I’d just finished parking my car in the covered garage at Reagan National Airport just across the river from Washington, D.C. when I noticed a dark green minivan slowly creeping through the row behind me. The vehicle caught my attention because its driver didn’t appear to be looking for an open spot. What’s more, the van had what looked like two cameras perched atop its roof — one of each side, both pointed down and slightly off to the side.

I had a few hours before my flight boarded, so I delayed my walk to the terminal and cut through several rows of cars to snag a video of the guy moving haltingly through another line of cars. I approached the driver and asked what he was doing. He smiled and tilted the lid on his bolted-down laptop so that I could see the pictures he was taking with the mounted cameras: He was photographing every license plate in the garage (for the record, his plate was a Virginia tag number 36-646L).

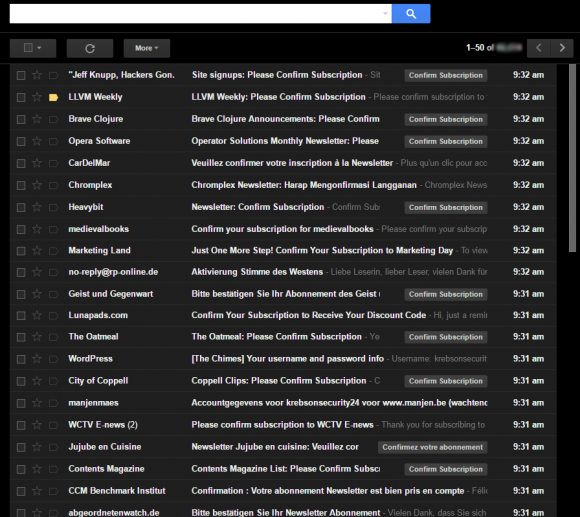

A van at Reagan National Airport equipped with automated license plate readers fixed to the roof.

The man said he was hired by the airport to keep track of the precise location of every car in the lot, explaining that the data is most often used by the airport when passengers returning from a trip forget where they parked their vehicles. I checked with the Metropolitan Washington Airports Authority (MWAA), which manages the garage, and they confirmed the license plate imaging service was handled by a third-party firm called HUB Parking.

I’m accustomed to having my license plate photographed when entering a parking area (Dulles International Airport in Virginia does this), but until that encounter at Reagan National I never considered that this was done manually.

“Reagan National uses this service to assist customers in finding their lost vehicles,” said MWAA spokesperson Kimberly Gibbs. “If the customer remembers their license plate it can be entered into the system to determine what garages and on what aisle their vehicle is parked.”

What does HUB Parking do with the information its clients collect? Ilaria Riva, marketing manager for HUB Parking, says the company does not sell or share the data it collects, and that it is up to the client to decide how that information is stored or shared.

“It is true the solution that HUB provides to our clients may collect data, but HUB does not own the data nor do we have any control over what the customer does with it,” Riva said.

Gibbs said MWAA does not share parking information with outside organizations. But make no mistake: the technology used at Reagan National Airport, known as automated license plate reader or ALPR systems, is already widely deployed by municipalities, police forces and private companies — particularly those in the business of repossessing vehicles from deadbeat owners who don’t pay their bills.

It’s true that people have zero expectation of privacy in public places — and roads and parking garages certainly are public places for the most part. But according to the Electronic Frontier Foundation (EFF), the data collected by ALPR systems can be very revealing, and in many cities ALPR technology is rapidly outpacing the law.

“By matching your car to a particular time, date and location, and then building a database of that information over time, law enforcement can learn where you work and live, what doctor you go to, which religious services you attend, and who your friends are,” the EFF warns. Continue reading

According to

According to

On Feb. 20, 2016, James William Schwartz, 84, was going about his daily routine, which mainly consisted of caring for his wife, MaryLou. Mrs. Schwartz was suffering from the end stages of endometrial cancer and wasn’t physically mobile without assistance. When Mr. Schwartz began having a heart attack that day, MaryLou went to use her phone to call for help and discovered it was completely shut off.

On Feb. 20, 2016, James William Schwartz, 84, was going about his daily routine, which mainly consisted of caring for his wife, MaryLou. Mrs. Schwartz was suffering from the end stages of endometrial cancer and wasn’t physically mobile without assistance. When Mr. Schwartz began having a heart attack that day, MaryLou went to use her phone to call for help and discovered it was completely shut off. On July 5, 2016, KrebsOnSecurity reached out to Bellevue, Wash., based Eddie Bauer after hearing from several sources who work in fighting fraud at U.S. financial institutions. All of those sources said they’d identified a pattern of fraud on customer cards that had just one thing in common: They were all recently used at some of Eddie Bauer’s

On July 5, 2016, KrebsOnSecurity reached out to Bellevue, Wash., based Eddie Bauer after hearing from several sources who work in fighting fraud at U.S. financial institutions. All of those sources said they’d identified a pattern of fraud on customer cards that had just one thing in common: They were all recently used at some of Eddie Bauer’s