Recent ebanking heists — such as a $121,000 online robbery at a New York fuel supplier last month — suggest that cyber thieves increasingly are cashing out by sending victim funds to prepaid debit card accounts. The shift appears to be an effort to route around a major bottleneck for these crimes: Their dependency on unreliable money mules.

Mules traditionally have played a key role in helping thieves cash out hacked accounts and launder money. They are recruited through email-based work-at-home job scams, and are told they will be helping companies process payments. In a typical scheme, the mule provides her banking details to the recruiter, who eventually sends a fraudulent transfer and tells the mule to withdraw the funds in cash, keep a small percentage, and wire the remainder to co-conspirators abroad.

Some of the mule gangs I’ve identified.

But mules are hardly the most expedient method of extracting funds. To avoid arousing suspicion (and triggering anti-money laundering reporting requirements by the banks), cyber crooks usually send less than $10,000 to each mule. In other words, for every $100,000 that the thieves want to steal, they need to have at least 10 money mules at the ready.

In reality, though, that number is quite often closer to 15 mules per $100,000. That’s because the thieves may send much lower amounts to mules that bank at institutions which have low transfer limit triggers. For instance, they almost always limit transfers to less than $5,000 when dealing with Bank of America mules, because they know transfers for more than that amount to consumer accounts will raise fraud flags at BofA.

Thus, the average mule is worth up to $10,000 to a cybercrook. Unsurprisingly, there is much competition and demand for available money mules in the cybercriminal underground. I’ve identified close to two dozen distinct money mule recruitment networks, most of which demand between 40-50 percent of the fraudulent transfer amounts for their trouble. Not only are mule expensive to acquire, they often take weeks to groom before they’re trusted with transfers.

But these mules also come with their own, well, baggage. I’ve interviewed now more than 200 money mules, and it’s hard to escape the conclusion that many mules simply are not the sharpest crayons in the box. They often have trouble following simple instructions, and frequently screw up important details when it comes time to cash out (there are probably good reasons that a lot of these folks are unemployed). Common goofs include transposing digits in account and routing numbers, or failing to get to the bank to withdraw the cash shortly after the fraudulent transfer, giving the victim’s bank precious time to reverse the transaction. In isolated cases, the mules simply disappear with the money and stiff the cyber thieves.

In several recent ebanking heists, however, thieves appear to have sent at least half of the transfers to prepaid cards, potentially sidestepping the expense and hassle of hiring and using money mules. For example, last month cyber crooks struck Alta East, a wholesale gasoline dealer in Middletown, N.Y. According to the firm’s comptroller Debbie Weeden, the thieves initiated 30 separate fraudulent transfers totaling more than $121,000. Half of those transfers went to prepaid cards issued by Metabank, a large prepaid card provider.

Prepaid cards are ideal because they can be purchased anonymously for small amounts ($25-$100 values) from supermarkets and other stores. A majority of these low-value cards are not reloadable, unless the cardholder goes online and provides identity information that the prepaid card issuer can tie to a legitimate credit holder. After that card is activated, it can be reloaded remotely by transferring or depositing funds into the account, and it can be used like a debit, ATM or credit card.

“The information we gather in opening it is the same information you’d be asked if you were opening a credit card account online,” said Brad Hanson, president of Metabank’s payment systems division. “We do checks against different public resources like Experian and LexisNexis to verify that all the information matches and is accurate, and that we have a reasonable belief that you are the person applying for the card.”

The trouble is, the thieves pulling these ebanking heists have access to massive amounts of stolen data that can be used to fraudulently open up prepaid cards in the names of people whose identities and computers have already been hijacked. Once those cards are approved, the crooks can simply transfer funds to them from cyberheist victims, and extract the cash at ATMs. Alternatively, wire transfer locations like Western Union even allow senders to use their debit cards to execute a “debit spend,” thereby sending money overseas directly from the card.

Continue reading →

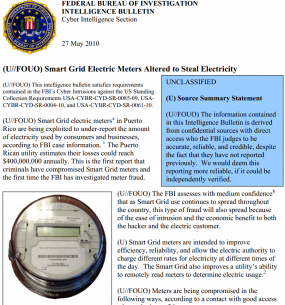

Visa and MasterCard send periodic alerts to card-issuing banks about cards that may need to be re-issued following a security breach at a processor or merchant. Indeed, it was two such alerts — issued within a day of each other in the final week of March — which prompted my reporting that ultimately exposed the incident. Since those initial alerts, Visa and MasterCard have issued at least seven updates, warning of additional compromised cards and pushing the window of vulnerability at Global Payments back further each time.

Visa and MasterCard send periodic alerts to card-issuing banks about cards that may need to be re-issued following a security breach at a processor or merchant. Indeed, it was two such alerts — issued within a day of each other in the final week of March — which prompted my reporting that ultimately exposed the incident. Since those initial alerts, Visa and MasterCard have issued at least seven updates, warning of additional compromised cards and pushing the window of vulnerability at Global Payments back further each time.