United Airlines has rolled out a series of updates to its Web site that the company claims will help beef up the security of customer accounts. But at first glance, the core changes — moving from a 4-digit PINs to password and requiring customers to pick five different security questions and answers — may seem like a security playbook copied from Yahoo.com, circa 2009. Here’s a closer look at what’s changed in how United authenticates customers, and hopefully a bit of insight into what the nation’s fourth-largest airline is trying to accomplish with its new system.

United, like many other carriers, has long relied on a frequent flyer account number and a 4-digit personal identification number (PIN) for authenticating customers at its Web site. This has left customer accounts ripe for takeover by crooks who specialize in hacking and draining loyalty accounts for cash.

Earlier this year, however, United began debuting new authentication systems wherein customers are asked to pick a strong password and to choose from five sets of security questions and pre-selected answers. Customers may be asked to provide the answers to two of these questions if they are logging in from a device United has never seen associated with that account, trying to reset a password, or interacting with United via phone.

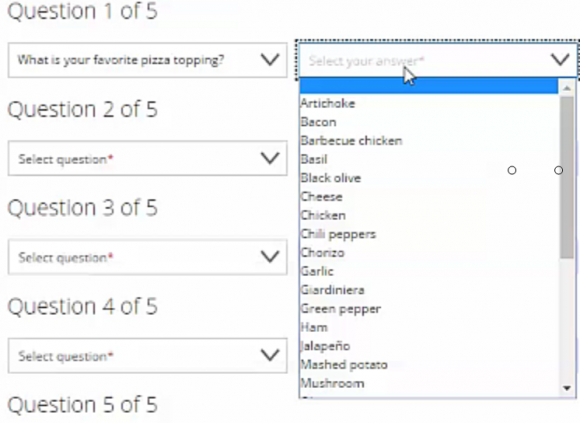

Some of the questions and answers United come up with.

Yes, you read that right: The answers are pre-selected as well as the questions. For example, to the question “During what month did you first meet your spouse or significant other,” users may select only from one of…you guessed it — 12 answers (January through December).

The list of answers to another security question, “What’s your favorite pizza topping,” had me momentarily thinking I using a pull down menu at Dominos.com — waffling between “pepperoni” and “mashed potato.” (Fun fact: If you were previously unaware that mashed potatoes qualify as an actual pizza topping, United has you covered with an answer to this bit of trivia in its Frequently Asked Questions page on the security changes.)

I recorded a short video of some of these rather unique questions and answers.

United said it opted for pre-defined questions and answers because the company has found “the majority of security issues our customers face can be traced to computer viruses that record typing, and using predefined answers protects against this type of intrusion.”

This struck me as a dramatic oversimplification of the threat. I asked United why they stated this, given that any halfway decent piece of malware that is capable of keylogging is likely also doing what’s known as “form grabbing” — essentially snatching data submitted in forms — regardless of whether the victim types in this information or selects it from a pull-down menu.

Benjamin Vaughn, director of IT security intelligence at United, said the company was randomizing the questions to confound bot programs that seek to automate the submission of answers, and that security questions answered wrongly would be “locked” and not asked again. He added that multiple unsuccessful attempts at answering these questions could result in an account being locked, necessitating a call to customer service.

United said it plans to use these same questions and answers — no longer passwords or PINs — to authenticate those who call in to the company’s customer service hotline. When I went to step through United’s new security system, I discovered my account was locked for some reason. A call to United customer service unlocked it in less than two minutes. All the agent asked me for was my frequent flyer number and my name.

(Incidentally, United still somewhat relies on “security through obscurity” to protect the secrecy of customer usernames by very seldom communicating the full frequent flyer number in written and digital communications with customers. I first pointed this out in my story about the data that can be gleaned from a United boarding pass barcode, because while the full frequent flyer number is masked with “x’s” on the boarding pass, the full number is stored on the pass’s barcode).

Conventional wisdom dictates that what little additional value security questions add to the equation is nullified when the user is required to choose from a set of pre-selected answers. After all, the only sane and secure way to use secret questions if one must is to pick answers that are not only incorrect and/or irrelevant to the question, but that also can’t be guessed or gleaned by collecting facts about you from background checking sites or from your various social media presences online.

Google published some fascinating research last year that spoke to the efficacy and challenges of secret questions and answers, concluding that they are “neither secure nor reliable enough to be used as a standalone account recovery mechanism.” Continue reading

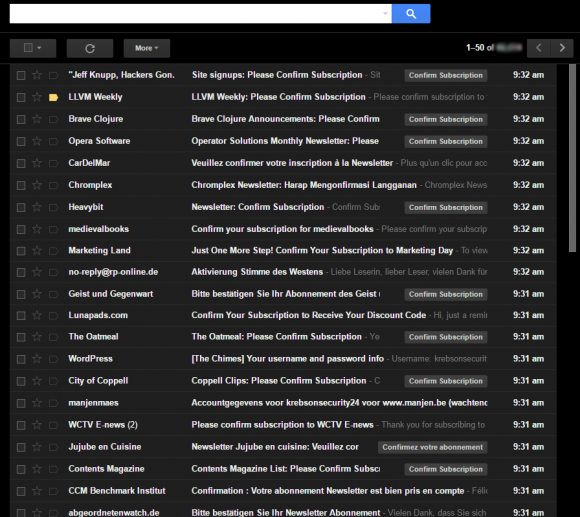

On Feb. 20, 2016, James William Schwartz, 84, was going about his daily routine, which mainly consisted of caring for his wife, MaryLou. Mrs. Schwartz was suffering from the end stages of endometrial cancer and wasn’t physically mobile without assistance. When Mr. Schwartz began having a heart attack that day, MaryLou went to use her phone to call for help and discovered it was completely shut off.

On Feb. 20, 2016, James William Schwartz, 84, was going about his daily routine, which mainly consisted of caring for his wife, MaryLou. Mrs. Schwartz was suffering from the end stages of endometrial cancer and wasn’t physically mobile without assistance. When Mr. Schwartz began having a heart attack that day, MaryLou went to use her phone to call for help and discovered it was completely shut off. On July 5, 2016, KrebsOnSecurity reached out to Bellevue, Wash., based Eddie Bauer after hearing from several sources who work in fighting fraud at U.S. financial institutions. All of those sources said they’d identified a pattern of fraud on customer cards that had just one thing in common: They were all recently used at some of Eddie Bauer’s

On July 5, 2016, KrebsOnSecurity reached out to Bellevue, Wash., based Eddie Bauer after hearing from several sources who work in fighting fraud at U.S. financial institutions. All of those sources said they’d identified a pattern of fraud on customer cards that had just one thing in common: They were all recently used at some of Eddie Bauer’s

As usual, patches

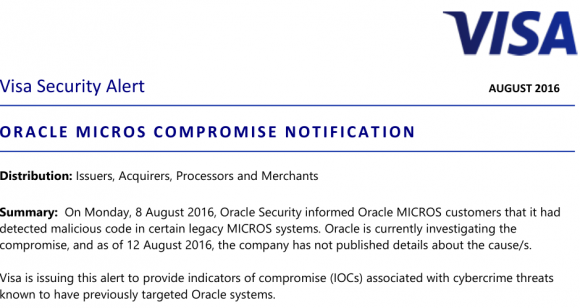

As usual, patches  Asked this weekend for comment on rumors of a large data breach potentially affecting customers of its retail division, Oracle acknowledged that it had “detected and addressed malicious code in certain legacy MICROS systems.” It also said that it is asking all MICROS customers to reset their passwords for the MICROS online support portal.

Asked this weekend for comment on rumors of a large data breach potentially affecting customers of its retail division, Oracle acknowledged that it had “detected and addressed malicious code in certain legacy MICROS systems.” It also said that it is asking all MICROS customers to reset their passwords for the MICROS online support portal.