A little-known feature of many modern smartphones is their ability to duplicate video on the device’s screen so that it also shows up on a much larger display — like a TV. However, new research shows that this feature may quietly expose users to a simple and cheap new form of digital eavesdropping.

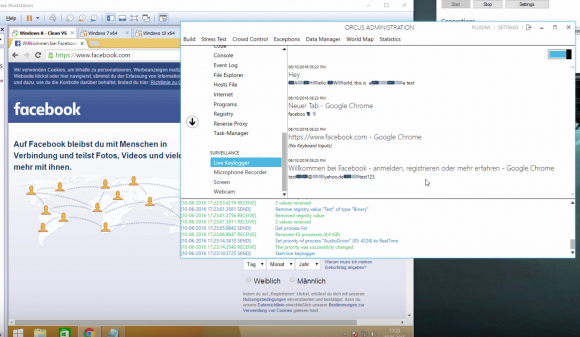

Dubbed “video jacking” by its masterminds, the attack uses custom electronics hidden inside what appears to be a USB charging station. As soon as you connect a vulnerable phone to the appropriate USB charging cord, the spy machine splits the phone’s video display and records a video of everything you tap, type or view on it as long as it’s plugged in — including PINs, passwords, account numbers, emails, texts, pictures and videos.

Some of the equipment used in the “video jacking” demonstration at the DEF CON security conference last week in Las Vegas. Source: Brian Markus.

[Click here if you’re the TL;DR type and just want to know if your phone is at risk from this attack.]

Demonstrations of this simple but effective mobile spying technique were on full display at the DEF CON security conference in Las Vegas last week. I was busy chasing a story at DEF CON unrelated to the conference this year, so I missed many people and talks that I wanted to see. But I’m glad I caught up with the team behind DEF CON’s annual and infamous “Wall of Sheep,” a public shaming exercise aimed at educating people about the dangers of sending email and other plain text online communications over open wireless networks.

Brian Markus, co-founder and chief executive officer for Aries Security, said he and fellow researchers Joseph Mlodzianowski and Robert Rowley came up with the idea for video jacking when they were brainstorming about ways to expand on their “juice jacking” experiments at DEF CON in 2011.

“Juice jacking” refers to the ability to hijack stored data when the user unwittingly plugs his phone into a custom USB charging station filled with computers that are ready to suck down and record said data (both Android and iOS phones now ask users whether they trust the computer before allowing data transfers).

In contrast, video jacking lets the attacker record every key and finger stroke the user makes on the phone, so that the owner of the evil charging station can later replay the videos and see any numbers or keys pressed on the smart phone.

That’s because those numbers or keys will be raised briefly on the victim’s screen with each key press. Here’s an example: While the user may have enabled a special PIN that needs to be entered before the phone unlocks to the home screen, this method captures even that PIN as long as the device is vulnerable and plugged in before the phone is unlocked.

GREAT. IS MY PHONE VULNERABLE?

Most of the phones vulnerable to video jacking are Android or other HDMI-ready smartphones from Asus, Blackberry, HTC, LG, Samsung, and ZTE. This page of HDMI enabled smartphones at phonerated.com should not be considered all-inclusive. Here’s another list. When in doubt, search online for your phone’s make and model to find out if it is HDMI or MHL ready.

Video jacking is a problem for users of HDMI-ready phones mainly because it’s very difficult to tell a USB cord that merely charges the phone versus one that also taps the phone’s video-out capability. Also, there’s generally no warning on the phone to alert the user that the device’s video is being piped to another source, Markus said.

“All of those phones have an HDMI access feature that is turned on by default,” he said. “A few HDMI-ready phones will briefly flash something like ‘HDMI Connected’ whenever they’re plugged into a power connection that is also drawing on the HDMI feature, but most will display no warning at all. This worked on all the phones we tested with no prompting.”

Both Markus and Rowley said they did not test the attack against Apple iPhones prior to DEF CON, but today Markus said he tested it at an Apple store and the video of the iPhone 6’s home screen popped up on the display in the store without any prompt. Getting it to work on the display required a special lightning digital AV adapter from Apple, which could easily be hidden inside an evil charging station and fed an extension adapter and then a regular lightning cable in front of that.

As usual, patches

As usual, patches  Asked this weekend for comment on rumors of a large data breach potentially affecting customers of its retail division, Oracle acknowledged that it had “detected and addressed malicious code in certain legacy MICROS systems.” It also said that it is asking all MICROS customers to reset their passwords for the MICROS online support portal.

Asked this weekend for comment on rumors of a large data breach potentially affecting customers of its retail division, Oracle acknowledged that it had “detected and addressed malicious code in certain legacy MICROS systems.” It also said that it is asking all MICROS customers to reset their passwords for the MICROS online support portal.

The SSA said all new and existing ‘my Social Security’ account holders will need to provide a cell phone number. The agency said it will use the mobile numbers to send users an 8-digit code via text message that needs to be entered along with a username and password to log in to the site.

The SSA said all new and existing ‘my Social Security’ account holders will need to provide a cell phone number. The agency said it will use the mobile numbers to send users an 8-digit code via text message that needs to be entered along with a username and password to log in to the site.

On July 22, KrebsOnSecurity reached out to San Francisco-based Kimpton after hearing from three different sources in the financial industry about a pattern of card fraud that suggested a card breach at close to two-dozen Kimpton hotels across the country.

On July 22, KrebsOnSecurity reached out to San Francisco-based Kimpton after hearing from three different sources in the financial industry about a pattern of card fraud that suggested a card breach at close to two-dozen Kimpton hotels across the country. At issue is a fairly technical proposed standard called DMARC. Short for “domain-based messaging authentication reporting and conformance,” DMARC tries to solve a problem that has plagued email since its inception: It’s surprisingly difficult for email providers and end users alike to tell whether a given email is real – i.e. that it really was sent by the person or organization identified in the “from:” portion of the missive.

At issue is a fairly technical proposed standard called DMARC. Short for “domain-based messaging authentication reporting and conformance,” DMARC tries to solve a problem that has plagued email since its inception: It’s surprisingly difficult for email providers and end users alike to tell whether a given email is real – i.e. that it really was sent by the person or organization identified in the “from:” portion of the missive.

In

In