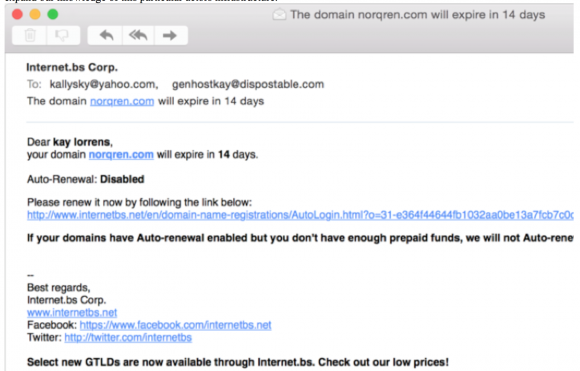

If you’ve been paying attention in recent years, you might have noticed that just about everyone is losing your personal data. Even if you haven’t noticed (or maybe you just haven’t actually received a breach notice), I’m here to tell you that if you’re an American, your basic personal data is already for sale. What follows is a primer on what you can do to avoid becoming a victim of identity theft as a result of all this data (s)pillage.

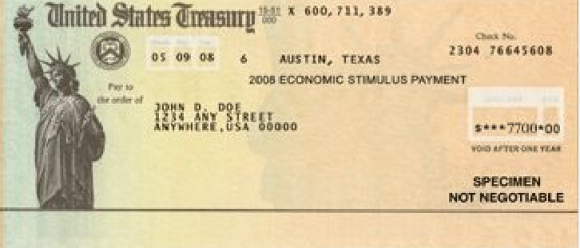

A seemingly never-ending stream of breaches at banks, healthcare providers, insurance companies and data brokers has created a robust market for thieves who sell identity data. Even without the help of mega breaches like the 80 million identities leaked in the Anthem compromise or last week’s news about 4 million records from the U.S. Office of Personnel Management gone missing, crooks already have access to the information needed to open new lines of credit or file phony tax refund requests in your name.

If your response to this breachapalooza is to do what each of the breached organizations suggest — to take them up on one or two years’ worth of free credit monitoring services — you might sleep better at night but you will probably not be any more protected against crooks stealing your identity. As I discussed at length in this primer, credit monitoring services aren’t really built to prevent ID theft. The most you can hope for from a credit monitoring service is that they give you a heads up when ID theft does happen, and then help you through the often labyrinthine process of getting the credit bureaus and/or creditors to remove the fraudulent activity and to fix your credit score.

In short, if you have already been victimized by identity theft (fraud involving existing credit or debit cards is not identity theft), it might be worth paying for these credit monitoring and repair services (although more than likely, you are already eligible for free coverage thanks to a recent breach at any one of dozens of companies that have lost your information over the past year). Otherwise, I’d strongly advise you to consider freezing your credit file at the major credit bureaus.

There is shockingly little public knowledge or education about the benefits of a security freeze, also known as a “credit freeze.” I routinely do public speaking engagements in front of bankers and other experts in the financial industry, and I’m amazed at how often I hear from people in this community who are puzzled to learn that there is even such a thing as a security freeze (to be fair, most of these people are in the business of opening new lines of credit, not blocking such activity).

Also, there is a great deal of misinformation and/or bad information about security freezes available online. As such, I thought it best to approach this subject in the form of a Q&A, which is the most direct method I know how to impart knowledge about a subject in way that is easy for readers to digest.

Q: What is a security freeze?

A: A security freeze essentially blocks any potential creditors from being able to view or “pull” your credit file, unless you affirmatively unfreeze or thaw your file beforehand. With a freeze in place on your credit file, ID thieves can apply for credit in your name all they want, but they will not succeed in getting new lines of credit in your name because few if any creditors will extend that credit without first being able to gauge how risky it is to loan to you (i.e., view your credit file). And because each credit inquiry caused by a creditor has the potential to lower your credit score, the freeze also helps protect your score, which is what most lenders use to decide whether to grant you credit when you truly do want it and apply for it.

Q: What’s involved in freezing my credit file?

A: Freezing your credit involves notifying each of the major credit bureaus that you wish to place a freeze on your credit file. This can usually be done online, but in a few cases you may need to contact one or more credit bureaus by phone or in writing. Once you complete the application process, each bureau will provide a unique personal identification number (PIN) that you can use to unfreeze or “thaw” your credit file in the event that you need to apply for new lines of credit sometime in the future. Depending on your state of residence and your circumstances, you may also have to pay a small fee to place a freeze at each bureau. There are four consumer credit bureaus, including Equifax, Experian, Innovis and Trans Union.

Q: How much is the fee, and how can I know whether I have to pay it?

A: The fee ranges from $0 to $15 per bureau, meaning that it can cost upwards of $60 to place a freeze at all four credit bureaus (recommended). However, in most states, consumers can freeze their credit file for free at each of the major credit bureaus if they also supply a copy of a police report and in some cases an affidavit stating that the filer believes he/she is or is likely to be the victim of identity theft. In many states, that police report can be filed and obtained online. The fee covers a freeze as long as the consumer keeps it in place. Equifax has a decent breakdown of the state laws and freeze fees/requirements. Continue reading