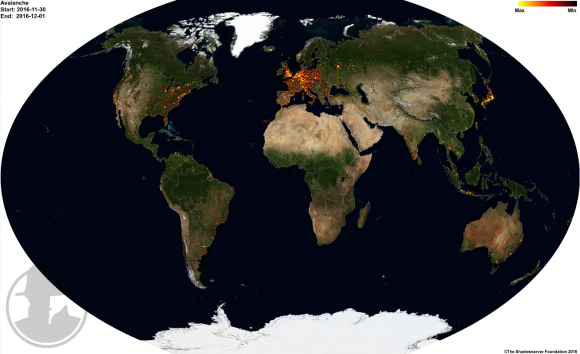

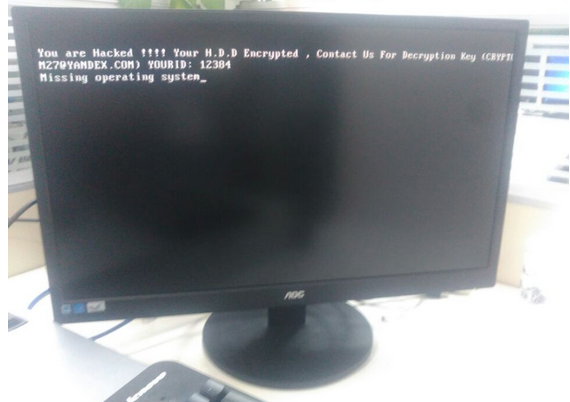

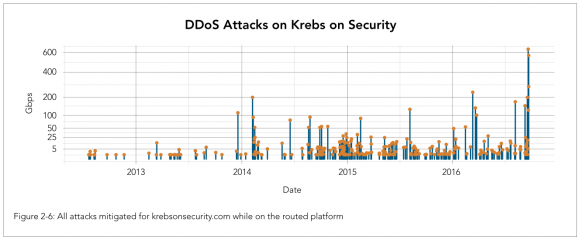

Addressing distributed denial-of-service (DDoS) attacks designed to knock Web services offline and security concerns introduced by the so-called “Internet of Things” (IoT) should be top cybersecurity priorities for the 45th President of the United States, according to a newly released blue-ribbon report commissioned by President Obama.

“The private sector and the Administration should collaborate on a roadmap for improving the security of digital networks, in particular by achieving robustness against denial-of-service, spoofing, and other attacks on users and the nation’s network infrastructure,” reads the first and foremost cybersecurity recommendation for President-elect Donald Trump. “The urgency of the situation demands that the next Administration move forward promptly on our recommendations, working closely with Congress and the private sector.”

“The private sector and the Administration should collaborate on a roadmap for improving the security of digital networks, in particular by achieving robustness against denial-of-service, spoofing, and other attacks on users and the nation’s network infrastructure,” reads the first and foremost cybersecurity recommendation for President-elect Donald Trump. “The urgency of the situation demands that the next Administration move forward promptly on our recommendations, working closely with Congress and the private sector.”

The 12-person, non-partisan commission produced a 90-page report (PDF) and recommended as their very first action item that the incoming President “should direct senior federal executives to launch a private–public initiative, including provisions to undertake, monitor, track, and report on measurable progress in enabling agile, coordinated responses and mitigation of attacks on the users and the nation’s network infrastructure.”

The panel said this effort should build on previous initiatives, such as a 2011 program by the U.S. Department of Commerce called the Industry Botnet Group.

“Specifically, this effort would identify the actions that can be taken by organizations responsible for the Internet and communications ecosystem to define, identify, report, reduce, and respond to attacks on users and the nation’s network infrastructure,” the report urged. “This initiative should include regular reporting on the actions that these organizations are already taking and any changes in technology, law, regulation, policy, financial reimbursement, or other incentives that may be necessary to support further action—while ensuring that no participating entity obstructs lawful content, applications, services, or nonharmful devices, subject to reasonable network management.”

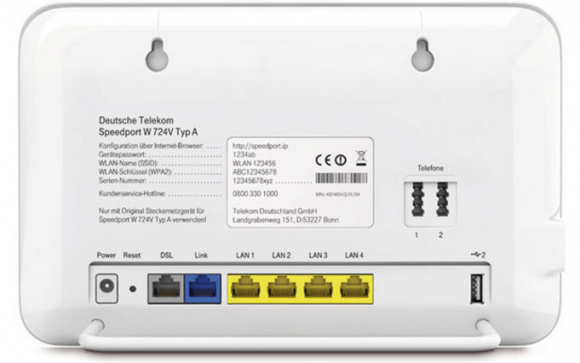

The report spans some six major imperatives, including 16 recommendations and 63 associated action items. The second major imperative focuses on IoT security concerns, and urges the federal government and private industry to embark upon a number of initiatives to “rapidly and purposefully to improve the security of the Internet of Things.”

“The Department of Justice should lead an interagency study with the Departments of Commerce and Homeland Security and work with the Federal Trade Commission, the Consumer Product Safety Commission, and interested private sector parties to assess the current state of the law with regard to liability for harm caused by faulty IoT devices and provide recommendations within 180 days,” the panel recommended. “To the extent that the law does not provide appropriate incentives for companies to design security into their products, and does not offer protections for those that do, the President should draw on these recommendations to present Congress with a legislative proposal to address identified gaps, as well as explore actions that could be accomplished through executive order.”

Meanwhile, Morning Consult reports that U.S. Federal Communications Commission Chairman Tom Wheeler has laid out an unexpected roadmap through which the agency could regulate the security of IoT devices. The proposed certification process was laid out in a response to a letter sent by Sen. Mark Warner (D-Va.) shortly after the IoT-based attacks in October that targeted Internet infrastructure company Dyn and knocked offline a number of the Web’s top destinations for the better part of a day.

Morning Consult’s Brendan Bordelon notes that while Wheeler is set to step down as chairman on Jan. 20, “the new framework could be used to support legislation enhancing the FCC’s ability to regulate IoT devices.” Continue reading