A KrebsOnSecurity story last month about credit card skimmers found in self-checkout lanes at some Walmart locations got picked up by quite a few publications. Since then I’ve heard from several readers who work at retailers that use hundreds of thousands of these Ingenico credit card terminals across their stores, and all wanted to know the same thing: How could they tell if their self-checkout lanes were compromised? This post provides a few pointers.

Happily, just days before my story point-of-sale vendor Ingenico produced a tutorial on how to spot a skimmer on self checkout lanes powered by Ingenico iSC250 card terminals. Unfortunately, it doesn’t appear that this report was widely disseminated, because I’m still getting questions from readers at retailers that use these devices.

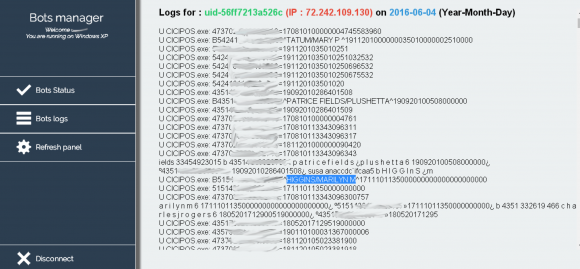

The red calipers in the image above show the size differences in various noticeable areas of the case overlay on the left compared to the actual iSC250 on the right. Source: Ingenico.

“In order for the overlay to fit atop the POS [point-of-sale] terminal, it must be longer and wider than the target device,” reads a May 16, 2016 security bulletin obtained by KrebsOnSecurity. “For this reason, the case overlay will appear noticeably larger than the actual POS terminal. This is the primary identifying characteristic of the skimming device. A skimmer overlay of the iSC250 is over 6 inches wide and 7 inches tall while the iSC250 itself is 5 9/16 inch wide and 6 1⁄2 inches tall.”

In addition, the skimming device that thieves can attach in the blink of an eye on top of the Ingenico self-checkout card reader blocks the backlight from coming through the fake PIN pad overlay.

Owned by Santa Clara, Calif. based networking giant

Owned by Santa Clara, Calif. based networking giant  The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible.

The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible. According to

According to  FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns.

FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns. Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out

Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out  During the height of tax-filing season in 2015, KrebsOnSecurity

During the height of tax-filing season in 2015, KrebsOnSecurity  On January 27, 2016, this publication was the first

On January 27, 2016, this publication was the first