Consumer demand for cheap prescription drugs sold through spam-advertised Web sites shows no sign of abating, according to a new analysis of bookkeeping records maintained by three of the world’s largest rogue pharmacy operations.

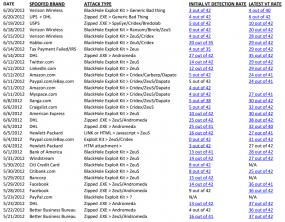

Researchers at the University of California, San Diego, the International Computer Science Institute and George Mason University examined caches of data tracking the day-to-day finances of GlavMed, SpamIt, and Rx-Promotion, shadowy affiliate programs that over a four-year period processed more than $170 million worth of orders from customers seeking cheaper, more accessible and more discretely available drugs. The result is perhaps the most detailed analysis yet of the business case for the malicious software and spam epidemics that persist to this day.

Their conclusion? Spam — and all of its attendant ills — will remain a prevalent and pestilent problem because consumer demand for the products most frequently advertised through junk email remains constant.

Their conclusion? Spam — and all of its attendant ills — will remain a prevalent and pestilent problem because consumer demand for the products most frequently advertised through junk email remains constant.

“The market for spam-advertised drugs is not even close to being saturated,” said Stefan Savage, a lead researcher in the study, due to be presented early next month at the 21st USENIX security conference in Bellevue, Wash. “The number of new customers these programs got each day explains why people spam: Because sending spam to everyone on the planet gets you new customers on an ongoing basis, so it’s not going away.”

The researchers found that repeat customers are critical to making any rogue pharmacy business profitable. Repeat orders constituted 27% and 38% of average program revenue for GlavMed and SpamIt, respectively; for Rx-Promotion, revenue from repeat orders was between 9% and 23% of overall revenue.

“This says a number of things, and one is that a lot of people who bought from these programs were satisfied,” Savage said. “Maybe the drugs they bought had a great placebo effect, but my guess is these are satisfied customers and they came back because of that.”

Whether the placebo effect is something that often applies with the consumption of erectile dysfunction drugs is not covered in this research paper, but ED drugs were by far the largest category of pills ordered by customers of all three pharmacy programs.

One interesting pattern that trickled out of the Rx-Promotion data underscores what made this pharmacy affiliate unique and popular among repeat buyers: A major portion of its revenues was generated through the sale of drugs that have a high potential for abuse and are thus tightly controlled in the United States, including opiates and painkillers like Oxycodone, Hydrocodone, and mental health pills such as Adderall and Ritalin. The researchers noticed that although pills in this class of drugs — known as Schedule II in U.S. drug control parlance — comprised just 14 percent of orders for Rx-Promotion, they accounted for nearly a third of program revenue, with the Schedule II opiates accounting for a quarter of revenue.

“The fact that such drugs are over-represented in repeat orders as well (roughly 50 percent more prevalent in both Rx-Promotion and, for drugs like Soma and Tramadol, in SpamIt) reinforces the hypothesis that abuse may be a substantial driver for this component of demand,” the researchers wrote.