Indictment, arrest of virtual currency founder targets alleged “financial hub of the cybercrime world.”

U.S. federal law enforcement agencies on Tuesday announced the closure and seizure of Liberty Reserve, an online, virtual currency that the U.S. government alleges acted as “a financial hub of the cyber-crime world” and processed more more than $6 billion in criminal proceeds over the past seven years.

The news comes four days after libertyreserve.com inexplicably went offline and newspapers in Costa Rica began reporting the arrest in Spain of the company’s founder Arthur Budovsky, 39-year-old Ukrainian native who moved to Costa Rica to start the business.

According to an indictment (PDF) filed in the U.S. District Court for the Southern District of New York, Budovsky and five alleged co-conspirators designed and operated Liberty Reserve as “a financial hub of the cyber-crime world, facilitating a broad range of online criminal activity, including credit card fraud, identity theft, investment fraud, computer hacking, child pornography, and narcotics trafficking.”

The U.S. government alleges that Liberty Reserve processed more than 12 million financial transactions annually, with a combined value of more than $1.4 billion. “Overall, from 2006 to May 2013, Liberty Reserve processed an estimated 55 million separate financial transactions and is believed to have laundered more than $6 billion in criminal proceeds,” the government’s indictment reads. Liberty Reserve “deliberately attracted and maintained a customer base of criminals by making financial activity on Liberty Reserve anonymous and untraceable.”

Despite the government’s claims, certainly not everyone using Liberty Reserve was involved in shady or criminal activity. As noted by the BBC, many users — principally those outside the United States — simply viewed the currency as cheaper, more secure and private alternative to PayPal. The company charged a one percent fee for each transaction, plus a 75 cent “privacy fee” according to court documents.

“It had allowed users to open accounts and transfer money, only requiring them to provide a name, date of birth and an email address,” BBC wrote. “Cash could be put into the service using a credit card, bank wire, postal money order or other money transfer service. It was then “converted” into one of the firm’s own currencies – mirroring either the Euro or US dollar – at which point it could be transferred to another account holder who could then extract the funds.”

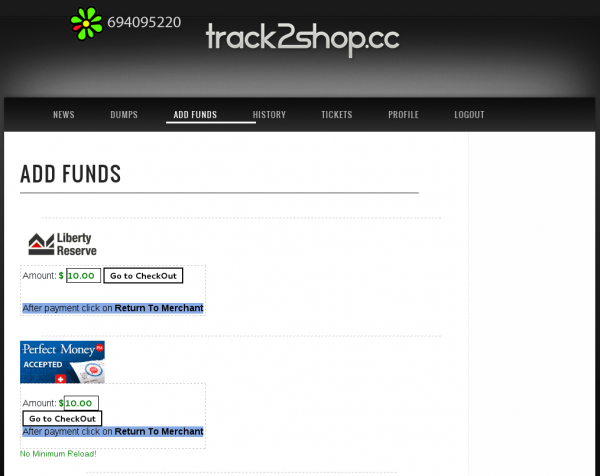

But according to the Justice Department, one of the ways that Liberty Reserve enabled the use of its services for criminal activity was by offering a shopping cart interface that merchant Web sites could use to accept Liberty Reserve as a form of payment (I’ve written numerous stories about many such services).

“The ‘merchants’ who accepted LR currency were overwhelmingly criminal in nature,” the government’s indictment alleges. “They included, for example, traffickers of stolen credit card data and personal identity information; peddlers of various types of online Ponzi and get-rich-quick schemes; computer hackers for hire; unregulated gambling enterprises; and underground drug-dealing websites.”

It remains unclear how much money is still tied up in Liberty Reserve, and whether existing customers will be afforded access to their funds. At a press conference today on the indictments, representatives from the Justice Department said the Liberty Reserve accounts are frozen. In a press release, the agency didn’t exactly address this question, saying: “If you believe you were a victim of a crime and were defrauded of funds through the use of Liberty Reserve, and you wish to provide information to law enforcement and/or receive notice of future developments in the case or additional information, please contact (888) 238- 0696 or (212) 637-1583.”

It seems clear, however, that the action against Liberty Reserve is part of a larger effort by the U.S. government to put pressure on virtual currencies. In tandem with the unsealing of the indictments against Budovsky and others, Manhattan District Attorney Cyrus R. Vance, Jr., announced the formation of the “Financial Intelligence Unit” — a group that will work with the FBI, IRS and Secret Service to more closely scrutinize suspicious activity reports filed by U.S. financial institutions.

“Keeping our Office and its investigations firmly rooted in the 21st Century means mining unique troves of data previously unavailable to prosecutors and investigators to uncover wrongdoing,” Vance said in a prepared statement. “As financial information has made the leap from ledger books to online sources, this new unit will be tasked with making sure these sets of data are analyzed, which will enhance our prosecutions of everything from classic white-collar crimes to street crimes to cybercrime.”

Several of Liberty Reserve’s competitors have apparently seen the writing on the wall and moved to distance themselves from U.S. customers. On Saturday, digital currency Perfect Money posted a note to its site saying it would no longer accept new registrations from individuals or companies based in the United States. “We bring to your attention that due to changes in our policy we forbid new registrations from individuals or companies based in the United States of America. This includes US citizens residing overseas,” the company wrote. “If you fall under the above mentioned category or a US resident, please do not register an account with us. We apologize for any inconvenience caused.”

WebMoney, a digital currency founded in Moscow and probably the closest competitor to Liberty Reserve in terms of users and daily transfer volumes, started blocking new account signups from users in the United States at least two months ago, according to Damon McCoy, assistant professor at George Mason University’s computer science department.

McCoy said that on March 13th, 2013, WebMoney presented him with the following message when he attempted to create an account on the service: “The services and products described on wmtransfer.com and webmoney.ru and offered by WM Transfer Ltd. are not being offered within the United States and not being offered to U.S residents or citizens, as defined under applicable law. WM Transfer ltd. and its products and services offered on the site wmtransfer.com,webmoney.ru are NOT registered or regulated by any U.S. including FINRA, SEC, FSC, NFA, FinCEN, CFTC or ASIC.”

It’s also not clear how the government’s actions will impact Bitcoin, a peer-to-peer digital currency that is gaining worldwide currency and momentum. While Bitcoin’s distributed nature in theory lacks the geographic central point of failure that allowed the US government to take action against Liberty Reserve, currency holders rely on bitcoin exchanges to convert bitcoins into other currencies; those entities must register with the U.S. Treasury Department as money service businesses, and could become a focus point for banking regulators going forward.

As I noted in my story last week, the U.S. District Court awarded the Justice Department control over (PDF) not only libertyreserve.com, but at least four other currency exchanges that worked closely with it. In addition, a civil action was filed against 35 exchanger websites seeking the forfeiture of the exchangers’ domain names.

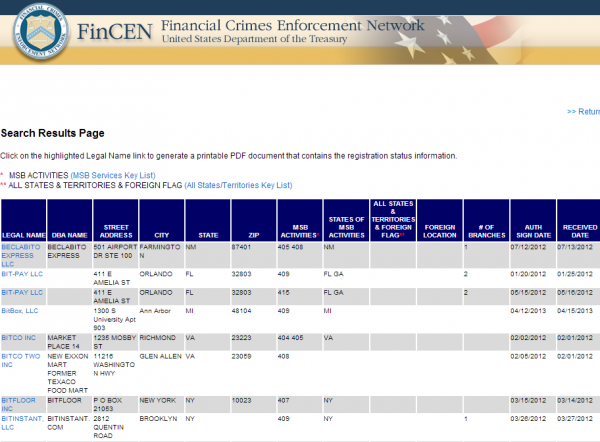

Some of the bitcoin exchanges currently registered with the U.S. Treasury as money service businesses.

One other big question looms large: How much data about Liberty Reserve’s customers was the U.S. government able to collect from this law enforcement action? According to The Tico Times, a Costa Rican daily newspaper, San José prosecutors conducted raids in Budovsky’s house and offices in Escazú, Santa Ana, southwest of San José, and in the province of Heredia, north of the capital.

But at least one cybercrime expert said it may be difficult for U.S. prosecutors and investigators to glean meaningful and actionable data from any servers or computers seized from Liberty Reserve.

“I would expect that there is a huge chance that most if not all of this data is heavily encrypted,” said Arkady Bukh, an attorney based in Brooklyn, N.Y. who has represented quite a few cybercrime defendants over the years. “Any case I’ve seen where we’re talking about more than $10 million, I always see very good investments in making sure that governments will not be able to penetrate the database without cooperation of the arrested parties.”

Five defendants, including Budovsky, were arrested on May 24. Vladimir Kats, the co-founder of Liberty Reserve, was arrested in Brooklyn, as were Liberty Reserve administrators Mark Marmilev and Maxim Chukharev. In a press conference today, Preet Bharara, the United States Attorney for the Southern District of New York, said the United States would be seeking the extradition from Spain of Budhovsky and Azzeddine El Amine, an account manager for the company.

Update, 2:58 p.m. ET: Added comments from Bukh, the phone numbers for Liberty Reserve account holders seeking more information, and the names of those arrested.

This does not make any sense to us the innocent users , this action has caused us into much lose. At least they should have compensate us. Because not all of the users are among of the above listed charges against the LR companies , we have lost enough funds due to the prohibition of Lr company, therefore we just hoping the Lr company could come up with logic and valuable evidence to defend their innocence users.

The above listed charges does not rely only on Lr it is going on everywhere in their highest banking companies in the countries , Governments should consider the innocent users who have been victims due to their immediate actions against LR company..

About the issue of liberty reserve, I will not argue that the medium was not use illegally, the truth is that there is no means of transaction in this world that criminals don’t use for their act. Am not a criminal and I have never use this mean to cheat any body. I have money in my liberty account which I cant afford to lose.

the fact remains that the usa govt is broke and she is looking for someone to fraud. 6b is not a little money if not they should have remembered that there are innocent lr users, and that people can die of heart attack from the shock of the news of the wicked act. So many placed their life servings in FOREX. YES it’s been used for illegal activities by wicked criminals but why not place a restriction on it, maybe ID protection or proof of residence or anything more? why not order the lr company to adjust their policy to maybe normal banking policy or more. Why close them down like that if not for personal reasons which i strongly believe that your eye is in the money inside the company. This is why so many countries dislike usa even if they pretend to be friends..

I don’t see how such an order could be enforced. LR had already been ordered to shut down, some years ago, but continued to operate illegally.

I myself have money in my LR account and I am just a hard working woman that is supporting a fiance overseas Iam far from a criminal wouldn’t have the slightest idea what or how to do it. I am angry though that there were n0 notifications issued in regards to the seizure etc. I feel for all the people who have funds in their LR accounts as well as the businesses that use it as well. And why not investigate other companies that are on the similar line there must be more out there somewhere.

I just hope us “little people” can get our money back as soon as possible. Too much stress for any person is not good..