GoToMyPC, a service that helps people access and control their computers remotely over the Internet, is forcing all users to change their passwords, citing a spike in attacks that target people who re-use passwords across multiple sites.

Owned by Santa Clara, Calif. based networking giant Citrix, GoToMyPC is a popular software-as-a-service product that lets users access and control their PC or Mac from anywhere in the world. On June 19, the company posted a status update and began notifying users that a system-wide password update was underway.

Owned by Santa Clara, Calif. based networking giant Citrix, GoToMyPC is a popular software-as-a-service product that lets users access and control their PC or Mac from anywhere in the world. On June 19, the company posted a status update and began notifying users that a system-wide password update was underway.

“Unfortunately, the GoToMYPC service has been targeted by a very sophisticated password attack,” reads the notice posted to status.gotomypc.com. “To protect you, the security team recommended that we reset all customer passwords immediately. Effective immediately, you will be required to reset your GoToMYPC password before you can login again. To reset your password please use your regular GoToMYPC login link.”

John Bennett, product line director at Citrix, said once the company learned about the attack it took immediate action. But contrary to previous published reports, there is no indication Citrix or its platforms have been compromised, he said.

“Citrix can confirm the recent incident was a password re-use attack, where attackers used usernames and passwords leaked from other websites to access the accounts of GoToMyPC users,” Bennett wrote in an emailed statement. “At this time, the response includes a mandatory password reset for all GoToMyPC users. Citrix encourages customers to visit the GoToMyPC status page to learn about enabling two-step verification, and to use strong passwords in order to keep accounts as safe as possible. ”

Citrix’s GoTo division also operates GoToAssist, which is geared toward technical support specialists, and GoToMeeting, a product marketed at businesses. The company said it has no indication that user accounts at other GoTo services were compromised, but assuming that’s true it’s likely because the attackers haven’t gotten around to trying yet.

It’s a fair bet that whoever perpetrated this attack had help from huge email and password lists recently leaked online from older breaches at LinkedIn, MySpace and Tumblr to name a few. Re-using passwords at multiple sites is a bad idea to begin with, but re-using your GoToMyPC remote administrator password at other sites seems like an exceptionally lousy idea.

The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible.

The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible. According to

According to  FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns.

FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns. Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out

Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out  During the height of tax-filing season in 2015, KrebsOnSecurity

During the height of tax-filing season in 2015, KrebsOnSecurity  On January 27, 2016, this publication was the first

On January 27, 2016, this publication was the first

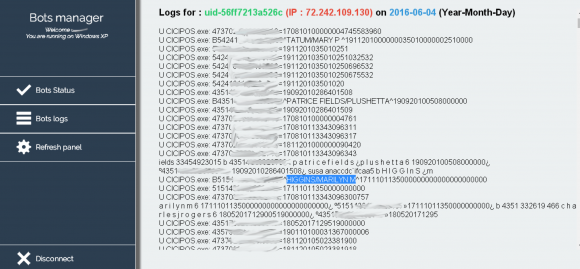

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had all been used in the last few months at various CiCi’s Pizza locations.

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had all been used in the last few months at various CiCi’s Pizza locations.