Less than six hours after Donald Trump became the presumptive president-elect of the United States, a Russian hacker gang perhaps best known for breaking into computer networks at the Democratic National Committee launched a volley of targeted phishing campaigns against American political think-tanks and non-government organizations (NGOs).

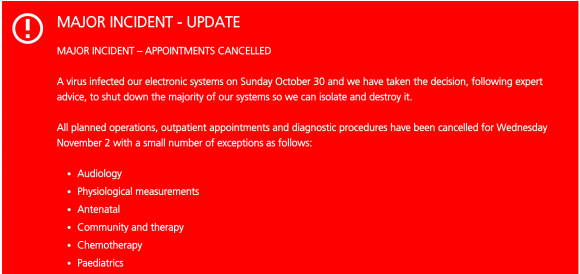

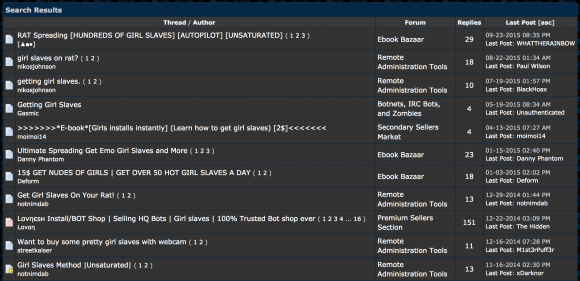

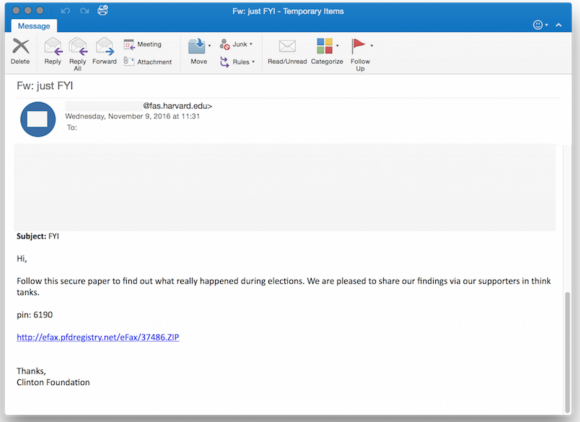

One of the phishing emails in the latest political espionage attack launched by The Dukes. Source: Volexity.

That’s according to a new report from Washington, D.C.-based cyber incident response firm Volexity. The firm’s researchers say they’ve been closely monitoring the activities of an well-established Russian malware development gang known variously as Cozy Bear, APT29, and The Dukes.

Hacking attacks launched by The Dukes were thought to be connected to intrusions at the Democratic National Committee (DNC), as well as cyber break-ins at multiple high-profile United States Government organizations, Volexity reports in a blog post published Thursday morning.

Last month, the Obama administration publicly acknowledged for the first time that it believed that the Russian government was responsible for stealing and disclosing emails from the DNC and a range of other institutions and prominent individuals, most recently Hillary Clinton’s campaign chairman, John D. Podesta. The emails were posted on WikiLeaks and other sites.

Volexity CEO Steven Adair said The Dukes have launched at least five sorties of email-based malware phishing attacks since Trump’s acceptance speech, and that the malware campaigns are ongoing.

“Two of the attacks purported to be messages forwarded on from the Clinton Foundation giving insight and perhaps a postmortem analysis into the elections,” Adair wrote.”Two of the other attacks purported to be eFax links or documents pertaining to the election’s outcome being revised or rigged. The last attack claimed to be a link to a PDF download on “Why American Elections Are Flawed.”

According to Volexity, in July 2015 the Dukes started heavily targeting think tanks and NGOs.

“This represented a fairly significant shift in the group’s previous operations and one that continued in the lead up to and immediately after the 2016 United States Presidential election,” Adair wrote.

Prior to the election, The Dukes were active on August 10, 2016 and on August 25, 2016, launching several waves of highly targeted spear phishing attacks against several U.S.-based think tanks and NGOs.

“These spear phishing messages were spoofed and made to appear to have been sent from real individuals at well-known think tanks in the United States and Europe,” Adair wrote. “These August waves of attacks purported to be from individuals at Transparency International, the Center for a New American Security (CNAS), the International Institute for Strategic Studies (IISS), Eurasia Group, and the Council on Foreign Relations (CFR).”

Adair said the more typical attacks from The Dukes come in the form of slightly less-targeted email blasts — often to just a few dozen recipients at a time — that include booby-trapped Microsoft Office documents.

When launched, the tainted Excel or Word document opens an actual file with real content, but it also prompts the target to enable “macros” — a powerful functionality built into Office documents that hackers can use to automatically download and run malicious code on a Windows system.

The Dukes prefer to launch the attacks using hacked servers and email inboxes belonging to unsuspecting, trusted workers at NGOs and U.S. government systems, Adair explained. Most often, he said, the intruders will repurpose a legitimate document found in one of these hacked inboxes and inject a sophisticated backdoor “trojan horse program.”

If the phishing target opens the document and has macros enabled in Microsoft Office — or allows macros to be run after the decoy document is shown — a malicious script embedded in the macro installs on the target’s system a powerful foothold for the attacker. Continue reading

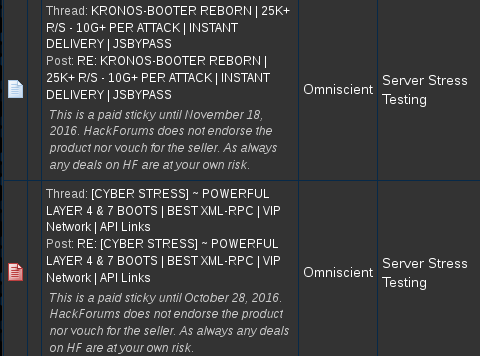

![TitaniumStresser[dot]net, as it appeared in 2014.](https://krebsonsecurity.com/wp-content/uploads/2016/11/titaniumstresser-580x689.png)