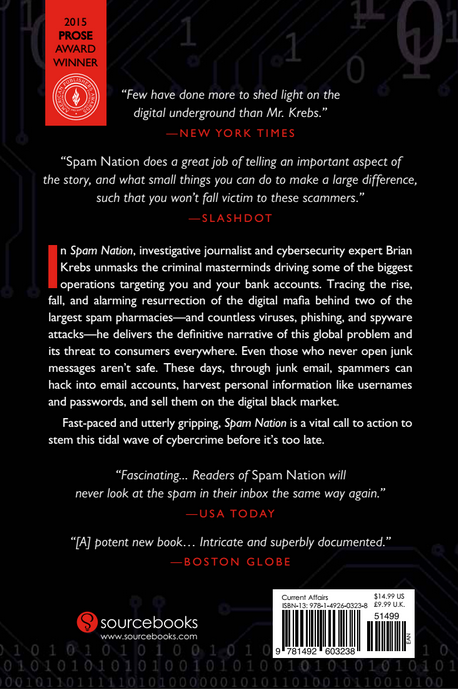

Some of you may have noticed that a new element recently debuted in the sidebar: The cover art for my upcoming book, Spam Nation, due to hit bookshelves (physical and virtual) November 18, 2014. Please allow me a few moments to explain what this book is about, and why you should pre-order it today.

Spam Nation delves deeper than perhaps any other publication into the workings of the cybercrime underground, giving readers unprecedented access to a well-hidden world that few outside of these communities have seen up close.

Update, Dec. 9, 2014: Spam Nation has just landed on the New York Times bestseller list!

Original post:

The backdrop of the story is a long-running turf war between two of the largest sponsors of spam. A true-crime tale of political corruption and ill-fated alliances, tragedy, murder and betrayal, this book explains how the conditions that gave rise to this pernicious industry still remain and are grooming a new class of cybercriminals.

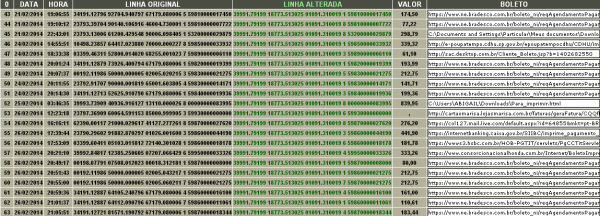

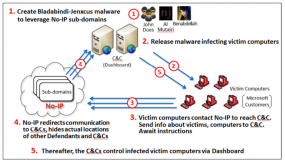

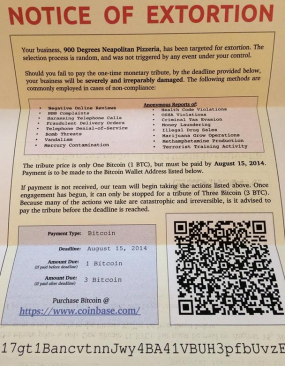

But Spam Nation isn’t just about junk email; most of the entrepreneurs building and managing large-scale spam operations are involved in virtually every aspect of cybercrime for which there is a classification, including malware development, denial-of-service attacks, identity theft, credit card fraud, money laundering, commercial data breaches and extortion.

Spam Nation looks at the crucial role played by cybercrime forums, and how these communities simultaneously weave the social fabric of the underground while protecting scam artists from getting scammed.

The book also includes a detailed history of the Russian Business Network (RBN); how it became the virtual boogeyman of the Internet and prefigured an entire industry of “bulletproof” hosting providers.

Along the way, we meet numerous buyers who explain what motivated them to respond to spam and ingest pills ordered from shadowy online marketers. In the chapter “Meet the Spammers,” readers get a closer look at the junk emailers responsible for running the world’s largest botnets.

In addition, Spam Nation includes first-hand accounts of efforts by vigilante groups to dismantle spam and malware operations, and the vicious counterattacks that these campaigns provoked from the spam community.

Now, here’s the important bit: Anyone who pre-orders the book and emails their proof-of-purchase to this address before Nov. 18, 2014 will receive a signed copy. This extends even to those who opt for a digital copy of the book. That’s because the signature will come on a bookplate, which is simply a decorative label that is affixed to the inside front cover. Bookplates allow my publisher Sourcebooks to distribute signed copies of Spam Nation without having to constantly ship me very heavy truckloads of books to sign and then ship back again for reshipment.

The pre-order link for Amazon is here; readers who wish to purchase the book from Barnes & Noble can do so here. Fans of the Washington D.C. literary landmark Politics and Prose can pre-order the book from them at this link. Forward your emailed proof-of-purchase, or a scan/photo of your receipt. Basically anything that says you purchased the book, the quantity purchased, as well as your name and mailing address. Continue reading

![Bulba[dot]cc, as it looked in May 2011.](https://krebsonsecurity.com/wp-content/uploads/2014/07/bulba-dot-cc-e-600x389.png)