How much would a cybercriminal, nation state or organized crime group pay for blueprints on how to exploit a serious, currently undocumented, unpatched vulnerability in all versions of Microsoft Windows? That price probably depends on the power of the exploit and what the market will bear at the time, but here’s a look at one convincing recent exploit sales thread from the cybercrime underworld where the current asking price for a Windows-wide bug that allegedly defeats all of Microsoft’s current security defenses is USD $90,000.

So-called “zero-day” vulnerabilities are flaws in software and hardware that even the makers of the product in question do not know about. Zero-days can be used by attackers to remotely and completely compromise a target — such as with a zero-day vulnerability in a browser plugin component like Adobe Flash or Oracle’s Java. These flaws are coveted, prized, and in some cases stockpiled by cybercriminals and nation states alike because they enable very stealthy and targeted attacks.

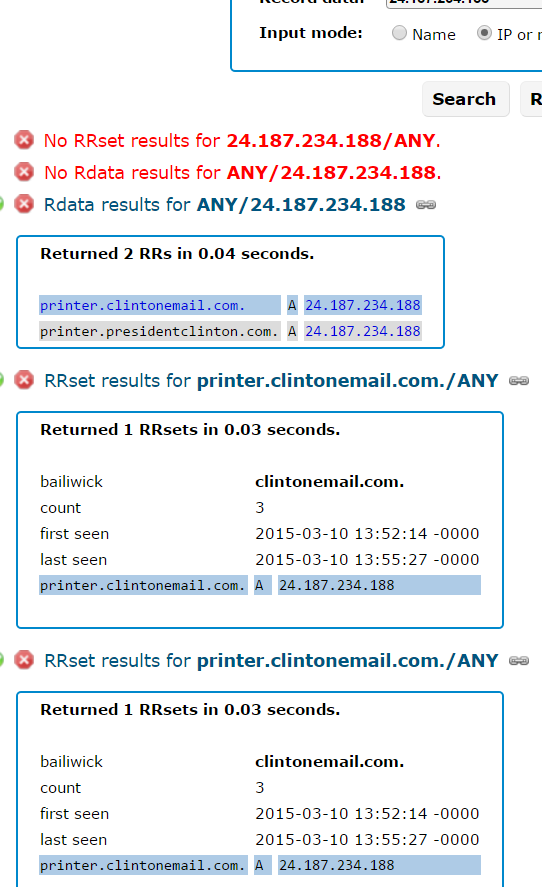

The $90,000 Windows bug that went on sale at the semi-exclusive Russian language cybercrime forum exploit[dot]in earlier this month is in a slightly less serious class of software vulnerability called a “local privilege escalation” (LPE) bug. This type of flaw is always going to be used in tandem with another vulnerability to successfully deliver and run the attacker’s malicious code.

LPE bugs can help amplify the impact of other exploits. One core tenet of security is limiting the rights or privileges of certain programs so that they run with the rights of a normal user — and not under the all-powerful administrator or “system” user accounts that can delete, modify or read any file on the computer. That way, if a security hole is found in one of these programs, that hole can’t be exploited to worm into files and folders that belong only to the administrator of the system.

This is where a privilege escalation bug can come in handy. An attacker may already have a reliable exploit that works remotely — but the trouble is his exploit only succeeds if the current user is running Windows as an administrator. No problem: Chain that remote exploit with a local privilege escalation bug that can bump up the target’s account privileges to that of an admin, and your remote exploit can work its magic without hindrance.

The seller of this supposed zero-day — someone using the nickname “BuggiCorp” — claims his exploit works on every version of Windows from Windows 2000 on up to Microsoft’s flagship Windows 10 operating system. To support his claims, the seller includes two videos of the exploit in action on what appears to be a system that was patched all the way up through this month’s (May 2016) batch of patches from Microsoft (it’s probably no accident that the video was created on May 10, the same day as Patch Tuesday this month).

A second video (above) appears to show the exploit working even though the test machine in the video is running Microsoft’s Enhanced Mitigation Experience Toolkit (EMET), a free software framework designed to help block or blunt exploits against known and unknown Windows vulnerabilities and flaws in third-party applications that run on top of Windows.

Jeff Jones, a cybersecurity strategist with Microsoft, said the company was aware of the exploit sales thread, but stressed that the claims were still unverified. Asked whether Microsoft would ever consider paying for information about the zero-day vulnerability, Jones pointed to the company’s bug bounty program that rewards security researchers for reporting vulnerabilities. According to Microsoft, the program to date has paid out more than $500,000 in bounties.

Microsoft heavily restricts the types of vulnerabilities that qualify for bounty rewards, but a bug like the one on sale for $90,000 would in fact qualify for a substantial bounty reward. Last summer, Microsoft raised its reward for information about a vulnerability that can fully bypass EMET from $50,000 to $100,000. Incidentally, Microsoft said any researcher with a vulnerability or who has questions can reach out to the Microsoft Security Response Center to learn more about the program and process.

ANALYSIS

It’s interesting that this exploit’s seller could potentially make more money by peddling his find to Microsoft than to the cybercriminal community. Of course, the videos and the whole thing could be a sham, but that’s probably unlikely in this case. For one thing, a scammer seeking to scam other thieves would not insist on using the cybercrime forum’s escrow service to consummate the transaction, as this vendor has. Continue reading

![The sales thread on exploit[dot]in.](https://krebsonsecurity.com/wp-content/uploads/2016/05/buggicorp-580x255.png)

Over the past weekend, KrebsOnSecurity began hearing from sources at multiple financial institutions who said they’d detected a pattern of fraudulent charges on customer cards that were used at various Noodles & Company locations between January 2016 and the present.

Over the past weekend, KrebsOnSecurity began hearing from sources at multiple financial institutions who said they’d detected a pattern of fraudulent charges on customer cards that were used at various Noodles & Company locations between January 2016 and the present. The 2012 breach was first exposed when a hacker posted a list of some 6.5 million unique passwords to a popular forum where members volunteer or can be hired to hack complex passwords. Forum members managed to crack some the passwords, and eventually noticed that an inordinate number of the passwords they were able to crack contained some variation of “linkedin” in them.

The 2012 breach was first exposed when a hacker posted a list of some 6.5 million unique passwords to a popular forum where members volunteer or can be hired to hack complex passwords. Forum members managed to crack some the passwords, and eventually noticed that an inordinate number of the passwords they were able to crack contained some variation of “linkedin” in them. Redmond made the announcement almost as a footnote in its Windows 10 Experience blog, but the feature caused quite a stir when the company’s flagship operating system first debuted last summer.

Redmond made the announcement almost as a footnote in its Windows 10 Experience blog, but the feature caused quite a stir when the company’s flagship operating system first debuted last summer.

“Based on the preliminary findings of the investigation and other information, the Company believes that malware, installed through the use of compromised third-party vendor credentials, affected one particular point of sale system at fewer than 300 of approximately 5,500 franchised North America Wendy’s restaurants, starting in the fall of 2015,” Wendy’s disclosed in their first quarter financial statement today. The statement continues:

“Based on the preliminary findings of the investigation and other information, the Company believes that malware, installed through the use of compromised third-party vendor credentials, affected one particular point of sale system at fewer than 300 of approximately 5,500 franchised North America Wendy’s restaurants, starting in the fall of 2015,” Wendy’s disclosed in their first quarter financial statement today. The statement continues: erabilities (flaws that attackers figure out how to exploit before before the software maker does) in Internet Explorer (IE) and in Windows. Half of the 16 patches that Redmond issued today earned its “critical” rating, meaning the vulnerabilities could be exploited remotely through no help from the user, save for perhaps clicking a link, opening a file or visiting a hacked or malicious Web site.

erabilities (flaws that attackers figure out how to exploit before before the software maker does) in Internet Explorer (IE) and in Windows. Half of the 16 patches that Redmond issued today earned its “critical” rating, meaning the vulnerabilities could be exploited remotely through no help from the user, save for perhaps clicking a link, opening a file or visiting a hacked or malicious Web site.