The U.S. Senate is preparing to vote on cybersecurity legislation that proponents say is sorely needed to better help companies and the government share information about the latest Internet threats. Critics of the bill and its many proposed amendments charge that it will do little, if anything, to address the very real problem of flawed cybersecurity while creating conditions that are ripe for privacy abuses. What follows is a breakdown of the arguments on both sides, and a personal analysis that seeks to add some important context to the debate.

Up for consideration by the full Senate this week is the Cybersecurity Information Sharing Act (CISA), a bill designed to shield companies from private lawsuits and antitrust laws if they seek help or cooperate with one another to fight cybercrime. The Wall Street Journal and The Washington Post each recently published editorials in support of the bill.

Update, 6:57 p.m. ET: The Senate this afternoon passed CISA by a vote of 74-21.

Original story:

“The idea behind the legislation is simple: Let private businesses share information with each other, and with the government, to better fight an escalating and constantly evolving cyber threat,” the WSJ said in an editorial published today (paywall). “This shared data might be the footprint of hackers that the government has seen but private companies haven’t. Or it might include more advanced technology that private companies have developed as a defense.”

“Since hackers can strike fast, real-time cooperation is essential,” the WSJ continued. “A crucial provision would shield companies from private lawsuits and antitrust laws if they seek help or cooperate with one another. Democrats had long resisted this legal safe harbor at the behest of plaintiffs lawyers who view corporate victims of cyber attack as another source of plunder.”

The Post’s editorial dismisses “alarmist claims [that] have been made by privacy advocates who describe it as a ‘surveillance’ bill”:

“The notion that there is a binary choice between privacy and security is false. We need both privacy protection and cybersecurity, and the Senate legislation is one step toward breaking the logjam on security,” the Post concluded. “Sponsors have added privacy protections that would scrub out personal information before it is shared. They have made the legislation voluntary, so if companies are really concerned, they can stay away. A broad coalition of business groups, including the U.S. Chamber of Commerce, has backed the legislation, saying that cybertheft and disruption are “advancing in scope and complexity.”

But critics of CISA say the devil is in the details, or rather in the raft of amendments that may be added to the bill before it’s passed. The Center for Democracy & Technology (CDT), a nonprofit technology policy group based in Washington, D.C., has published a comprehensive breakdown of the proposed amendments and their potential impacts.

CDT says despite some changes made to assuage privacy concerns, neither CISA as written nor any of its many proposed amendments address the fundamental weaknesses of the legislation. According to CDT, “the bill requires that any Internet user information volunteered by a company to the Department of Homeland Security for cybersecurity purposes be shared immediately with the National Security Agency (NSA), other elements of the Intelligence Community, with the FBI/DOJ, and many other Federal agencies – a requirement that will discourage company participation in the voluntary information sharing scheme envisioned in the bill.”

CDT warns that CISA risks turning the cybersecurity program it creates into a backdoor wiretap by authorizing sharing and use of CTIs (cyber threat indicators) for a broad array of law enforcement purposes that have nothing to do with cybersecurity. Moreover, CDT says, CISA will likely introduce unintended consequences:

“It trumps all law in authorizing companies to share user Internet communications and data that qualify as ‘cyber threat indicators,’ [and] does nothing to address conduct of the NSA that actually undermines cybersecurity, including the stockpiling of zero day vulnerabilities.”

ANALYSIS

On the surface, efforts to increase information sharing about the latest cyber threats seem like a no-brainer. We read constantly about breaches at major corporations in which the attackers were found to have been inside of the victim’s network for months or years on end before the organization discovered that it was breached (or, more likely, they were notified by law enforcement officials or third-party security firms).

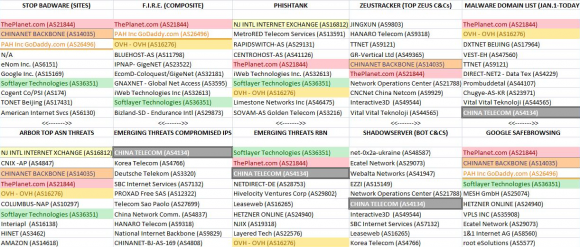

If only there were an easier way, we are told, for companies to share so-called “indicators of compromise” — Internet addresses or malicious software samples known to be favored by specific cybercriminal groups, for example — such breaches and the resulting leakage of consumer data and corporate secrets could be detected and stanched far more quickly.

In practice, however, there are already plenty of efforts — some public, some subscription-based — to collect and disseminate this threat data. From where I sit, the biggest impediment to detecting and responding to breaches in a more timely manner comes from a fundamental lack of appreciation — from an organization’s leadership on down — for how much is riding on all the technology that drives virtually every aspect of the modern business enterprise today. While many business leaders fail to appreciate the value and criticality of all their IT assets, I guarantee you today’s cybercrooks know all too well how much these assets are worth. And this yawning gap in awareness and understanding is evident by the sheer number of breaches announced each week. Continue reading →

One-quarter of the patches from Microsoft address flaws that the company labels “critical,” meaning they can be exploited by malware or malcontents to break into vulnerable systems with no help from users. Four of the bulletins address vulnerabilities that were publicly disclosed prior to Patch Tuesday, meaning malicious hackers had a head start in figuring out how to exploit those weaknesses.

One-quarter of the patches from Microsoft address flaws that the company labels “critical,” meaning they can be exploited by malware or malcontents to break into vulnerable systems with no help from users. Four of the bulletins address vulnerabilities that were publicly disclosed prior to Patch Tuesday, meaning malicious hackers had a head start in figuring out how to exploit those weaknesses.