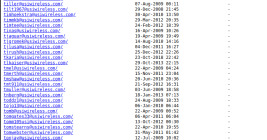

Crickets from Chirp Systems in Smart Lock Key Leak

The U.S. government is warning that smart locks securing entry to an estimated 50,000 dwellings nationwide contain hard-coded credentials that can be used to remotely open any of the locks. The lock’s maker Chirp Systems remains unresponsive, even though it was first notified about the critical weakness in March 2021. Meanwhile, Chirp’s parent company, RealPage, Inc., is being sued by multiple U.S. states for allegedly colluding with landlords to illegally raise rents.