Authorities in Santa Clara, Calif. have arrested and charged a 19-year-old area man on suspicion hijacking mobile phone numbers as part of a scheme to steal large sums of bitcoin and other cryptocurrencies. The arrest is the third known law enforcement action this month targeting “SIM swappers,” individuals who specialize in stealing wireless phone numbers and hijacking online financial and social media accounts tied to those numbers.

Xzavyer Clemente Narvaez was arrested Aug. 17, 2018 by investigators working with Santa Clara County’s “REACT task force,” which says it’s targeting those involved in “the takeovers of cell phone, email and financial accounts resulting in the theft of cryptocurrency.”

Prosecutors allege Narvaez used the proceeds of his crimes (estimated at > $1 million in virtual currencies) to purchase luxury items, including a McLaren — a $200,000 high-performance sports car. Investigators said they interviewed several alleged victims of Narvaez, including one man who reported being robbed of $150,000 in virtual currencies after his phone number was hijacked.

A fraudulent SIM swap occurs when a victim’s cell phone service is redirected from a SIM card under the control of the victim to one under the control of the suspect, without the knowledge or authorization of the victim account holder.

When a victim experiences a fraudulent SIM swap, their phone suddenly has no service and all incoming calls and text messages are sent to the attacker’s device. This includes any one-time codes sent via text message or automated phone call that many companies use to supplement passwords for their online accounts.

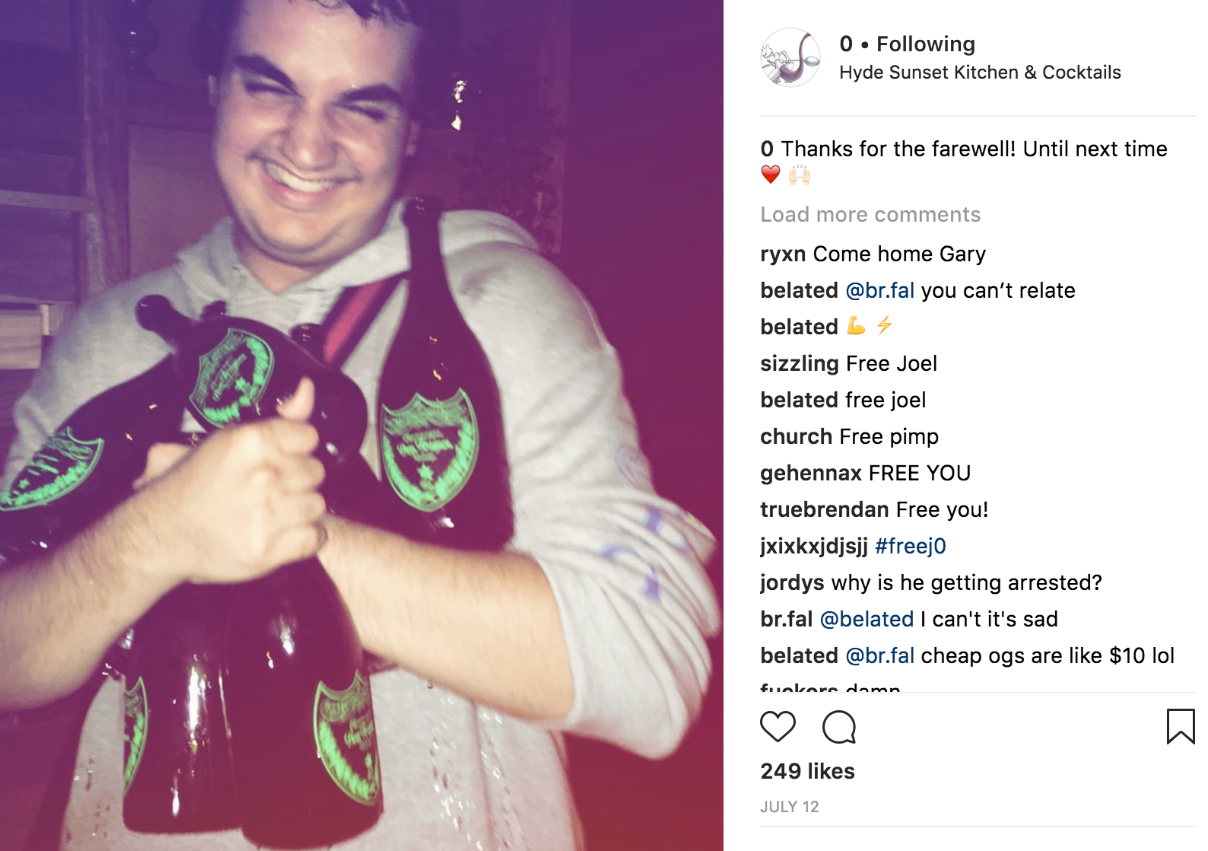

Narvaez came to law enforcement’s attention following the arrest of Joel Ortiz, a gifted 20-year-old college student from Boston who was charged in July 2018 with using SIM swaps to steal more than $5 million in cryptocurrencies from 40 victims.

A redacted “statement of facts” in the case obtained by KrebsOnSecurity says records obtained from Google revealed that a cellular device used by Ortiz to commit SIM swaps had at one point been used to access the Google account identified as Xzavyer.Narvaez@gmail.com.

That statement refers frequently to the term IMEI; this is the International Mobile Equipment Identity number, which is a unique identification number or serial number that all mobile phones and smartphones have.

Prosecutors used data gathered from a large number of tech companies to put Narvaez’s phone in specific places near his home in Tracy, Calif. at the time his alleged victims reported having their phones hijacked. His alleged re-use of the same mobile device for multiple SIM hijacks ultimately gave him away:

“On 7/18/18, investigators received information from an AT&T investigator regarding unauthorized SIM swaps conducted through an AT&T authorized retailer. He reported that approximately 28 SIM swaps were conducted using the same employee ID number over an approximately two-week time period in November 2017. Records were obtained that included a list of IMEI numbers used to take over the victims’ cell phone numbers.”

“AT&T provided call detail records pertaining to the IMEI numbers listed to conduct the SIM swaps. One of those IMEI numbers, ending in 3218, was used to take over the cell phone of a resident of Illinois. I contacted the victim who verified that some of his accounts had been “hacked” in late 2017 but said he did not suffer any financial loss. Sgt. Tarazi analyzed the AT&T location data pertaining to that account takeover. That data indicated that on 7/27/17, when the victim from Illinois lost access to his accounts, the IMEI (ending in 3218) of the cell phone controlling the victim’s cell phone number was located in Tracy, California.”

“The specific tower is located approximately 0.6 miles away from the address 360 Yosemite Drive in Tracy. Several “NELOS” records (GPS coordinates logged by AT&T to estimate the location of devices on their network) indicate the phone was within 1000 meters of 360 Yosemite Drive in Tracy. AT&T also provided call detail records pertaining to Narvaez’ cell phone account, which was linked to him through financial services account records. Sgt. Tarazi examined those records and determined that Narvaez’ own cell phone was connected to the same tower and sector during approximately the same time frame that the suspect device (ending in 3218) was connected to the victim’s account.”

Apple responded to requests with records pertaining to customer accounts linked to that same suspect IMEI number. Those records identified three California residents whose Apple accounts were linked to that same IMEI number. Continue reading

According to security firm Ivanti, the first of the two zero-day flaws (

According to security firm Ivanti, the first of the two zero-day flaws ( “The FBI has obtained unspecified reporting indicating cyber criminals are planning to conduct a global Automated Teller Machine (ATM) cash-out scheme in the coming days, likely associated with an unknown card issuer breach and commonly referred to as an ‘unlimited operation’,” reads a confidential alert the FBI shared with banks privately on Friday.

“The FBI has obtained unspecified reporting indicating cyber criminals are planning to conduct a global Automated Teller Machine (ATM) cash-out scheme in the coming days, likely associated with an unknown card issuer breach and commonly referred to as an ‘unlimited operation’,” reads a confidential alert the FBI shared with banks privately on Friday.

TCM is a subsidiary of Washington, D.C.-based ICBA Bancard Inc., which helps community banks provide a credit card option to their customers using bank-branded cards.

TCM is a subsidiary of Washington, D.C.-based ICBA Bancard Inc., which helps community banks provide a credit card option to their customers using bank-branded cards.

In such a scenario, the attacker might configure the link to lead to an “exploit kit,” crimeware designed to be stitched into hacked or malicious sites that exploits a variety of Web-browser vulnerabilities for the purposes of installing malware of the attacker’s choosing.

In such a scenario, the attacker might configure the link to lead to an “exploit kit,” crimeware designed to be stitched into hacked or malicious sites that exploits a variety of Web-browser vulnerabilities for the purposes of installing malware of the attacker’s choosing.