Earlier this month, employees at more than 1,000 companies saw one or two paycheck’s worth of funds deducted from their bank accounts after the CEO of their cloud payroll provider absconded with $35 million in payroll and tax deposits from customers. On Monday, the CEO was arrested and allegedly confessed that the diversion was the last desperate gasp of a financial shell game that earned him $70 million over several years.

Michael T. Mann, the 49-year-old CEO of Clifton Park, NY-based MyPayrollHR, was arrested this week and charged with bank fraud. In court filings, FBI investigators said Mann admitted under questioning that in early September — on the eve of a big payroll day — he diverted to his own bank account some $35 million in funds sent by his clients to cover their employee payroll deposits and tax withholdings.

After that stunt, two different banks that work with Mann’s various companies froze those corporate accounts to keep the funds from being moved or withdrawn. That action set off a chain of events that led another financial institution that helps MyPayrollHR process payments to briefly pull almost $26 million out of checking accounts belonging to employees at more than 1,000 companies that use MyPayrollHR.

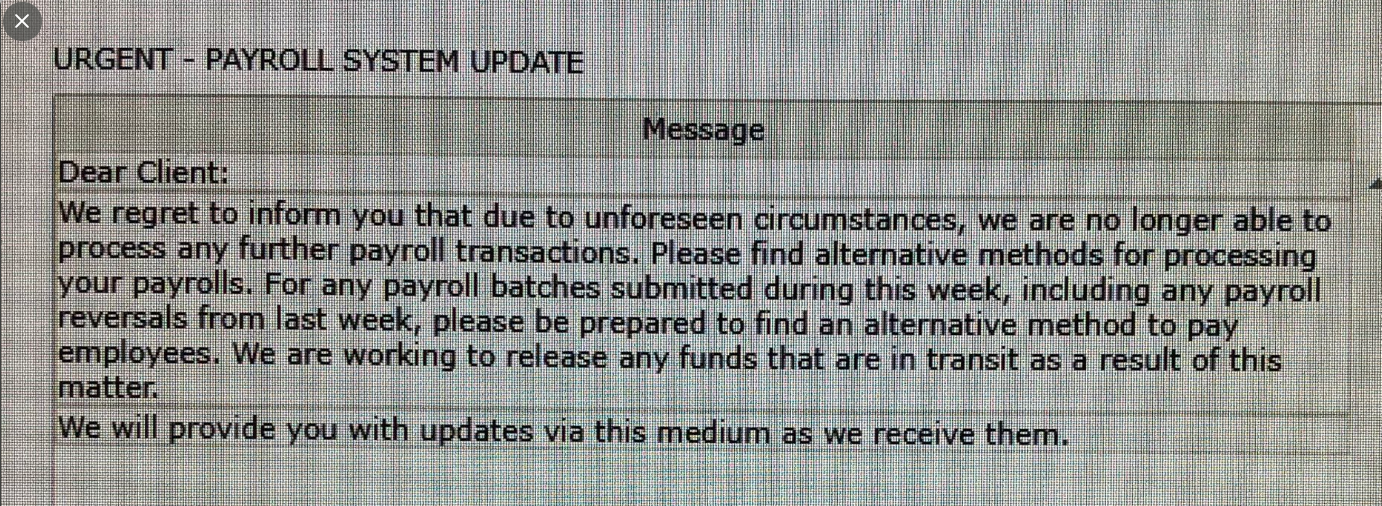

At the same time, MyPayrollHR sent a message (see screenshot above) to clients saying it was shutting down and that customers should find alternative methods for paying employees and for processing payroll going forward.

In the criminal complaint against Mann (PDF), a New York FBI agent said the CEO admitted that starting in 2010 or 2011 he began borrowing large sums of money from banks and financing companies under false pretenses.

“While stating that MyPayroll was legitimate, he admitted to creating other companies that had no purpose other than to be used in the fraud; fraudulently representing to banks and financing companies that his fake businesses had certain receivables that they did not have; and obtaining loans and lines of credit by borrowing against these non-existent receivables.”

“Mann estimated that he fraudulently obtained about $70 million that he has not paid back. He claimed that he committed the fraud in response to business and financial pressures, and that he used almost all of the fraudulently obtained funds to sustain certain businesses, and purchase and start new ones. He also admitted to kiting checks between Bank of America and Pioneer [Savings Bank], as part of the fraudulent scheme.”

Check-kiting is the illegal act of writing a check from a bank account without sufficient funds and depositing it into another bank account, explains MagnifyMoney.com. “Then, you withdraw the money from that second account before the original check has been cleared.”

Kiting also is known as taking advantage of the “float,” which is the amount of time between when an individual submits a check as payment and when the individual’s bank is instructed to move the funds from the account.

Magnify Money explains more:

“Say, for example, that you write yourself a check for $500 from checking account A, and deposit that check into checking account B — but the balance in checking account A is only $75. Then, you promptly withdraw the $500 from checking account B. This is check-kiting, a form of check fraud that uses non-existent funds in a checking account or other type of bank account. Some check-kiting schemes use multiple accounts at a single bank, and more complicated schemes involve multiple financial institutions.”

“In a more complex scenario, a person could open checking accounts at bank A and bank B, at first depositing $500 into bank A and nothing in bank B. Then, they could write a check for $10,000 with account A and deposit it into account B. Bank B immediately credits the account, and in the time it might take for bank B to clear the check (generally about three business days), the scammer writes a $10,000 check with bank B, which gets deposited into bank A to cover the first check. This could keep going, with someone writing checks between banks where there’s no actual funds, yet the bank believes the money is real and continues to credit the accounts.”

The government alleges Mann was kiting millions of dollars in checks between his accounts at Bank of American and Pioneer from Aug. 1, 2019 to Aug. 30, 2019.

For more than a decade, MyPayrollHR worked with California-based Cachet Financial Services to process payroll deposits for MyPayrollHR client employees. Every other week, MyPayrollHR’s customers would deposit their payroll funds into a holding account run by Cachet, which would then disburse the payments into MyPayrollHR client employee bank accounts.

But when Mann diverted $26 million in client payroll deposits from Cachet to his account at Pioneer Bank, Cachet’s emptied holding account was debited for the payroll payments. Cachet quickly reversed those deposits, causing one or two pay periods worth of salary to be deducted from bank accounts for employees of companies that used MyPayrollHR.

That action caused so much uproar from affected companies and their employees that Cachet ultimately decided to cancel all of those reversals and absorb that $26 million hit, which it is now trying to recover through the courts.

According to prosecutors in New York, Pioneer was Mann’s largest creditor.

“Mann stated that the payroll issue was precipitated by his decision to route MyPayroll’s clients’ payroll payments to an account at Pioneer instead of directly to Cachet,” wrote FBI Special Agent Matthew J. Wabby. “He did this in order to temporarily reduce the amount of money he owed to Pioneer. When Pioneer froze Mann’s accounts, it’s also (inadvertently) stopped movement of MyPayroll’s clients’ payroll payments to Cachet.”

Approximately $9 million of the $35 million diverted by Mann was supposed to go to accounts at the National Payment Corporation (NatPay) — the Florida-based firm which handles tax withholdings for MyPayrollHR clients. NatPay said its insurance should help cover the losses it incurred when MyPayrollHR’s banks froze the company’s accounts.

Court records indicate Mann hasn’t yet entered a plea, but that he was ordered to be released today under a $200,000 bond secured by a family home and two vehicles. His passport also was seized.

Not sure what the courts were thinking when they allowed a security bond against Mann’s assets (home, two cars). Chances are those asset were procured and financially supported with stolen funds!

He commits 70 million dollars worth of fraud…..and gets released on bond.

Brilliant……

Got to love America……

Is this a great country or what?

I need to get into this kinda racket. I’m risking five and ten year bits extorting perverts for a few hundred each every month and this focker does a 70million heist and gets a signature bond! Next stop interwebs, Paulie’s payroll commin soon!!

Or, you know, you could get a real job.

Just a thought.

You can’t get ahead with a real job.

Sure you can. Don’t make bad decisions that bury you in debt you already know you can’t pay. Stay within your means and getting ahead isn’t a goal, it just happens.

Ahead of what? Ahead of whom? At what point/salary are you officially “ahead”?

America…….. land of obstinate children that have trouble with simple things like basic punctuation……..

Typically bonds are not issues above what can be afforded by the accused, and they are only denied if they are deemed a credible flight risk.

There is a lot to holding an accused person in prison, and if it is performed as a punitive measure (or reliably perceived as one) it could mean a dismissal of the case and/or no charges due to the mishandling of the accused.

“…he used almost all of the fraudulently obtained funds to sustain certain businesses, and purchase and start new ones.”

Wait, he started & maintained a bunch of fake businesses to steal money from banks which he then spent mainly to… start & maintain a bunch of fake businesses? I smell a rat – this is not why he started doing it or what he spend the money on. I’ll be very interested to hear how this plays out in court.

Just what I was thinking!

Yeah, my bet is on gambling.

I’d wager that’s a safe bet.

What are the odds?

It says the money was spent on businesses, but these dirt balls blur the line between business and personal. Remodeling your house? Ah… just call it a business expense. It’s a clever little trick they use, and since this is America, nobody has any real interest in prosecuting it.

There are quite a few similar cases of “businessmen” getting into this sort of Ponzi scheme, there isn’t a need for a different sort of problem behind it all.

In the initial report it said that many of his side businesses were just shell companies to hold the funds. It’s kind of like that vegetable oil scheme in the 60’s where that guy filled several tanks with water and put some salad oil on top with pipes connecting the tanks so that oil could be transferred from one tank to another so the dipstick would show the thousand gallons inside was oil. He used it as collateral against around $150 million in loans (about $1.7 billion today)

Two words:

Testicles

Fire ants

That’s 3 words.

You beat me to it!

or Five…

But his bank acc was frozen so it was all for naught?

And this, ladies and gentlemen, is why we must drill into EVERYONE’S HEAD (Including Upper Management) to enforce things called “Least Privilege” and “Separation of Duties”.

Hw would least privilege prevent an officer ofhte company from transferring funds?

He either can or he can’t.

While those are two good principles, I don’t see how they apply here. Especially not separation of duties. Mann owned his company, it was that the boss was trying to rip everyone off.

The principle that needed to be applied there wasn’t “separation of duties” it was “Don’t be a crook.”

The separation of duties could be thus: The payroll processing company should not handle the funds. It should instead provide the employer with a file to credit the employees, taxes and other deductions, in a format acceptable to the employer’s bank.

The procedure that you describe puts the burden for tax filings, etc… back on the employer. One reason that they hire payroll firms is avoid having to figure out how to transmit tax withholdings (on varying schedules) to a bunch of states. And, no accounting department wants to reconcile hundreds, if not thousands, of payroll transactions each payroll cycle. It is much easier to have it pulled out in one lump sum by the payroll processor.

A direct result of this fraud is that a lot of companies will stick with the major players, such as ADP and Paychex, for their payroll processing.

I bet ADP perpetrated this fraud to get companies to stick with them. Did I mention I like Spaghetti?

Meanwhile, none of us at my company have been paid today. Apparently Paychex is having an issue….

I’d love to learn more about how monies were pulled out of employees accounts and whether any laws or contracts may have been broken. What allowed that in the first place? (I know it was returned in the end but still curious)

ACH transactions can be reversed for a significant period of time after they’re transmitted (I can’t remember the exact amount of time, but I think it’s 30 days or more) for just the kind of situation that Cachet found itself in: a customer processed fraudulent transactions.

Josh-

The bank was using the ACH network, however they didn’t follow the rules(NACHA) regarding these types of transactions.

This was covered in an earlier piece by Brian.

Basically Cachet (the company his company hired to move money around) submitted an ACH reversal but it contained errors that caused banks to reject it.

So they then corrected those errors and submitted the reversal.

However some banks ignored the errors on the first reversal and processed the second reversal as well, leading to more money being taken out than was originally deposited.

Personally I’d love to know the list of banks who processed the first reversal, since it’d be a list of banks people should avoid (though I suppose it’d also be a list of banks criminals would be interested in doing business with).

A bank should not accept a reversal unless it has executed to original, to be reversed, credit. It seems some banks do not follow this simple precaution.

I want a list of BANKS who participated in this. It would be a public service. I also want a list of immediate area (Albany area, etc.) places who were scammed. Would the New York State Department of Labor have this information at its disposal. I am serious as a heart attack. I know people who work at Davis Vision in Latham, NY who have not received paychecks in a timely manner, which as you know, pay for a call center person isn’t a lot, so backlog of even one Paycheck is devastating. If you know, please write me at my email address which I’ve supplied. Ruining lives isn’t fair. If you can’t pay your bills, no one cares—-and yeah, try to defend the Idiot Local Man who did this to so many REAL, LIVE PEOPLE, ruining their lives. Were it you or me for much less of a “crime”, we’d still be in JAIL. PERIOD…NO BAIL. WHY he should be out on any kind of bail? By the way, not receiving your Paycheck from your employer, as promised on PAY DAY, is a FEDERAL and STATE Violation. So, tell me again why Michael Mann is out on bail? It is ultimately His fault the money is gone and the BANKS who pulled the money out of employees’ accounts are complicit. LET ME KNOW. I WANT TO KNOW. I do not want to do business with those Banks and I want to know what BIG BUSINESS in the Albany Area were affected, in particular, Davis Vision. Thank you for your time and consideration.

Wait, did I read it right — he stole $75M and was released on $200k bail? Who was the think tank behind that decision? (Oh, that’s the white collar crime. OK then …)

Ever watch that “Dog the Bounty Hunter” reality series? You think he’s going to turn down 200 grand to catch a numb nut like this? There are plenty of professionals that would love that bond jumper opportunity, and the crook wouldn’t have a chance of escaping.

I wouldn’t be surprised if Mann would cut a deal with a bounty hunter for a share of the bounty.

Nice explanation on the process of “Check-kiting “

Personally, I didn’t understand it. A bank check gets credited immediately, but those require verification of funds at the source bank, A personal check is not credited until it gets cleared. So I don’t understand how the kiting scheme worked.

The funds from the check are usually immediately available, even if the check hasn’t cleared yet. At least if you are well-known to the bank and didn’t have any issues.

If the check fails to clear a couple days later the amount would be reverted, but since you have a couple days you can take the money out, and deposit it in the check source account…

Net net is still ZERO. The only thing that is gained is lots of checks written and lots of trips to the bank teller. What’s the point if the money stays in the banking system? It’s not like ur writing a 1m check and depositing 1k…u still need to deposited 1m to make up for the initial check. Weird?

If you look like you’ve got $1m in two different bank accounts, you can go to another bank and say “Hey, lend me a bunch of money – here’s the proof that I’m already loaded and won’t have any trouble paying you back”. That’s the trick – it’s easy to get a lot more money if you’re already rich.

As long as you keep depositing checks (good or bad) to cover the ones that you just wrote, you don’t have to have ever actually had the funds. He probably started off with opening the accounts and running them for a few months with relatively small amounts to establish himself with the bank. Then he started ramping up the amounts. With those large balances as collateral, as Tom mentioned, he probably set up credit lines as well as getting credit from other companies.

Kiting is a bit like juggling. If the slightest thing goes wrong, it all collapses. That’s why many companies REQUIRE their accounting and treasury employees to take vacations. Of course, with remote access these days, that isn’t as useful of a means of detecting fraud as it used to be.

Umm I laugh at all of this. Try just cashing a regular, heck, even a payroll check WITH your name on it….and being a Black man!

I’ve literally had even a bank manager come out to verify on a check less than 200 dollars…and these guys raking them for millions! LMAO!!

I don’t understand it either. When I deposit a bank check or money order that is over $500.00 the bank puts a 3 – 5 business day hold on it. For personal checks they put a 30 day hold. Why wouldn’t they do the same for business accounts?

This has all the hallmarks of a classic mafia bust-out scheme.

I can see an all new episode of American Greed coming.

Stacy Keach and the producers of American Greed will have their work cut out for them.

I can’t wait!!

I was thinking the same thing. I’m sure it will be an upcoming episode and I will be watching it.

Jury of peers should be replaced by jury of the thousands of employees victimized.

Insurance Fraud is what it’s about while the lawyers eat up the stolen loot!

Clearly the bank(s) that loaned him all the money for the fake businesses didnt do their part in responsible lending. Cant wait to see how this plays out.

How did those two banks not detect this in the years that it was going on? That’s what I want to know

Exactly! BANKING 101: Know Your Customer!!! This means know what they do, see their businesses and not just blindly give a loan based on paper. Shame on the banks for lending money and not doing their due diligence, especially their head of lending. Heads will roll and their regulator will have a field day with this!!

Interesting that while everyone visualized him as already disappeared with the stolen money, he was apparently withdrew to his home and stopped answering the phone.

Coupla days ago my checking account was debited for two payments of my monthly CMS (Medicare) premium, and then one of the charges was reversed the next night. The bank person (I went to ask) said he didn’t know how either event took place. I didn’t press the issue.

Is there a lot of that going around?

John, on September 26 I received the following email from Medicare:

“Due to a processing error, a small percentage of people with Medicare who pay their Medicare premiums through Easy Pay had their premiums deducted twice from their bank account. Medicare is currently working with the Treasury Department to reverse the duplicate Medicare premium deduction and have the erroneous deduction credited back to bank accounts, as soon as possible.

If you are concerned about overdraft or other fees related to the issue, you should contact your bank and ask that fees be waived.

If you have questions, please contact us at 1-800-MEDICARE. If you’d like to chat online with us, visit MyMedicare.gov and click on the “Live Chat” icon at the top right of the page.

Sincerely,

The Medicare Team

If you are currently receiving Medicare communications via snail mail I recommend changing your preferences to email communication and paperless claim notices. You will receive stuff from Medicare in a much more timely fashion. I also maintain a sufficient balance in the credit union account I use for automatic payments so that there is a cushion should something like this occur and I don’t incur overdraft fees. (Financial institutions often offer other ways to avoid overdrafts if you are limited to how much you can keep in a checking account.)

Yes, there is a lot of that going on. I had a mystery subscription charge my bank account on Amazon’s last day of the quarter. One they needed to window dress for sure. As a professor, I asked my students who else had this on their Amazon account. out of 60 total, I got 12 students that checked their accounts or parents and found the same issue. 5 days after the close of the month the payment to Amazon was reversed and no amount was left in the checking not in not out. NO trace. Only saw it there because I watch like a hawk.

So my classes listened to Amazon quarterly webcast and we laughed hysterically when they said the Subscription division had surprisingly good returns at the end of the quarter.

My comment to this is likely to raise some ire I know, however, this smells of more like highly unethical behavior rather than a premeditated scam simply because of his actions: he isn’t on some island hiding with millions in the bank. If this is more about desperation and a bad habit of getting away with something to buy time and create potentially legitimate businesses (and jobs, by the way) then it is simply bad business and not ‘criminal’, 30-years-in-jail, IMO. The lending banks and business partners, like Cachet, should share in the responsibility of this mess! By the way, speaking so much of America, looks like lying and cheating are in and our new chic culture thanks to you know who!

You’re substantially correct.

The “arrested this week” link leads to a 9/17 link about the FBI searching his house, I don’t know if NBC changed the story behind the link or what.

I found this link at BizJournals.com describing the arrest thusly:

According to the complaint filed by federal prosecutors:

–Mann fraudulently obtained at least $70 million in loans from banks and other financial institutions.

–As part of that alleged fraud, he created companies that “had no purpose other than to be used in the fraud.”

–He also fraudulently represented to banks and financing companies that his fake businesses had receivables that they did not have.

–He obtained loans and lines of credit by borrowing against these non-existent receivables.

Mann, 49, is accused of starting the scheme in 2010 or 2011.

He probably meant to link to this

https://www.nbcnews.com/news/us-news/mypayrollhr-ceo-arrested-charged-70-million-bank-fraud-scheme-n1057856

“Bank of American” -> “Bank of America”

The only ones claiming he confessed are Krebs, the prosecution, and some career agent. The defense and defendant denied any confession.

That’s why it’s up for a trial.

The defendant never left town, cooperated with investigators, and surrendered on request. There’s no flight issue, because even if he had a dime from the alleged fraud, he didn’t spend any of it.

That’s why he was granted bail.

You people who don’t understand how Mann got bail are ignorant or purposely obtuse.

You’re right. The purpose of bail is to ensure appearance at court, not function as punishment. If all his known funds are frozen and his passport has been seized, he’s probably not a flight risk.

Talk about lame processes. Baltimore backup/data storage consisted of storing data on local hard drives (i.e., drives in the user’s computer).

https://www.baltimoresun.com/politics/bs-md-ci-audit-it-20190927-23hrwbtdyzcu7lmmwdqzbmzja4-story.html

“That’s because instead of saving data using a cloud storage method, as is recommended today, employees were saving files on their computers’ hard drives, as people did before and around the turn of the century, the audit found.

“Performance measures data were saved electronically in responsible personnel’s hard drives,” Pasch reported. “One of the responsible personnel’s hard drive was confiscated and the other responsible personnel’s selected files were removed due to the May 2019 ransomware incident.”

Most big businesses are criminal enterprises. There are only two things surprising about this escapade. First, he got caught. As a white collar criminal those chances are small and that’s why he took this risk. Second, he might actually be prosecuted because he stole from other criminal enterprises, namely banks.

This shouldn’t be a surprise. We elected a Mafia family to run our government so that’s a pretty good indicator of where we are morally.

“Mann was the founder of Lincoln Academy, a North Carolina basketball school tailored toward elite prospects. He largely funded the program and often paid for athletes’ tuition, board and lodging, according to the Daily Mail.”

https://usatodayhss.com/2019/michael-mann-arrest-70m-fraud-charges-lincoln-academy-closes

These businesses are commonly used across America. As bad as this is, I have seen worse relatively speaking. I know of a professional whose CPA talked into giving the money for not only the payroll taxes but his personal income taxes for a period of years. The CPA had a stroke and the entire scheme collapsed. The professional , between his practice and personally, owed the IRS $2.5 million . All of which he thought he had paid timely. The IRS was not real understanding.

It happens. It was stupid on the part of the professional.

Robbing Peter to pay Paul.

I look forward to watching this future ‘American Greed’ episode on CNBC.

What an asshat. Did he really think he’d get away with this?

I own a payroll company in California. I have operated honestly for 40+ years and am proud of it. I know of Cachet Financial and feel for their problems. My industry starting with A.. many years ago, started impounding federal payroll taxes. It created substantial trust account balances and interest earnings for the payroll processor. The IRS should never have allowed it. The funds should stay in the taxpayer’s account until due, then transferred to IRS. This is easily done with EFTPS. In all of the years in this business my company has never had a federal tax trust account and never will. SEND A LETTER TO IRS… NO MORE THIRD PARTY (PAYROLL PROCESSORS) FEDERAL TAX IMPOUNDING. ALL TAX PAYMENTS GO DIRECTLY FROM TAXPAYER TO IRS. Thanks

I am an EA, and we see several cases of payroll theft every year. It is so tempting for employers to ‘forget’ to make their payroll deposits, and there is no mechanism to tell the employees that they are being robbed.

It is also not at all unheard of for payroll service providers to fall prey to the same temptation. There is this big pot of money just sitting there, too much temptation for the weak to keep their hands off.