First, the good news: The past year has witnessed the decimation of spam volume, the arrests of several key hackers, and the high-profile takedowns of some of the Web’s most notorious botnets. The bad news? The crooks behind these huge crime machines are fighting back — devising new approaches designed to resist even the most energetic takedown efforts.

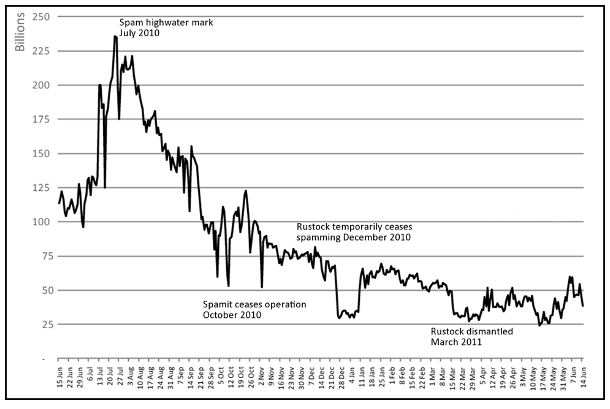

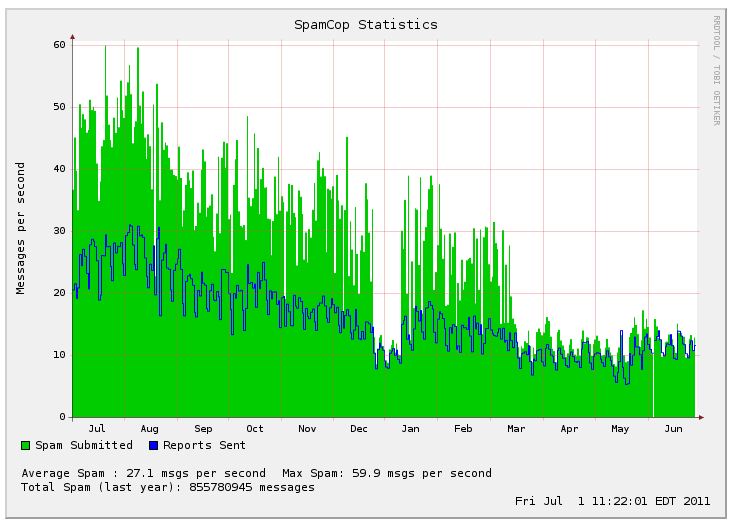

The volume of junk email flooding inboxes each day is way down from a year ago, as much as a 90 percent decrease according to some estimates. Symantec reports that spam volumes hit their high mark in July 2010, when junk email purveyors were blasting in excess of 225 billion spam messages per day. The company says daily spam volumes now hover between 25 and 50 billion missives daily. Anti-spam experts from Cisco Systems are tracking a similarly precipitous decline, from 300 billion per day in June 2010 to just 40 billion in June 2011.

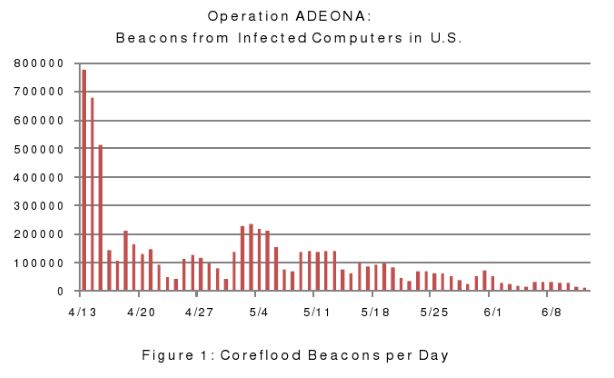

There may be many reasons for the drop in junk email volumes, but it would be a mistake to downplay efforts by law enforcement officials and security experts. In the past year, authorities have taken down some of the biggest botnets and apprehended several top botmasters. Most recently, the FBI worked with dozens of ISPs to kneecap the Coreflood botnet. In April, Microsoft launched an apparently successful sneak attack against Rustock, a botnet once responsible for sending 40 percent of all junk email.

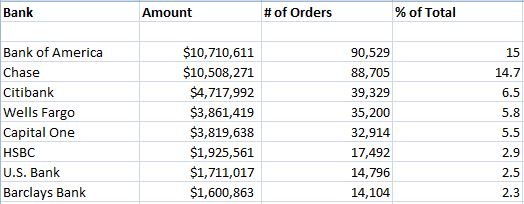

In December 2010, the FBI arrested a Russian accused of running the Mega-D botnet. In October 2010, authorities in the Netherlands arrested the alleged creator of the Bredolab botnet and dismantled huge chunks of the botnet. A month earlier, Spamit.com, one of the biggest spammer affiliate programs ever created, was shut down when its creator, Igor Gusev, was named the world’s number one spammer and went into hiding. In August 2010, researchers clobbered the Pushdo botnet, causing spam from that botnet to slow to a trickle.

But botmasters are not idly standing by while their industry is dismantled. Analysts from Kaspersky Lab this week published research on a new version of the TDSS malware (a.k.a. TDL), a sophisticated malicious code family that includes a powerful rootkit component that compromises PCs below the operating system level, making it extremely challenging to detect and remove. The latest version of TDSS — dubbed TDL-4 — has already infected 4.5 million PCs; it uses a custom encryption scheme that makes it difficult for security experts to analyze traffic between hijacked PCs and botnet controllers. TDL-4 control networks also send out instructions to infected PCs using a peer-to-peer network that includes multiple failsafe mechanisms.