Visa this week delayed by three years a deadline for fuel station owners to install payment terminals at the pump that are capable of handling more secure chip-based cards. Experts say the new deadline — extended from 2017 — comes amid a huge spike in fuel pump skimming, and means fraudsters will have another three years to fleece banks and their customers by installing card-skimming devices at the pump.

Until this week, fuel station owners in the United States had until October 1, 2017 to install chip-capable readers at their pumps. Under previous Visa rules, station owners that didn’t have chip-ready readers in place by then would have been on the hook to absorb 100 percent of the costs of fraud associated with transactions in which the customer presented a chip-based card yet was not asked or able to dip the chip (currently, card-issuing banks eat most of the fraud costs from fuel skimming). The chip card technology standard, also known as EMV (short for Europay, MasterCard and Visa) makes credit and debit cards far more expensive and difficult for thieves to clone.

This week, however, Visa said fuel station owners would have until October 1, 2020 to meet the liability shift deadline.

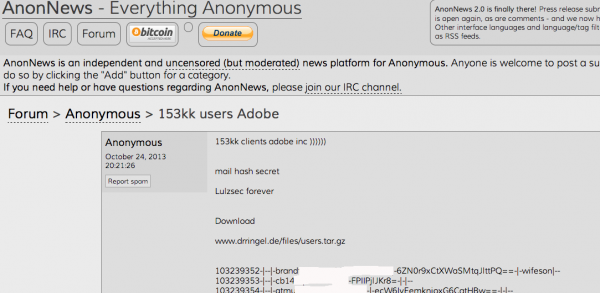

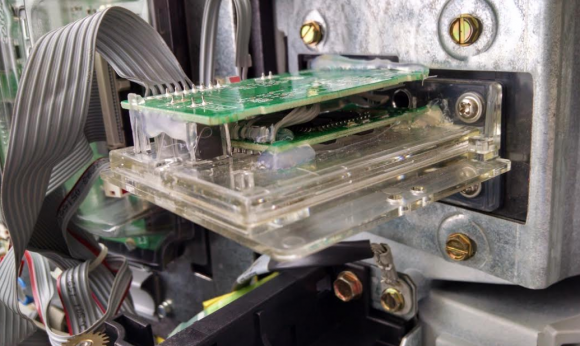

A Bluetooth-based pump card skimmer found inside of a Food N Things pump in Arizona in April 2016.

“The fuel segment has its own unique challenges, which we recognized when we first set the chip activation date for automated fuel dispensers/pumps (AFDs) two years after regular in-store locations,” Visa said in a statement explaining its decision. “We knew that the AFD segment would need more time to upgrade to chip because of the complicated infrastructure and specialized technology required for fuel pumps. For instance, in some cases, older pumps may need to be replaced before adding chip readers, requiring specialized vendors and breaking into concrete. Furthermore, five years after announcing our liability shift, there are still issues with a sufficient supply of regulatory-compliant EMV hardware and software to enable most upgrades by 2017.”

Visa said fuel pump skimming accounts for just 1.3 percent of total U.S. payment card fraud.

“During this interim period, Visa will monitor AFD fraud trends closely and work with merchants, acquirers and issuers to help mitigate any potential counterfeit fraud exposure at AFDs,” Visa said.

Avivah Litan, a fraud analyst with Gartner Inc., said the deadline shift wasn’t unexpected given how many U.S. fuel stations are behind on costly updates, noting that in some cases it can cost more than $10,000 per pump to accommodate chip card readers. The National Association of Convenience Stores estimates that station operators will spend approximately $30,000 per store to accommodate chip readers, and that the total cost to the fuel industry could exceed $4 billion.

“Some of them you can just replace the payment module inside the pump, but the older pumps will need to be completely removed and replaced,” Litan said. “Gas stations and their unattended pumps have always been an easy target for thieves. The fraud usually migrates to the point of least resistance, and we’re seeing now the fraudsters really moving to targeting unattended stations that haven’t been upgraded.” Continue reading