A number of credit unions say they have experienced an unusually high level of debit card fraud from the breach at nationwide fast food chain Wendy’s, and that the losses so far eclipse those that came in the wake of huge card breaches at Target and Home Depot.

As first noted on this blog in January, Wendy’s is investigating a pattern of unusual card activity at some stores. In a preliminary 2015 annual report, Wendy’s confirmed that malware designed to steal card data was found on some systems. The company says it doesn’t yet know the extent of the breach or how many customers may have been impacted.

As first noted on this blog in January, Wendy’s is investigating a pattern of unusual card activity at some stores. In a preliminary 2015 annual report, Wendy’s confirmed that malware designed to steal card data was found on some systems. The company says it doesn’t yet know the extent of the breach or how many customers may have been impacted.

According to B. Dan Berger, CEO at the National Association of Federal Credit Unions, many credit unions saw a huge increase in debit card fraud in the few weeks before the Wendy’s breach became public. He said much of that fraud activity was later tied to customers who’d patronized Wendy’s locations less than a month prior.

“This is what we’ve heard from three different credit union CEOs in Ohio now: It’s more concentrated and the amounts hitting compromised debit accounts is much higher that what they were hit with after Home Depot or Target,” Berger said. “It seems to have been been [the work of] a sophisticated group, in terms of the timing and the accounts they targeted. They were targeting and draining debit accounts with lots of money in them.”

Berger shared an email sent by one credit union CEO who asked not to be named in this story:

“Please take this Wendy’s story very seriously. We have been getting killed lately with debit card fraud. We have already hit half of our normal yearly fraud so far this year, and it is not even the end of January yet. After reading this, we reviewed activity on some of our accounts which had fraud on them. The first six we checked had all been to Wendy’s in the last quarter of 2015.”

All I am suggesting is that we are experiencing much high[er] losses lately than we ever did after the Target or Home Depot problems. I think we may be end up with 5 to 10 times the loss on this breach, wherever it occurred. Accordingly, please put this story in the proper perspective.”

Wendy’s declined to comment for this story.

Even if thieves don’t know the PIN assigned to a given debit card, very often banks and credit unions will let customers call in and change their PIN using automated systems that ask the caller to verify the cardholder’s identity by keying in static identifiers, like Social Security numbers, dates of birth and the card’s expiration date.

Thieves can abuse these automated systems to reset the PIN on the victim’s debit card, and then use a counterfeit copy of the card to withdraw cash from the account at ATMs. As I reported in September 2014, this is exactly what happened in the wake of the Home Depot breach. Continue reading

Tax refund fraud affects hundreds of thousands — if not millions — of U.S. citizens annually. It starts when crooks submit your personal data to the IRS and claim a refund in your name, but have the money sent to an account or address you don’t control.

Tax refund fraud affects hundreds of thousands — if not millions — of U.S. citizens annually. It starts when crooks submit your personal data to the IRS and claim a refund in your name, but have the money sent to an account or address you don’t control. The number is more than double the figures the IRS released in August 2015, when it said some

The number is more than double the figures the IRS released in August 2015, when it said some

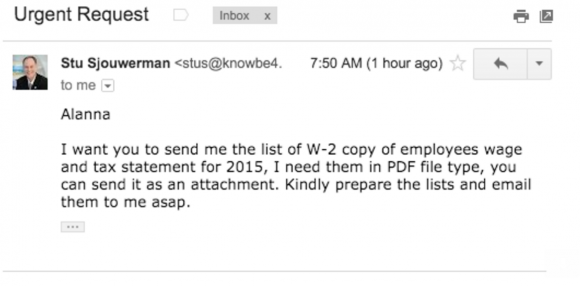

Stu Sjouwerman, chief executive at security awareness training company KnowBe4, told KrebsOnSecurity that earlier this week his firm’s controller received an email designed to look like it was sent by Sjouwerman requesting a copy of all employee W-2 forms for this year (full disclosure: KnowBe4 is an advertiser on this site). The email read:

Stu Sjouwerman, chief executive at security awareness training company KnowBe4, told KrebsOnSecurity that earlier this week his firm’s controller received an email designed to look like it was sent by Sjouwerman requesting a copy of all employee W-2 forms for this year (full disclosure: KnowBe4 is an advertiser on this site). The email read:

Visa CEO Charles W. Scharf

Visa CEO Charles W. Scharf  KrebsOnSecurity reader Suzanne Perry, a self-professed “shopaholic” from Gilbert, Penn., said she recently received an email from Kohls.com stating that the email address on her account had been changed. Recognizing this as a common indicator of a compromised account, Perry said she immediately went to Kohls.com — which confirmed her fears that her password had been changed.

KrebsOnSecurity reader Suzanne Perry, a self-professed “shopaholic” from Gilbert, Penn., said she recently received an email from Kohls.com stating that the email address on her account had been changed. Recognizing this as a common indicator of a compromised account, Perry said she immediately went to Kohls.com — which confirmed her fears that her password had been changed.