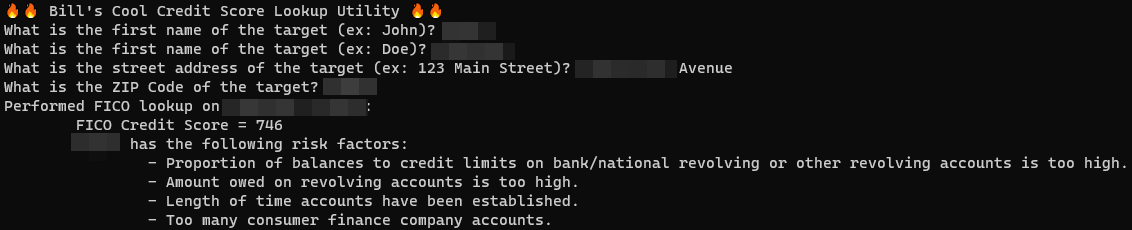

In a Twitter discussion last week on ransomware attacks, KrebsOnSecurity noted that virtually all ransomware strains have a built-in failsafe designed to cover the backsides of the malware purveyors: They simply will not install on a Microsoft Windows computer that already has one of many types of virtual keyboards installed — such as Russian or Ukrainian. So many readers had questions in response to the tweet that I thought it was worth a blog post exploring this one weird cyber defense trick.

The Commonwealth of Independent States (CIS) more or less matches the exclusion list on an awful lot of malware coming out of Eastern Europe.

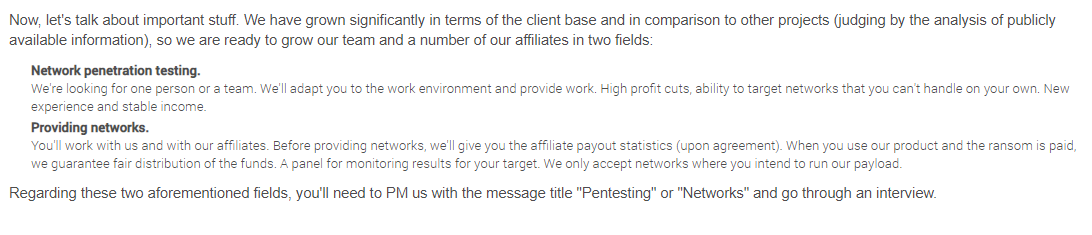

The Twitter thread came up in a discussion on the ransomware attack against Colonial Pipeline, which earlier this month shut down 5,500 miles of fuel pipe for nearly a week, causing fuel station supply shortages throughout the country and driving up prices. The FBI said the attack was the work of DarkSide, a new-ish ransomware-as-a-service offering that says it targets only large corporations.

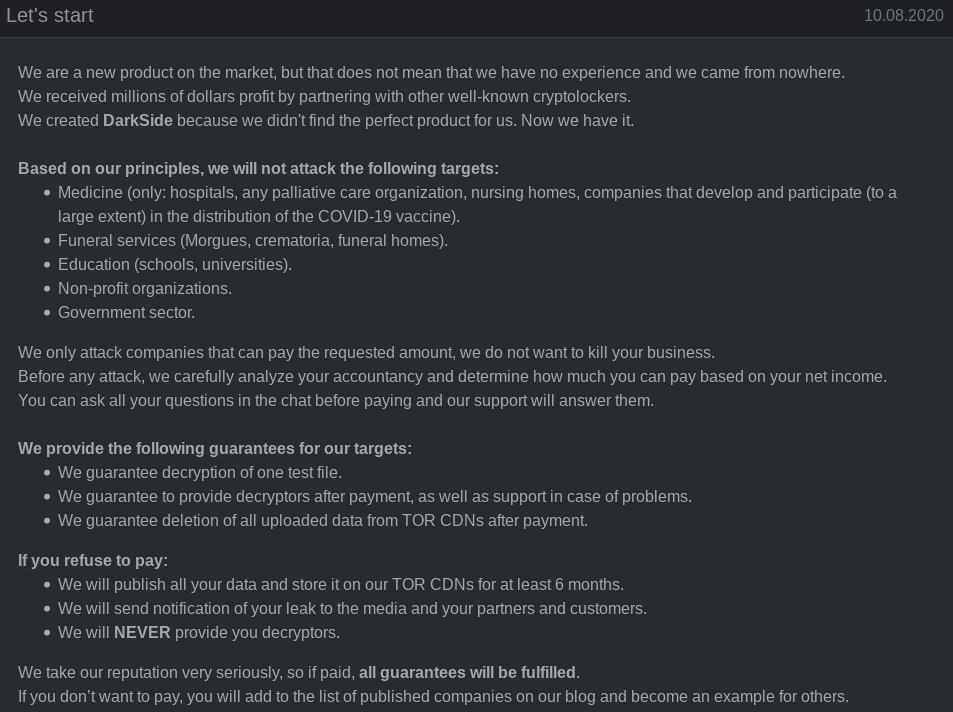

DarkSide and other Russian-language affiliate moneymaking programs have long barred their criminal associates from installing malicious software on computers in a host of Eastern European countries, including Ukraine and Russia. This prohibition dates back to the earliest days of organized cybercrime, and it is intended to minimize scrutiny and interference from local authorities.

In Russia, for example, authorities there generally will not initiate a cybercrime investigation against one of their own unless a company or individual within the country’s borders files an official complaint as a victim. Ensuring that no affiliates can produce victims in their own countries is the easiest way for these criminals to stay off the radar of domestic law enforcement agencies.

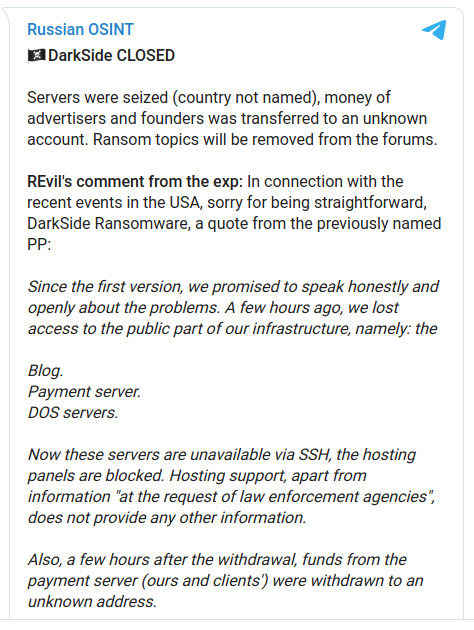

Possibly feeling the heat from being referenced in President Biden’s Executive Order on cybersecurity this past week, the DarkSide group sought to distance itself from their attack against Colonial Pipeline. In a message posted to its victim shaming blog, DarkSide tried to say it was “apolitical” and that it didn’t wish to participate in geopolitics.

“Our goal is to make money, and not creating problems for society,” the DarkSide criminals wrote last week. “From today we introduce moderation and check each company that our partners want to encrypt to avoid social consequences in the future.”

But here’s the thing: Digital extortion gangs like DarkSide take great care to make their entire platforms geopolitical, because their malware is engineered to work only in certain parts of the world.

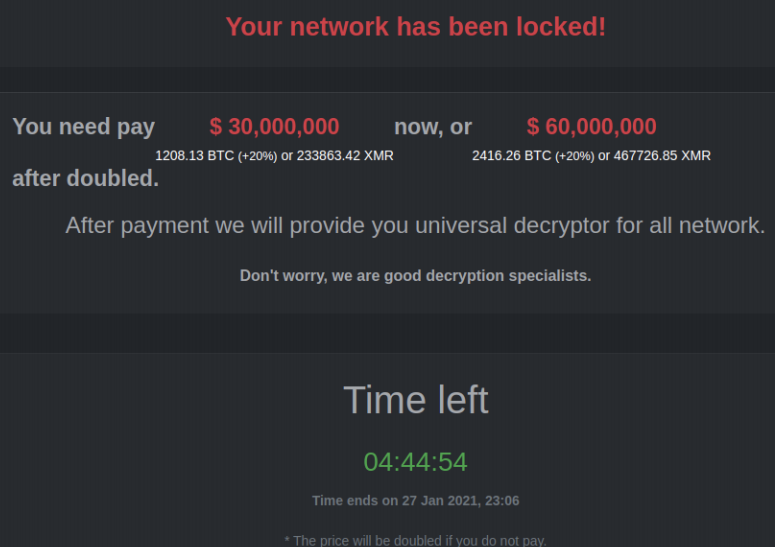

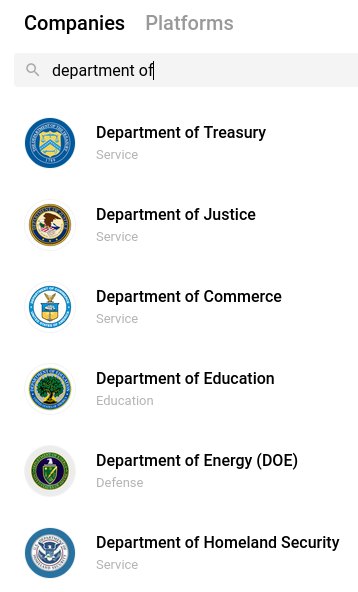

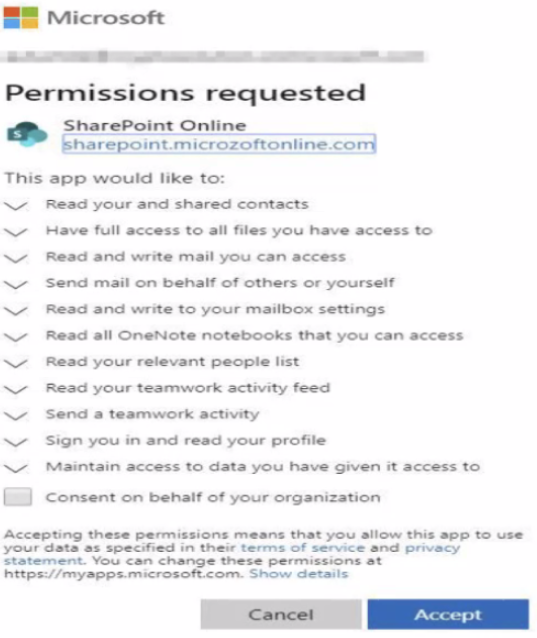

DarkSide, like a great many other malware strains, has a hard-coded do-not-install list of countries which are the principal members of the Commonwealth of Independent States (CIS) — former Soviet satellites that mostly have favorable relations with the Kremlin. The full exclusion list in DarkSide (published by Cybereason) is below:

Image: Cybereason.

Simply put, countless malware strains will check for the presence of one of these languages on the system, and if they’re detected the malware will exit and fail to install.

[Side note. Many security experts have pointed to connections between the DarkSide and REvil (a.k.a. “Sodinokibi”) ransomware groups. REvil was previously known as GandCrab, and one of the many things GandCrab had in common with REvil was that both programs barred affiliates from infecting victims in Syria. As we can see from the chart above, Syria is also exempted from infections by DarkSide ransomware. And DarkSide itself proved their connection to REvil this past week when it announced it was closing up shop after its servers and bitcoin funds were seized.] Continue reading