It may soon become easier for Internet service providers to anticipate and block certain types of online assaults launched by Web-based attack-for-hire services known as “booter” or “stresser” services, new research released today suggests.

The findings come from researchers in Germany who’ve been studying patterns that emerge when miscreants attempt to mass-scan the entire Internet looking for systems useful for launching these digital sieges — known as “distributed denial-of-service” or DDoS attacks.

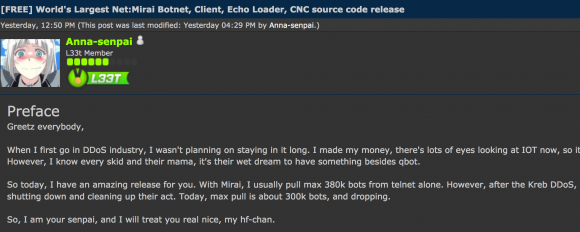

To understand the significance of their research, it may help to briefly examine how DDoS attacks have evolved. Not long ago, if one wanted to take down large Web site, one had to build and maintain a large robot network, or “botnet,” of hacked computers — which is a fairly time intensive, risky and technical endeavor.

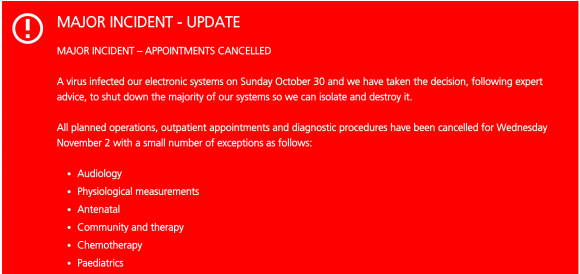

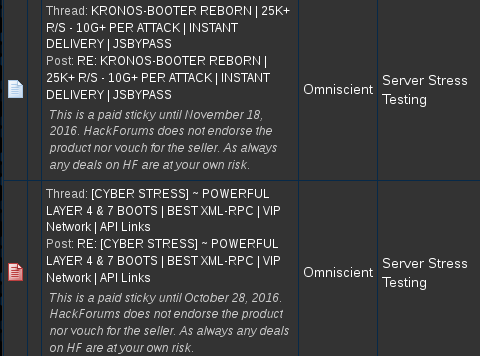

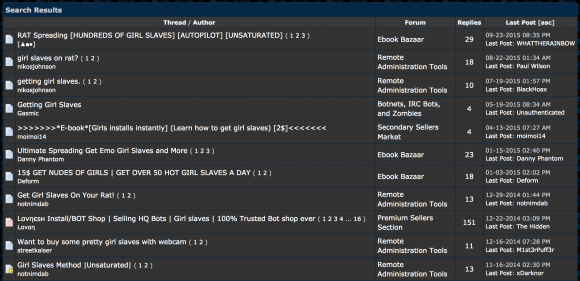

These days, however, even the least sophisticated Internet user can launch relatively large DDoS attacks just by paying a few bucks for a subscription to one of dozens of booter or stresser services, some of which even accept credit cards and PayPal payments.

These Web-based DDoS-for-hire services don’t run on botnets: They generally employ a handful of powerful servers that are rented from some dodgy “bulletproof” hosting provider. The booter service accepts payment and attack instructions via a front end Web site that is hidden behind Cloudflare (a free DDoS protection service).

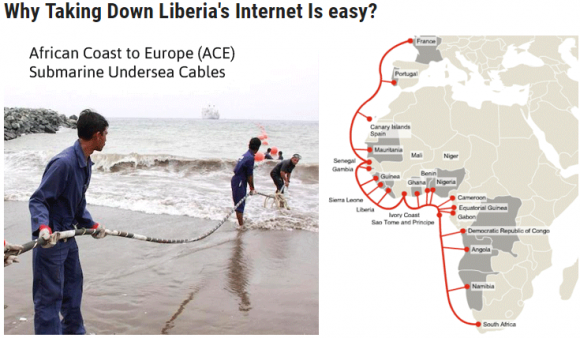

But the back end of the booter service is where the really interesting stuff happens. Virtually all of the most powerful and effective attack types used by booter services rely on a technique called traffic amplification and reflection, in which the attacker can reflect or “spoof” his traffic from one or more third-party machines toward the intended target.

In this type of assault, the attacker sends a message to a third party, while spoofing the Internet address of the victim. When the third party replies to the message, the reply is sent to the victim — and the reply is much larger than the original message, thereby amplifying the size of the attack.

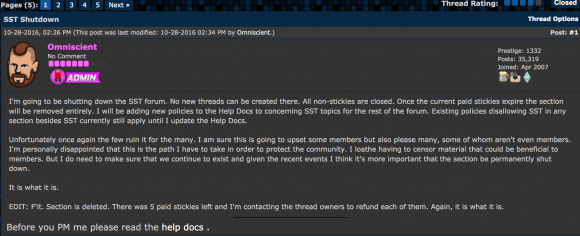

To find vulnerable systems that can be leveraged this way, booters employ large-scale Internet scanning services that constantly seek to refresh the list of systems that can be used for amplification and reflection attacks. They do this because, as research has shown (PDF), anywhere from 40-50 percent of the amplifiers vanish or are reassigned new Internet addresses after one week.

Enter researchers from Saarland University in Germany, as well as the Yokohama National University and National Institute of Information and Communications Technology — both in Japan. In a years-long project first detailed in 2015, the researchers looked for scanning that appeared to be kicked off by ne’er-do-wells running booter services.

To accomplish this, the research team built a kind of distributed “honeypot” system — which they dubbed “AmpPot” — designed to mimic services known to be vulnerable to amplification attacks, such as DNS and NTP floods.

“To make them attractive to attackers, our honeypots send back legitimate responses,” the researchers wrote in a 2015 paper (PDF). “Attackers, in turn, will abuse these honeypots as amplifiers, which allows us to observe ongoing attacks, their victims, and the DDoS techniques. To prevent damage caused by our honeypots, we limit the response rate. This way, while attackers can still find these ratelimited honeypots, the honeypots stop replying in the face of attacks.”

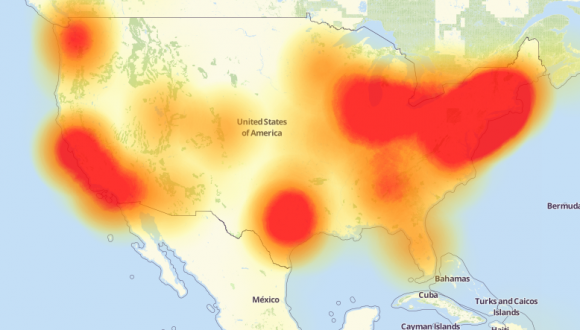

In that 2015 paper, the researchers said they deployed 21 globally-distributed AmpPot instances, which observed more than 1.5 million attacks between February and May 2015. Analyzing the attacks more closely, they found that more than 96% of the attacks stem from single sources, such as booter services.

“When focusing on amplification DDoS attacks, we find that almost all of them (>96%) are caused by single sources (e.g. booters), and not botnets,” the team concluded. “However, we sadly do not have the numbers to compare this [to] DoS attacks in general.”

Many large-scale Internet scans like the ones the researchers sought to measure are launched by security firms and other researchers, so the team needed a way to differentiate between scans launched by booter services and those conducted for research or other benign purposes.

“To distinguish between scans performed by researchers and scans performed with malicious intent we relied on a simple assumption: That no attack would be based on the results of a scan performed by (ethical) researchers,” said Johannes Krupp, one of the main authors of the report. “In fact, thanks to our methodology, we do not have to make this distinction upfront, but we can rather look at the results and say: ‘We found attacks linked to this scanner, therefore this scanner must have been malicious.’ If a scan was truly performed by benign parties, we will not find attacks linked to it.”

SECRET IDENTIFIERS

What’s new in the paper being released today by students at Saarland University’s Center for IT-Security, Privacy and Accountability (CISPA) is the method by which the researchers were able to link these mass-scans to the very amplification attacks that follow soon after.

The researchers worked out a way to encode a secret identifier into the set of AmpPot honeypots that any subsequent attack will use, which varies per scan source. They then tested to see if the scan infrastructure was also used to actually launch (and not just to prepare) the attacks. Continue reading →

![TitaniumStresser[dot]net, as it appeared in 2014.](https://krebsonsecurity.com/wp-content/uploads/2016/11/titaniumstresser-580x689.png)