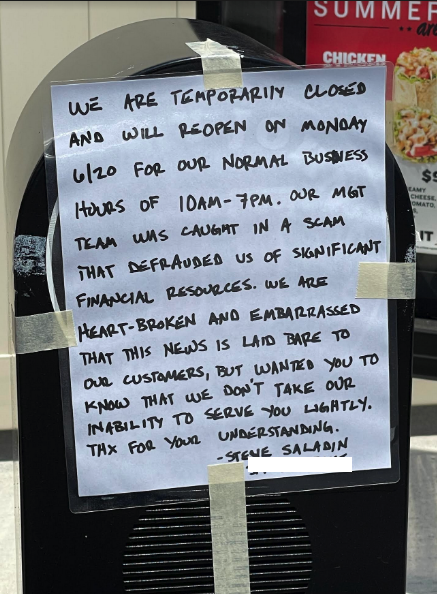

Twice in the past month KrebsOnSecurity has heard from readers who had their accounts at big-three credit bureau Experian hacked and updated with a new email address that wasn’t theirs. In both cases the readers used password managers to select strong, unique passwords for their Experian accounts. Research suggests identity thieves were able to hijack the accounts simply by signing up for new accounts at Experian using the victim’s personal information and a different email address.

John Turner is a software engineer based in Salt Lake City. Turner said he created the account at Experian in 2020 to place a security freeze on his credit file, and that he used a password manager to select and store a strong, unique password for his Experian account.

Turner said that in early June 2022 he received an email from Experian saying the email address on his account had been changed. Experian’s password reset process was useless at that point because any password reset links would be sent to the new (impostor’s) email address.

An Experian support person Turner reached via phone after a lengthy hold time asked for his Social Security Number (SSN) and date of birth, as well as his account PIN and answers to his secret questions. But the PIN and secret questions had already been changed by whoever re-signed up as him at Experian.

“I was able to answer the credit report questions successfully, which authenticated me to their system,” Turner said. “At that point, the representative read me the current stored security questions and PIN, and they were definitely not things I would have used.”

Turner said he was able to regain control over his Experian account by creating a new account. But now he’s wondering what else he could do to prevent another account compromise.

“The most frustrating part of this whole thing is that I received multiple ‘here’s your login information’ emails later that I attributed to the original attackers coming back and attempting to use the ‘forgot email/username’ flow, likely using my SSN and DOB, but it didn’t go to their email that they were expecting,” Turner said. “Given that Experian doesn’t support two-factor authentication of any kind — and that I don’t know how they were able to get access to my account in the first place — I’ve felt very helpless ever since.”

Arthur Rishi is a musician and co-executive director of the Boston Landmarks Orchestra. Rishi said he recently discovered his Experian account had been hijacked after receiving an alert from his credit monitoring service (not Experian’s) that someone had tried to open an account in his name at JPMorgan Chase.

Rishi said the alert surprised him because his credit file at Experian was frozen at the time, and Experian did not notify him about any activity on his account. Rishi said Chase agreed to cancel the unauthorized account application, and even rescinded its credit inquiry (each credit pull can ding your credit score slightly).

But he never could get anyone from Experian’s support to answer the phone, despite spending what seemed like eternity trying to progress through the company’s phone-based system. That’s when Rishi decided to see if he could create a new account for himself at Experian.

“I was able to open a new account at Experian starting from scratch, using my SSN, date of birth and answering some really basic questions, like what kind of car did you take out a loan for, or what city did you used to live in,’ Rishi said.

Upon completing the sign-up, Rishi noticed that his credit was unfrozen.

Like Turner, Rishi is now worried that identity thieves will just hijack his Experian account once more, and that there is nothing he can do to prevent such a scenario. For now, Rishi has decided to pay Experian $25.99 a month to more closely monitor his account for suspicious activity. Even using the paid Experian service, there were no additional multi-factor authentication options available, although he said Experian did send a one-time code to his phone via SMS recently when he logged on.

“Experian now sometimes does require MFA for me if I use a new browser or have my VPN on,” Rishi said, but he’s not sure if Experian’s free service would have operated differently.

“I get so angry when I think about all this,” he said. “I have no confidence this won’t happen again.”

In a written statement, Experian suggested that what happened to Rishi and Turner was not a normal occurrence, and that its security and identity verification practices extend beyond what is visible to the user.

“We believe these are isolated incidents of fraud using stolen consumer information,” Experian’s statement reads. “Specific to your question, once an Experian account is created, if someone attempts to create a second Experian account, our systems will notify the original email on file.”

“We go beyond reliance on personally identifiable information (PII) or a consumer’s ability to answer knowledge-based authentication questions to access our systems,” the statement continues. “We do not disclose additional processes for obvious security reasons; however, our data and analytical capabilities verify identity elements across multiple data sources and are not visible to the consumer. This is designed to create a more positive experience for our consumers and to provide additional layers of protection. We take consumer privacy and security seriously, and we continually review our security processes to guard against constant and evolving threats posed by fraudsters.” Continue reading