Far too many otherwise intelligent and talented software developers these days apparently think they can get away with writing, selling and supporting malicious software and then couching their commerce as a purely legitimate enterprise. Here’s the story of how I learned the real-life identity of Canadian man who’s laboring under that same illusion as proprietor of one of the most popular and affordable tools for hacking into someone else’s computer.

Earlier this week I heard from Daniel Gallagher, a security professional who occasionally enjoys analyzing new malicious software samples found in the wild. Gallagher said he and members of @malwrhunterteam and @MalwareTechBlog recently got into a Twitter fight with the author of Orcus RAT, a tool they say was explicitly designed to help users remotely compromise and control computers that don’t belong to them.

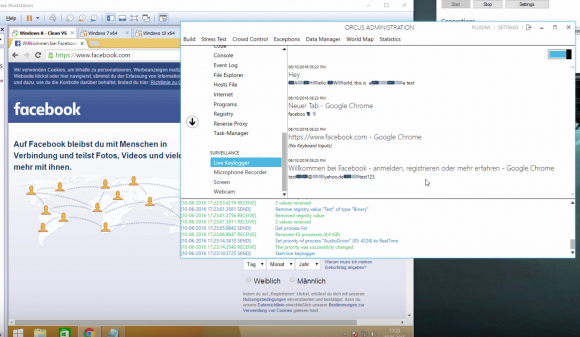

A still frame from a Youtube video demonstrating Orcus RAT’s keylogging ability to steal passwords from Facebook and other sites.

The author of Orcus — a person going by the nickname “Ciriis Mcgraw” a.k.a. “Armada” on Twitter and other social networks — claimed that his RAT was in fact a benign “remote administration tool” designed for use by network administrators and not a “remote access Trojan” as critics charged. Gallagher and others took issue with that claim, pointing out that they were increasingly encountering computers that had been infected with Orcus unbeknownst to the legitimate owners of those machines.

The malware researchers noted another reason that Mcgraw couldn’t so easily distance himself from how his clients used the software: He and his team are providing ongoing technical support and help to customers who have purchased Orcus and are having trouble figuring out how to infect new machines or hide their activities online.

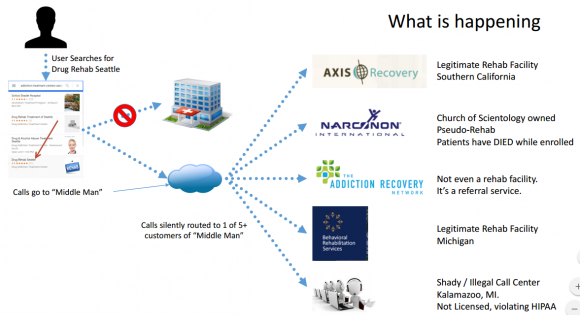

What’s more, the range of features and plugins supported by Armada, they argued, go well beyond what a system administrator would look for in a legitimate remote administration client like Teamviewer, including the ability to launch a keylogger that records the victim’s every computer keystroke, as well as a feature that lets the user peek through a victim’s Web cam and disable the light on the camera that alerts users when the camera is switched on.

A new feature of Orcus announced July 7 lets users configure the RAT so that it evades digital forensics tools used by malware researchers, including an anti-debugger and an option that prevents the RAT from running inside of a virtual machine.

Other plugins offered directly from Orcus’s tech support page (PDF) and authored by the RAT’s support team include a “survey bot” designed to “make all of your clients do surveys for cash;” a “USB/.zip/.doc spreader,” intended to help users “spread a file of your choice to all clients via USB/.zip/.doc macros;” a “Virustotal.com checker” made to “check a file of your choice to see if it had been scanned on VirusTotal;” and an “Adsense Injector,” which will “hijack ads on pages and replace them with your Adsense ads and disable adblocker on Chrome.”

WHO IS ARMADA?

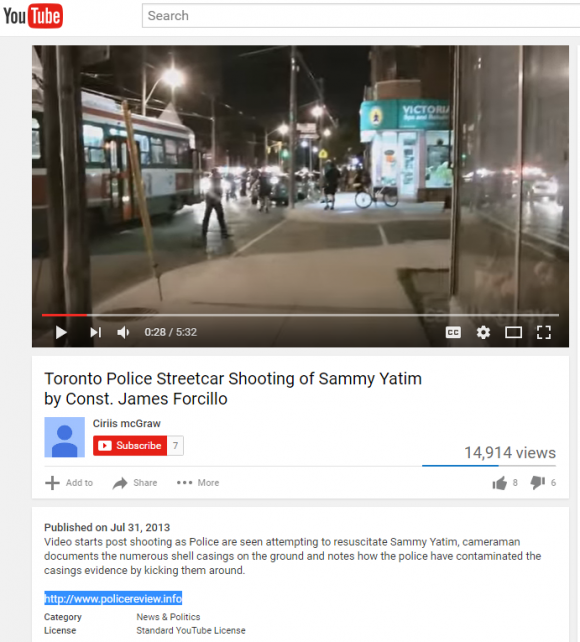

Gallagher said he was so struck by the guy’s “smugness” and sheer chutzpah that he decided to look closer at any clues that Ciriis Mcgraw might have left behind as to his real-world identity and location. Sure enough, he found that Ciriis Mcgraw also has a Youtube account under the same name, and that a video Mcgraw posted in July 2013 pointed to a 33-year-old security guard from Toronto, Canada.

Gallagher noticed that the video — a bystander recording on the scene of a police shooting of a Toronto man — included a link to the domain policereview[dot]info. A search of the registration records attached to that Web site name show that the domain was registered to a John Revesz in Toronto and to the email address john.revesz@gmail.com.

Gallagher noticed that the video — a bystander recording on the scene of a police shooting of a Toronto man — included a link to the domain policereview[dot]info. A search of the registration records attached to that Web site name show that the domain was registered to a John Revesz in Toronto and to the email address john.revesz@gmail.com.

A reverse WHOIS lookup ordered from Domaintools.com shows the same john.revesz@gmail.com address was used to register at least 20 other domains, including “thereveszfamily.com,” “johnrevesz.com, revesztechnologies[dot]com,” and — perhaps most tellingly — “lordarmada.info“.

Johnrevesz[dot]com is no longer online, but this cached copy of the site from the indispensable archive.org includes his personal résumé, which states that John Revesz is a network security administrator whose most recent job in that capacity was as an IT systems administrator for TD Bank. Revesz’s LinkedIn profile indicates that for the past year at least he has served as a security guard for GardaWorld International Protective Services, a private security firm based in Montreal.

Revesz’s CV also says he’s the owner of the aforementioned Revesz Technologies, but it’s unclear whether that business actually exists; the company’s Web site currently redirects visitors to a series of sites promoting spammy and scammy surveys, come-ons and giveaways. Continue reading

In

In

First off, if you have Adobe Flash Player installed and haven’t yet hobbled this insecure program so that it runs only when you want it to, you are playing with fire. It’s bad enough that hackers are constantly finding and exploiting zero-day flaws in Flash Player before Adobe even knows about the bugs.

First off, if you have Adobe Flash Player installed and haven’t yet hobbled this insecure program so that it runs only when you want it to, you are playing with fire. It’s bad enough that hackers are constantly finding and exploiting zero-day flaws in Flash Player before Adobe even knows about the bugs.

![Exposed[dot]su was built with the help of identity information obtained and/or stolen from ssndob[dot]ru.](https://krebsonsecurity.com/wp-content/uploads/2014/03/exposed-su-600x462.png)