John Bernard, the subject of a story here last week about a self-proclaimed millionaire investor who has bilked countless tech startups, appears to be a pseudonym for John Clifton Davies, a U.K. man who absconded from justice before being convicted on multiple counts of fraud in 2015. Prior to his conviction, Davies served 16 months in jail before being cleared of murdering his wife on their honeymoon in India.

The Private Office of John Bernard, which advertises itself as a capital investment firm based in Switzerland, has for years been listed on multiple investment sites as the home of a millionaire who made his fortunes in the dot-com boom 20 years ago and who has oodles of cash to invest in tech startups.

But as last week’s story noted, Bernard’s investment company is a bit like a bad slot machine that never pays out. KrebsOnSecurity interviewed multiple investment brokers who all told the same story: After promising to invest millions after one or two phone calls and with little or no pushback, Bernard would insist that companies pay tens of thousands of dollars worth of due diligence fees up front.

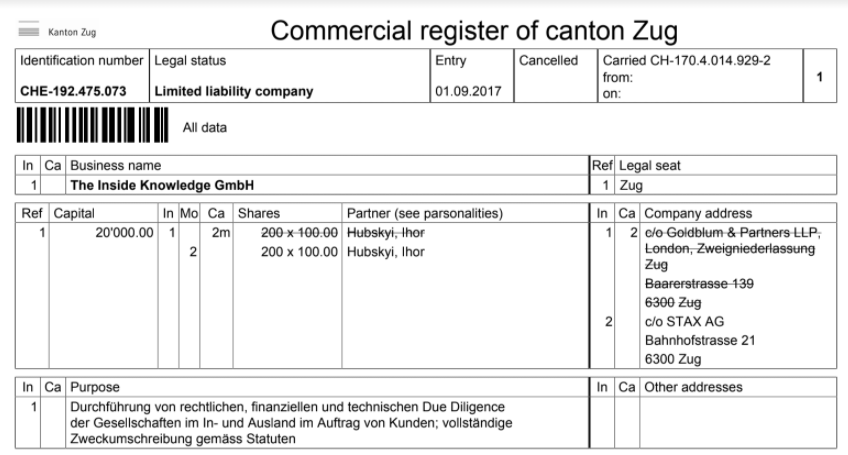

However, the due diligence company he insisted on using — another Swiss firm called Inside Knowledge — also was secretly owned by Bernard, who would invariably pull out of the deal after receiving the due diligence money.

Neither Mr. Bernard nor anyone from his various companies responded to multiple requests for comment over the past few weeks. What’s more, virtually all of the employee profiles tied to Bernard’s office have since last week removed those firms from their work experience as listed on their LinkedIn resumes — or else deleted their profiles altogether.

Sometime on Thursday John Bernard’s main website — the-private-office.ch — replaced the content on its homepage with a note saying it was closing up shop.

“We are pleased to announce that we are currently closing The Private Office fund as we have reached our intended investment level and that we now plan to focus on helping those companies we have invested into to grow and succeed,” the message reads.

As noted in last week’s story, the beauty of a scam like the one multiple investment brokers said was being run by Mr. Bernard is that companies bilked by small-time investment schemes rarely pursue legal action, mainly because the legal fees involved can quickly surpass the losses. What’s more, most victims will likely be too ashamed to come forward.

Also, John Bernard’s office typically did not reach out to investment brokers directly. Rather, he had his firm included on a list of angel investors focused on technology companies, so those seeking investments usually came to him.

Finally, multiple sources interviewed for this story said Bernard’s office offered a finders fee for any investment leads that brokers brought his way. While such commissions are not unusual, the amount promised — five percent of the total investment in a given firm that signed an agreement — is extremely generous. However, none of the investment brokers who spoke to KrebsOnSecurity were able to collect those fees, because Bernard’s office never actually consummated any of the deals they referred to him.

PAY NO ATTENTION TO THE EMPTY BOOKSHELVES

After last week’s story ran, KrebsOnSecurity heard from a number of other investment brokers who had near identical experiences with Bernard. Several said they at one point spoke with him via phone or Zoom conference calls, and that he had a distinctive British accent.

When questioned about why his staff was virtually all based in Ukraine when his companies were supposedly in Switzerland, Bernard replied that his wife was Ukrainian and that they were living there to be closer to her family.

One investment broker who recently got into a deal with Bernard shared a screen shot from a recent Zoom call with him. That screen shot shows Bernard bears a striking resemblance to one John Clifton Davies, a 59-year-old from Milton Keynes, a large town in Buckinghamshire, England about 50 miles (80 km) northwest of London.

In 2015, Mr. Davies was convicted of stealing more than GBP 750,000 from struggling companies looking to restructure their debt. For at least seven years, Davies ran multiple scam businesses that claimed to provide insolvency consulting to distressed companies, even though he was not licensed to do so.

“After gaining the firm’s trust, he took control of their assets and would later pocket the cash intended for creditors,” according to a U.K. news report from 2015. “After snatching the cash, Davies proceeded to spend the stolen money on a life of luxury, purchasing a new upmarket home fitted with a high-tech cinema system and new kitchen.”

Davies disappeared before he was convicted of fraud in 2015. Two years before that, Davies was released from prison after being held in custody for 16 months on suspicion of murdering his new bride in 2004 on their honeymoon in India.

Davies’ former wife Colette Davies, 39, died after falling 80 feet from a viewing point at a steep gorge in the Himachal Pradesh region of India. Mr. Davies was charged with murder and fraud after he attempted to collect GBP 132,000 in her life insurance payout, but British prosecutors ultimately conceded they did not have enough evidence to convict him.

THE SWISS AND UKRAINE CONNECTIONS

While the photos above are similar, there are other clues that suggest the two identities may be the same person. A review of business records tied to Davies’ phony insolvency consulting businesses between 2007 and 2013 provides some additional pointers.

John Clifton Davies’ former listing at the official U.K. business registrar Companies House show his company was registered at the address 26 Dean Forest Way, Broughton, Milton Keynes.

A search on that street address at 4iq.com turns up several interesting results, including a listing for senecaequities.com registered to a John Davies at the email address john888@myswissmail.ch.

A Companies House official record for Seneca Equities puts it at John Davies’ old U.K. address at 26 Dean Forest Way and lists 46-year-old Iryna Davies as a director. “Iryna” is a uniquely Ukrainian spelling of the name Irene (the Russian equivalent is typically “Irina”).

A search on John Clifton Davies and Iryna turned up this 2013 story from The Daily Mirror which says Iryna is John C. Davies’ fourth wife, and that the two were married in 2010.

A review of the Swiss company registrar for The Inside Knowledge GmbH shows an Ihor Hubskyi was named as president of the company. This name is phonetically the same as Igor Gubskyi, a Ukrainian man who was listed in the U.K.’s Companies House records as one of five officers for Seneca Equities along with Iryna Davies.

KrebsOnSecurity sought comment from both the U.K. police district that prosecuted Davies’ case and the U.K.’s National Crime Agency (NCA). Neither wished to comment on the findings. “We can neither confirm nor deny the existence of an investigation or subjects of interest,” a spokesperson for the NCA said.

If you enjoyed this story, please see the follow-up reporting:

Promising Infusions of Cash, Fake Investor John Bernard Walked Away With $30 Million

Over the top amazing reporting! Thank you for bringing up this scam especially in the current climate as scams are on the rise.

His character indicates the UK police were right to suspect he murdered his wife. But I guess that’s stating the obvious.

Karma is hunting this guy for sure.

“Iryna is John C. Davies’ fourth wife”. This sounds like an episode from “Perry Mason” or “Law and Order”. This is great detective work. I think Netflix should be reaching out to you to spin up a “Krebs on the Case” pilot.

I was thinking the same thing. This sounds like a bad Netflix who-done-it plot. Sad that this is instead real-life.

Contact me. I can confirm details.

we are right now in the midst of due diligence with Inside Knowledge and have paid Bernard’s company…now knowing it’s all a scam…..

would like a short conversation just to compare notes and perhaps learn something from you and yours

what a world!!!

Jeff

Once again, Brian — great stuff. Also I would watch the hell out of ‘techvet’s suggested program: “Krebs on the Case”!

Crying shame he’s a Brit, and not one of ours. He sounds like the kind of businessman/quality guy who would make a great President, a fitting follow-on to the current officeholder.

Troll

Obsessed much?

Trump dies in prison either way, no obsession required. Good point.

Once a shyster, always a shyster !

…”subjects of interest” is legal speak for there is an active investigation w/o really saying so…only law enforcement says “of interest”…

Columbo couldn’t have done a better job !

Look forward to part 2

I think Mr. Krebs should run a training course for police and other legitimate cyber-sleuths and teach them how to do the research Mr. Krebs can do (and likely sell them the tools he’s undoubtedly built to help him do the research).

Ditto

Marital timeline was unclear to me. Was he married to wives 3 and 4 at the same time?

I don’t think they were at the same time… I think they were disposed of in a timely fashion before the next marriage.

Iryna should stay out of hot tubs and off penthouse balconies.

Reads like fiction! Looks like he “invested” $10m a couple of weeks ago https://www.nasdaq.com/press-release/futuris-company-announces-signing-of-head-of-terms-for-exclusive-equity-investment but that company seems as equally dodgy. The plot thickens

I looked up the address of the Futuris Company – it’s a UPS store in a strip mall in Ashburn, VA.

It’s a real company. They got snookered like countless others.

“subject to the satisfactory completion of due diligence…”

Touché. Wonder how much they paid for DD. If it is a real company they must be devastated that that won’t get their millions

But what if he is really innocent in murdering 3rd wife?

Does this mean that putting someone for 16 months to jail derails one’s life so much that one’s only resort is: a) possibly fraudulent activity; and b) living in a low-cost country (Ukrane)?

It may be a Dostoyevsky kind of story, showing tragedy of life.

By the way, anyone noticed how a valid life insurance claim was derailed on a fairly vague and irrelevant pretext (the wife did not die from a heart disease)?

Not really, it depends on the policy. His policy may not have covered accidental death, or only covered accidental death in areas where a proper investigation can be done (which not all of India is equipped, much less adequately funded, to do). Insurance companies exist to deny claims, if there’s any reason spelled out in the contract to allow them not to pay out, they will use that reason.

Him not getting a payout likely stems from it only covering natural causes (these policies are easier and cheaper to get), though its possible the same reasons that led to his detention led to increased scrutiny that ended in them using the terms of the contract to avoid a payout.

That’s why you are the best at what you do !! Good read.. I am sure the Milton Keynes Tourist Board will be pleased with the mention… Stay safe my friend.

Brian, contact me… I need confirmed details you got from Bailey.

Its a pretty good resemblance to him I have to admit, but its not him.

I actually met John Bernard last year and introduced him to a company that I was trying to raise $25 million for called Toledo Solar Inc. He was actually a really nice guy, albeit he was a very private individual surrounded by security when I met him and paranoid about who he did business with, he bought me a nice lunch and to start with we had a good relationship.

He entered into an agreement to make the investment but before doing so he wanted to have some due diligence done. He brought in a firm that was the downfall of the deal. The investment opportunity said they had orders of around $900 million and that they were valuing their company in excess of $100 million to which he was sceptical about. My partners and I were convinced though that this was a good opportunity and pressed Bernard to invest.

Whilst the company was and still is fundamentally a good company they didn’t really have the orders that they had suggested and unfortunately for us Bernard had brought in a due diligence company who dissected the opportunity piece by piece and who produced a damming report on what had presented initially. Needless to say the company valuation was way off and they didn’t have the order book that they had said they did. It was at that point that the relationship turned sour, Bernard was very angered that he had effectively been lied to and didn’t take it well, He demanded that his costs on looking at the investment opportunity be met although I don’t think that ever happened.

My partners decided that the best form of defence was to attack and went on a little campaign to try and smear Bernard, even suggesting at some point that Bernard wasn’t his real identity in a vain effort to try and get him to complete the investment. Needless to say it didn’t work and all ended badly.

I actually lost my job over the whole incident and whilst I can’t blame Bernard for everything, my advice would be if you’re doing business with him be straight and if you have anything to hide don’t because he will find it.

We live and learn

Lol “Andrew” seems pretty good at copying and pasting.

An aspect of the soap opera that is called “Brexit”.

A number of the largest contributors, to the original campaign, were reacting to actions on the part of the EU in addressing money laundering.

Wow. This is actually impressive on multiple levels.

He doesn’t go after his targets directly…knowing as a funding source they will invariably find him.

He knows enough to realize that due diligence is a common deal breaker and exploits that.

He gins the process by offering a very good broker commission knowing he won’t ever have to pay it.

In theory, he could even scam the same broker twice.

The main problems with this approach is that anyone with deep experience is probably not going to use a random due diligence outfit. And then the scam collapses.

What is really scary is if he had been less greedy and partnered with another scammer to establish a due diligence firm, this theoretically could have worked. That firm simply does some very cheap and small DD work, legitimately, to build cred. And then pulls these games on the big money makers.

Unreal and nice reporting. I should have known this guy was a time bomb when I read he was an unaccredited turnaround “expert”. I don’t know who he’d be advising in such a role, but they must have been very very small or very very trusting. Or both.