My inbox has been flooded of late with pitches for new technologies aimed at making credit cards safer and more secure. Many of these solutions are exceedingly complex and overwrought — if well-intentioned — responses to a problem that we already know how to solve. Here’s a look at a few of the more elaborate approaches.

Some of these ideas may have benefited from additional research into where financial institutions actually experience most of their fraud losses. Hint: Lost-and-stolen fraud is minuscule compared to losses from other types of fraud, such as counterfeit cards and online fraud. Case in point: A new product called Safe Swipe. From their pitch:

“The basic premise of our solution, Safe Swipe…is a technology which ‘marries’ your smart mobile device, phone, tablet and or computer to your credit/debit card(s). We’ve developed a Geo-Locator software program which triangulates your location with the POS device and your mobile phone so that if your phone and credit card are not within a certain predetermined range of one another the purchase would be challenged. In addition, we incorporated an ON/OFF type switch where you can ‘Lock Down’ your credit/debit card from your mobile device making it useless should it ever be stolen.”

The truth is that you can “lock down” your credit card if it’s lost or stolen by calling your credit card company and reporting it as such. Along these lines, I received multiple pitches from the folks who dreamed up a product/service called “Siren Swipe.” Check it out:

“The SIREN SWIPE system immediately notifies local police (via the local 911 center) of a thief’s location (ie merchant address) once heswipes a card that has already been reported stolen,” the folks at this company said in an email pitch to KrebsOnSecurity. “SIREN SWIPE has the potential to drastically impact the credit card fraud landscape because although card credentials being stolen is a forgone conclusion, which cards thieves decide to actually use is not. For a thief browsing a site like Rescator, the knowledge that using certain banks’ cards could result in an immediate police response can make thieves avoid using these banks’ stolen cards over and over again. And in the best case scenario, a carder site admin could just decide not to sell subscribing banks’ cards in the interest of customer service.”

The sad truth is that, for the most part, cops generally have more important things to do than chase around the street urchins who end up using stolen credit and debit cards, and they’re not going to turn on the dome lights and siren over something like this. Also, the signals for fraud are all backwards here: The fraudsters know to use criminal card-checking services before buying and/or using stolen cards, so they don’t generally end up using a pile of cards that have already been cancelled.

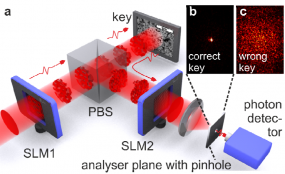

My favorite overwrought solution to making credit cards more secure comes from researchers in the Netherlands, who recently put out a paper announcing a card security idea they’re calling Quantum-Secure Authentication. According to its creators, this approach relies on “the unique quantum properties of light to create a secure question-and-answer exchange that cannot be spoofed or copied. From their literature:

“Traditional magnetic-stripe-only cards are relatively simple to use but simple to copy. Recently, banks have begun issuing so-called ‘smart cards’ that include a microprocessor chip to authenticate, identify & enhance security. But regardless of how complex the code or how many layers of security, the problem remains that an attacker who obtains the information stored inside the card can copy or emulate it. The new approach…avoids this risk entirely by using the peculiar quantum properties of photons that allow them to be in multiple locations at the same time to convey the authentication questions & answers. Though difficult to reconcile with our everyday experiences, this strange property of light can create a fraud-proof Q&A exchange, like those used to authorize credit card transactions.”

The main reason so many of these newfangled technologies are even being proposed is that the United States lags 20 years behind Europe and the rest of the world in adopting chip/smartcard technology in credit and debit cards. This is starting to change on both the card-issuing side (the banks) and the merchant side. Most of the biggest banks are already issuing chip cards, with smaller institutions following suit next year. In October 2015, merchants that haven’t yet installed card swipe terminals that accept chip cards will be liable for all of the fraud costs on any fraudulent transaction involving a chip card.

It’s unclear how much appetite there is for new technology to help banks fight card fraud, when so many financial institutions have yet to roll out chip cards. A payments fraud survey released this week by the Federal Reserve Bank of Minneapolis found that “high percentages of surveyed financial institutions report that fraud prevention costs exceed actual losses for many types of payments, especially wire, cash, and ACH payments. This trend is even more striking for non-financial respondents. In every payment category, a higher percentage of such firms responded that prevention costs exceed fraud losses.”

The Fed survey (PDF), which quizzed both banks and corporations, found that about half of the financial institutions that experienced payment fraud losses reported increases in those losses, while three quarters of the non-financial firms responded that loss rates had remained about the same over the prior year.

“In keeping with previous surveys, signature debit transactions are the payment type cited by the largest number of financial institutions as accounting for high levels of payments fraud losses (92% of financial service companies), while checks are cited by 75% of non-financial companies,” the Fed concluded. “While this finding could suggest that companies are overcompensating in prevention vis-à-vis likely losses, it is also possible that risk mitigation strategies and fraud prevention investments have indeed been effective.”

we living in world.

1.problem.2.reaction.3.solution.

first place all this banking system was very weak.

and fraudsters keep slandering fincial system in western countries.

until all system will be so tight that there is no way to make even small transactions without 3-4 security measures.

couse places like ukraina and russia are professional groups who work for this and they are supplied with high tech and and very complex stuff….the question is who gave the IDEA ? to start stealing this way? who told this??? who?? some one unknown? and were all this knowleddge come from? to make money this way?

Complexity is the enemy of security. If we were to implement the “solutions” those people propose, we would actually be worse off. Complexity more often than not leads to the establishment of new attack vectors or abets existing ones.

Surely making it illegal to store full credit card numbers and having a system wherr recurring payments are handled by the bank, not the merchant would save a whole lot of pain.

Interesting article – thanks – but the link to the “Fed survey” appears not to be functional now. However, the report does appear to be available from the Federal Reserve Bank of Minneapolis at http://www.minneapolisfed.org/~/media/files/about/what%20we%20do/2014paymentsfraudsurveysummaryofregionalresults.pdf?la=en