Federal prosecutors in New York today announced the arrest and charging of a San Francisco man they say ran the online drug bazaar and black market known as Silk Road 2.0. In conjunction with the arrest, U.S. and European authorities have jointly seized control over the servers that hosted Silk Road 2.0 marketplace.

The home page of the Silk Road 2.0 market has been replaced with this message indicating the community’s Web servers were seized by authorities.

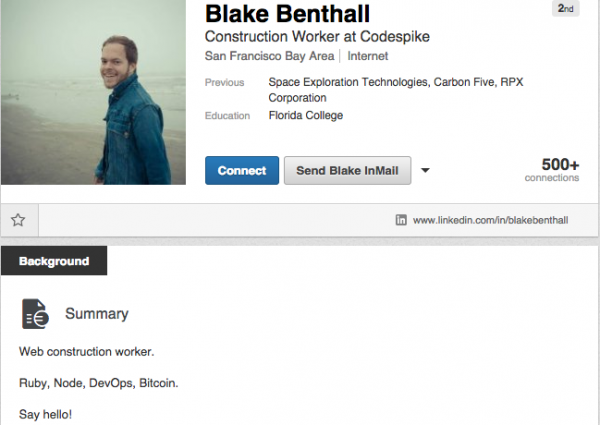

On Wednesday, agents with the FBI and the Department of Homeland Security arrested 26-year-old Blake Benthall, a.k.a. “Defcon,” in San Francisco, charging him with drug trafficking, conspiracy to commit computer hacking, and money laundering, among other alleged crimes.

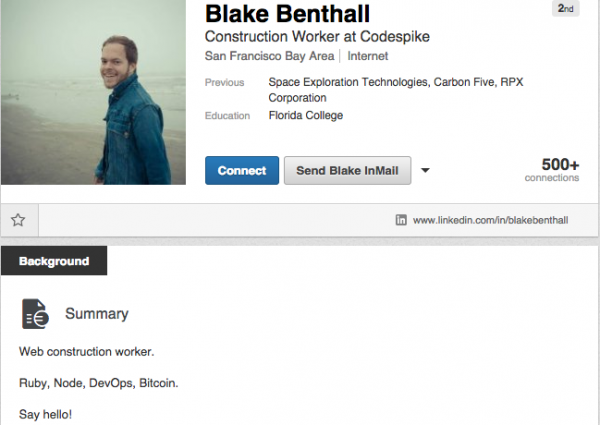

Benthall’s LinkedIn profile says he is a native of Houston, Texas and was a programmer and “construction worker” at Codespike, a company he apparently founded using another company, Benthall Group, Inc. Benthall’s LinkedIn and Facebook profiles both state that he was a software engineer at Space Exploration Technologies Corp. (SpaceX), although this could not be immediately confirmed. Benthall describes himself on Twitter as a “rocket scientist” and a “bitcoin dreamer.”

Blake Benthall’s public profile page at LinkedIn.com

Benthall’s arrest comes approximately a year after the launch of Silk Road 2.0, which came online less than a month after federal agents shut down the original Silk Road community and arrested its alleged proprietor — Ross William Ulbricht, a/k/a “Dread Pirate Roberts.” Ulbricht is currently fighting similar charges, and made a final pre-trial appearance in a New York court earlier this week.

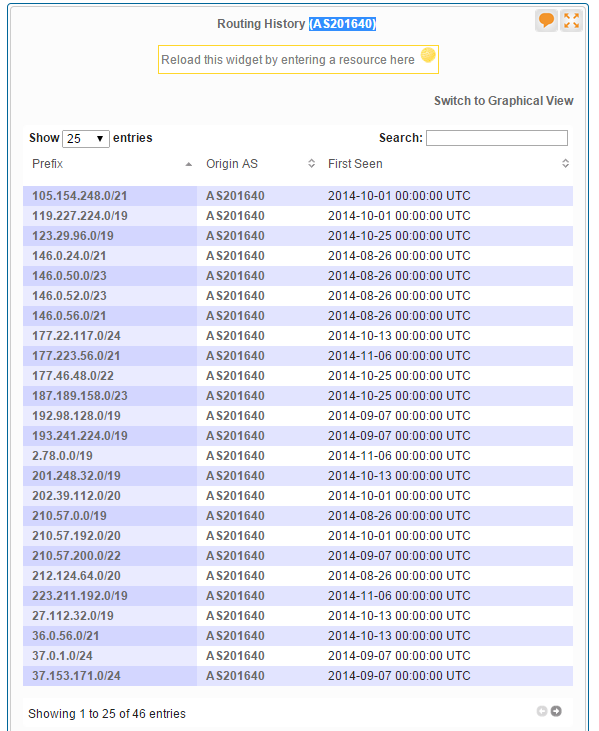

According to federal prosecutors, since about December 2013, Benthall has secretly owned and operated Silk Road 2.0, which the government describes as “one of the most extensive, sophisticated, and widely used criminal marketplaces on the Internet today.” Like its predecessor, Silk Road 2.0 operated on the “Tor” network, a special network of computers on the Internet, distributed around the world, designed to conceal the true IP addresses of the computers on the network and thereby the identities of the network’s users.

“Since its launch in November 2013, Silk Road 2.0 has been used by thousands of drug dealers and other unlawful vendors to distribute hundreds of kilograms of illegal drugs and other illicit goods and services to buyers throughout the world, as well as to launder millions of dollars generated by these unlawful transactions,”reads a statement released today by Preet Bharara, the United States Attorney for the Southern District of New York. “As of September 2014, Silk Road 2.0 was generating sales of at least approximately $8 million per month and had approximately 150,000 active users.”

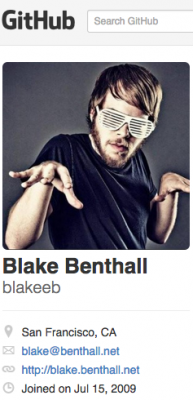

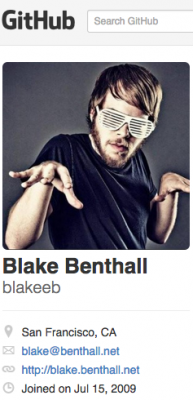

Benthall’s profile on Github.

The complaint against Benthall claims that by October 17, 2014, Silk Road 2.0 had over 13,000 listings for controlled substances, including, among others, 1,783 listings for “Psychedelics,” 1,697 listings for “Ecstasy,” 1,707 listings for “Cannabis,” and 379 listings for “Opioids.” Apart from the drugs, Silk Road 2.0 also openly advertised fraudulent identification documents and computer-hacking tools and services. The government alleges that in October 2014, the Silk Road 2.0 was generating at least approximately $8 million in monthly sales and at least $400,000 in monthly commissions.

The complaint describes how federal agents infiltrated Silk Road 2.0 from the very start, after an undercover agent working for Homeland Security investigators managed to infiltrate the support staff involved in the administration of the Silk Road 2.0 website.

“On or about October 7, 2013, the HSI-UC [the Homeland Security Investigations undercover agent] was invited to join a newly created discussion forum on the Tor network, concerning the potential creation of a replacement for the Silk Road 1.0 website,” the complaint recounts. “The next day, on or about October 8, 2013, the persons operating the forum gave the HSI‐UC moderator privileges, enabling the HSI‐UC to access areas of the forum available only to forum staff. The forum would later become the discussion forum associated with the Silk Road 2.0 website.”

The complaint also explains how the feds located and copied data from the Silk Road 2.0 servers. “In May 2014, the FBI identified a server located in a foreign country that was believed to be hosting the Silk Road 2.0 website at the time. On or about May 30, 2014, law enforcement personnel from that country imaged the Silk Road 2.0 Server and conducted a forensic analysis of it. Based on posts made to the SR2 Forum, complaining of service outages at the time the imaging was conducted, I know that once the Silk Road 2.0 server was taken offline for imaging, the Silk Road 2.0 website went offline as well, thus confirming that the server was used to host the Silk Road 2.0 website.” Continue reading →

In addition, my publisher has graciously extended the freeZeusGard offer until Nov. 25 for the next 500 people who order more than one copy of the book.

In addition, my publisher has graciously extended the freeZeusGard offer until Nov. 25 for the next 500 people who order more than one copy of the book.