Security conferences are a great place to learn about the latest hacking tricks, tools and exploits, but they also remind us of important stuff that was shown to be hackable in previous years yet never really got fixed. Perhaps the best example of this at last week’s annual DefCon security conference in Las Vegas came from hackers who built on research first released in 2010 to show just how trivial it still is to read, modify and clone most HID cards — the rectangular white plastic “smart” cards that organizations worldwide distribute to employees for security badges.

Nearly four years ago, researchers at the Chaos Communication Congress (CCC), a security conference in Berlin, released a paper (PDF) demonstrating a serious vulnerability in smart cards made by Austin, Texas-based HID Global, by far the largest manufacturer of these devices. The CCC researchers showed that the card reader device that HID sells to validate the data stored on its then-new line of iClass proximity cards includes the master encryption key needed to read data on those cards.

More importantly, the researchers proved that anyone with physical access to one of these readers could extract the encryption key and use it to read, clone, and modify data stored on any HID cards made to work with those readers.

At the time, HID responded by modifying future models of card readers so that the firmware stored inside them could not be so easily dumped or read (i.e., the company removed the external serial interface on new readers). But according to researchers, HID never changed the master encryption key for its readers, likely because doing so would require customers using the product to modify or replace all of their readers and cards — a costly proposition by any measure given HID’s huge market share.

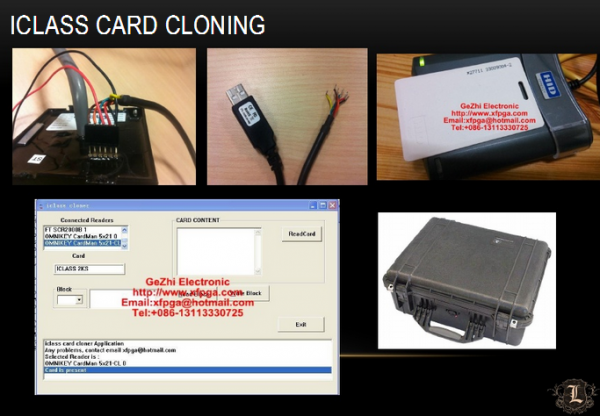

Unfortunately, this means that anyone with a modicum of hardware hacking skills, an eBay account, and a budget of less than $500 can grab a copy of the master encryption key and create a portable system for reading and cloning HID cards. At least, that was the gist of the DefCon talk given last week by the co-founders of Lares Consulting, a company that gets hired to test clients’ physical and network security.

Lares’ Joshua Perrymon and Eric Smith demonstrated how an HID parking garage reader capable of reading cards up to three feet away was purchased off of eBay and modified to fit inside of a common backpack. Wearing this backpack, an attacker looking to gain access to a building protected by HID’s iClass cards could obtain that access simply by walking up to a employee of the targeted organization and asking for directions, a light of a cigarette, or some other pretext.