There is a terrifying and highly effective “method” that criminal hackers are now using to harvest sensitive customer data from Internet service providers, phone companies and social media firms. It involves compromising email accounts and websites tied to police departments and government agencies, and then sending unauthorized demands for subscriber data while claiming the information being requested can’t wait for a court order because it relates to an urgent matter of life and death.

In the United States, when federal, state or local law enforcement agencies wish to obtain information about who owns an account at a social media firm, or what Internet addresses a specific cell phone account has used in the past, they must submit an official court-ordered warrant or subpoena.

Virtually all major technology companies serving large numbers of users online have departments that routinely review and process such requests, which are typically granted as long as the proper documents are provided and the request appears to come from an email address connected to an actual police department domain name.

But in certain circumstances — such as a case involving imminent harm or death — an investigating authority may make what’s known as an Emergency Data Request (EDR), which largely bypasses any official review and does not require the requestor to supply any court-approved documents.

It is now clear that some hackers have figured out there is no quick and easy way for a company that receives one of these EDRs to know whether it is legitimate. Using their illicit access to police email systems, the hackers will send a fake EDR along with an attestation that innocent people will likely suffer greatly or die unless the requested data is provided immediately.

In this scenario, the receiving company finds itself caught between two unsavory outcomes: Failing to immediately comply with an EDR — and potentially having someone’s blood on their hands — or possibly leaking a customer record to the wrong person.

“We have a legal process to compel production of documents, and we have a streamlined legal process for police to get information from ISPs and other providers,” said Mark Rasch, a former prosecutor with the U.S. Department of Justice.

“And then we have this emergency process, almost like you see on [the television series] Law & Order, where they say they need certain information immediately,” Rasch continued. “Providers have a streamlined process where they publish the fax or contact information for police to get emergency access to data. But there’s no real mechanism defined by most Internet service providers or tech companies to test the validity of a search warrant or subpoena. And so as long as it looks right, they’ll comply.”

To make matters more complicated, there are tens of thousands of police jurisdictions around the world — including roughly 18,000 in the United States alone — and all it takes for hackers to succeed is illicit access to a single police email account.

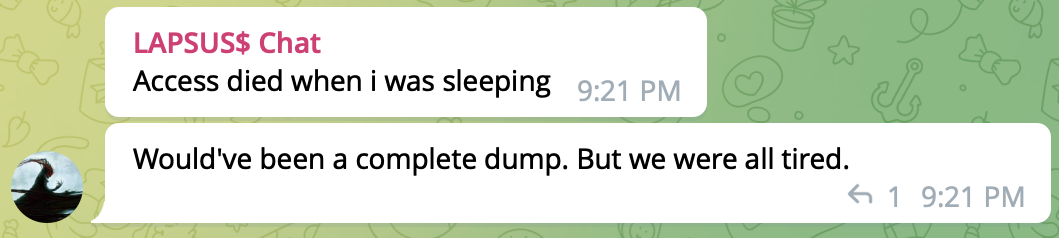

THE LAPSUS$ CONNECTION

The reality that teenagers are now impersonating law enforcement agencies to subpoena privileged data on their targets at whim is evident in the dramatic backstory behind LAPSUS$, the data extortion group that recently hacked into some of the world’s most valuable technology companies, including Microsoft, Okta, NVIDIA and Vodafone.

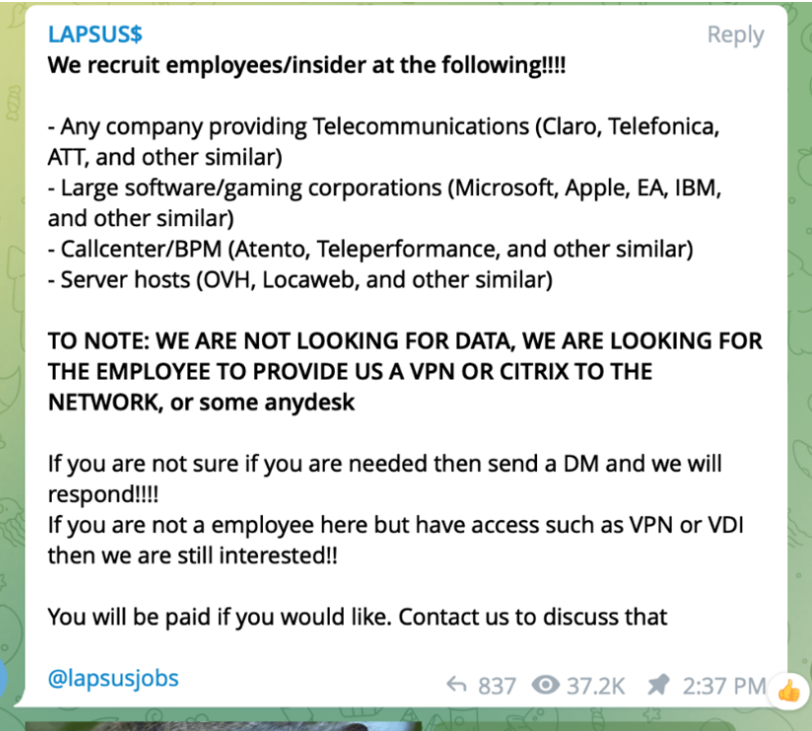

In a blog post about their recent hack, Microsoft said LAPSUS$ succeeded against its targets through a combination of low-tech attacks, mostly involving old-fashioned social engineering — such as bribing employees at or contractors for the target organization.

“Other tactics include phone-based social engineering; SIM-swapping to facilitate account takeover; accessing personal email accounts of employees at target organizations; paying employees, suppliers, or business partners of target organizations for access to credentials and multi-factor authentication (MFA) approval; and intruding in the ongoing crisis-communication calls of their targets,” Microsoft wrote of LAPSUS$.

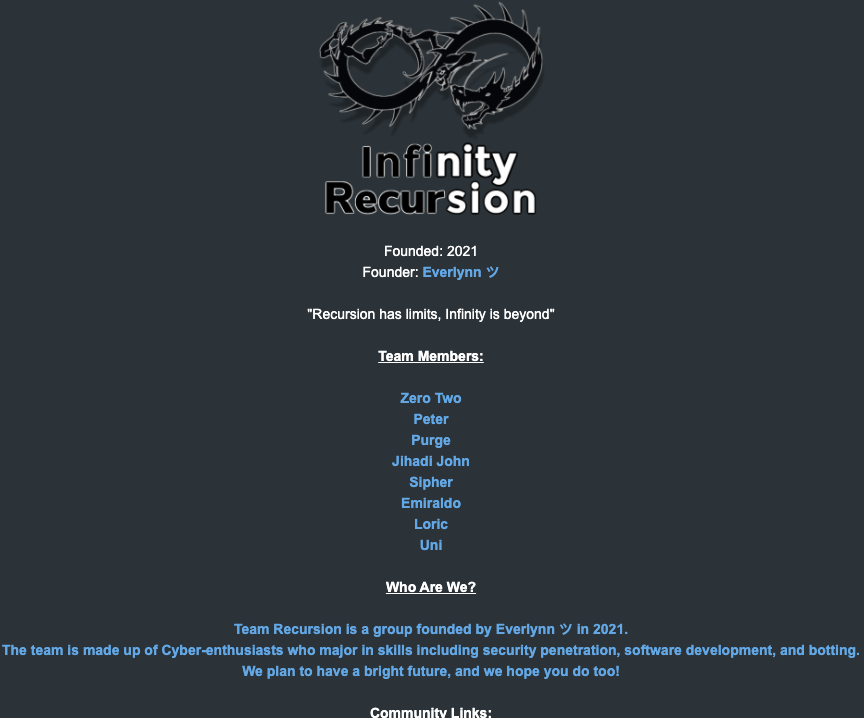

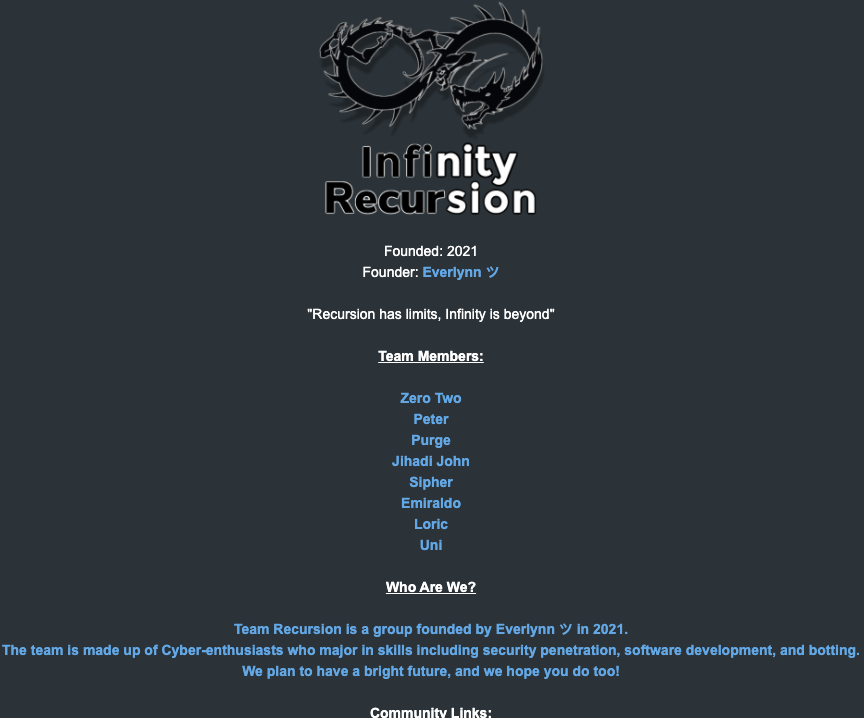

The roster of the now-defunct “Infinity Recursion” hacking team, from which some members of LAPSUS$ allegedly hail.

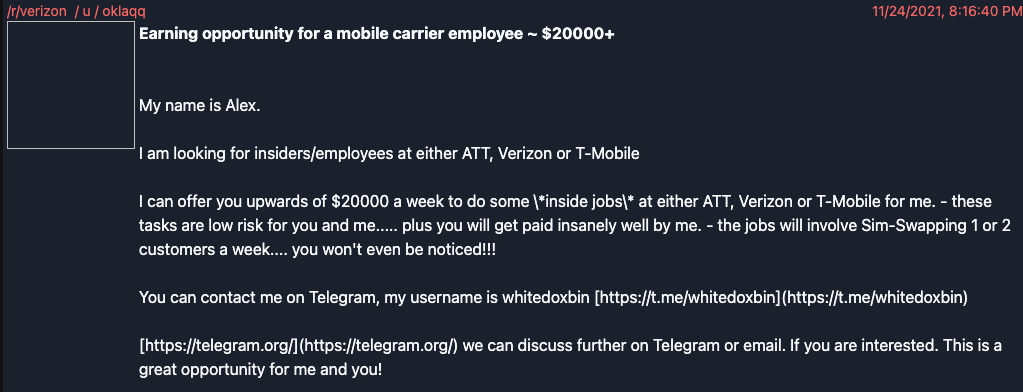

Researchers from security firms Unit 221B and Palo Alto Networks say that prior to launching LAPSUS$, the group’s leader “White” (a.k.a. “WhiteDoxbin,” “Oklaqq”) was a founding member of a cybercriminal group calling itself the “Recursion Team.” This group specialized in SIM swapping targets of interest and participating in “swatting” attacks, wherein fake bomb threats, hostage situations and other violent scenarios are phoned in to police as part of a scheme to trick them into visiting potentially deadly force on a target’s address.

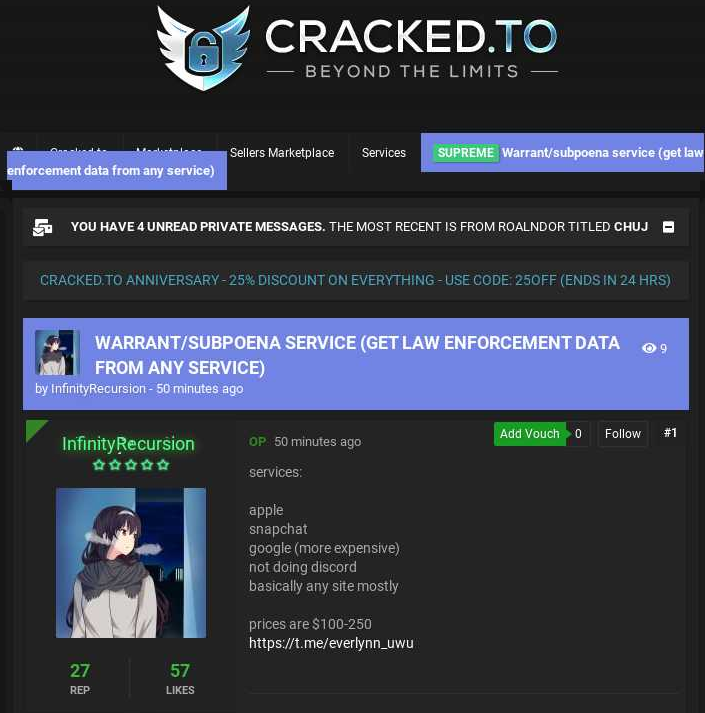

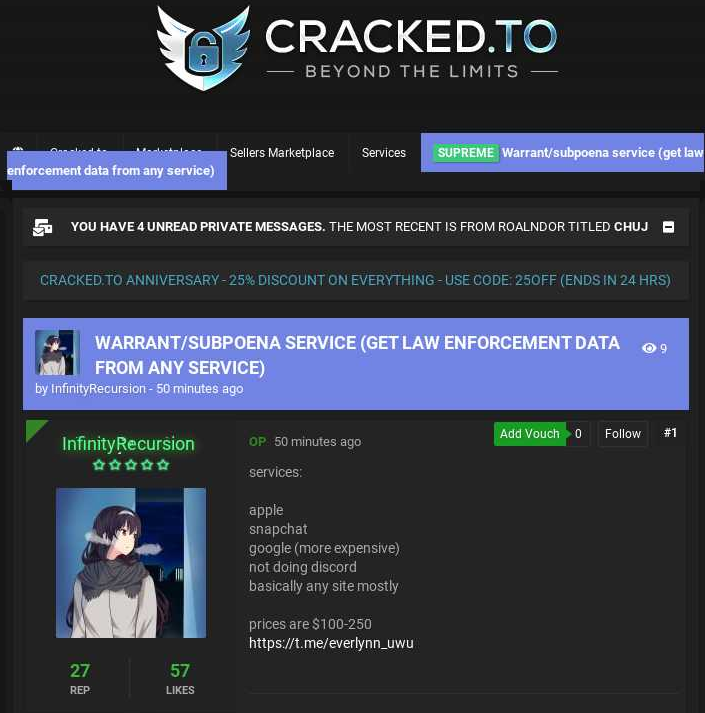

The founder of the Recursion Team was a then 14-year-old from the United Kingdom who used the handle “Everlynn.” On April 5, 2021, Everlynn posted a new sales thread to the cybercrime forum cracked[.]to titled, “Warrant/subpoena service (get law enforcement data from any service).” The price: $100 to $250 per request.

Everlynn advertising a warrant/subpoena service based on fake EDRs. Image: Ke-la.com.

“Services [include] Apple, Snapchat, Google (more expensive), not doing Discord, basically any site mostly,” read Everlynn’s ad, which was posted by the user account “InfinityRecursion.”

A month prior on Cracked, Everlynn posted a sales thread, “1x Government Email Account || BECOME A FED!,” which advertised the ability to send email from a federal agency within the government of Argentina.

“I would like to sell a government email that can be used for subpoena for many companies such as Apple, Uber, Instagram, etc.,” Everlynn’s sales thread explained, setting the price at $150. “You can breach users and get private images from people on SnapChat like nudes, go hack your girlfriend or something haha. You won’t get the login for the account, but you’ll basically obtain everything in the account if you play your cards right. I am not legally responsible if you mishandle this. This is very illegal and you will get raided if you don’t use a vpn. You can also breach into the government systems for this, and find LOTS of more private data and sell it for way, way more.”

Last week, the BBC reported that authorities in the United Kingdom had detained seven individuals aged 16 to 21 in connection with LAPSUS$. Continue reading →