A 35-year-old Dutchman thought to be responsible for launching what’s been called “the largest publicly announced online attack in the history of the Internet” was arrested in Barcelona on Thursday by Spanish authorities. The man, identified by Dutch prosecutors only as “SK,” was being held after a European warrant was issued for his arrest in connection with a series of massive online attacks last month against Spamhaus, an anti-spam organization.

According to a press release issued by the Public Prosecutor Service in The Netherlands, the National Prosecutor in Barcelona ordered SK’s arrest and the seizure of computers and mobile phones from the accused’s residence there. The arrest is being billed as a collaboration of a unit called Eurojust, the European Union’s Judicial Cooperation Unit.

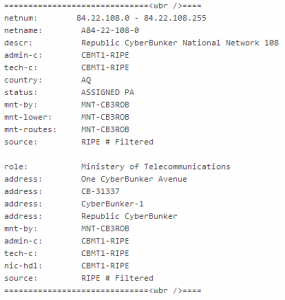

The dispute began late last year, when Spamhaus added to its blacklist several Internet address ranges in the Netherlands. Those addresses belong to a Dutch company called “Cyberbunker,” so named because the organization is housed in a five-story NATO bunker, and has advertised its services as a bulletproof hosting provider.

“A year ago, we started seeing pharma and botnet controllers at Cyberbunker’s address ranges, so we started to list them,” said a Spamhaus member who asked to remain anonymous. “”We got a rude reply back, and he made claims about being his own independent country in the Republic of Cyberbunker, and said he was not bound by any laws and whatnot. He also would sign his emails ‘Prince of Cyberbunker Republic.” On Facebook, he even claimed that he had diplomatic immunity.”

Spamhaus took its complaint to the upstream Internet providers that connected Cyberbunker to the larger Internet. According to Spamhaus, those providers one by one severed their connections with Cyberbunker’s Internet addresses. Just hours after the last ISP dropped Cyberbunker, Spamhaus found itself the target of an enormous amount of attack traffic designed to knock its operations offline.

It is not clear who SK is, but according to multiple sources, the man identified as SK is likely one Sven Olaf Kamphuis. The attack on Spamhaus was the subject of a New York Times article on Mar. 26, 2013, which quoted Mr. Kamphuis as a representative of Cyberbunker and saying, “We are aware that this is one of the largest DDoS attacks the world had publicly seen.” Kamphuis also reportedly told The Times that Cyberbunker was retaliating against Spamhaus for “abusing their influence.”

Also, a Facebook profile by that same name identifies its account holder as living in Barcelona and a native of Amsterdam, as well as affiliated with “Republic Cyberbunker.”

Mr. Kamphuis could not be immediately reached for comment.

![After migrating the data from Exposed.su to Exposed.re, the curator added [Swatted] notations.](https://krebsonsecurity.com/wp-content/uploads/2013/04/Fotor0417131216-600x450.jpg)