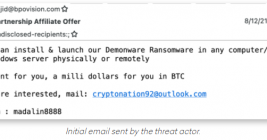

Wanted: Disgruntled Employees to Deploy Ransomware

Criminal hackers will try almost anything to get inside a profitable enterprise and secure a million-dollar payday from a ransomware infection. Apparently now that includes emailing employees directly and asking them to unleash the malware inside their employer’s network in exchange for a percentage of any ransom amount paid by the victim company.