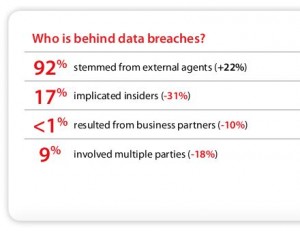

The number of financial and confidential records compromised as a result of data breaches in 2010 fell dramatically compared to previous years, a decrease that cybercrime investigators attribute to a sea-change in the motives and tactics used by criminals to steal information. At the same time, organizations of all sizes are dealing with more frequent and smaller breaches than ever before, and most data thefts continue to result from security weaknesses that are relatively unsophisticated and easy to prevent.

These are some of the conclusions drawn from Verizon‘s fourth annual Data Breach Investigations Report. The report measures data breaches based on compromised records, including the theft of Social Security numbers, intellectual property, and credit card numbers, among other things.

These are some of the conclusions drawn from Verizon‘s fourth annual Data Breach Investigations Report. The report measures data breaches based on compromised records, including the theft of Social Security numbers, intellectual property, and credit card numbers, among other things.

It’s important to note at the outset that Verizon’s report only measures loss in terms of records breached. Many businesses hit by cyber crooks last year lost hundreds of thousands of dollars apiece when thieves stole one set of records, such as their online banking credentials.

The data-rich 74-page study is based on information gleaned from Verizon and U.S. Secret Service investigations into about 800 new data compromise incidents since last year’s report (the study also includes an appendix detailing 30 cybercrime cases investigated by the Dutch National High Tech Crime Unit).

Although the report examines the data from more breaches in a single year than ever before (the total Verizon/US Secret Service dataset from all previous years included just over 900 breaches), Verizon found that the total number of breached records fell from 361 million in 2008 to 144 million in 2009 to just 4 million last year.

A good portion of the report is dedicated to positing what might be responsible for this startling decline, but its authors seem unwilling to let the security industry take any credit for it.

“An optimist may interpret these results as a sign that the security industry is WINNING! Sorry, Charlie”, the report says. “While we’d really like that to be the case, one year just isn’t enough time for such a wholesale improvement in security practices necessary to cut data loss so drastically.”

The study suggests a number of possible explanations. For example:

-There were relatively few huge data heists. Those which had been responsible for the majority of the breached records in the past few years were breaches involving tens of millions of stolen credit and debit cards. Those high profile attacks may have achieved fame and fortune for the attackers, but they also attracted a lot of unwanted attention. Many of the past megabreaches ended in the capture and arrest of those responsible, such the case of Albert Gonzales, the former Secret Service informant who was sentenced last year to 20 years in prison for his role in the theft of 130 million credit and debit card numbers from card processing giant Heartland Payment Systems. “Those that wish to stay out of jail may have changed their goals and tactics to stay under the radar,” the report notes. “This could be one of the chief reasons behind the rash of ‘mini breaches’ involving smaller organizations.”

-Megabreaches of years past flooded criminal underground markets with so many stolen card numbers that their value plummeted. Criminals’ attention may have turned to stealing other lower profile data types, such as bank account credentials, personal information and intellectual property. In other words, criminals might opt to let the markets clear before stealing more huge quantities or selling what they already had purloined. “It’s worth noting that a lot of the cards that were stolen over the last few years in these megabreaches probably are going to start expiring soon,” said Bryan Sartin, director of investigative response at Verizon Business. “So we could be in a holding pattern right now.”

-Megabreaches of years past flooded criminal underground markets with so many stolen card numbers that their value plummeted. Criminals’ attention may have turned to stealing other lower profile data types, such as bank account credentials, personal information and intellectual property. In other words, criminals might opt to let the markets clear before stealing more huge quantities or selling what they already had purloined. “It’s worth noting that a lot of the cards that were stolen over the last few years in these megabreaches probably are going to start expiring soon,” said Bryan Sartin, director of investigative response at Verizon Business. “So we could be in a holding pattern right now.”