that would reduce the opportunity for fraud. We have lots of history to look back on that shows how paper is so easy to forge.

And another comparison to extremist rhetoric… stop saying things like 100% or ALWAYS or NEVER. The real world isn’t so black and white.

When the credit card companies shifted responsibility for fraudulent transactions to the store in cases where a Chip capable card was used in a POs terminal that only supported swipe, the stores upgraded because there was a financial incentive to do so. If we mandated that the States issue chip capable cards (and provided a small subsidy to pay for the chip cards), but also shifted the responsibility to the state so that they are on the hook for re-imbursing any fraudulent claims, then you can be sure that the states would improve the security of the cards.

Thanks Brian for the update on the continuing saga on SNAP fraud.

More fraud to come.

The four Card Security Options offered, were enjoyable to read, in their hope.

Asking the American public (average comprehensive reading ability: the 9th grade?) to adopt these, when the P/W popularity of “qwerty123” is still strong, is an act of hope…

“Ahs believes in security, but it’s gottah be easy…yah know?”

Excelente publicación con tema que a todos nos interesa. Saludo cordial desde nuestra web especializada en los sorteos de Euromillones.

1. Why doesn’t any out of state use immediately trigger a fraud investigation?

2. Why aren’t there fraud charge backs to the merchants? That’s what the credit card companies do — they deduct it from the payments to the merchant.

3. With all the computers and cameras that grocery stores have nowaday, why can’t they put an end to this? I think they would if it were costing THEM money.

——————————————————————————-

Edit: https://briansclube.cc/login/

I recieve SNAP.every purchase i make has the amount and balance printed on the receipt of every purchase.my SNAP balance after groceries is about $2.73.for a month.a case of red bulls and slim jims for others at the kwicky stop.

I recieve SNAP.every purchase i make has the amount and balance printed on the receipt of every purchase.my SNAP balance after groceries is about $2.73.for a month.a case of red bulls and slim jims for others at the kwicky stop.