An exhaustive inquiry published today by a consortium of investigative journalists says a three-part series KrebsOnSecurity published in 2015 on a Romanian ATM skimming gang operating in Mexico’s top tourist destinations disrupted their highly profitable business, which raked in an estimated $1.2 billion and enjoyed the protection of top Mexican authorities.

The multimedia investigation by the Organized Crime and Corruption Reporting Project (OCCRP) and several international journalism partners detailed the activities of the so-called Riviera Maya crime gang, allegedly a mafia-like group of Romanians who until very recently ran their own ATM company in Mexico called “Intacash” and installed sophisticated electronic card skimming devices inside at least 100 cash machines throughout Mexico.

According to the OCCRP, Riviera Maya’s skimming devices allowed thieves to clone the cards, which were used to withdraw funds from ATMs in other countries — often halfway around the world in places like India, Indonesia, and Taiwan.

Investigators say each skimmer captured on average 1,000 cards per month, siphoning about $200 from individual victim accounts. This allowed the crime gang to steal approximately $20 million monthly.

“The gang had little tricks,” OCCRP reporters recounted in their video documentary (above). “They would use the cards in different cities all over the globe and wait three months so banks would struggle to trace where the card had originally been cloned.”

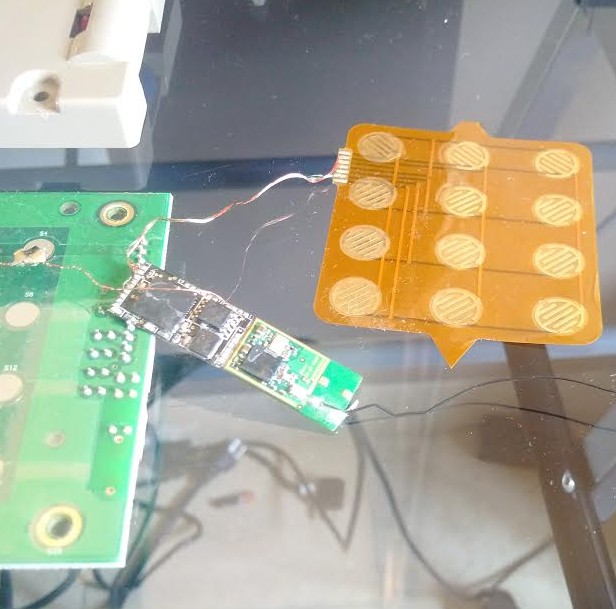

In September 2015, I traveled to Mexico’s Yucatan Peninsula to find and document almost two dozen ATMs in the region that were compromised with Bluetooth-based skimming devices. Unlike most skimmers — which can be detected by looking for out-of-place components attached to the exterior of a compromised cash machine — these skimmers were hooked to the internal electronics of ATMs operated by Intacash’s competitors by authorized personnel who’d reportedly been bribed or coerced by the gang.

But because the skimmers were Bluetooth-based, allowing thieves periodically to collect stolen data just by strolling up to a compromised machine with a mobile device, I was able to detect which ATMs had been hacked using nothing more than a cheap smart phone.

One of the Bluetooth-enabled PIN pads pulled from a compromised ATM in Mexico. The two components on the left are legitimate parts of the machine. The fake PIN pad made to be slipped under the legit PIN pad on the machine, is the orange bit, top right. The Bluetooth and data storage chips are in the middle.

Several days of wandering around Mexico’s top tourist areas uncovered these sophisticated skimmers inside ATMs in Cancun, Cozumel, Playa del Carmen and Tulum, including a compromised ATM in the lobby of my hotel in Cancun. OCCRP investigators said the gang also had installed the same skimmers in ATMs at tourist hotspots on the western coast of Mexico, in Puerto Vallarta, Sayulita and Tijuana.

Part III of my 2015 investigation concluded that Intacash was likely behind the scheme. An ATM industry source told KrebsOnSecurity at the time that his technicians had been approached by ATM installers affiliated with Intacash, offering those technicians many times their monthly salaries if they would provide periodic access to the machines they maintained.

The alleged leader of the Riviera Maya organization and principal owner of Intacash, 43-year-old Florian “The Shark” Tudor, is a Romanian with permanent residence in Mexico. Tudor claims he’s an innocent, legitimate businessman who’s been harassed and robbed by Mexican authorities.

Last year, police in Mexico arrested Tudor for illegal weapons possession, and raided his various properties there in connection with an investigation into the 2018 murder of his former bodyguard, Constantin Sorinel Marcu.

According to prosecution documents, Marcu and The Shark spotted my reporting shortly after it was published in 2015, and discussed what to do next on a messaging app:

The Shark: Krebsonsecurity.com See this. See the video and everything. There are two episodes. They made a telenovela.

Marcu: I see. It’s bad.

The Shark: They destroyed us. That’s it. Fuck his mother. Close everything.

The intercepted communications indicate The Shark also wanted revenge on whoever was responsible for leaking information about their operations.

The Shark: Tell them that I am going to kill them.

Marcu: Okay, I can kill them. Any time, any hour.

The Shark: They are checking all the machines. Even at banks. They found over 20.

Marcu: Whaaaat?!? They found? Already??

Throughout my investigation, I couldn’t be sure whether Intacash’s shiny new ATMs — which positively blanketed tourist areas in and around Cancun — also were used to siphon customer card data. I did write about my suspicions that Intacash’s ATMs were up to no good when I found they frequently canceled transactions just after a PIN was entered, and typically failed to provide paper receipts for withdrawals made in U.S. dollars.

But citing some of the thousands of official documents obtained in their investigation, the OCCRP says investigators now believe Intacash installed the same or similar skimming devices in its own ATMs prior to deploying them — despite advertising them as equipped with the latest security features and fraudulent device inhibitors.

Tudor’s organization “had the access that gave The Shark’s crew huge opportunities for fraud,” the OCCRP reports. “And on the Internet, the number of complaints grew. Foreign tourists in Mexico fleeced” by Intacash’s ATMs.

Many of the compromised ATMs I located in my travels throughout Mexico were at hotels, and while Intacash’s ATMs could be found on many street locations in the region, it was rare to find them installed at hotels.

The confidential source with whom I drove from place to place at the time said Intacash avoided installing their machines at hotels — despite such locations being generally far more profitable — for one simple reason: If one’s card is cloned from a hotel ATM, the customer can easily complain to the hotel staff. With a street ATM, not so much.

The investigation by the OCCRP and its partners paints a vivid picture of a highly insular, often violent transnational organized crime ring that controlled at least 10 percent of the $2 billion annual global market for skimmed cards.

It also details how the group laundered their ill-gotten gains, and is alleged to have built a human smuggling ring that helped members of the crime gang cross into the U.S. and ply their skimming trade against ATMs in the United States. Finally, the series highlights how the Riviera Maya gang operated with impunity for several years by exploiting relationships with powerful anti-corruption officials in Mexico.

Tudor and many of his associates maintain their innocence and are still living as free men in Mexico, although Tudor is facing charges in Romania for his alleged involvement with organized crime, attempted murder and blackmail. Intacash is no longer operating in Mexico. In 2019, Intacash’s sponsoring bank in Mexico suspended the company’s contract to process ATM transactions.

For much more on this investigation, check out OCCRP’s multi-part series, How a Crew of Romanian Criminals Conquered the World of ATM Skimming.

Bravo, Brian!

I personally never use street or standalone ATMs. There’s one in particular on the street near Hollywood High School that just looks – I don’t know – suspicious. It’s sitting on the sidewalk in front of a temporary wire perimeter fence next to an empty lot with overgrown weeds.

Send picture of that.

Excellent video that is well worth the 30 minutes to watch. Would love to hear the news some day that Florian Tudor is convicted of these crimes.

ATMs spread Coronavirus too. Eeewww…

Nicely done, Brian!

God bless you Brian. The work you do is just unbelievable.

That was great watch and interesting.

A good plan when traveling out of the US is to bring new cash sufficient to exchange for foreign currency. That keeps you out of ATMs.

Taking a bunch of cash on an international trip is a terrible idea!!

If you are robbed of your cash you have lost that money. If your credit card is skimmed you are protected as long as you report any fraudulent charges within 60 days.

You also have to pay exchange fees and the exchange rate is almost always better from the back that issues the credit card.

** from the BANK that issues the credit card.

Thank you for your excellent work.

really nice work Brian, thanks a lot!

The RSS feed at http://www.krebsonsecurity.com/feed/ gives a security error:

“The issuer certificate of a locally looked up certificate could not be found. No certificates could be verified”

This is in QuiteRSS reader, not if I input the same URL in Firefox, so I’m unsure what could be going on.

Thanks. We’re aware of it. It’s not an issue specific to this site. See: https://nakedsecurity.sophos.com/2020/06/02/the-mystery-of-the-expiring-sectigo-web-certificate/

Brian, thank you for the link -very helpful. Saw the problem this morning but hadn’t gotten to it yet. This might be worthy of a column of its own.

This gang has affiliates over the world. Four Romanians were recently arrested in Dublin Ireland for cyber fraud. https://www.irishmirror.ie/news/irish-news/crime/gardai-arrest-four-romanian-men-22131064

I remember the original articles. I live in a less touristy part of south east Mexico, and I have used the Bluetooth trick to check out suspicious ATMs. I now only use cash machines at actual bank branches. Thanks Brian for your work.

Wow! remarkable coverage and investigation, Great work Brian.

Great work, Brian.

One thing that we might read about in six months or a year is how the Trump family has been involved in a large money laundering ring. I really hope so for the sake of our country.

“Investigators say each skimmer captured on average 1,000 cards per month, siphoning about $200 from individual victim accounts. This allowed the crime gang to steal approximately $20 million monthly.”

1’000*200 = 200’000, so shouldn’t it be 200’000$ a month instead of 20 million?

The investigators say the gang had at least 100 compromised ATMs.

Excellent job, Brian!

I remember your 3 part series was quite interesting and now with all the OCCPR pieces… y’all should get together & write another book.

Thanks Brian for all the hard work you do to keep us informed!!!

I think people are crazy for even going down to any Mexico tourist spot. It is well known that kidnappers can hold loved ones for ransom; and there is nothing you can do about it. You have no right to self protection down there, so you are just a big fat target for crime.

I had a friend who came from Mexico and was studying in college in our engineering program, and he said he had to fly home for the holidays, because traveling on the ground is too risky there. That was clear back in 1990. When all this changed in 1971, it became too dangerous for my father to travel down there, where he used to be able to carry a concealed firearm. Our family begged him to quit traveling down there, and he finally complied in the early 1980s. Fortunately one of the people he visited down there had a lot of political pull and was able to carry a .45 pistol with him everywhere they went; as a wealthy land owner he was lucky.

It’s almost as good as The Wire. 🙂

Great job, Brian & OCCRP!

Good work (and interesting), as usual, Brian!

Regards,

Krebs, you got older than in your banner at the top of website 🙂 . Time to refresh.

Good journalism! Wondering, if ever that ‘shark’ will be arrested. With so much money, he can hide until the end of the days.

Great work Brian. Thank you.

Great work and an awesome job. Romania is a beautiful county but unfortunately those individuals ruin our image.

Brian,

Apologies if I wrote something wrong in a post to this thread (the other day) that you decided not to post here. Not sure what it could have been r what I did wrong, but nevertheless, sorry. Just wanted to reiterate nice work and great followup as I remember the original articles from 3 years ago.

Also, isn’t this why people shouldn’t ever trust an ATM anywhere anymore? We’ve been 5+ years since we gave them up completely (even for own use at our financial institution) and we haven’t—-wherever we’ve traveled (first, second and third world countries)—-encountered any problems and/or inconveniences. Digital cash and digitally stored pay methods are surprisingly everywhere if one looks hard enough.

The guy from minute 11:33 definitely doesnt speak romanian to me…or he supposed to speak in other language there…

Great Work Brian!

I remembered this story from 2015, so when I was in Playa Del Carmen on vacation, I made sure to scan with bluetooth first for any suspicious pings. I work for a large ATM company, so I’m alert when it comes to what to look for externally.

“Investigators say each skimmer captured on average 1,000 cards per month, siphoning about $200 from individual victim accounts. This allowed the crime gang to steal approximately $20 million monthly.”

How did you get $20M monthly? That looks like $200,000 monthly.

The gang had at least 100 compromised ATMs. 1,000 x $200 x 100.

Lots of “Sharks” in Florida be it by sea or just hanging around in some shady corner in one of the big cities.

Great article, I need to watch the video again !