The data breach at Atlanta-based credit and debit card processor Global Payments just keeps getting bigger. Earlier this month, I reported that Visa and MasterCard were alerting banks that the breach extended back to June 2011. Now it appears the breach jeopardized cards processed by Global as far back as January 2011.

The latest disclosure, detailed in a story at BankInfoSecurity.com, now aligns with the timeline outlined by anonymous hackers who reached out to me after I broke the story on this breach back at the end of March. Global has disclosed relatively little about the breach, and has sought to downplay the severity of it. Initial reports suggested that more than 10 million card accounts were compromised in the breach, yet Global insists fewer than 1.5 million were taken. Recent reports by The Wall Street Journal put that figure closer to 7 million stolen card accounts.

The latest disclosure, detailed in a story at BankInfoSecurity.com, now aligns with the timeline outlined by anonymous hackers who reached out to me after I broke the story on this breach back at the end of March. Global has disclosed relatively little about the breach, and has sought to downplay the severity of it. Initial reports suggested that more than 10 million card accounts were compromised in the breach, yet Global insists fewer than 1.5 million were taken. Recent reports by The Wall Street Journal put that figure closer to 7 million stolen card accounts.

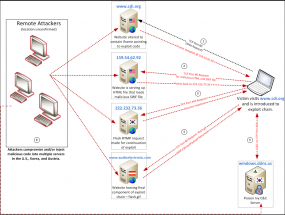

Shortly after the breach, Global executives were complaining about “rumor and innuendo” in press reports about the incident. I borrowed that quote for the title of a follow-up blog post, which included claims from a hacker who told me he was reaching out because he felt Global was hiding the true extent of the breach. He told me that he was part of a group that had been inside of Global since just after the new year in 2011. From that story:

The hacker said the company’s network was under full criminal control from that time until March 26, 2012. “The data and quantities that was gathered [was] much more than they writed [sic]. They finished End2End encryption, but E2E not a full solution; it only defend [sic] from outside threats.” He went on to claim that hackers had been capturing data from the company’s network for the past 13 months — collecting the data monthly — gathering data on a total of 24 million unique transactions before they were shut out.

Global has refused to comment further on the incident, referring people to a Web site with a series of Q&As for various parties potentially impacted by the breach. I guess only time will tell whether the hackers were right about the number of compromised transactions as well.