It remains unclear whether those responsible for stealing Social Security numbers and other data on as many as 143 million Americans from big-three credit bureau Equifax intend to sell this data to identity thieves. But if ever there was a reminder that you — the consumer — are ultimately responsible for protecting your financial future, this is it. Here’s what you need to know and what you should do in response to this unprecedented breach.

Some of the Q&As below were originally published in a 2015 story, How I Learned to Stop Worrying and Embrace the Security Freeze. It has been updated to include new information specific to the Equifax intrusion.

Q: What information was jeopardized in the breach?

A: Equifax was keen to point out that its investigation is ongoing. But for now, the data at risk includes Social Security numbers, birth dates, addresses on 143 million Americans. Equifax also said the breach involved some driver’s license numbers (although it didn’t say how many or which states might be impacted), credit card numbers for roughly 209,000 U.S. consumers, and “certain dispute documents with personal identifying information for approximately 182,000 U.S. consumers.”

Q: Was the breach limited to Americans?

A: No. Equifax said it believes the intruders got access to “limited personal information for certain UK and Canadian residents.” It has not disclosed what information for those residents was at risk or how many from Canada and the UK may be impacted.

Q: What is Equifax doing about this breach?

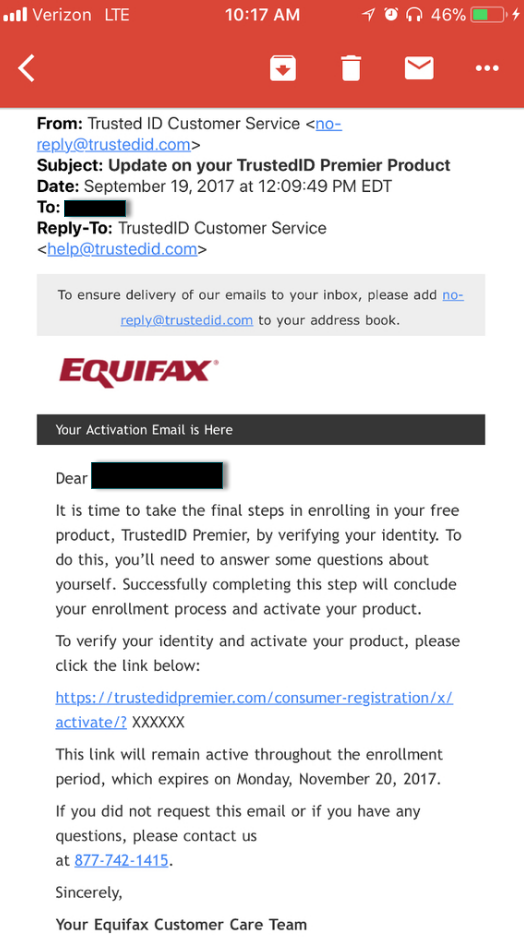

A: Equifax is offering one free year of their credit monitoring service. In addition, it has put up a Web site — www.equifaxsecurity2017.com — that tried to let people determine whether they were affected.

Q: That site tells me I was not affected by the breach. Am I safe?

A: As noted in this story from Friday, the site seems hopelessly broken, often returning differing results for the same data submitted at different times. In the absence of more reliable information from Equifax, it is safer to assume you ARE compromised.

Q: I read that the legal language in the terms of service that consumers must accept before enrolling in the free credit monitoring service from Equifax requires one to waive their rights to sue the company in connection with this breach. Is that true?

A: Not according to Equifax. The company issued a statement over the weekend saying that nothing in that agreement applies to this cybersecurity incident.

Q: So should I take advantage of the credit monitoring offer?

A: It can’t hurt, but I wouldn’t count on it protecting you from identity theft.

Q: Wait, what? I thought that was the whole point of a credit monitoring service?

A: The credit bureaus sure want you to believe that, but it’s not true in practice. These services do not prevent thieves from using your identity to open new lines of credit, and from damaging your good name for years to come in the process. The most you can hope for is that credit monitoring services will alert you soon after an ID thief does steal your identity.

Q: Well then what the heck are these services good for?

A: Credit monitoring services are principally useful in helping consumers recover from identity theft. Doing so often requires dozens of hours writing and mailing letters, and spending time on the phone contacting creditors and credit bureaus to straighten out the mess. In cases where identity theft leads to prosecution for crimes committed in your name by an ID thief, you may incur legal costs as well. Most of these services offer to reimburse you up to a certain amount for out-of-pocket expenses related to those efforts. But a better solution is to prevent thieves from stealing your identity in the first place.

Q: What’s the best way to do that?

A: File a security freeze — also known as a credit freeze — with the four major credit bureaus.

Q: What is a security freeze?

A: A security freeze essentially blocks any potential creditors from being able to view or “pull” your credit file, unless you affirmatively unfreeze or thaw your file beforehand. With a freeze in place on your credit file, ID thieves can apply for credit in your name all they want, but they will not succeed in getting new lines of credit in your name because few if any creditors will extend that credit without first being able to gauge how risky it is to loan to you (i.e., view your credit file). And because each credit inquiry caused by a creditor has the potential to lower your credit score, the freeze also helps protect your score, which is what most lenders use to decide whether to grant you credit when you truly do want it and apply for it.

Q: What’s involved in freezing my credit file?

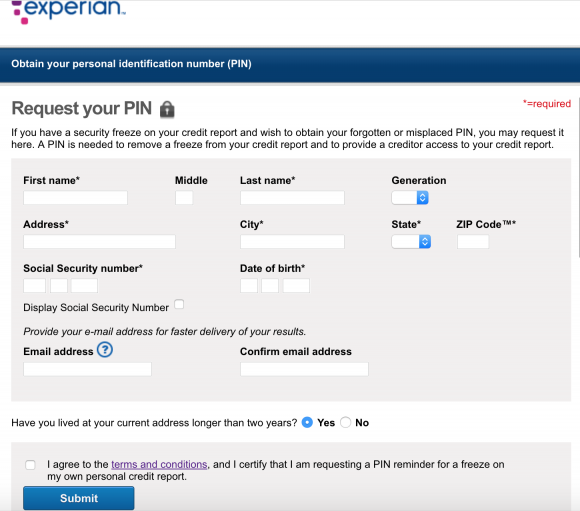

A: Freezing your credit involves notifying each of the major credit bureaus that you wish to place a freeze on your credit file. This can usually be done online, but in a few cases you may need to contact one or more credit bureaus by phone or in writing. Once you complete the application process, each bureau will provide a unique personal identification number (PIN) that you can use to unfreeze or “thaw” your credit file in the event that you need to apply for new lines of credit sometime in the future. Depending on your state of residence and your circumstances, you may also have to pay a small fee to place a freeze at each bureau. There are four consumer credit bureaus, including Equifax, Experian, Innovis and Trans Union. It’s a good idea to keep your unfreeze PIN(s) in a folder in a safe place (perhaps along with your latest credit report), so that when and if you need to undo the freeze, the process is simple.

Q: How much is the fee, and how can I know whether I have to pay it?

A: The fee ranges from $0 to $15 per bureau, meaning that it can cost upwards of $60 to place a freeze at all four credit bureaus (recommended). However, in most states, consumers can freeze their credit file for free at each of the major credit bureaus if they also supply a copy of a police report and in some cases an affidavit stating that the filer believes he/she is or is likely to be the victim of identity theft. In many states, that police report can be filed and obtained online. The fee covers a freeze as long as the consumer keeps it in place. Consumers Union has a useful breakdown of state-by-state fees. Continue reading →

In

In