When news broke last month that the credit card breach at fast food chain Wendy’s impacted fewer than 300 out of the company’s 5,800 locations, the response from many readers was, “Where’s the Breach?” Today, Wendy’s said the number of stores impacted by the breach is “significantly higher” and that the intrusion may not yet be contained.

On January 27, 2016, this publication was the first to report that Wendy’s was investigating a card breach. In mid-May, the company announced in its first quarter financial statement that the fraud impacted just five percent of stores.

On January 27, 2016, this publication was the first to report that Wendy’s was investigating a card breach. In mid-May, the company announced in its first quarter financial statement that the fraud impacted just five percent of stores.

But since that announcement last month, a number of sources in the fraud and banking community have complained to this author that there was no way the Wendy’s breach only affected five percent of stores — given the volume of fraud that the banks have traced back to Wendy’s customers.

What’s more, some of those same sources said they were certain the breach was still ongoing well after Wendy’s made the five percent claim in May. In my March 02 piece Credit Unions Feeling Pinch in Wendy’s Breach, I quoted B. Dan Berger, CEO of the National Association of Federal Credit Unions, saying the he’d heard from three credit union CEOs who said the fraud they’ve experienced so far from the Wendy’s breach has eclipsed what they were hit with in the wake of the Home Depot and Target breaches.

Today, Wendy’s acknowledged in a statement that the breach is now expected to be “considerably higher than the 300 restaurants already implicated.” Company spokesman Bob Bertini declined to be more specific about the number of stores involved, citing an ongoing investigation. Bertini also declined to say whether the company is confident that the breach has been contained.

“Wherever we are finding it we’ve taken action,” he said. “But we can’t rule out that there aren’t others.”

Bertini said part of the problem was that the breach happened in two waves. He said the outside forensics investigators that were assigned to the case by the credit card associations initially found 300 locations that had malware on the point-of-sale devices, but that the company’s own investigators later discovered a different strain of the malware at some locations. Bertini declined to provide additional details about either of the malware strains found in the intrusions.

“In recent days, our investigator has identified this additional strain or mutation of the original malware,” he said. “It just so happens that this new strain targets a different point of sale system than the original one, and we just within the last few days discovered this.” Continue reading

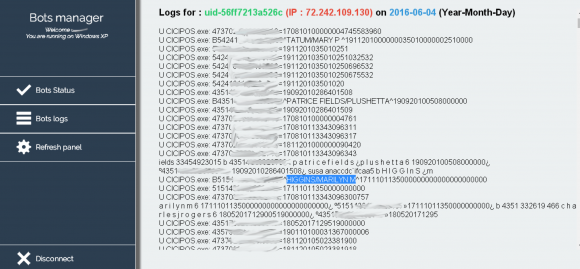

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had all been used in the last few months at various CiCi’s Pizza locations.

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had all been used in the last few months at various CiCi’s Pizza locations.

![The sales thread on exploit[dot]in.](https://krebsonsecurity.com/wp-content/uploads/2016/05/buggicorp-580x255.png)

Over the past weekend, KrebsOnSecurity began hearing from sources at multiple financial institutions who said they’d detected a pattern of fraudulent charges on customer cards that were used at various Noodles & Company locations between January 2016 and the present.

Over the past weekend, KrebsOnSecurity began hearing from sources at multiple financial institutions who said they’d detected a pattern of fraudulent charges on customer cards that were used at various Noodles & Company locations between January 2016 and the present.