Image: Shutterstock.

Apple and the satellite-based broadband service Starlink each recently took steps to address new research into the potential security and privacy implications of how their services geo-locate devices. Researchers from the University of Maryland say they relied on publicly available data from Apple to track the location of billions of devices globally — including non-Apple devices like Starlink systems — and found they could use this data to monitor the destruction of Gaza, as well as the movements and in many cases identities of Russian and Ukrainian troops.

At issue is the way that Apple collects and publicly shares information about the precise location of all Wi-Fi access points seen by its devices. Apple collects this location data to give Apple devices a crowdsourced, low-power alternative to constantly requesting global positioning system (GPS) coordinates.

Both Apple and Google operate their own Wi-Fi-based Positioning Systems (WPS) that obtain certain hardware identifiers from all wireless access points that come within range of their mobile devices. Both record the Media Access Control (MAC) address that a Wi-FI access point uses, known as a Basic Service Set Identifier or BSSID.

Periodically, Apple and Google mobile devices will forward their locations — by querying GPS and/or by using cellular towers as landmarks — along with any nearby BSSIDs. This combination of data allows Apple and Google devices to figure out where they are within a few feet or meters, and it’s what allows your mobile phone to continue displaying your planned route even when the device can’t get a fix on GPS.

With Google’s WPS, a wireless device submits a list of nearby Wi-Fi access point BSSIDs and their signal strengths — via an application programming interface (API) request to Google — whose WPS responds with the device’s computed position. Google’s WPS requires at least two BSSIDs to calculate a device’s approximate position.

Apple’s WPS also accepts a list of nearby BSSIDs, but instead of computing the device’s location based off the set of observed access points and their received signal strengths and then reporting that result to the user, Apple’s API will return the geolocations of up to 400 more BSSIDs that are nearby the one requested. It then uses approximately eight of those BSSIDs to work out the user’s location based on known landmarks.

In essence, Google’s WPS computes the user’s location and shares it with the device. Apple’s WPS gives its devices a large enough amount of data about the location of known access points in the area that the devices can do that estimation on their own.

That’s according to two researchers at the University of Maryland, who theorized they could use the verbosity of Apple’s API to map the movement of individual devices into and out of virtually any defined area of the world. The UMD pair said they spent a month early in their research continuously querying the API, asking it for the location of more than a billion BSSIDs generated at random.

They learned that while only about three million of those randomly generated BSSIDs were known to Apple’s Wi-Fi geolocation API, Apple also returned an additional 488 million BSSID locations already stored in its WPS from other lookups.

UMD Associate Professor David Levin and Ph.D student Erik Rye found they could mostly avoid requesting unallocated BSSIDs by consulting the list of BSSID ranges assigned to specific device manufacturers. That list is maintained by the Institute of Electrical and Electronics Engineers (IEEE), which is also sponsoring the privacy and security conference where Rye is slated to present the UMD research later today.

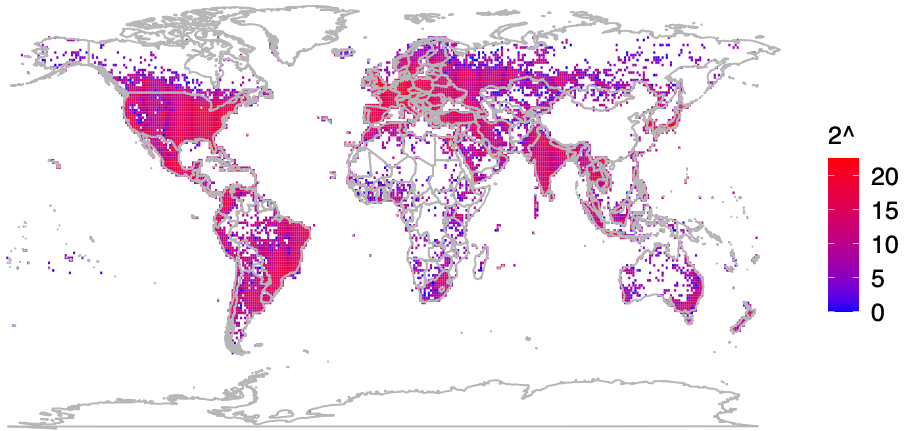

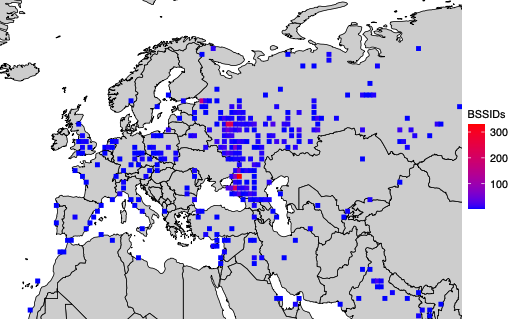

Plotting the locations returned by Apple’s WPS between November 2022 and November 2023, Levin and Rye saw they had a near global view of the locations tied to more than two billion Wi-Fi access points. The map showed geolocated access points in nearly every corner of the globe, apart from almost the entirety of China, vast stretches of desert wilderness in central Australia and Africa, and deep in the rainforests of South America.

The researchers said that by zeroing in on or “geofencing” other smaller regions indexed by Apple’s location API, they could monitor how Wi-Fi access points moved over time. Why might that be a big deal? They found that by geofencing active conflict zones in Ukraine, they were able to determine the location and movement of Starlink devices used by both Ukrainian and Russian forces.

The reason they were able to do that is that each Starlink terminal — the dish and associated hardware that allows a Starlink customer to receive Internet service from a constellation of orbiting Starlink satellites — includes its own Wi-Fi access point, whose location is going to be automatically indexed by any nearby Apple devices that have location services enabled.

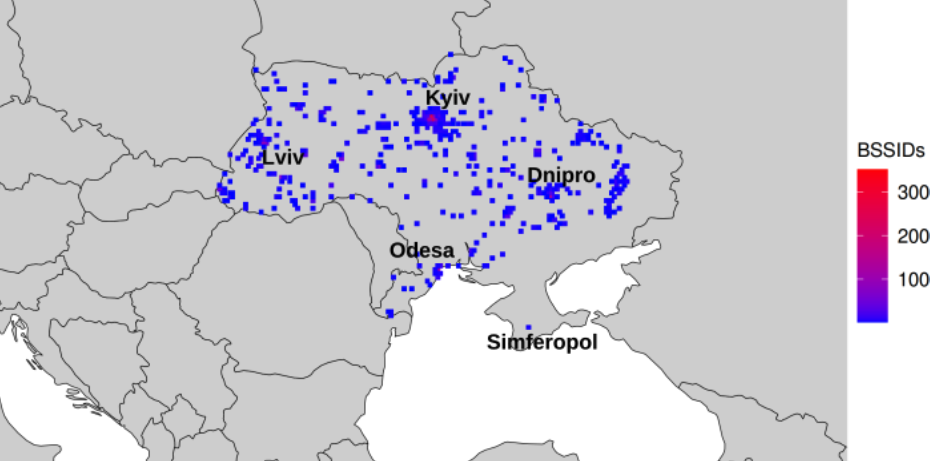

The University of Maryland team geo-fenced various conflict zones in Ukraine, and identified at least 3,722 Starlink terminals geolocated in Ukraine.

“We find what appear to be personal devices being brought by military personnel into war zones, exposing pre-deployment sites and military positions,” the researchers wrote. “Our results also show individuals who have left Ukraine to a wide range of countries, validating public reports of where Ukrainian refugees have resettled.”

In an interview with KrebsOnSecurity, the UMD team said they found that in addition to exposing Russian troop pre-deployment sites, the location data made it easy to see where devices in contested regions originated from.

“This includes residential addresses throughout the world,” Levin said. “We even believe we can identify people who have joined the Ukraine Foreign Legion.”

A simplified map of where BSSIDs that enter the Donbas and Crimea regions of Ukraine originate. Image: UMD.

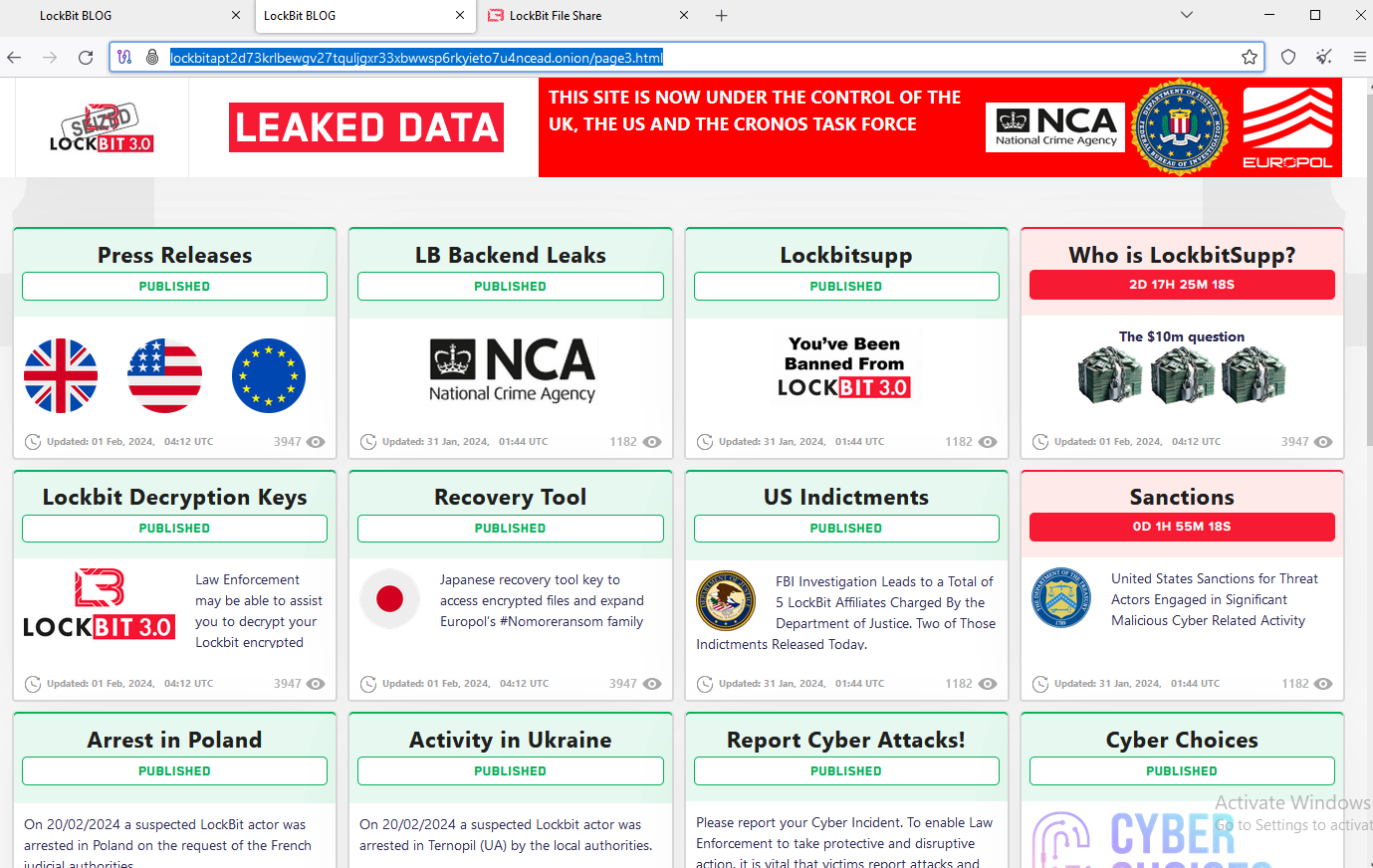

Levin and Rye said they shared their findings with Starlink in March 2024, and that Starlink told them the company began shipping software updates in 2023 that force Starlink access points to randomize their BSSIDs. Continue reading