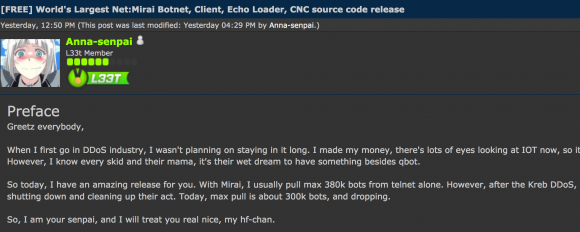

Earlier this month a hacker released the source code for Mirai, a malware strain that was used to launch a historically large 620 Gbps denial-of-service attack against this site in September. That attack came in apparent retribution for a story here which directly preceded the arrest of two Israeli men for allegedly running an online attack for hire service called vDOS. Turns out, the site where the Mirai source code was leaked had some very interesting things in common with the place vDOS called home.

The domain name where the Mirai source code was originally placed for download — santasbigcandycane[dot]cx — is registered at the same domain name registrar that was used to register the now-defunct DDoS-for-hire service vdos-s[dot]com.

Normally, this would not be remarkable, since most domain registrars have thousands or millions of domains in their stable. But in this case it is interesting mainly because the registrar used by both domains — a company called namecentral.com — has apparently been used to register just 38 domains since its inception by its current owner in 2012, according to a historic WHOIS records gathered by domaintools.com (for the full list see this PDF).

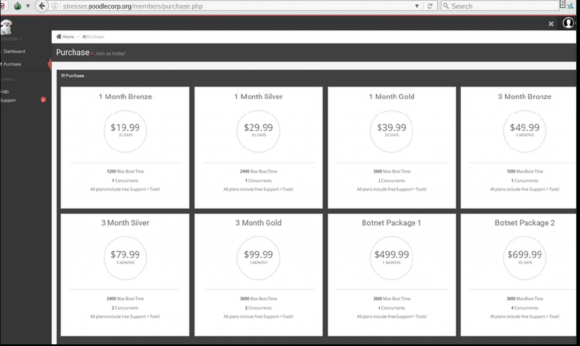

What’s more, a cursory look at the other domains registered via namecentral.com since then reveals a number of other DDoS-for-hire services, also known as “booter” or “stresser” services.

It’s extremely odd that someone would take on the considerable cost and trouble of creating a domain name registrar just to register a few dozen domains. It costs $3,500 to apply to the Internet Corporation for Assigned Names and Numbers (ICANN) for a new registrar authority. The annual fee for being an ICANN-approved registrar is $4,000, and then there’s a $800 quarterly fee for smaller registrars. In short, domain name registrars generally need to register many thousands of new domains each year just to turn a profit.

Many of the remaining three dozen or so domains registered via Namecentral over the past few years are tied to vDOS. Before vDOS was taken offline it was massively hacked, and a copy of the user and attack database was shared with KrebsOnSecurity. From those records it was easy to tell which third-party booter services were using vDOS’s application programming interface (API), a software function that allowed them to essentially resell access to vDOS with their own white-labeled stresser.

And a number of those vDOS resellers were registered through Namecentral, including 83144692[dot].com — a DDoS-for-hire service marketed at Chinese customers. Another Namecentral domain — vstress.net — also was a vDOS reseller.

Other DDoS-for-hire domains registered through Namecentral include xboot[dot]net, xr8edstresser[dot]com, snowstresser[dot]com, ezstress[dot]com, exilestress[dot]com, diamondstresser[dot]net, dd0s[dot]pw, rebelsecurity[dot]net, and beststressers[dot]com.

WHO RUNS NAMECENTRAL?

Namecentral’s current owner is a 19-year-old California man by the name of Jesse Wu. Responding to questions emailed from KrebsOnSecurity, Wu said Namecentral’s policy on abuse was inspired by Cloudflare, the DDoS protection company that guards Namecentral and most of the above-mentioned DDoS-for-hire sites from attacks of the very kind they sell.

“I’m not sure (since registrations are automated) but I’m going to guess that the reason you’re interested in us is because some stories you’ve written in the past had domains registered on our service or otherwise used one of our services,” Wu wrote.

“We have a policy inspired by Cloudflare’s similar policy that we ourselves will remain content-neutral and in the support of an open Internet, we will almost never remove a registration or stop providing services, and furthermore we’ll take any effort to ensure that registrations cannot be influenced by anyone besides the actual registrant making a change themselves – even if such website makes us uncomfortable,” Wu said. “However, as a US based company, we are held to US laws, and so if we receive a valid court issued order to stop providing services to a client, or to turn over/disable a domain, we would happily comply with such order.”

Wu’s message continued:

“As of this email, we have never received such an order, we have never been contacted by any law enforcement agency, and we have never even received a legitimate, credible abuse report. We realize this policy might make us popular with ‘dangerous’ websites but even then, if we denied them services, simply not providing them services would not make such website stop existing, they would just have to find some other service provider/registrar or change domains more often. Our services themselves cannot be used for anything harmful – a domain is just a string of letters, and the rest of our services involve website/ddos protection/ecommerce security services designed to protect websites.”

Taking a page from Cloudflare, indeed. I’ve long taken Cloudflare to task for granting DDoS protection for countless DDoS-for-hire services, to no avail. I’ve maintained that Cloudflare has a blatant conflict of interest here, and that the DDoS-for-hire industry would quickly blast itself into oblivion because the proprietors of these attack services like nothing more than to turn their attack cannons on each other. Cloudflare has steadfastly maintained that picking and choosing who gets to use their network is a slippery slope that it will not venture toward.

Although Mr. Wu says he had nothing to do with the domains registered through Namecentral, public records filed elsewhere raise serious unanswered questions about that claim.

In my Sept. 8 story, Israeli Online Attack Service Earned $600,000 in Two Years, I explained that the hacked vDOS database indicated the service was run by two 18-year-old Israeli men. At some point, vDOS decided to protect all customer logins to the service with an extended validation (EV) SSL certificate. And for that, it needed to show it was tied to an actual corporate entity.

My investigation into those responsible for supporting vDOS began after I took a closer look at the SSL certificate that vDOS-S[dot]com used to encrypt customer logins. On May 12, 2015, Digicert.com issued an EV SSL certificate for vDOS, according to this record.

As we can see, whoever registered that EV cert did so using the business name VS NETWORK SERVICES LTD, and giving an address in the United Kingdom of 217 Blossomfield Rd., Solihull, West Midlands.

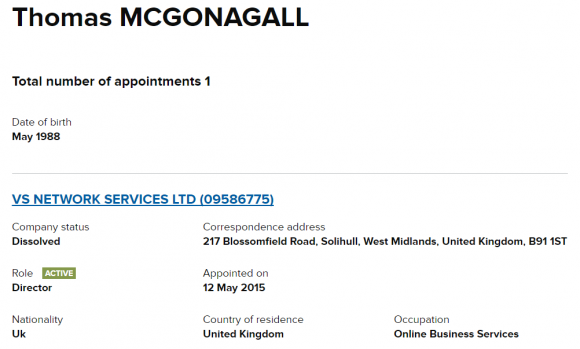

Who owns VS NETWORK SERVICES LTD? According this record from Companies House UK — an official ledger of corporations located in the United Kingdom — the director of the company was listed as one Thomas McGonagall.

Records from Companies House UK on the firm responsible for registering vDOS’s SSL certificate.

This individual gave the same West Midlands address, stating that he was appointed to VS Network Services on May 12, 2015, and that his birthday was in May 1988. A search in Companies House for Thomas McGonagall shows that a person by that same name and address also was listed that very same day as a director for a company called REBELSECURITY LTD.

If we go back even further into the corporate history of this mysterious Mr. McGonagall we find that he was appointed director of NAMECENTRAL LTD on August 18, 2014. Mr. McGonagall’s birthday is listed as December 1995 in this record, and his address is given as 29 Wigorn Road, 29 Wigorn Road, Smethwick, West Midlands, United Kingdom, B67 5HL. Also on that same day, he was appointed to run EZSTRESS LTD, a company at the same Smethwick, West Midlands address.

Strangely enough, those company names correspond to other domains registered through Namecentral around the same time the companies were created, including rebelsecurity[dot]net, ezstress[dot]net.

Asked to explain the odd apparent corporate connections between Namecentral, vDOS, EZStress and Rebelsecurity, Wu chalked that up to an imposter or potential phishing attack.

“I’m not sure who that is, and we are not affiliated with Namecentral Ltd.,” he wrote. “I looked it up though and it seems like it is either closed or has never been active. From what you described it could be possible someone set up shell companies to try and get/resell EV certs (and someone’s failed attempt to set up a phishing site for us – thanks for the heads up).”

Interestingly, among the three dozen or so domains registered through Namecentral.com is “certificateavenue.com,” a site that until recently included nearly identical content as Namecentral’s home page and appears to be aimed at selling EV certs. Certificateavenue.com was responding as of early-October, but it is no longer online.

I also asked Wu why he chose to become a domain registrar when it appeared he had very few domains to justify the substantial annual costs of maintaining a registrar business. Continue reading

That’s right: If you purchased a “Never Hillary” poster or donated funds to the NRSC through

That’s right: If you purchased a “Never Hillary” poster or donated funds to the NRSC through  Recently, I heard from a cybersecurity researcher who’d created a virtual “honeypot” environment designed to simulate hackable IoT devices. The source, who asked to remain anonymous, said his honeypot soon began seeing traffic destined for Asus and Linksys routers running default credentials. When he examined what that traffic was designed to do, he found his honeypot systems were being told to download a piece of malware from a destination on the Web.

Recently, I heard from a cybersecurity researcher who’d created a virtual “honeypot” environment designed to simulate hackable IoT devices. The source, who asked to remain anonymous, said his honeypot soon began seeing traffic destined for Asus and Linksys routers running default credentials. When he examined what that traffic was designed to do, he found his honeypot systems were being told to download a piece of malware from a destination on the Web.

Zero-day vulnerabilities describe flaws that even the makers of the targeted software don’t know about before they start seeing the flaws exploited in the wild, meaning the vendor has “zero days” to fix the bugs.

Zero-day vulnerabilities describe flaws that even the makers of the targeted software don’t know about before they start seeing the flaws exploited in the wild, meaning the vendor has “zero days” to fix the bugs. According to

According to