In the early days of the Internet, there was a period when Internet Protocol 4 (IPv4) addresses (e.g. 4.4.4.4) were given out like cotton candy to anyone who asked. But these days companies are queuing up to obtain new IP space from the various regional registries that periodically dole out the prized digits. With the value of a single IP hovering between $15-$25, those registries are now fighting a wave of shady brokers who specialize in securing new IP address blocks under false pretenses and then reselling to spammers. Here’s the story of one broker who fought back in the courts, and lost spectacularly.

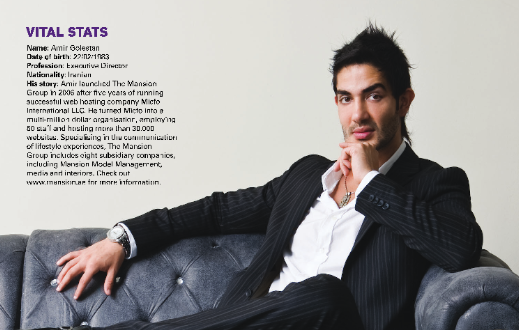

On May 14, South Carolina U.S. Attorney Sherri Lydon filed criminal wire fraud charges against Amir Golestan, alleging he and his Charleston, S.C. based company Micfo LLC orchestrated an elaborate network of phony companies and aliases to gather more than 735,000 IPs from the American Registry for Internet Numbers (ARIN), a nonprofit which oversees IP addresses assigned to entities in the U.S., Canada, and parts of the Caribbean.