The makers of MacKeeper — a much-maligned software utility many consider to be little more than scareware that targets Mac users — have acknowledged a breach that exposed the usernames, passwords and other information on more than 13 million customers and, er…users. Perhaps more interestingly, the guy who found and reported the breach doesn’t even own a Mac, and discovered the data trove merely by browsing Shodan — a specialized search engine that looks for and indexes virtually anything that gets connected to the Internet.

IT helpdesk guy by day and security researcher by night, 31-year-old Chris Vickery said he unearthed the 21 gb trove of MacKeeper user data after spending a few bored moments searching for database servers that require no authentication and are open to external connections.

IT helpdesk guy by day and security researcher by night, 31-year-old Chris Vickery said he unearthed the 21 gb trove of MacKeeper user data after spending a few bored moments searching for database servers that require no authentication and are open to external connections.

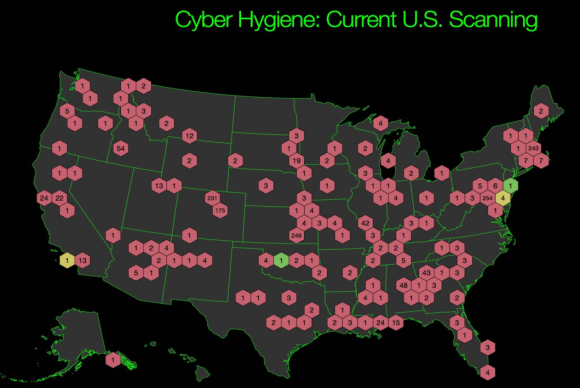

Vickery told Shodan to find all known instances of database servers listening for incoming connections on port 27017. “Ports” are like doorways that govern access into and out of specific areas of a server, and each port number generally maps to one or a handful of known Web applications and services. Port 27017 happens to be associated with MongoDB, a popular database management system.

In short order, Vickery’s request turned up four different Internet addresses, all of which he later learned belonged to Kromtech, the company that makes MacKeeper.

“There are a lot of interesting, educating and intriguing things that you can find on Shodan,” Vickery said. “But there’s a lot of stuff that should definitely not be out there, and when I come across those I try to notify the owner of the affected database.”

Vickery said he reached out the company, which responded quickly by shuttering public access to its user database, and publicly thanking him for reporting it.

“Some 13 million customer records leaked from is aware of a potential vulnerability in access to our data storage system and we are grateful to the security researcher Chris Vickery who identified this issue without disclosing any technical details for public use,” the company said in a statement published to its site totday. “We fixed this error within hours of the discovery. Analysis of our data storage system shows only one individual gained access performed by the security researcher himself. We have been in communication with Chris and he has not shared or used the data inappropriately.”

Kromtech said all customer credit card and payment information is processed by a 3rd party merchant and was never at risk. Continue reading

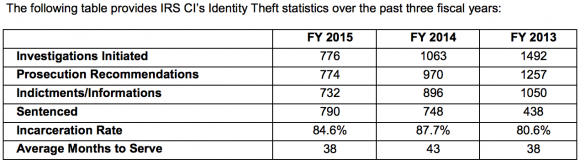

The good news is that the states and Uncle Sam have got a whole new bag of technological tricks up their sleeves this coming tax season. The bad news is ID thieves are already testing those defenses, and will be working against a financially strapped federal agency that’s been forced to cede much of its ability to investigate and prosecute such crimes.

The good news is that the states and Uncle Sam have got a whole new bag of technological tricks up their sleeves this coming tax season. The bad news is ID thieves are already testing those defenses, and will be working against a financially strapped federal agency that’s been forced to cede much of its ability to investigate and prosecute such crimes.

This type of scam mainly impacts brick-and-mortar retailers that issue gift cards when consumers return merchandise at a store without presenting a receipt. Last week I heard from KrebsOnSecurity reader Lisa who recently went online to purchase a bunch of steeply discounted gift cards issued by pet supply chain Petco.

This type of scam mainly impacts brick-and-mortar retailers that issue gift cards when consumers return merchandise at a store without presenting a receipt. Last week I heard from KrebsOnSecurity reader Lisa who recently went online to purchase a bunch of steeply discounted gift cards issued by pet supply chain Petco.